Blockchain enthusiasts and wizards from all over the world gathered at Dune Analytics’ first conference DuneCon on September 15th, which was hosted at Funkhaus on the banks of the river Spree in Berlin.

Several of our marketing team members attended the event, networked with attendees and gave out some cool Perp swag!

The Berlin Pepe t-shirt will soon be available on our merch store.

Read on for some highlights from DuneCon.

Opening Keynote

The first talk was by Dune co-founder and CEO Fredrik Haga, who explained that Dune started with $3,000 in capital and around a third of this was spent on a visit to a Berlin hackathon.

In a nod to the book How Innovation Works by Matt Ridley, Frederik explained that innovation is a key ingredient for economic growth: “Innovation must have a dynamic and open economy in which new companies, upstarts and outsiders can challenge the status quo”.

TradFi is a closed and slow system with many frictions where everything you do is local, meaning that data has been siloed and knowledge is contained, which aren’t the best conditions to foster innovation.

On the other hand, open data makes blockchains the most dynamic and open of any economy, where anyone can access it and use it. That’s exactly where Dune comes in, by making crypto data accessible. But more than being a data tool, Frederik also emphasized it’s a community as well, where people are building on top of each other’s work and learning from each other.

And instead of a product feedback loop, the open permissionless quality of using Dune for blockchain data transforms this into an industry wide feedback loop, enabling greater innovation since anyone can write SQL on any data and figure out what’s really happening in Web3.

Dune API Announcement

While Frederik explained why the ‘data must flow’, Dune co-founder and CTO Mats Olsen explained how exactly Dune is continuing to make crypto data accessible and covered some of the different tools available on the platform:

-

Dune Engine: a new serverless SQL engine that allows you to query much bigger datasets much faster. While there will always be a free community version, starting in November, there’ll be higher performance paid tiers.

-

Spellbook: a way to contribute to community made, standardized abstractions. Allows you to develop, test and document changes and contributions to standardized data sets like dex.trades or nft.trades.

Olsen then announced the launch of a new feature: Dune API, which will allow you to turn any query into an API endpoint to build a “living, breathing, always improving API” that can be used by anyone to build anything with Dune’s data.

How a VC Does Diligence Using Dune Data

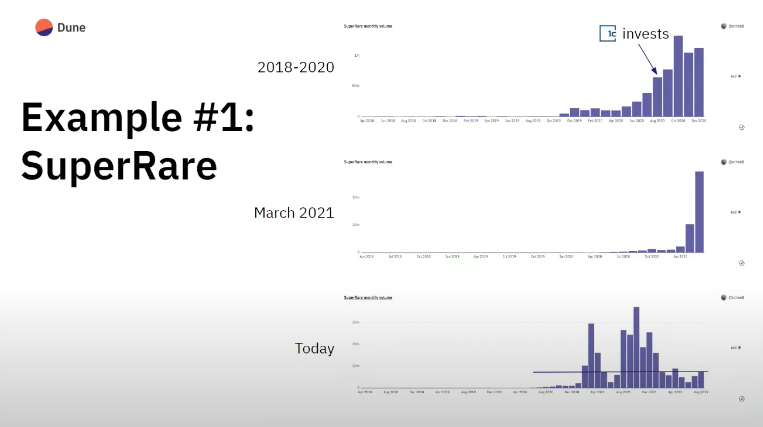

Richard Chen, who is a General Partner at cryptocurrency focused investment firm 1confirmation and the Dune Wizard with the most stars, explained that “up only” is not what you should look for when looking at the graphs of a protocol on Dune.

Chen said that successful projects tend to display a general pattern comprising three stages:

-

Exponential stage with 50% growth month-over-month.

-

Then a vertical stage when there’s a speculative frenzy.

-

And finally, a retracement stage with a retreat from the all-time highs, but bottoms out higher than the first stage’s all-time high.

These stages were illustrated with a few examples from well-known Web3 projects, namely SuperRare, OpenSea, and Nexus Mutual.

Chen’s talk also covered some common pitfalls when looking at Dune charts. For instance, even when a graph is going up and to the right, you have to make sure it represents real usage, since Web3 projects can pay for people to use their products (which isn’t possible in Web2).

He recommends being on the lookout for charts that have a hard floor when usage or revenue dips, as opposed to trending to zero and showing no signs of recovery. “Ponzi tokenomics” and yield farming are two factors to consider, as both can attract mercenary capital that may not stick around once the faucet dries up.

Finally, product innovation matters and projects that have copied others may see success for some time, but ultimately it’s what new things that are brought to the table and the quality of the team that determine long-term success.

Data Science on Uniswap v3

Austin Adams and Xin Wan from Uniswap Labs talked about how Uniswap data is generated, how this data is used by the protocol and some insights from their new paper on Just-in-Time (JIT) liquidity.

All important actions on Uniswap v3 are accompanied by an event, which can be easily transformed. But events have to be decoded and updated in databases, which is where Dune comes in and makes it easier for data analysts.

Some key things the protocol uses Dune for include:

-

Wallet retention: 36% of wallets swap again after their initial swap.

-

Volume by token for the Uniswap interface by using the dex.trades and ERC 20 tokens abstractions.

-

Breakdown of volume on different DEXs to track the competitive landscape of different DEX and the best pairs to introduce support for.

The final part of the talk centered on JIT liquidity, with Wan explaining that it was anticipated when the team were designing Uniswap v3, but they weren't sure how prevalent this phenomenon was going to be.

Some of the reasons why JIT liquidity is an important focus: it gives traders better prices, uncovers the competitive dynamic between liquidity providers as well as the level of sophistication overall of participants in the Uniswap protocol. Therefore, it’s an important thing to monitor since it can help guide future protocol developments.

JIT liquidity, on most days, accounts for less than $1 million in volume, which is a tiny percentage of the total trading volume. Overall, there’s 0.1%-0.2% going to JIT liquidity providers, which barely matters for other liquidity providers. While JIT liquidity happens extremely rarely, when it does it tends to be extremely concentrated, as illustrated by the chart below.

Wan concluded that talk by sharing the Dune query that powered all the analysis shared on JIT, which comprises just 300 lines of code.

The Evolution of the DeFi User Base

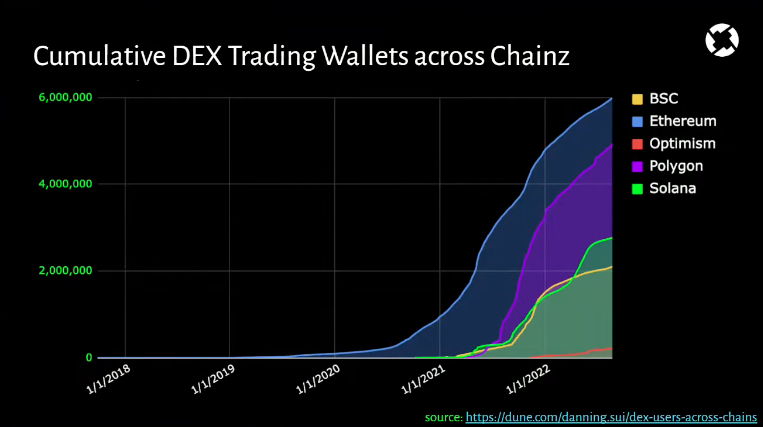

Danning Sui of 0x Labs reviewed the growth of DeFi users in her talk, covering the diversity of the applications vertical, the increasing sophistication of roles of DeFi users and the scale compared across multi-chain ecosystem.

The visualization below was one of the main highlights, which shows a 7-day snapshot of the DEX landscape, with Uniswap having the largest number of users. Each coloured node represents wallets that exclusively use a trading platform (i.e., the pink node quantifies the number of wallets that only use Uniswap), while the yellow and red dots show wallets that have traded on 2 or 3 DEXs.

Another interesting chart shared by Sui showed the number of wallets trading on DEXes over time across different blockchains:

Trends in Crypto Using Dune Data

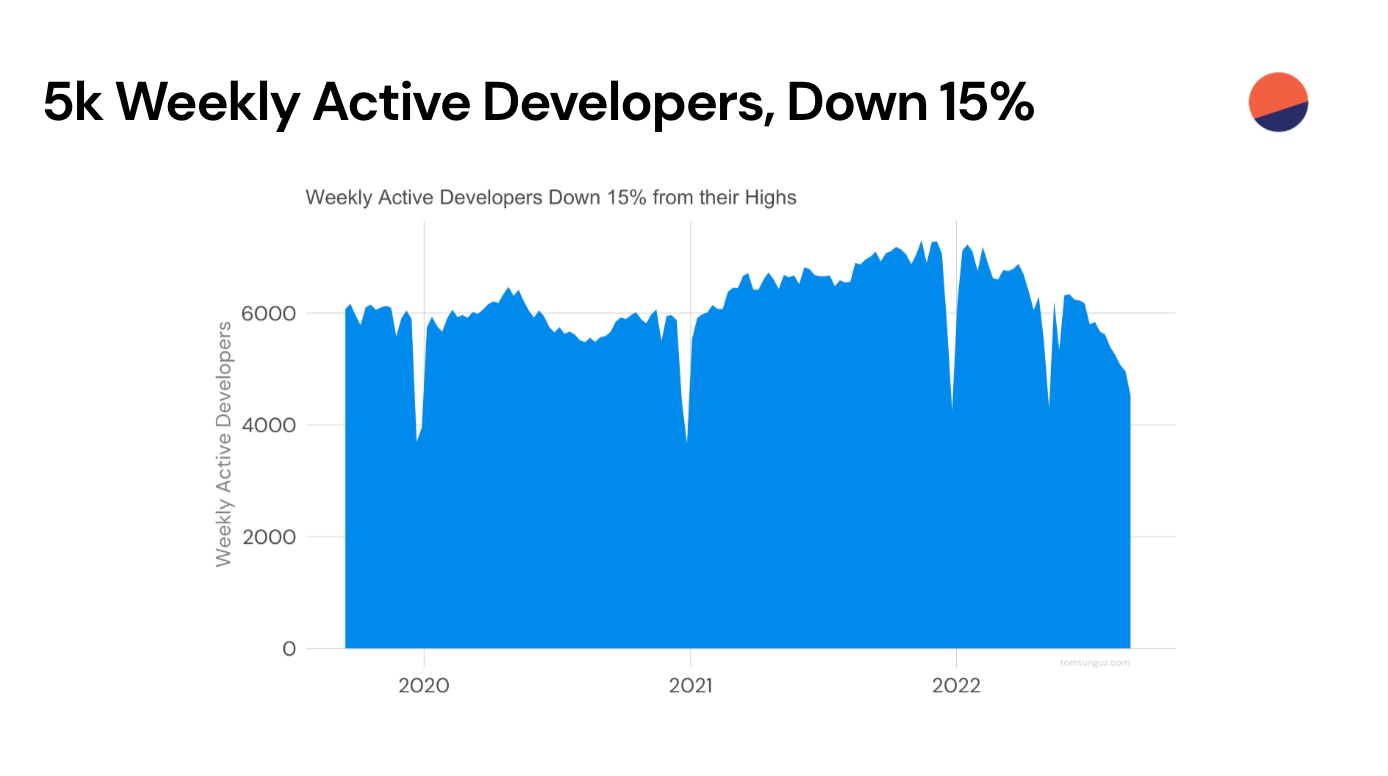

The Managing Director of Redpoint, Tomasz Tunguz, delved into data trends and highlighted the top 15 observations about the state of Web 3.

Some of the key points included are listed below:

- There are 2.5 million daily active users (DAUs) across different blockchains. BSC is the leader with almost 1 million DAUs followed by Solana and Ethereum.

- Crypto is still a niche sector, with most activity down 40-70% from the peak.

- There are strong positive correlations between the prices of Coinbase’s COIN stock and Uniswap’s $UNI token (+0.79), as well as revenues for both (+0.60).

- Layer 2s represent 30-40% of Ethereum transactions while only consuming less than 2% of the gas fees! Inflows into the Layer 2 ecosystem amount to an impressive $250M each month.

- Web3 projects are becoming similar to Web2 companies in that their valuations are becoming more correlated with the revenue generated. Tomasz also noted that an underrated metric going forward will be the cost of customer acquisition.

- Developer activity remains robust, only declining 15% from the highs seen in late 2021, and the number of contracts deployed has remained fairly constant at 300,000 per month.

To go even deeper into the state of Web3, check out Tunguz’s commentary on the data and full slide deck for his talk in this blog post.

Wizard Panel: Paths & Careers in Web3 Data Science

A panel talk with Florian Barth of Dune, Hildebert Moulié of Dragonfly, Kofi Kufuor of 1confirmation and Chuxin Huang of Optimism discussed how you can get started on a path in building a career in Web3 data science.

Some key takeaways for budding Wizards included:

-

Put your data and dashboards in front of the public to grow your reputation. Even if it’s wrong, you can go back and correct it later, as outreaching to the community to get feedback can help improve your skills and queries.

-

Find your communities and interests, be present and start being helpful, as it doesn’t matter if you don’t know everything. Aim to follow an iterative process of answering some question, ask the community in Dune’s Discord how it’s done, then put that into practice, then share your results and repeat.

-

Very few people are putting out valuable and useful stuff, so when you do that, you’ll get noticed. Focus on a single protocol, sharing with the community of that protocol before expanding out. Work on presenting some interesting statistics that haven’t been uncovered yet.

-

You could even re-work existing dashboards and make them look better.

There were plenty of other interesting talks on the mainstage and workshops on the breakout stage, all of which can be replayed on YouTube. As well as insightful talks and workshops, the afterparty gave the guests a chance to network further and enjoy some cool art installations!

We look forward to the next DuneCon!

Links