This is a short overview of the NFT2.0 projects from the Blast ecosystem. The projects are selected from the NFT2.0 aggregator. The information below does not constitute financial advice.

Any project that expands the field of creation and utilization of NFT will be categorized as NFT2.0.

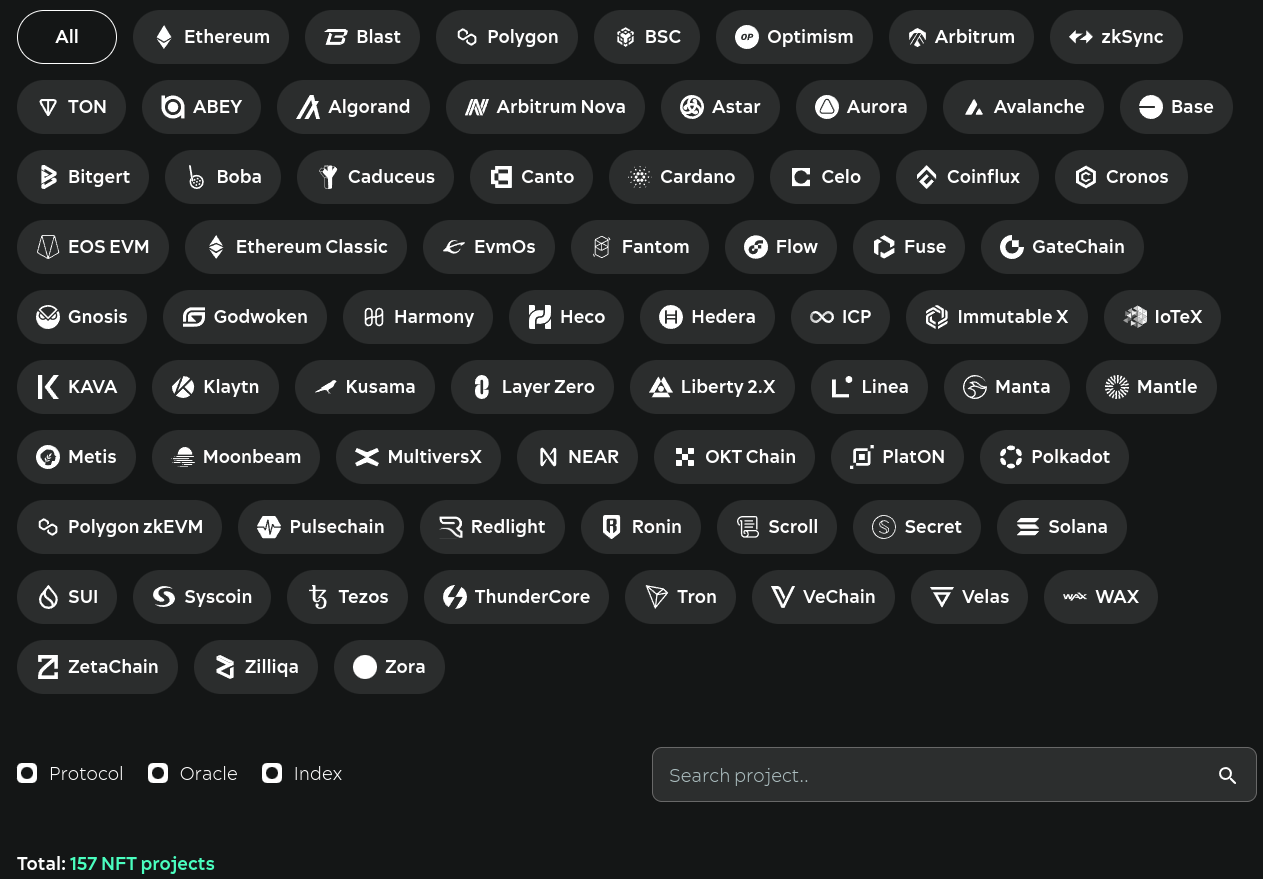

NFT2.0 Aggregator Options

-

Network filter or you can go to direct link for Blast n

-

Project type filter: protocol, oracle, index (this includes dynamic NFTs among others)

- Tags filter in project cards (click on the “NFT derivatives” tag, for example, and see all projects with this tag in the selected network)

If your project extends the reach of NFT you can add it to the aggregator free of cost by filling out the form

NFT2.0 Project Review

NFT derivatives

In this section we will look at NFT derivatives of any type.

-

Doubler is a gain strategy protocol that optimizes crypto asset investment and minimizes risks while pursuing certain profit. Doubler serves as a storage tool for users' crypto assets. By depositing supported cryptocurrency assets in Doubler, users can lock in their value, eliminate unnecessary market risks, and receive a reward at the end of the protocol. Doubler reallocates crypto assets within the protocol, and the rewards received by users come from the profitable part in the market.

-

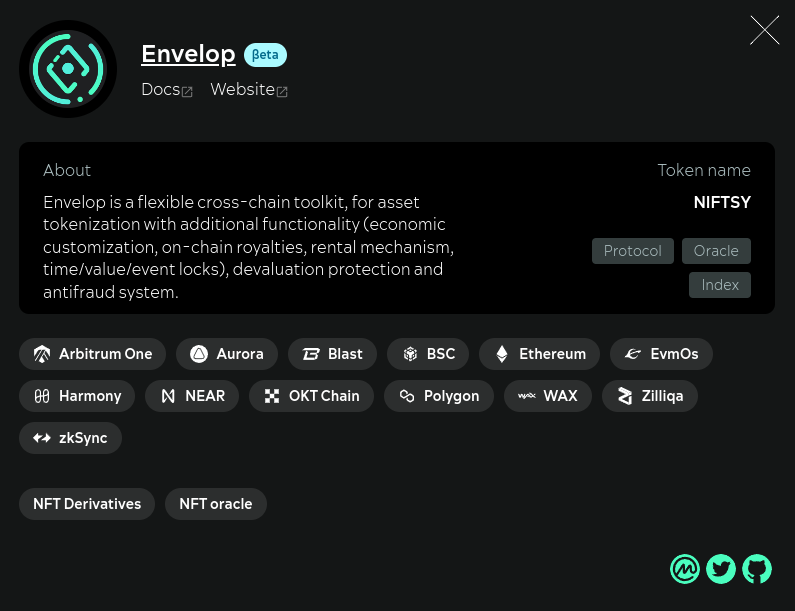

Envelop is a programmable asset protocol. Based on the protocol, you can create derivatives with customizable functions in a few clicks. In combination with the Envelop NFT oracle, you get a huge number of cases that do not require development, from dynamic SBTs to vesting NFTs and collateralized derivatives.

-

NFTperp is a perpetual futures DEX for NFTs. It launched in 2022 on Arbitrum now starting in the Blast network. nftperp v2 introduces a transformative liquidity protocol called Fusion AMM that combines the strengths of automated market makers (AMMs) and on-chain decentralized limit order books (DLOBs). The insurance fund operates as an ERC4626 vault, allowing for easy liquidity contributions.

-

Nibbl is a web3 protocol that lets you make editions of your NFTs. With Nibbl, you can make NFT editions, and create a community of like-minded collectors who also own these NFT editions.

-

NFTFeed, is a multichain NFT platform that combines finance and Web 3.0 to enhance the intrinsic value, liquidity of NFT and the Defi market. NFT liquidity allows users to add NFTs to a liquidity pool and receive LP tokens in return. Aggregator farming allows NFT to engage in a variety of lending, borrowing, and farming activities, optimizing the use of assets held by NFT and potentially increasing its market value. NFT Future Contract allows users to lock their future assets into NFT and set a future price, offering a unique way to sell and trade digital assets.

-

Wasabi is an asset-backed NFT derivatives protocol. There are three different derivatives of the product in the range: Wasabi Perps, Wasabi Options, Liquidity Aggregation (Buy Now - Pay Later)

Wasabi Perps allow for long and short-term liquidation trades based on on-chain index price.

Wasabi options allow traders to set long or short positions before the expiration date without any liquidation issues.

Wasabi offers a liquid NFT derivatives market through liquidity aggregation, matching buyers with the most favorable terms across all NFT protocols to provide them with long and short positions.

NFT Lending

This section presents protocols for borrowing against NFTs as collateral.

-

MetaStreet is a permissionless lending protocol for on-chain collateral. MetaStreet structures high yield sources into a tradable asset. Structuring is accomplished through MetaStreet v2: Automatic Tranche Maker ("ATM"), a permissionless NFT lending protocol that automatically organizes capital into a pool based on the risk and return (rate) profiles of depositors. The ability to trade assets is enabled by the Liquid Credit Token ("LCT"), a liquid, composite ERC-20 representing each lender's position in the pool.

-

PumpX Multichain Consumer Liquidity Protocol - a lending protocol that integrates financial liquidity and facilitates consumer adoption of financially backed cryptocurrencies. PumpX Marketplace Aggregator, a flagship application built on top of the liquidity protocol that serves as an early adoption interface for everyday users. PumpX's peer-to-peer loan matching model will utilize more innovative ways to create assets and liquidity for non-blue chip tokens/NFTs.

-

Ajna is a peer to pool, oracleless, permissionless lending protocol with no governance, accepting both fungible and non fungible tokens as collateral.

Liquidity providers' NFTs (LP-NFT)

This section presents the positions of liquidity providers in DEX pools tokenized through NFTs.

-

MonoSwap has integrated LP-NFT and Maestro's innovative technology and concentrated liquidity managers into the V3 AMM to improve and expand trading capabilities. Non-fungible yield-bearing staked positions serve as an additional layer above regular LP tokens, incorporating new features that benefit both users and protocols:

-

Dynamic Handling of Locks and Yield Boosts: Manage locking on staked positions and the accompanying yield enhancements.

-

Increased capital efficiency by implementing a variety of custom staking strategies.

-

Reusability, both within their protocol, exemplified by pools, and through the potential for external implementations.

-

-

RogueX is a Blast native AMM designed to capitalize on underutilized assets in traditional AMM liquidity pools. It goes beyond standard spot trading by introducing perpetual trading within the same pool. RogueX extends the concept of concentrated liquidity (LP-NFT) to create a decentralized exchange that leverages these untapped reserves. In this way, RogueX provides users with an enhanced trading experience, reduced slippage, and increased capital efficiency.

-

Thruster is a degen-first DEX. With the ability to utilize custom curves, several new features and related products can be built on top of Concentrated Liquidity (CL):

-

Automated Liquidity Managers: Because the Uniswap v3 design allows for dynamic liquidity management, protocol and strategy managers can create vaults that accept liquidity and adjust custom ranges based on market conditions to maximize fee.

-

Limit Orders: Custom price ranges in Uniswap v3 allow you to create limit orders that sell or buy assets at specific price points, providing greater control over trade execution.

-

Options: CL protocols can be used to efficiently create options like range payouts.

-

SocialFi NFT

The social profile and connections tokenized through NFT are presented in this section.

-

Alpha Club is a Blast native yield bearing whisper listening marketplace that aims to be the de facto place to voice and exchange voices in cryptocurrency. Users can create clubs (which can later be turned into NFTs), trade access to clubs like stocks, and upload/record voices or place voice spaces in these clubs. Access to a club is represented by a "card" that conforms to the ERC-3525 standard. Thus, the card can be linked to items off-chain, making it a repository for items such as IDs, coupons, Airdrop points, or even access to NFC-enabled devices, opening up real-world use cases. Cards can be traded against a bonding curve (the user can buy/sell them at any time without a counterparty) or traded as NFTs on other platforms.

-

UPTO3 is based on the concept of event knowledge graph, which builds and utilizes event graphs to provide users with complete and accurate event correlation information, thus supporting various intelligent applications and decision analysis. With the help of artificial intelligence technology, UPTO3 efficiently extracts event elements such as subjects, time and event content from big data. In addition, the system intelligently establishes relationships between events, providing a solid foundation for building an event knowledge graph. The event will be released as an NFT. Event consensus will be achieved through verification tasks. Decentralized validators perform verification tasks to get rewarded in the form of tokens. Features Blast (L2), all gas generated by verification goes into the reward pool.

ERC-404

ERC-404 is one of the approaches aimed at solving the problem of liquidity of illiquid assets.

-

Blachhh is a collection of 10,0000 unique tokens. Blachhh is creating a new era of semi-fungible tokens with their own liquidity and fractionalization.

-

Blastroid coming to Blast with a combination of ERC721 and ERC404. A cyberpunk game is in development, promising a deep, immersive experience with NFT Blastroid taking center stage. The first generation Blastroid NFT features BlastroidApes, each with unique traits and designs and minted as ERC-721 tokens. To enhance the value and uniqueness of Blastroid Apes, ERC404 enhancement tokens are presented, available in several rarity options: Rare, Mythic, and Legendary. Combine your Genesis ERC721 with ERC404 to level up and evolve your ERC721 NFT. Owners can combine a Genesis 1 NFT with an ERC404 token to unlock an enhanced version of their NFT, increasing its aesthetics, rarity, and utility in the Blastroid ecosystem.

Refundable NFT

- BLASTR NFTs combine ERC721 standards with a unique twist. Minting involves locking ETH into an NFT contract for a certain amount of time. After the lock-in period ends, these NFTs are effectively free as you can get a full refund. Simply request a refund, the NFT will be burned and your ETH returned, making NFT ownership flexible and risk-free.

Community NFT

NFTs created through the efforts of many participants fall into this category. Such NFTs are also called collaborative NFTs.

- 50x50 is an application in which people jointly make NFT

ERC-6551

ERC-6651 is a new standard for NFT token development, aiming to enhance functionality, security, and interoperability. It introduces token-bound accounts (TBAs) that can hold tokens and other NFTs, interact with smart contracts, and change based on external factors or user inputs.

- Mangrove is an EVM-compatible order book-based exchange protocol, in which offers can be bound to a smart contract. Membership in the DAO is represented by ownership of NFTs (ERC-721). There is a collection of NFTs for each of the governance groups.Each member's NFT is managed by a TBA (ERC-6551), and this TBA in turn receives tokens to represent the member's attributes, such as its Activity Score (ERC-20, relevant only for Builders and Pods).To allow members to retain their membership NFTs after leaving Mangrove, they model active membership by issuing an "Active Badge" token to TBA as part of a multi-token contract (ERC-1155); when a member leaves the group, the active badge is burned.

Envelop is a programmable asset protocol.

🌎 Website | 🐦 Twitter | 🗯 Telegram-chat | 🐱 Github | 📢 TG channel

📩 Wrapper dApp | 🌾 Farming dApp | 🗂 SAFT wNFT | 🔨 Mint