Astra DAO is an open-source, non-custodial index investment platform built on Ethereum. Through a unique tokenization process, Astra DAO facilitates easy access to crypto-oriented investment strategies.

- For a complete technical description of Astra DAO, check GitBook.

Astra DAO’s Objective:

Tokenization has extended the scope of property rights, paving the way for new economic opportunities. By eliminating signup processes and intermediaries, DeFi can redefine traditional finance and develop a trillion-dollar industry.

Despite this, the current state of Web 3 disadvantages small investors. Reasons include:

- Investors lack the time and resources to research large numbers of crypto assets.

- Investors find balancing a diversified portfolio to be difficult and expensive.

Astra DAO remedies these problems via its decentralized index platform, encouraging an ecosystem of competitive, sustainable returns.

How Does Astra DAO Work?

Rebalancing index portfolios are accessible on Astra DAO by swapping ETH or ERC20 stablecoins for Index Participation Units (iTokens). iTokens are non-transferrable, ERC20 tokens proportional to a holder's share in an index's value.

Once received, iTokens cannot transfer to other wallets. Instead, iTokens can only redeem by being sent back to their correlating index smart contract.

Each holder receives iTokens based on the ratio of value given to the entire index value:

iTokens provide a consistent way to add and remove liquidity from Astra DAO indices. iToken holders (also known as 'Index Participants') seek to profit from the long-term growth of successful indices. In addition, index creators earn fees from participation.

Astra DAO's iToken protocol promotes a fair relationship between index creators and investors, offering sustainable returns to both sides.

Astra DAO operates autonomously on Ethereum to maintain a transparent index investment platform. Investors can join any index by purchasing its corresponding iTokens. Notably, only ETH or ERC20 stablecoins (specifically DAI, USDT, and USDC) can swap for iTokens.

ASTRA Token Utility

The ASTRA token (ASTRA) is the central currency of the platform and governance ecosystem. ASTRA tokens provide utility access, voting power, and staking rights. Astra DAO's Treasury distributes ASTRA as yield for stakers and payment for DAO participants. ASTRA also settles performance and early exit fees.

ASTRA token holders maintain the right to create and sell indices, vote in on-chain governance proposals, and earn yield from liquidity provision and staking. Index creators are obliged to pay 5,000,000,000 ASTRA to offer their service on the platform. Additionally, Astra governance proposals require the proposer to stake 5,000,000,000 ASTRA.

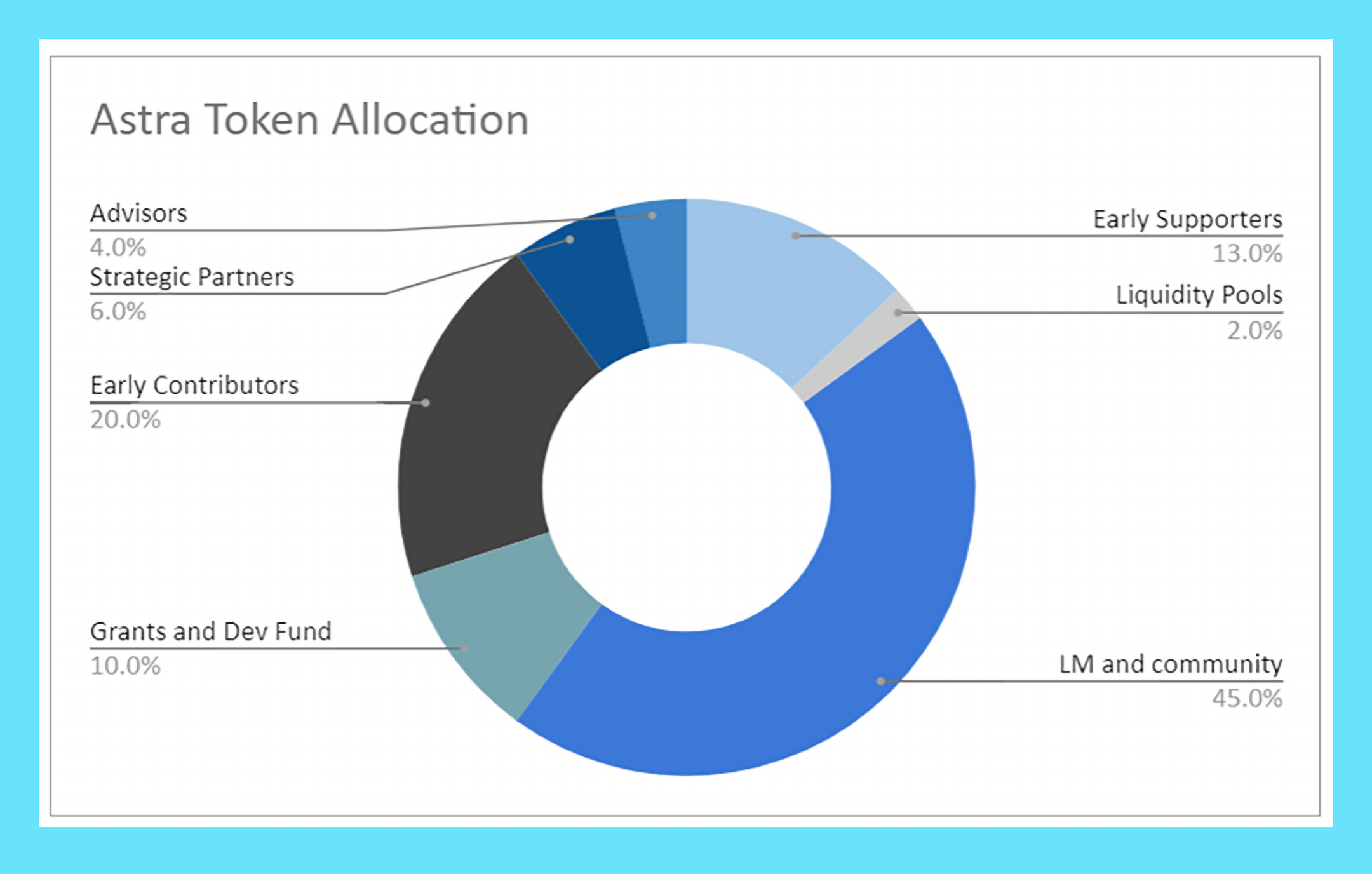

ASTRA Token Allocation

Upon launch, Astra DAO will distribute ASTRA tokens between early contributors, strategic partners, advisors, early supporters, liquidity pools, the grants & development fund, and the liquidity mining fund. In total, 100-Trillion ASTRA tokens will be minted and dispersed over time. Various vesting periods mitigate the risk of large amounts of tokens becoming liquid quickly on the market.

Astra DAO allocated 45% of the ASTRA token supply to Liquidity Mining and Community Rewards and 10% to the Growth and Community Grant fund to enable a decentralized ecosystem and provide appropriate incentives.

Since nearly half the ASTRA supply is reserved for rewards, and because ASTRA staking rewards are partially funded through fee revenue, Astra DAO can offer competitive, long-term yield through no inflationary tokenomics.

Platform Fee Distribution

Astra DAO's index platform does not require any 'out-of-pocket' fees. Instead, index creators earn 20% performance fees (taken from applicable iToken profits) and 2% early exit fees (charged if iTokens withdraw before six months). To ensure fair protocol revenue distribution, 80% of all platform fees go directly to the index creator, while the remaining 20% is distributed to ASTRA stakers.

Astra DAO's innovative fee distribution encourages long-term holding and promotes sustainable returns for investors and creators.

How to Earn Bonus ASTRA

Astra DAO offers numerous ways to earn bonus ASTRA, each based on the participant's role within the organization:

- ASTRA token holders may stake their value for yield (and receive up to 2.5x accelerated staking rewards).

- Index creators earn fee revenue from performance and early exit fees.

- Index participants earn by staking their iTokens and participating in successful indices.

- Liquidity providers earn through Astra DAO's Liquidity Mining Rewards Pool.

- Loyalty Appreciation / Grant participants earn by participating in Strategic Token Distributions and Community Grants, or by opting to withdraw iTokens through 'Premium Payout.'

All Astra DAO token holders can stake their value for yield, including ASTRA, iTokens, and LP tokens. Reward issuance rates are determined by the DAO-managed Treasury and from variable multipliers.

Astra DAO's staking protocol recognizes the value in long-term holding, even if the held assets are small. To do so, Astra DAO determines a 'staking score' for each user, calculated as an average ASTRA token holdings over the last 60 days. This calculation measures time and amount to promote staker loyalty and DAO participation.

Governance

ASTRA token holders maintain the right to participate in Astra DAO's governance process. Investors can discuss governance proposals by posting on astradao.org/governance. Here, the community can give feedback, make suggestions, and vote on proposals formally entered into the Astra DAO network.

When a proposal owner believes their idea has a reasonable chance of passing, they can submit it through the Governance Dashboard. To prevent spam and ensure only important proposals are submitted, 5,000,000,000 ASTRA must be staked for six months to submit a proposal.

Summary

Astra DAO uses next-generation tokenization to facilitate easy access to crypto-oriented investment strategies. Accordingly, Astra DAO's decentralized protocol adheres to the internet's oldest principles, including fairness, transparency, and personal autonomy.