Introduction

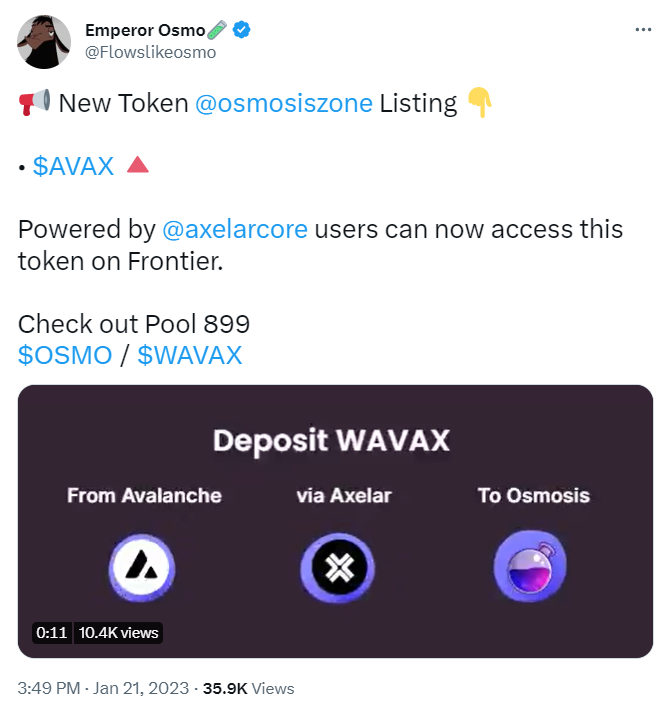

WAVAX is the wrapped version of Avalanche's native token AVAX, which was listed on Osmosis on January 21st, 2023. The first week of WAVAX trading on Osmosis saw a surge in the number of liquidity providers (LPs) and the volume of LP activities. This article provides an analysis of WAVAX activity on Osmosis during its first week of trading. We will focus on LP activities, token transfers, bridging, and swapping, and compare WAVAX trading on Osmosis to native swaps on Avalanche during the same time period.

LP Activities

According to data analysis, LPs are providing more $OSMO liquidity to pool 899 compared to wAVAX. Moreover, the number and volume of LP activities are higher for joining the pool rather than exiting it. The average volume of LP transactions has increased since the first week, and the average volume is greater for exits compared to joins. This suggests that LPs are more likely to exit the pool once they have earned a certain level of profit or are no longer interested in providing liquidity to that particular pool.

Token Transfers

The data shows that more wAVAX is being transferred into Osmosis than out of it. Within Osmosis, there is a very low amount of wAVAX flowing, indicating that traders are more interested in buying wAVAX on Osmosis rather than selling it. Moreover, the data also shows an increase in the volume of wAVAX transfers since the end of the first week. This increase could indicate a growing interest in WAVAX trading on Osmosis or simply an increase in the number of traders and LPs participating in the WAVAX ecosystem on Osmosis.

Bridging

All wAVAX flows from AXELAR to Osmosis. Until February 14th, there was only one day where the net flow was negative, indicating that wAVAX flowed more from Osmosis to AXELAR on that day. This suggested that there was a strong interest in bringing wAVAX into Osmosis from the AXELAR ecosystem at that time. However, since then, the outflow has been more favorable among bridgers compared to inflow. The bridge analysis provides insights into the flow of wAVAX between different ecosystems, highlighting the importance of interoperability between chains for the growth of the WAVAX ecosystem.

Swapping

The number of wAVAX swaps and unique swappers has increased since the beginning of the second week. There is a peak in the number of swaps on February 2nd, which is reflected on the Avalanche chain as well. This suggests that there is significant demand for wAVAX trading on both Osmosis and Avalanche, indicating the importance of both platforms for the liquidity and growth of the WAVAX ecosystem.

Conclusion

Overall, the insights provided by this analysis can be useful for traders, liquidity providers, and other participants in the WAVAX ecosystem. By comparing the trading activity on both platforms, we can gain insights into the preferences and behavior of traders and LPs in the WAVAX ecosystem. The success of the WAVAX ecosystem on Osmosis and Avalanche will depend on the continued participation and activity of traders and LPs, as well as the interoperability between chains.

Check out the dashboard for a more detailed analysis. 🔍📊 🔗

Twitter: SocioCrypto