The perpetual futures exchange landscape has been exploding in recent months across crypto and as a trader we now have different chains and product experiences that we can explore and hopefully profit from. Core to this recent expansion in derivatives exchanges more broadly has been the increasing adoption of L2’s across Ethereum. Whether it’s protocols in testnet built on Starknet still such as ZKX protocol and RabbitX or protocols that are live and doing serious volume such as GMX, Kwenta and dYdX, there’s a number of ways in which a trader can capitalise on discrepancies between exchanges.

Let’s start with a simple explainer of what it means to be delta-neutral. A delta-neutral strategy is one that attempts to construct a portfolio or group of positions that have no directional risk to the market. For example if I both open a long trade of 1 ETH and a short trade of 1 ETH at the exact same price, then regardless of the movement of the market, my total portfolio value will not change (ignoring fees).

Understanding the basics

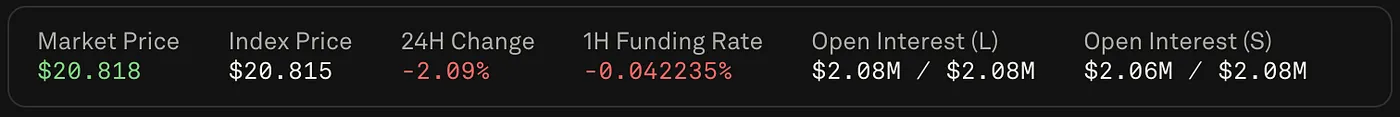

A perpetual exchange such as Kwenta built on top of Synthetix has a funding rate (see image below). In simple terms a funding rate ensures that the perpetual price of an asset e.g. ETH remains in line with the spot value of ETH. If you are familiar with derivatives you likely have traded or heard of a ‘futures’ contract. Where a futures contract is an agreement between a buyer and a seller to transact an asset at an agreed date and price in the future, a perpetual has no expiration date. As a trader this gives you an opportunity to take advantage of this pricing mechanism to increase your potential risk adjusted returns.

Let’s decode the funding rate you see in the image. Different perpetual exchanges across different chains will use slightly contrasting mechanisms to calculate funding rates but as a trader you want to understand the time period in which funding is paid/received as well as how the funding rate fluctuates over time. To calculate the annual APR using the funding rate above the calculation is as follows:

0.007060% * 24 = 0.17% (1 day APR)

0.16944% * 365 = 61.8% (1 year APR)

When the funding rate is positive (as per our example) traders that are long pay the funding rate whereas traders who are short receive the funding rate. This is important as it sets the stage for understanding how we can build delta-neutral strategies to use the funding rate to our advantage.

Strategies

Armed with our new knowledge on funding rates, let’s explore some ways in which we can exploit them to our benefit to generate delta-neutral returns.

Cash and carry

The simplest strategy commonly known as the cash and carry trade is to buy the spot asset and sell the perpetual future in the same size. The funding rate presented above is for the crypto asset OP. The trade would look as follows:

Buy $10,000 OP spot.

Short $10,000 OP on a perpetual exchange.

OP is trading at approximately $2.50 at the time of writing this article and therefore to execute this strategy a trader needs to ensure that they are able to as effectively as possible both buy and short the asset in equal size and price as possible in order to eliminate what is known as leg risk. Leg risk is the risk that when putting on the two sides of the trade that the markets moves so that the two sides don’t end up balancing each other out i.e. they are not market neutral.

The goal of the above trade is to pick up the 62% in annualised funding i.e. $6,200 in annual returns regardless of if the market trends up or down. While this sounds too good to be true, a trader must understand how funding rates can vary across different exchanges but also different assets. There are various analytics sites available for tracking funding rates across exchanges such as coinglass and Laevitas that are essential for traders to understand how the funding rate deviates over time. The first image below shows how the funding rate changes for the asset $UMA with each red bar representing the funding rate for an 8 hour period. On the extremes, the $UMA funding rate was -0.75% meaning that extrapolated out on a daily basis you would pay/receive (depending if you were short or long) 2.25% in funding fees i.e. 821.25% annualised!

Even if we were to assume a -0.1% funding payment every 8 hours, this equates to >100% APR annually. Returning to our earlier cash and carry strategy, a trader would take advantage of this persistent negative funding rate to long $UMA and short the corresponding amount of $UMA spot elsewhere. To short spot $UMA a trader would need to borrow it from a defi money market protocol and therefore incur borrow costs which would reduce the returns. Maybe there is a more capital efficient strategy?

Funding rate arbitrage

While the combination of a spot position and a perpetual is attractive and often simpler to manage for a trader, there are other ways to position in a delta-neutral manner involving leverage enabling a more capital efficient and potentially higher return (also risk). A funding rate arbitrage strategy involves a long and a short perpetual position across different exchanges. The goal here is to find the largest discrepancy between two funding rates on the same asset. The below image is the funding rate for Sol on Kwenta. The funding rate is paid/received every 1 hour. A trader would want to take a long position in Sol on Kwenta given the funding rate is negative and take a short position for the same amount on dYdX (second image).

The benefit of using perpetuals is we can employ leverage on both the long and short leg of the trade. Let’s see what the returns might look like if we use leverage to maximise gains using the same $10,000 as per the cash and carry trade example from earlier. I’ll employ 5x leverage for this example.

$2,000 long Sol on Kwenta at 5x leverage = $10,000

$2,000 short sol on dydx at 5x leverage = $10,000

Daily funding received on Kwenta = 0.042235 * 24 = 1.01364% (370% annualised)

Daily funding received on dydx = 0.000138 *24 = 0.003312% (1.21% annualised)

For rounding and simplicity sake let’s say we are making $100 per day on $20,000 i.e. 0.5%. That’s actually 2.5% daily on $4,000 collateral!

This all sounds too easy right?

Important considerations

Funding rate fluctuations

Although examples presented previously have shown funding rates fluctuate, they have generally been consistent in their negativity/positivity (see UMA example). This has meant that a delta-neutral position in the asset has been easier to manage as both sides of the trade are able to be held for days, weeks or even months. See the image below for AAVE on dYdX on how the funding rate fluctuates between positive and negative. Asset selection and exchange selection are the key determinants in selecting a delta-neutral trade that has the highest probability of success.

Leg risks

I covered leg risk earlier in the article but it’s an important topic to reiterate. When choosing exchanges you must consider fees and spreads in order to execute the trade in a delta-neutral manner. Leg risk is the risk the market moves a significant direction after you place one side of the trade (one leg) and therefore you delta does not = 0 and you are exposed to market direction.

Liquidation

Leverage carries benefits in capital efficiency provided you are executing a profitable trade however it also presents liquidation risk that must be managed. If you are trading both sides of the position using perpetuals then it’s likely that one side will be liquidated (depending on how long you hold the position) and a trader will need to ensure that they manage the overall position in order to close it delta neutral.

General fees and associated trading costs

You need to consider the various associated costs that are incurred on both sides of the trade as well as the fee structure and the associated chain costs. Are you trading on one chain or across chains? are you trading on Ethereum layer 1 for one leg and optimism for the other leg etc…

Other delta-neutral strategies?

While I focused on a couple of simple strategies in this article focusing in on using perpetual exchanges, there are a number of other ways in which a trader can express a market neutral view in order to collect risk premia involving options, cex vs dex, futures vs spot etc….

Options utilise more greeks than just delta and therefore they have become natural instruments to express views on non-delta risk premia. This is an article for another time!

Concluding remarks

It might be sad for me to admit but I think I’ve tested nearly every perpetual exchange that exists in crypto — at least across the major chains and L2’s. That said, there’s a few features I’d like to see as common place or developed further:

-

Clear historical funding rate data

-

An interface that enables cross exchange atomic positioning

While historical funding is not necessarily an indicator of future funding rates, it is nonetheless helpful in helping the trader when considering their strategy when presented in a clean and simple UI.

Atomic positioning would likely need to be developed outside of a perpetual exchange as a layer on top enabling positioning across various perpetual exchanges to be executed in one transaction.

I didn’t even get a chance to mention automating all of this through bots or the opportunities across cex/dex for these strategies. Any quants/devs/HFTs want to collaborate on the next piece?

It’s an exciting time to be both building and trading in the space. As L2’s continue to proliferate the market, the quality of the exchanges and the opportunity for traders will only increase. In order to answer the question set in the title, there’s only one way to answer that. Go and test these protocols and try it yourself!

Good luck out there and reach out if you’re also an active user in the DeFi perpetuals space!