Just thought I would gather my thoughts here on why I am bullish for Olympus in 2022.

Volt

Volt is a multi-collateral fork of RAI which promises to be one of the major projects to watch in 2022. Captained by an ambitious and all round nice guy OneTrueKirk it has certainly captured the imagination of the Ohmies and was the very first protocol to join Olympus Incubator. Don’t be surprised to see PCV protocols inhale VOLT starting with Olympus, but likely Frax and Fei too.

With some of the biggest DAOs at its back and a long list of the top angels in the space - don’t be surprised if this protocol launches with a FDV in the hundreds of millions.

Olympus managed to snag a 6% share of the VCON governance token as a part of the Incubator deal.

Redacted

- Olympus x Redacted double fly wheel - Olympus is generating a stream of productive assets from Redacted and Redacted is consuming a large amount of OHM. Olympus:

- Owns 20% of pBTRFLY and earns 5% of distributed BTRFLY

- Receives 20% of bribe revenue

- Receives 5% of paid out BTRFLY when users bond:

- Receives 5% of bonded assets currently CRV, CVX, OHM-BTRFLY:

-

The above is just from this last 2 weeks - imagine what it will be in a few months.

-

Soon this will probably include DPX, FXS, FXS-cvxFXS, SPELL and others.

-

Redacted generates massive value for Olympus and since Redacted will own a huge amount of OHM - it turns a double flywheel for both Olympus and Redacted.

-

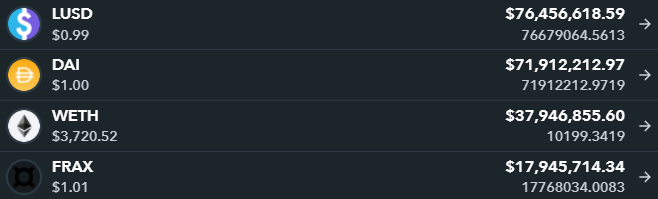

A large amount of the treasury assets can be viewed in this wallet bundle

Concave

Little is known of the Concave Co-op, except their objective is to create a spoon (as opposed to a fork) and spoon back value to Olympus from all the forks far and wide. We expect to see the Olympus treasury to start filling up with tributes, perhaps even becoming a whale in some of these forks in time… now that would be poetic. Expect more details and a launch in early January. Also follow the Concave Echo newsletter here for updates

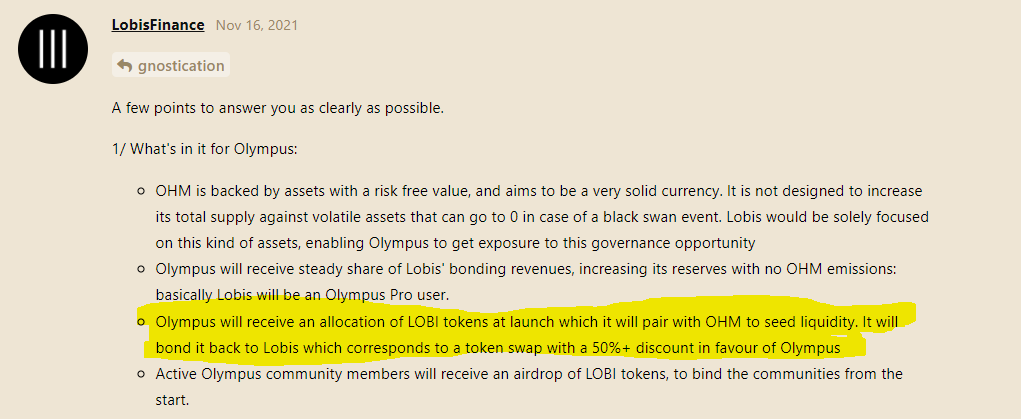

Lobis

- Not as shiny as Redacted - Lobis is the grungy younger brother of Olympus governance subDAOs and is not to be overlooked. Olympus receives a smaller 1.1% fee on all bonds to Lobis and - as they are just gearing up - this has amounted to just 196 LOBI at a current market price of $76K:

- Olympus also holds about $6 million OHM-LOBI liquidity given to Olympus at launch - this will soon be bonded back at a handsome discount for even more LOBI token.

- Assuming Olympus would receive a 10% discount on bonding the liquidity - it would then own 35.4% of all LOBI in circulation.

- Lobis treasury currently holds $1.891 million in TOKE, $5.6 million in CRV and $9.7 million in FXS - Olympus would by proxy control $6 million of the underlying assets - and that same portion of any FPI airdrop to come.

Phantom DAO

Casper and Nearlyheadlessnick are two Ohmies and operators who saw a niche and grabbed it - throw in the backing of the Bong Bear community - and you get a powerhouse Olympus DAO outpost on the up and coming Fantom blockchain.

Launching with a Fantom focused accelerator, a reimplementation of the Olympus code and going DAO first from day one - the founders passed the muster at their Olympus AMA and sailed through a governance vote to become an endorsed fork on Fantom. The partnerships comes with the backing and support from the Olympus DAO contributors and community - with Olympus receiving 3.33% of governance token at launch - slated for early Jan.

Debt DAO

Debt DAO promises to be the aggregation layer between large treasuries like Olympus, money printers such as Frax, Tribe and Dola, and opportunities for Web3 debt yield. Targeting an underserved market in the space, it seems like the moment for founders William X and Kiba to build out their ambitious vision. Sharing Olympus’ values and wanting them embedded within the Debt DAO community, Kiba and William impressed at an Olympus AMA - leading to a formal partnership with the decentralized reserve bank.

With Olympus brimming with capital ready to put to work and holding a 3.3% stake in Debt DAO - the upcoming launch and LBP promises to big. Oh… did I mention they will be the first protocol to raise an LBP in OHM… probably nothing…

Putting the treasury to work

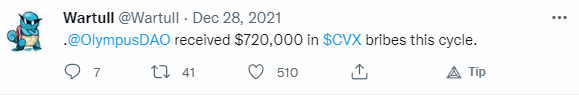

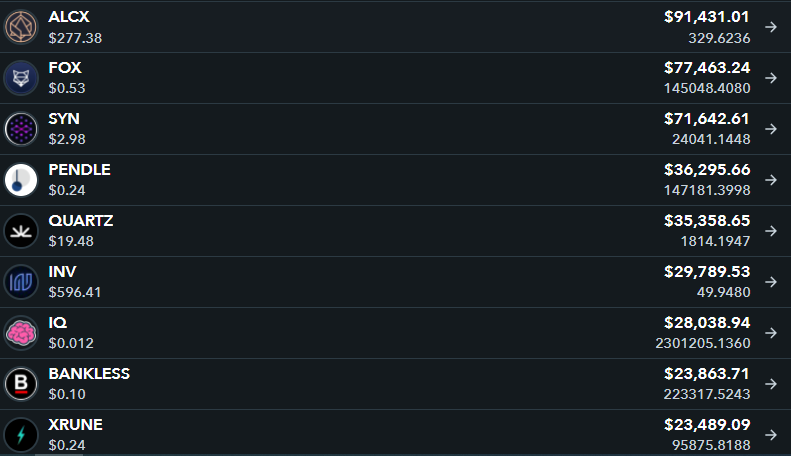

- Olympus has $42 million worth of CVX

- Because Olympus has a credible reputation of diamond handing its partners tokens it gets much more lucrative private bribes for example in this round ALCX and FXS

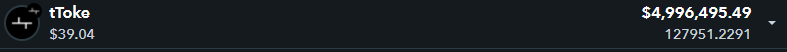

- Olympus owns a lot of TOKE which allows the DAO to direct liquidity and is earning ~28% apr in TOKE staked against the OHM reactor:

- Olympus was fortunate to swap with FXS for OHM with our partner Frax just before the FXS price ripped skyward:

- Not only will Olympus qualify for the upcoming FPI airdrop - it also means that if an OHM-FRAX gauge is approved Olympus will be able to weight vote for FXS rewards and farm without competition.

- Olympus has already vested a small portion of its pKLIMA and it already is a major asset in our treasury growing by the day:

- Olympus as a part of the Proteus program is able to consume partners assets across chain in return for gOHM rewards:

- Thanks to that brash Italian man Olympus stack of xSushi is earning everyday and ripping upward:

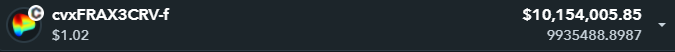

- The stablecoin treasury is farming now with a portion of our FRAX earning ~25% apy:

- Stablecoin and ETH farming of our other treasury assets is about to accelerate to about 50% of excess reserve assets thanks to OIP-54:

Olympus Pro Revenue

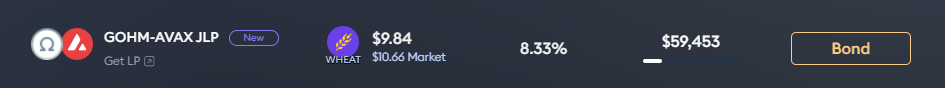

- Olympus Pro is a sustainable source of protocol revenue for Olympus - taking in 3.3% of bonding payouts and sending it to the treasury to back OHM:

- Some of our partners have signed on for massive multi-month campaigns - and so with every bond purchase, 3.3% of our partner’s tokens paid out and roll into the diamond handed treasury of Olympus to back OHM.

- With the launch of permissionless Olympus Pro just around the corner - prepare for a supercharge of this revenue stream.

- The liquidity model being developed in the DAO built on top of OP - allowing partners to accelerate the ownership of their liquidity when paired with OHM is going to increase OHM demand, take in more partner tokens and make tradfi heads explode.

Grants & Give

If you weren’t living under a rock you would know by now that Olympus has a grants program. What you might not know is that a number of grants have already been approved and teams are building out new products, services and integrations across web3 - some of them will drive demand for OHM and some of them will be a healthy source of revenue.

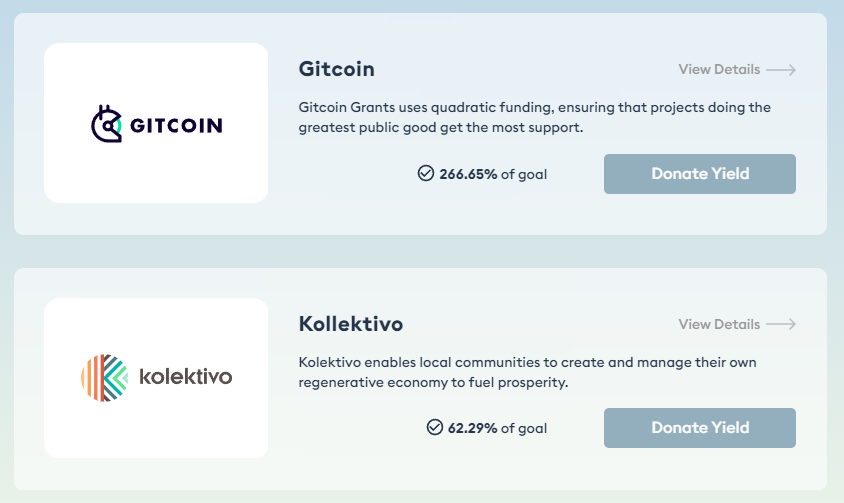

Olympus Give and the underlying Tyche technology to redirect rebases - is going see an explosion of use cases for OHM into 2022:

There are already a number of teams building on-top of the new DeFi primitive which is yield redirection - some of them are gonna change the game…

Incubator

Keep your eyes peeled for the next Incubator partner with a similar ambition and allocation as Volt - scheduled for announcement in early Jan:

Odyssey - NFT's & the OhmieSea

The Olympus Odyssey subDAO is incubating and partnering to launch and support a number of number of NFT projects, games and protocols with sustainable service fees:

You’ve surely heard of OwenSea - but have you heard of OhmieSea - this has been in development since April 2021 and will launch in March 2022.

Watch this space.

OHM in Treasuries

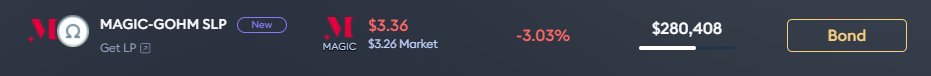

Smart protocols like Fiat DAO, TreasureDAO and Growth DeFi are already stacking gOHM in their treasuries - because they can see the coming OHM wars. Having friends like these stack gOHM in their treasury is a constant buy pressure on the OHM asset. Many more on their way… and perhaps the biggest of all in the next weeks ROME.

And don’t sleep on SquidDAO who just inhaled OHM at their recent auctions and are already out and about providing liquidity across chain:

Add to this a number of friendly forks like Umami holding a $1mm in gOHM and committing to keep a full 25% of its treasury into the future in gOHM.

And then Exodia conducting a $300K OTC gOHM buy in exchange for DAI from the Olympus treasury with many more to come.

And the list of upcoming releases goes on and on and on

Argo

Trireme

Hermes

Agon

Playgrounds

Eurus

FrenDAO

Atlantis

Olympus Academy

CEX listings within weeks thanks to marketmaker GSR

Terra, Solana, ICB…

And about 40 OP partners waiting in the pipeline

Metamars

Helios

Proteus

ve?

And so much more that is still under wraps

Summing up

The market cap of OHM is currently $2,148,054,211 at a price per OHM of $297 - the current backing per OHM is over $100 with the treasury assets about $800 million.

NFA - but if Olympus continues its partnerships and incubator cadence - just the equity held by the Olympus treasury in new projects alone will likely be greater this current market cap by this time next year.

Probably the same again from Redacted, Concave and Lobis.

And these aren’t even the main game of why protocols are/will be scrambling to stack OHM.

Olympus is the value of an activated, passionate community of cooperative builders that is full of leaders instead of just one - parallelisation towards a common goal - that is what is driving value to OHM.

And I think OHM is undervalued.

And I have a high conviction position in OHM.

And a lil extra alfa since you made it to the end

Olympus loves the Beras and the feeling is mutual…