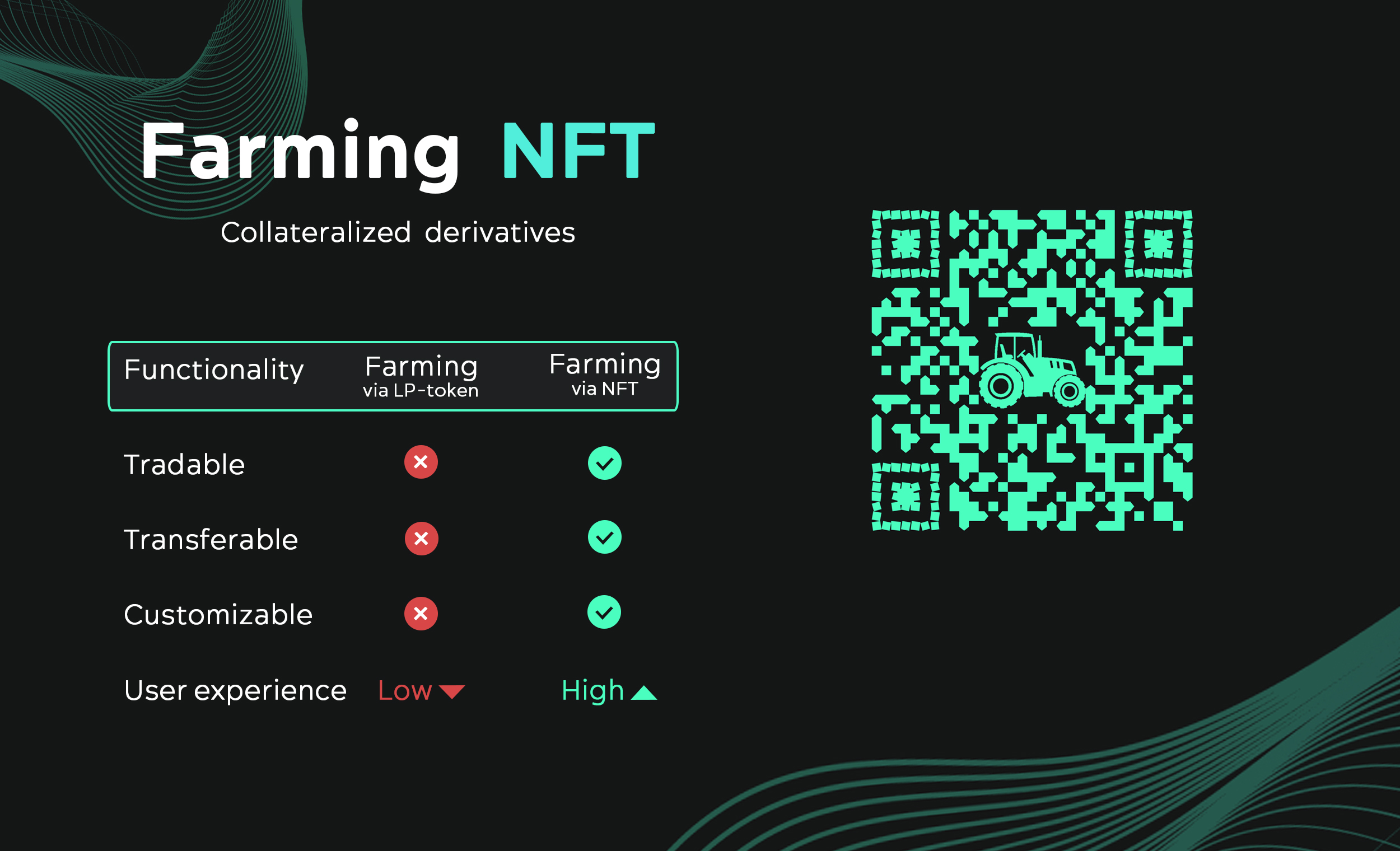

Let’s start with the basics and try to understand how staking differs from farming. Staking as a process of blocking tokens seems to be similar. The main point of staking is to provide a working network. When you farm with Envelop, you create a wNFT where interest rates, farming times and collateral tokens become one collateralized derivative, which is more flexible and honest than ERC-20 LP tokens. So you can sell farming wNFTs on any NFT marketplace, while it is impossible to sell your staking position, you can only delegate. This important difference gives your farming wNFT positions the most important feature in any market — liquidity!

Can staking work with a set of assets? Absolutely not. Can Envelop Farming be a basis for linking to other derivatives? Of course it can. Structurally, farming and, for example, NFT gifts could already be the collateral for even more complex financial tools.

Can staking be part of farming? Yes, of course it can. But can staking be bigger than farming? No, of course not. So farming via Envelop’s NFT is essentially next-generation farming 2.0, where you can tune quite a bit.

So Envelop changes many crypto concepts, leaving the heart of the processes, but making them more functional.

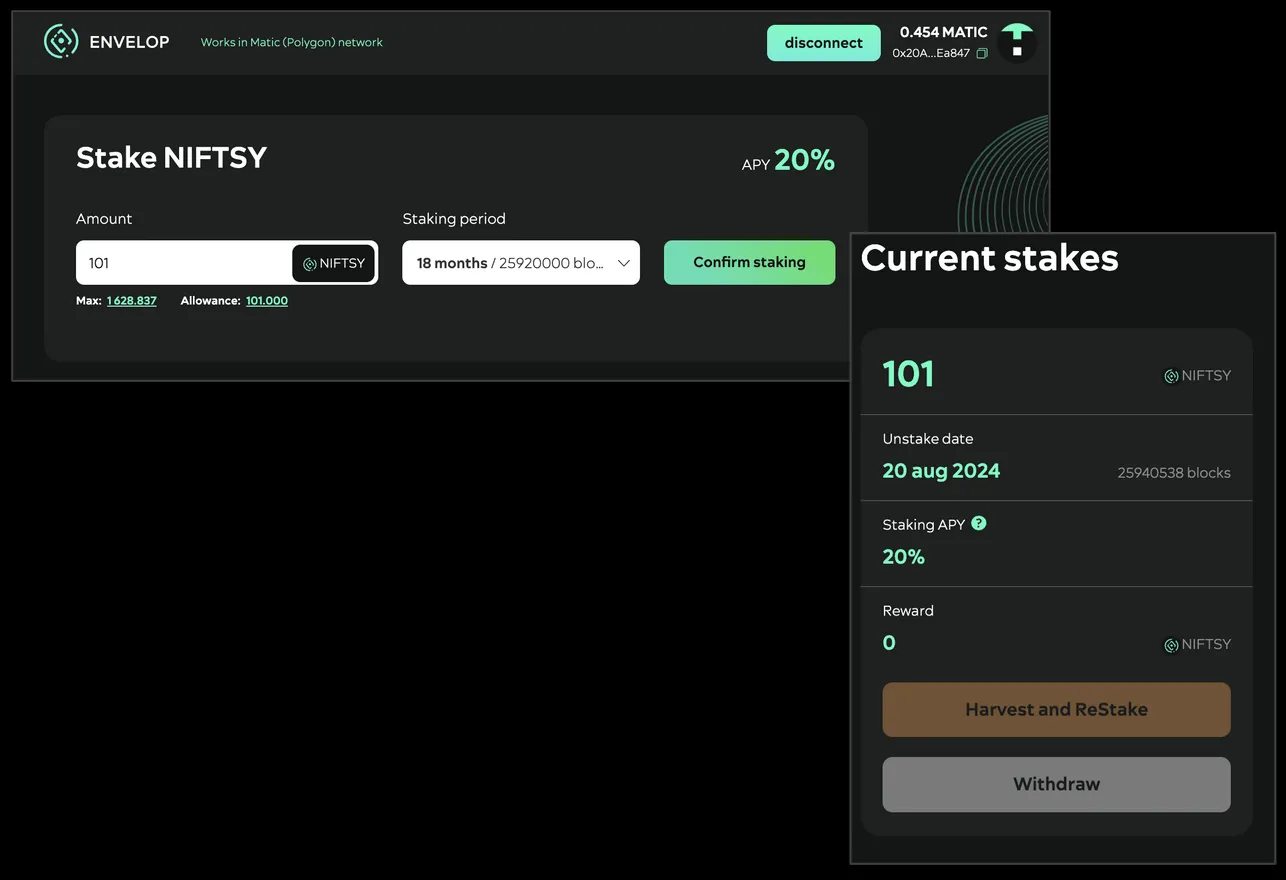

Farming is the transfer of cryptocurrency under the management of another entity with a predetermined term of return of assets plus interest for the service. In DAO Envelop architecture, it is the RIGHT to transfer cryptocurrency, interest on it and other programmable properties, through wNFT.

In this kind of programmable farming, the owner of the wNFT gets a reward for farming. Think of it as instant farming, holding your future harvest.

If you transferred or sold your farming NFT during staking, before the harvest, you will receive nothing. The new owner of the farming NFT will receive all the reward.

In the infographic below you can find the main differences between farming via LP-tokens and farming via NFT.

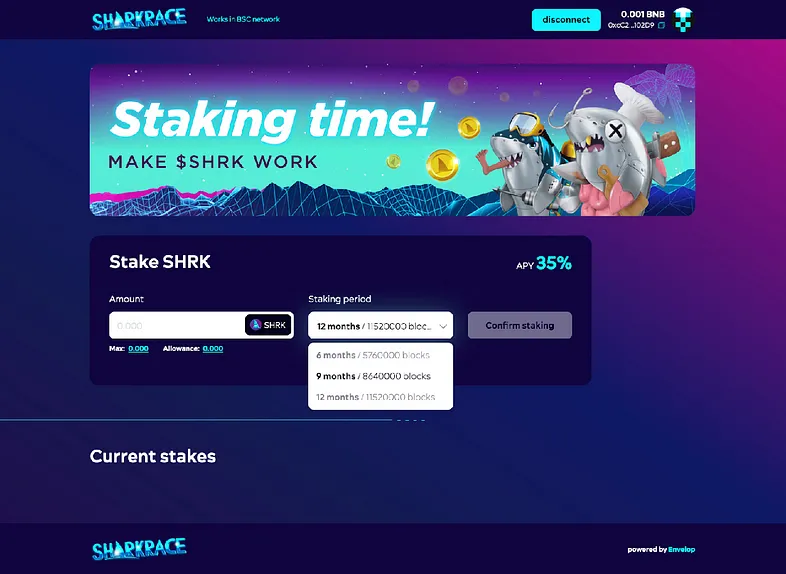

This approach can be used to create more complex cases. When a network of partners joins together and adds several different tokens to the collateral of such an aggregating farming NFT. It turns out such a “multi-farming NFT”, which can still be sold or gifted in one transaction. In this case, you save on commission and transfer your entire portfolio (or you can think of it as an index) of farming tokens.

So, Liquid Farming is easy to plug tool to perform farming via wNFT concept. Projects can use this tool to offer their community farming options. Main advantage is that when tokens are farmed, the owner gets tradable wNFT, which stands as a right of rewards claiming, and unstaking of tokens — so the owner can resell all his vested tokens and future rewards by just selling wNFT. Also it is a useful mechanic when farming is limited by the quantity of farmers/pool of tokens.

Farming NFT Value proposition

-

Attractive for project community members

-

Tradable farming positions

-

Easy rebalance

-

No APY and transactional losses

-

Simplicity — no need in LP-tokens

Example of white label implementation for Shark Race: https://sharkrace.envelop.is/#/

Contract — https://bscscan.com/address/0x40bc52774Dc8D59adf7e893543BDbe7a68a13a8f

Envelop is a collateral-backed and price discovery cross-chain protocol to provide NFT with inner value and liquidity.

🌎 Website | 🐦 Twitter | 🗯 Telegram-chat | 🐱 Github | 📢 TG channel

📩 Wrapper dApp | 🌾 Farming dApp | 🗂 SAFT wNFT | 🔨 Mint