Introduction to Chainlink and Its Significance

Chainlink is one of the most ambitious projects in web3, providing everything from price oracles to external API adapters. With the ability for anyone to easily connect to any web or off-chain API and use it as an input or output for smart contracts on the blockchain, Chainlink has become a go-to for many organizations in the crypto industry.

At the Indexing Company, we love Chainlink and indexing systems, so we decided to index their price oracles and run them through our transformation engine.

Understanding Chainlink's Price Oracles

First, let's cover the basics. What are Chainlink's price oracles, and why are they important for the crypto industry?

In the simplest terms, a price oracle is a source that provides up-to-date, real-time pricing data to software running smart contracts on a blockchain network. It can be compared to stock exchange tickers of companies in the past that supplied real-time pricing data to people. Without accurate and reliable sources for crypto prices, smart contract software would not be able to execute correctly.

Chainlink's price oracles offer a reliable alternative to traditional methods of data collection and market assessment. The decentralized, secure protocol provides access to a range of leading sources that can be used to make informed price predictions. Prices are managed via an open-source aggregation algorithm, which minimizes the risk of falsified or inaccurate results.

This is extremely beneficial compared to other price oracle solutions on the market, as it ultimately reduces the need for manual response checks and lowers financial exposure in potential errors. Chainlink's security data privacy and compliance measures also maintain top-level protection against external threats such as hacking and performance issues, giving users confidence in their pricing decisions.

The Technology Behind Chainlink's Price Oracles

Chainlink's Price Oracles aren't just a manifestation of advanced technology, they also embody a system of record that's been painstakingly curated for its reliability and seamless functionality. By engineering this intricate system, Chainlink ensures that the transaction data it sources maintains a high level of accuracy. The superior infrastructure underpinning Chainlink's Price Oracles plays a pivotal role in their operation, making them an invaluable asset within the broader cryptocurrency ecosystem.

Chainlink's Decentralized Data Aggregation

Chainlink has harnessed the power of decentralized data aggregation to fortify the reliability of its price oracles. This method dramatically enhances data accuracy and reliability, providing an unimpeachable source of information for users. The decentralized nature of blockchain data aggregation serves as a buffer against data manipulation, further strengthening the credibility of the data Chainlink oracles deliver.

Chainlink's Oracle Reputation System

To ensure the consistent performance of its network, Chainlink has implemented an Oracle Reputation System. This system objectively evaluates the performance of various oracles, assigning ratings based on reliability and accuracy. These ratings offer valuable insights into the quality of data each oracle provides and directly contribute to the overall performance and credibility of Chainlink's network.

Data Quality and Chainlink

In the realm of operations of price oracles, data quality is non-negotiable. Chainlink has established stringent protocols to guarantee high-quality data from its price oracles. By placing an unwavering emphasis and focus on data quality, Chainlink sets a high standard for the reliability and usability of the data it provides.

Understanding Price Oracle Attacks

The cryptosphere is not immune to security concerns and challenges, and price oracle attacks are one such issue that warrants attention. These attacks can have significant implications for the integrity of a blockchain network, reinforcing the importance of Chainlink's commitment to security and robust design. By understanding these attacks, we can better appreciate the safeguards Chainlink has in place to prevent such vulnerabilities.

Chainlink's Role in the DeFi Ecosystem

Chainlink's price oracles have carved out a pivotal role in the burgeoning DeFi ecosystem. As a key player in the DeFi landscape, Chainlink has made significant strides in enhancing the reliability and accessibility of decentralized financial services. Its influence and importance in shaping the DeFi market are unequivocal, marking it as a game-changer in the world of decentralized finance.

The Process and Advantages of Indexing Chainlink's Price Oracles

So, why index Chainlink's price oracles?

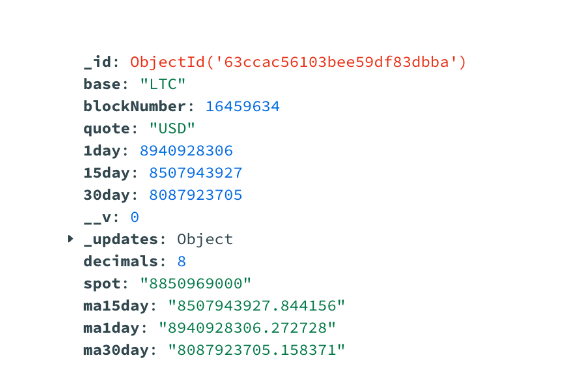

By indexing Chainlink's price oracles, we can configure the Indexing Company's transformation engine to generate some interesting data points.

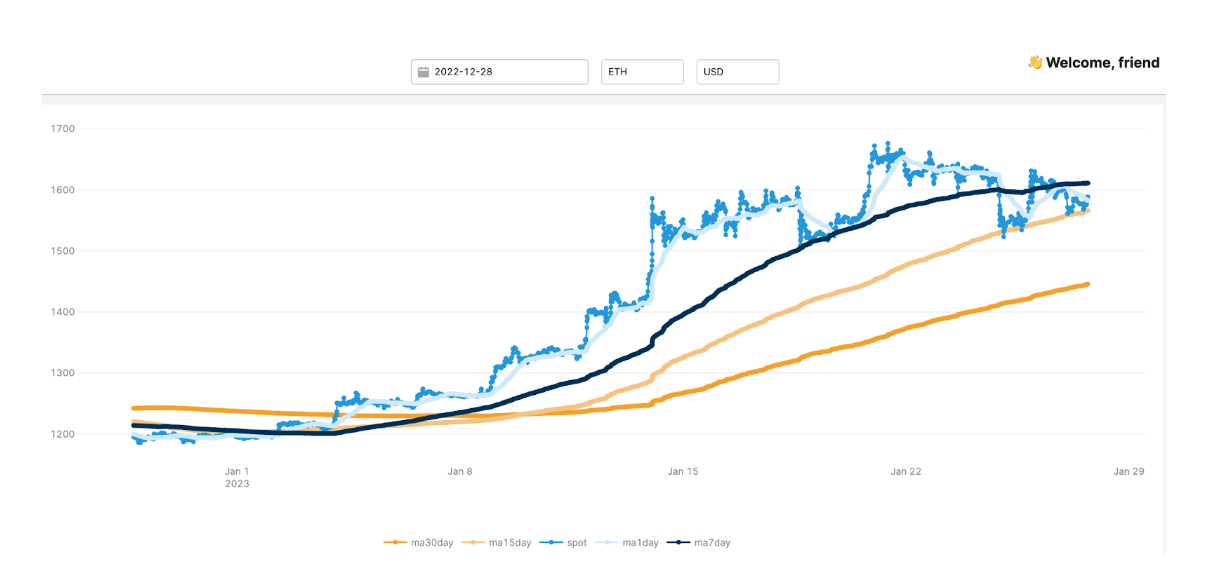

First, we indexed the feeds and merged labels (e.g. ETH/USD) to compare and contrast price data. Next, using real time data we ran different transformations to get things like spot, 1-day, 7-day, 15-day, and 30-day moving averages. Lastly, to visualize the above data points, we exposed an API via GraphQL and routed it into ReTool.

Testing and Comparing with Traditional Exchange

Test it yourself!

You might ask yourself, "I can already get this data on Coinbase. What's the big deal?"

The difference is in how the data is obtained and disseminated. for example, Exchanges like Coinbase get crypto prices by matching buyers and sellers in transactions on their platform, and the prices on the exchange reflect the supply and demand of the crypto assets being traded on that particular platform. The prices of crypto assets on different exchanges can vary due to differences in trading volume, order book depth, and other factors.

Chainlink price oracles, on the other hand, obtain crypto prices from multiple, decentralized data sources, such as other decentralized exchanges (DEXs), off-chain data aggregators, and oracles. The Chainlink network is decentralized, meaning that it is a distributed ledger not controlled by any single entity or organization, making it resistant to manipulation and tampering. The Chainlink network uses a consensus mechanism to ensure that the data provided by the oracles is accurate, and it uses smart contracts to ensure that the data is tamper-proof.

If the goal of web3 is decentralization, using tools like Chainlink's price oracles is pivotal.

Upcoming Advancements and Opportunities in Blockchain Data Indexing

We're finishing documentation this week then we'll make the current version of the API publicly available to developers (for free!)

The above exercise, in addition to whatsmynameagain.xyz and mirrormirror.page, are examples of what can be created with The Indexing Company's technology. Our mission is to provide the infrastructure so you can become the data company or surface to your business, partners and end users.

Email us today at hello@indexing.co, and we'll get you set up with your own configurable indexers and transformations to create fun tools like this.

Final Thoughts

The indexing Chainlink's price oracles facilitates digital transformation by leveraging advanced technologies like artificial intelligence and multiple blockchains. This process generates valuable data points, enabling informed decision-making and enhancing the reliability of blockchain data. By utilizing decentralized data aggregation, Chainlink's price oracles play a crucial role in the decentralized finance (DeFi) ecosystem, providing reliable and accessible pricing information. This advancement opens new opportunities and drives innovation in the evolving landscape of DeFi and beyond.

At The Indexing Company, we're excited to contribute to this journey by offering our indexing technology to enterprises around the world. As we look forward to what's next, we're not just observers; more than a decade in we're active participants shaping the future of data in a decentralized world. Join us on this journey - the future of data awaits you.