The prop trading market in 2025 is packed with options – from established giants to fresh Web3 startups. Let’s break down who’s who and what each one offers.

🔎 In This Article, You’ll Learn:

-

The biggest competitors to Upscale and what they bring to the table

-

What makes Upscale’s approach unique and its key advantages

-

The pros and cons of ech top prop trading platform

-

Why Upscale could be your best choice among dozens of alternatives

🌓 Let’s split Upscale’s competitors into two main categories. First, we’ll look at the classic leaders in prop trading, like FTMO, TopStep, and The5%ers. Then, we’ll check out the next-gen platforms, such as FundedNext, FundingPips, E8Markets, Breakout Prop, and Bitfunded. This will help you understand the different approaches in prop trading and what sets Upscale apart.

First up: The Classic Prop Trading Leaders

FTMO

— One of the most well-known names in Forex & CFD trading. Founded: 2015, Prague.

🔶 How is it different from Upscale?

FTMO works with classic platforms like MetaTrader, cTrader, and DXTrade, though more traders are now switching to modern tools like TradingView or mini-apps for real-time updates. You can start with a bigger account here, but the minimum deposit is higher, which might not suit everyone. Also, trading fees for stocks, Forex, metals, and other traditional assets are still pretty steep. One key thing: FTMO has a rule that blocks trading 2 minutes before and after major news events — keep that in mind.

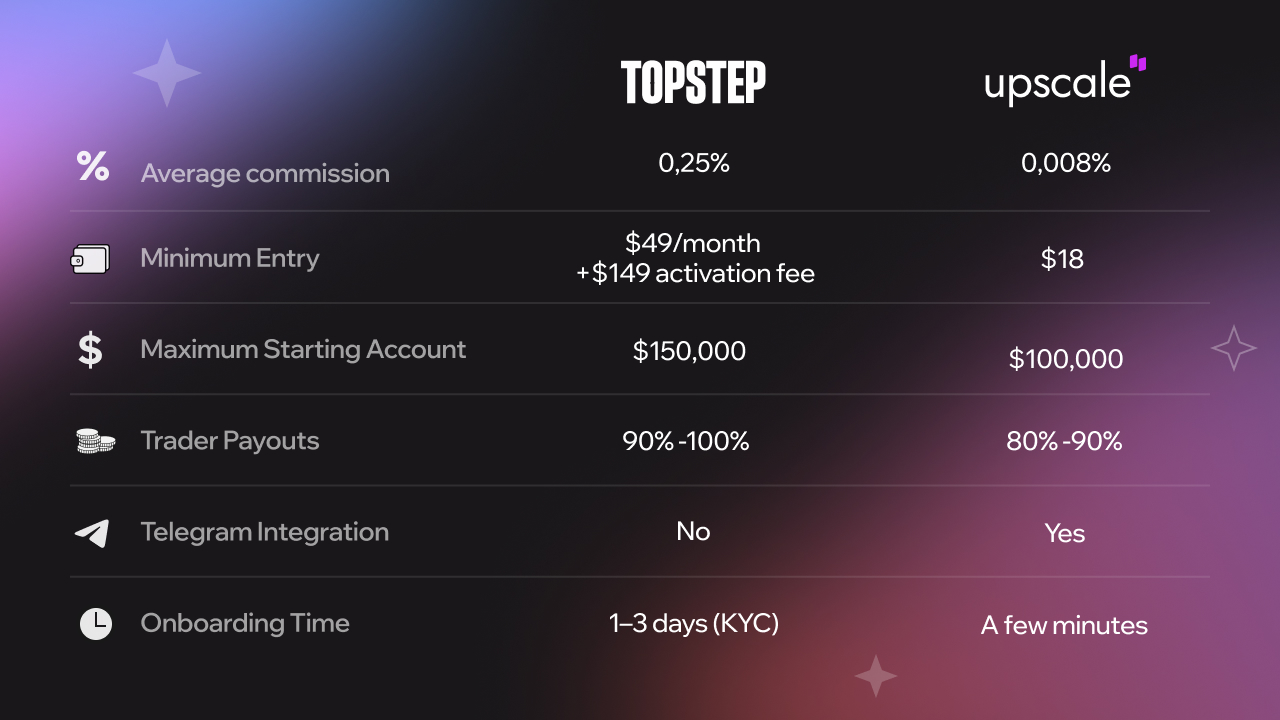

TopStep

– For over 10 years, this prop firm has helped traders get funded in classic futures trading. Founded: 2012, Chicago.

🔶 How is it different from Upscale?

TopStep only works through its own TopstepX platform. Trading is limited to classic futures markets, not cryptocurrencies. The platform uses a traditional monthly subscription model for challenge participation, and after passing the challenge, traders must pay a one-time activation fee to get a funded account.

With Upscale, traders pay once for the challenge, and after passing it, they get immediate access to a funded account — no recurring fees or activation costs. Plus, TopStep has strict day-trading rules — positions must be closed by the end of the day, which can be limiting for traders used to 24/7 markets.

The 5%ers

— A prop firm for traders in Forex, crypto, and indices. Founded: 2016, Israel.

🔶 How is it different from Upscale?

The 5%ers operates through classic platforms like MetaTrader and cTrader, plus their own proprietary tools. Upscale, on the other hand, uses the TradingView terminal powered by Pyth Network’s decentralized price feeds — with the added convenience of Telegram bot trading.

The entry threshold at The 5%ers is much higher than Upscale’s, and commissions are steeper. Like most traditional platforms, The 5%ers requires a 1-3 day KYC process, which isn’t ideal for traders who value speed and anonymity. With Upscale, all you need is a Web3 wallet — fund your challenge in just minutes, no paperwork!

Another downside? The 5%ers, like FTMO, enforces a 2-minute trading freeze before and after major news events — another restriction Upscale traders don’t face.

💬 "Yeah, the old-school prop firms have tons of restrictions and crazy fees. What about the new players?"

Let's check out these next-gen platforms:

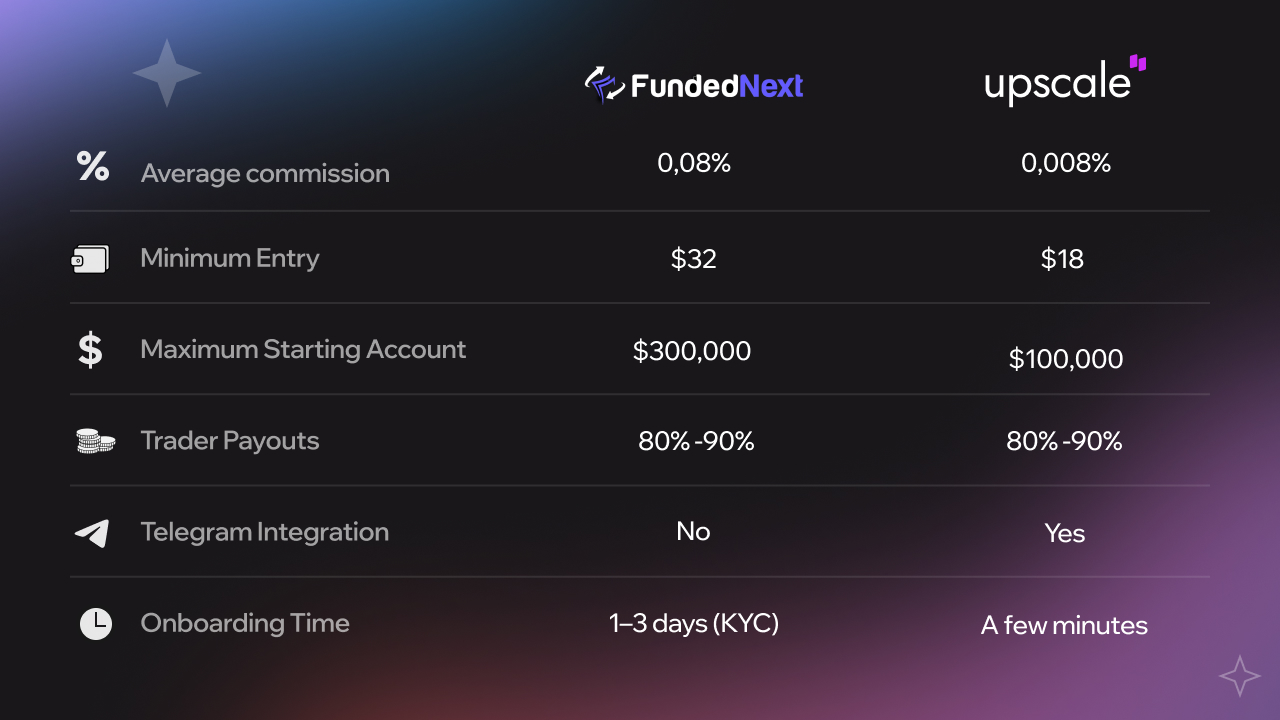

FundedNext

— A fresh player for Forex and crypto trading. Founded: 2022, UAE.

🔶 How is it different from Upscale?

FundedNext supports classic trading terminals and offers leverage up to 1:100, while Upscale limits it to 1:5 – a more conservative approach that keeps trading predictable, minimizes sharp drawdowns, and avoids turning it into a gambling game.

When it comes to fees, Upscale stands out with the lowest minimum entry and most competitive commissions on the market — just $18 and 0.008%! But that’s not all. Unlike most prop firms, Upscale invests in its traders' growth, helping them improve their skills and achieve consistent results through free courses in Storm Academy.

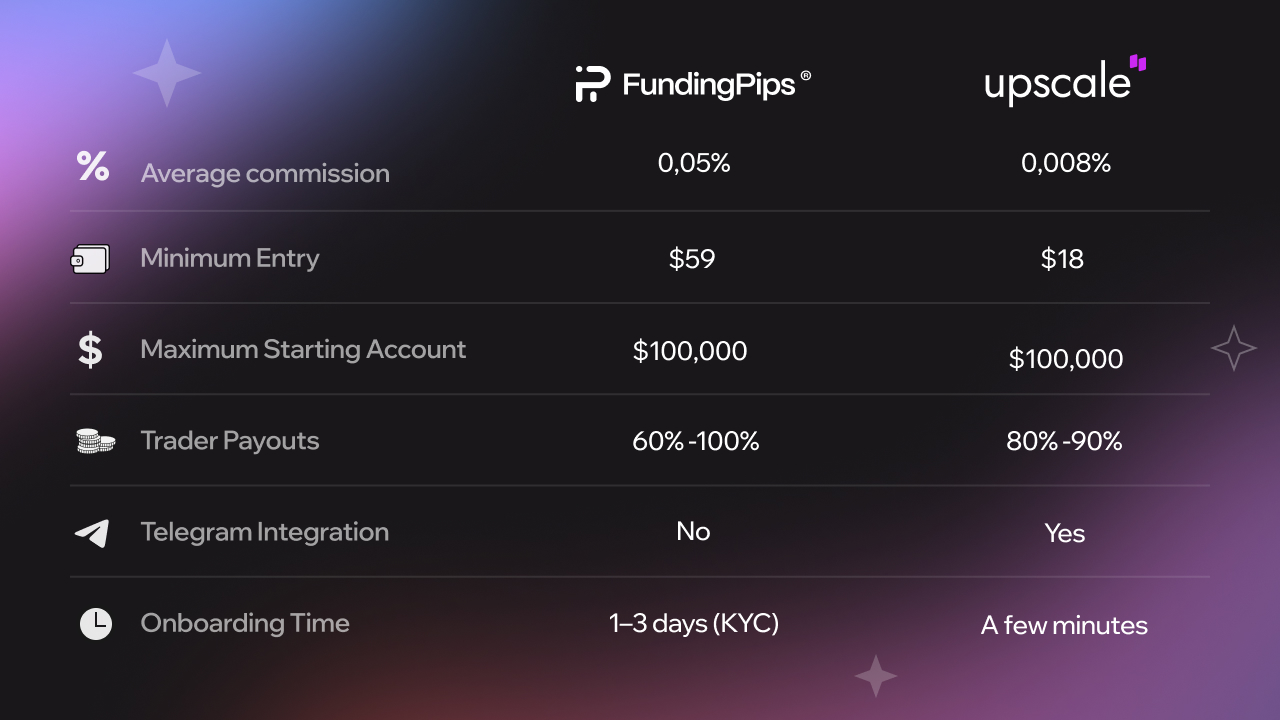

FundingPips

— A tech-driven prop trading project built by traders, for traders. Founded: 2020, Dubai.

🔶 How is it different from Upscale?

FundingPips requires just $59 to start, but payouts begin at 60% for traders, while Upscale offers 80% from day one. Unlike competitors, Upscale has no verification process, lower fees, and smoother trading via TradingView & Telegram.

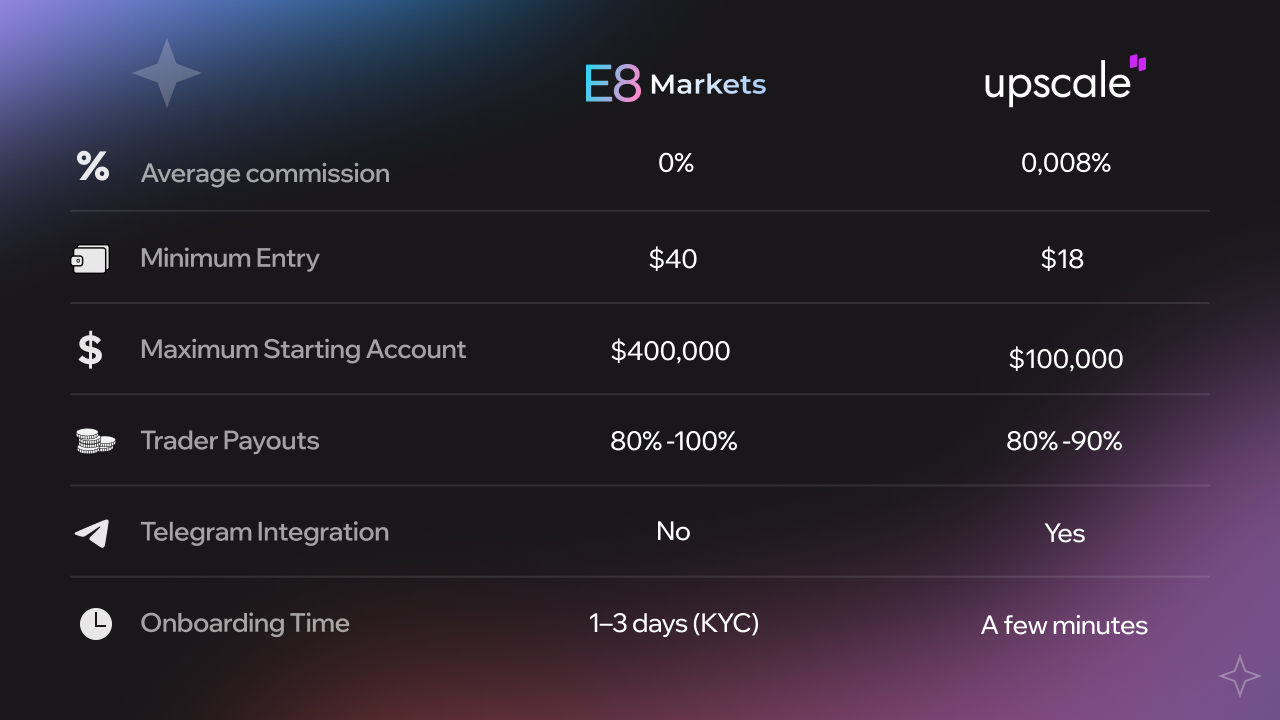

E8 Markets

— A prop firm with multiple evaluation options for traders. Founded: 2021, Dallas, USA.

🔶 How is it different from Upscale?

E8 Markets operates through classic trading terminals without Web3 features, which may not suit everyone in today’s trading world. Their trader evaluation structure offers three challenge options: E8 One (1 phase), Classic (2 phases), and Track (3 phases). Each has its own rules — for example, in the 1-phase challenge, traders need to hit a +10% profit target, while on Upscale, it’s just 5%. The daily loss limit is 4% of the starting balance, with a max drawdown of 6%, compared to Upscale’s 5% daily loss limit and 10% max drawdown. To support traders, the platform provides external webinars and materials since it doesn’t have its own Academy.

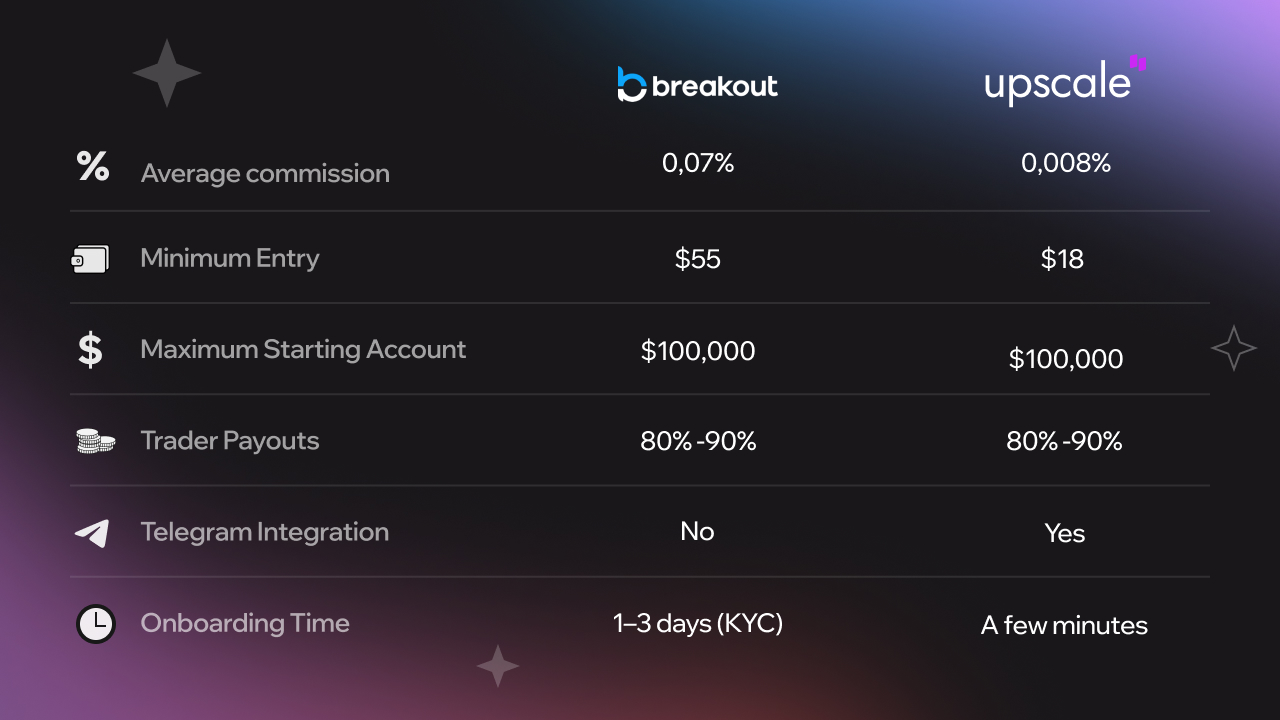

Breakout Prop

— project with its own trading terminal, focusing mainly on crypto assets. Founded: 2023, USA.

🔶 How is it different from Upscale?

Breakout Prop has stricter evaluation rules compared to Upscale. Traders face either a one-step challenge (+10% profit target, 4% daily loss limit, 6% max drawdown) or a two-step challenge (+5% and +10% targets). Meanwhile, Upscale’s profit targets are easier to hit — just +5% and +8%. The minimum entry fee starts at $55, which is higher than Upscale’s. Trading fees are $3.50 per lot (for opening/closing a $10,000 position), while Upscale charges only 0.008% per trade — way more cost-effective.

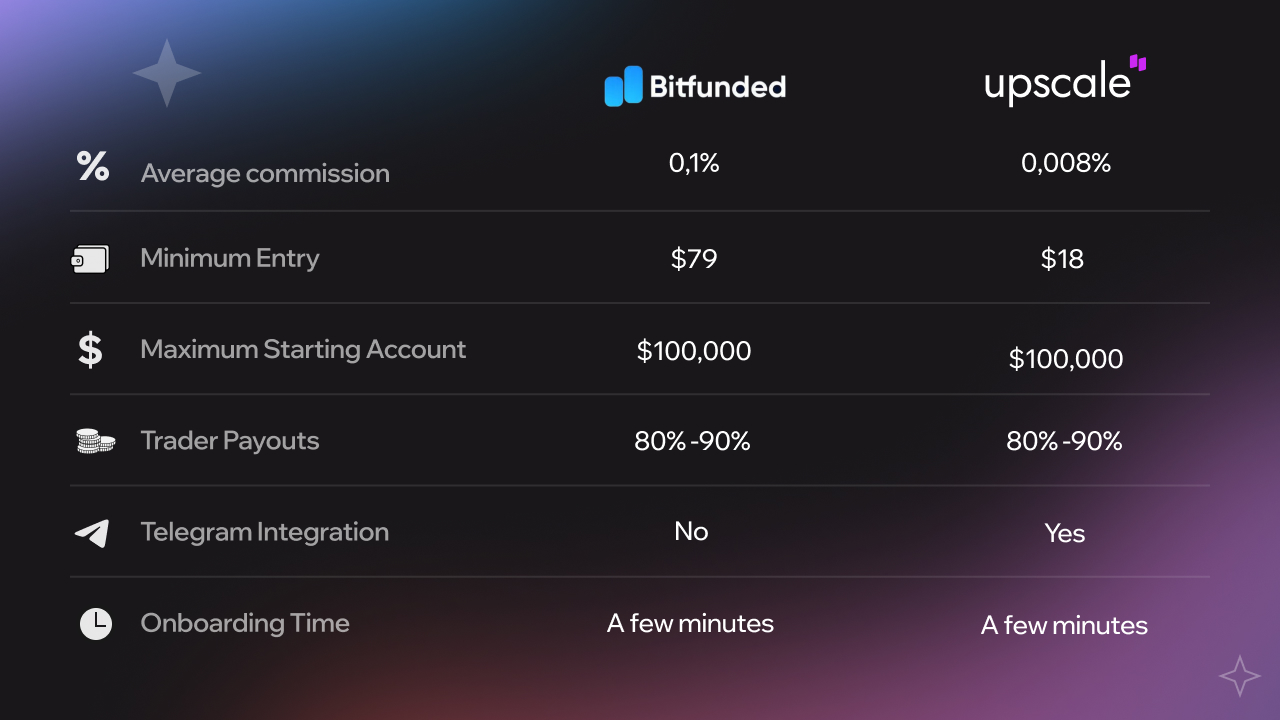

Bitfunded

— newer player focusing on crypto trading funding. Founded: 2023, UAE.

🔶 How is it different from Upscale?

Bitfunded focuses exclusively on cryptocurrency trading. The challenge fee starts at $79, and payments can be made via credit cards or Solana Pay — though there’s no built-in Web3 wallet integration. Payouts may be subject to internal policies, but exact withdrawal fees or commissions aren’t clearly specified.

Among other emerging players, SpiceProp from the Czech Republic stands out with its forex-focused trading and high leverage up to 1:100. Then there’s PropW, the official prop trading platform of the CoinW exchange. Both launched in 2023-2024 and are still in active development.

Beyond these platforms, newer projects keep popping up in the market. But for a fair comparison, it’s best to focus on established and proven players first.

💬 "So many options out there! But what are the conditions at Upscale? What makes it so special?"

🔶 Upscale’s advantages:

🚀 Just 0.008% fee per trade (open/close) with no hidden costs or slippage – one of the best rates in the industry.

🚀 Challenge starts from just $18 – the lowest entry threshold among major prop firms.

🚀 Some of the most flexible challenge rules: two phases with 5% and 8% targets, 5% daily drawdown, and 10% max drawdown limits.

🚀 Upscale’s modern trading terminal runs on a decentralized Pyth Network price feed. With aggregated Pyth prices and zero slippage on BTC, Upscale sets a new standard for fair and profitable trading.

🚀 Traders keep at least 80% of profits, with potential to increase up to 90%.

🚀 No IP restrictions, news trading bans, or hedging limits: Trade from any country, use any strategy (including hedging), and enter trades during high-impact news – no artificial blocks or restrictions.

🚀 Upscale is the only platform offering trading directly in Telegram Mini App and web – no extra terminals needed.

🚀 Fastest onboarding: Sign up and start trading in just minutes – no KYC required.

🚀 Access to 200+ top crypto assets for trading.

🚀 Maximum capital: Up to $100,000 per account, with the ability to manage 4 accounts at once – scaling up to $400,000 total.

🚀 Free education: All Upscale traders get free access to Storm Academy – learn advanced strategies, improve skills, and boost trading performance.

💬 "Agreed, the conditions are top-notch! So what’s next?"

⏰ Time to take action

✍️ Prop trading isn’t some exclusive luxury anymore — it’s a tool for every smart trader. And if you’re still wondering whether to give it a shot, the question isn’t "Do I need access to up to $400,000 in capital?" The real question is: Are you ready to miss out on trading with minimal risk and maximum opportunity?

💎 Check out Upscale Telegram or visit the Upscale website. Start transforming your trading life today.

The future of prop trading is already here. And it fits right in your pocket! 🚀