Introduction

Stablecoins have emerged as both a central point of focus and a subject of concern within the blockchain ecosystem. On one hand, there is a consensus that stablecoins play a pivotal role in the world of Decentralized Finance (DeFi), generating considerable enthusiasm. On the other hand, vulnerabilities have become apparent, particularly following the UST depegging and the subsequent turmoil on the Terra blockchain. Long-standing concerns about governmental challenges, particularly regarding USDT, continue to raise alarms. Nevertheless, despite these challenges, the blockchain space continues to witness the emergence of numerous projects dedicated to the development and integration of stablecoins.

This growing interest and the need for robust stablecoin projects necessitate a deeper understanding of stablecoin projects and theoretically-driven frameworks for assessing their functionality.

Stablecoin Functionality Framework

In a recent article, Caesar identified a lack of consensus in understanding crucial aspects of stablecoins, resulting in uncertainty regarding project directions. They posit that the fundamental question for any stablecoin project revolves around the value proposition of stablecoins. To address this, Caesar offers a theoretical analysis and proposes a framework for comprehending this question, which they term "stablecoin functionality."

According to Caesar, stablecoins should serve five primary functions: Medium of Exchange, Store of Value/Peg Stability, Capital Efficiency, Fiat On-Ramp/Off-Ramp, Censorship Resistance.

Assessing Stablecoin Functionality with On-Chain Data

When it comes to the practical application of Caesar’s theoretical framework, data and measurements become crucial. One approach is to gauge the subjective perception of users regarding the functionalities suggested by the framework using off-chain data. However, in this blog post, I aim to take this discussion further by exploring how this theoretical framework can be applied in practice to assess the functionality and health of stablecoin projects using on-chain data.

In the following sections, I delve into each of these functionalities and provide suggested metrics that can be collected through on-chain data analysis for assessment. To illustrate my points, I also present some example cases of assessing the functionalities of USDC and USDT on Avalanche, using on-chain data provided by FlipsideCrypto. Finally, I conclude with suggestions for further empirical and theoretical analyses.

Stablecoins as a Medium of Exchange

Caesar argues that stablecoins should function as a medium of exchange, facilitating seamless transactions. Presently, only $USDT, $USDC, and, to some extent, $DAI are widely used for purchasing other cryptocurrencies or conducting transactions. Other stablecoins often lack the necessary liquidity, network effects, holders, or capital efficiency to provide a scalable medium of exchange.

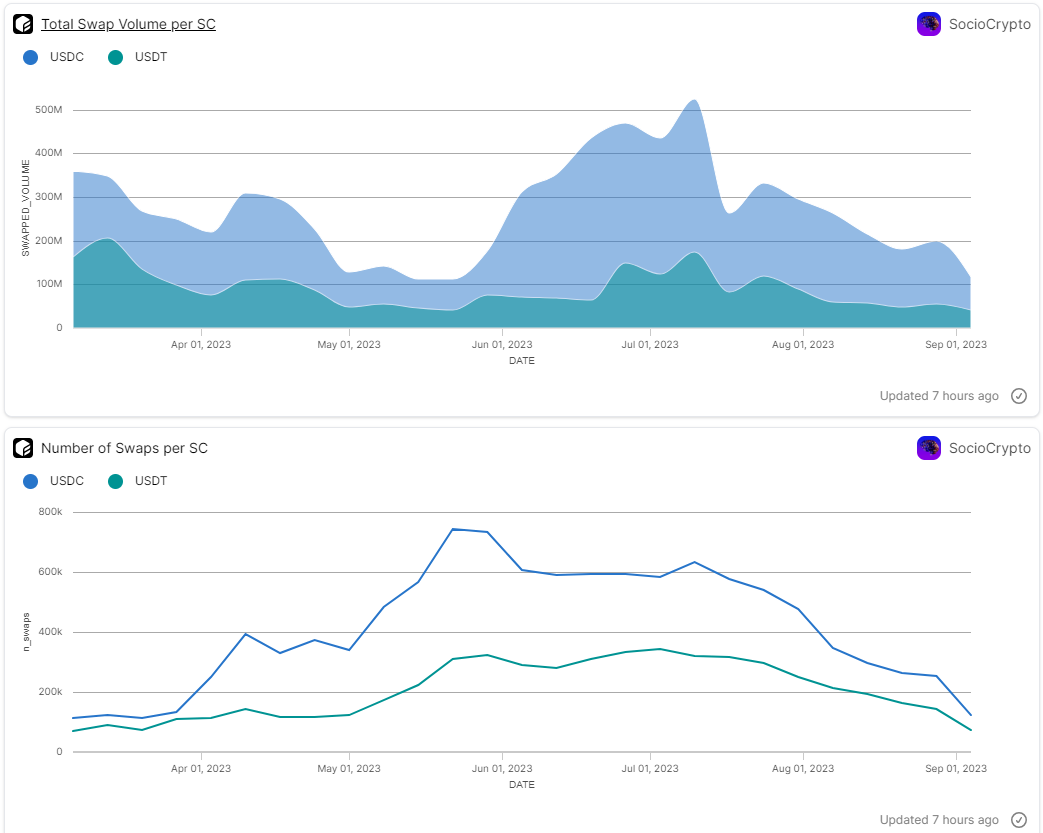

To evaluate the extent to which a stablecoin functions as a medium of exchange, we can examine the frequency of stablecoin transfers to determine how easily they are being transacted. We can also delve into stablecoin swaps (trading), both to and from other cryptocurrencies, to assess how effectively these stablecoins facilitate trading and exchange.

The most important metrics for this evaluation relate to the number of wallets/addresses involved in stablecoin transfers and stablecoin swaps, as well as the volume and number of transfers and stablecoin swaps.

Peg Stability and Value as a Store of Value

Caesar contends that stablecoins are invaluable tools for safeguarding assets within the highly volatile crypto environment. Consequently, maintaining their peg to a stable value is of paramount importance, and most stablecoins strive to achieve varying degrees of success in this regard.

One critical metric to consider is the frequency of deviations from the pegged value. Another indicator of the effectiveness of a stablecoin project can be observed through the usage patterns of its users. The circulating supply and its evolution can provide valuable insights. An empirical research shows that during periods prone to depegging, USDt and BUSD functioned better than DAI and USDC.

Furthermore, many new stablecoin projects, categorized as yield-bearing stablecoins, offer yields to their holders and stakers through LSTs or governance tokens. This mechanism serves to protect their users against inflation according to Caesar. The evolution of the number of stablecoin pools with fixed or dynamically changing yield rates can be indicative of this functionality of stablecoins.

Capital Efficiency

Capital efficiency, according to Caesar, refers to “the amount of capital a user needs to generate a given quantity of stablecoins”. While fiat-backed stablecoins, including USD-pegged ones like USDt and USDC or Euro-pegged ones like EUROC, offer a 1:1 ratio with centralized solutions, crypto-backed stablecoins require over-collateralization accompanied by liquidation risks, which affects scalability. This poses challenges to their scalability while offering a more decentralized and permissionless solution to the stablecoin ecosystem.

For non-fiat stablecoins, capital efficiency can be measured by the collateralization ratio: Total Collateral Locked / Total Stablecoins in Circulation. Liquidity pools and market depth can serve as proxies for capital efficiency, as deeper liquidity can lead to more capital-efficient trading and swapping of stablecoins. Calculating the fees associated with stablecoin issuance and redemption can also be correlated with capital efficiency, as higher fees can reduce capital efficiency by increasing the cost of generating or redeeming stablecoins.

Fiat On-Ramp and Off-Ramp

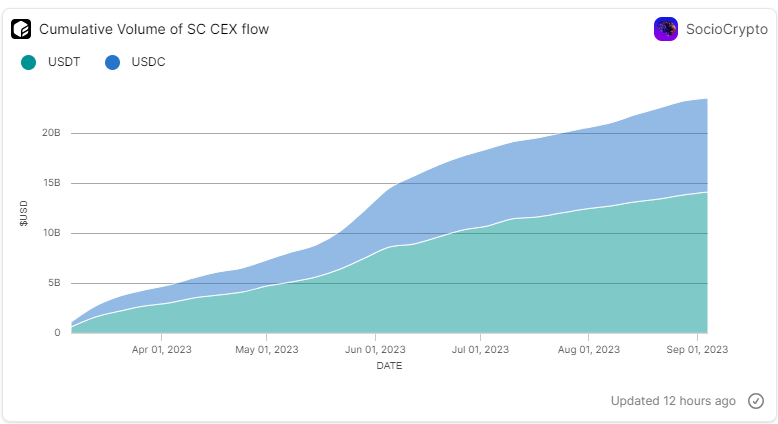

As Caesar emphasized, seamless conversion between bank holdings and stablecoins is crucial for driving adoption and user-friendliness. The best indicators can be found in the flow of stablecoins between CEXes and chains.

For instance, a study over the past 6 months indicates that over $20 billion worth of USDC and USDT has been transferred between CEXes and the Avalanche chain. Notably, there is a higher outflow of USDC from the chain compared to USDT.

Censorship Resistance

Censorship resistance, the freedom to transact, the freedom from confiscation, and transaction immutability, is an inevitable principle of blockchain. Projects that do not align with this principle are meant for failure. To assess the censorship resistance of stablecoins, we can analyze their adoption within the Decentralized Finance (DeFi) space. The level of adoption and integration of these stablecoins within DeFi platforms may indicate a higher degree of censorship resistance. Furthermore, we can assess the usage and adoption of these stablecoins in various protocols, particularly in projects related to cross-border payments, remittances, and trading. Widespread usage can enhance censorship resistance.

Conclusion and Directions for Future Research

In this blog post, I have revisited Caesar's framework for assessing the functionality of stablecoins, emphasizing empirical research and the utilization of on-chain data. The analysis shows that stablecoin functionality can be rigorously analyzed through on-chain data, opening up new avenues for discussion, research, and theoretical exploration in the field.

Looking ahead, there are several promising directions for further exploration. Firstly, we can consider extending the functionality framework to include commodity-backed stablecoins like AGX and AUX and newly introduced “stablecoins”. These assets, although centralized like USDt and USDC, deviate from the traditional peg to the USD, warranting a closer examination of their unique characteristics and functionality.

Another intriguing path of inquiry involves the integration of on-chain analysis with user surveys. This mixed-methods approach could provide valuable insights into how users perceive stablecoin functionalities, shedding light on aspects that may not always align with the stated objectives of these projects.

Moreover, on-chain data analysts can leverage this framework to develop comprehensive analytical dashboards. These dashboards would serve as invaluable tools for continuously monitoring and assessing the health of stablecoin projects, contributing to the ongoing refinement and optimization of these essential components within the cryptocurrency ecosystem.

In essence, the study of stablecoins remains a dynamic and evolving field ripe with opportunities for further exploration, refinement, and innovation.

References:

-

Solving the Stablecoin Question: Stablecoin Functionality by Caesar

-

Data-driven Analysis of Stablecoin Functionality on Avalanche by SocioCrypto

-

Cover image is generated by AI using fotor.com