This is a guest post by Omer Arbnom Yanar, an independent researcher. He expressed his opinions about dollar-cost averaging (DCA) in this article, which may not represent the views of DeGate DAO. You can do DCA on DeGate, with zero trading fees.

There are various investment and trading strategies depending on the investor’s preferences. Investors choose these strategies based on their knowledge, risk tolerance, stress tolerance, time horizon, and time dedication. Dollar-cost averaging (DCA) is one of the least stressful and least knowledge-intensive strategies due to its nature.

In this post, we will discuss the main features of DCA and examine the return on investment (ROI) of some DCA strategies by backtesting the historical data using Python scripts. The data used in the backtest is retrieved from the CryptoCompare API. Here is the content list:

-

What Is DCA?

-

Strategies for DCA

-

Risks and Loss Scenarios

-

Backtesting Past ROIs

-

Comparison with HODLing

-

What DeGate Offers?

What Is DCA?

Dollar-cost averaging, or DCA for short, is one of the most investor-friendly strategies. It does not require a deep understanding of trading metrics or worrying about timing investments to find the lowest and highest points on the chart.

Everyone dreams about buying Bitcoin in 2011 when the price was around $1. However, managing a large position is stressful due to high volatility; remember, it dropped to $0.30 after surging to $1. On the other hand, continuously buying in small amounts over time would average out the purchase price, as one would be buying at both high and low points, making position management less stressful.

DCA means buying (or selling, we’ll discuss different strategies below) an asset for a certain period without concerning the current price. In the end, the investor would have bought it at both high and low prices and would get a sort of average cost. Obviously, the cost of the total investment will be higher than buying all the assets at the lowest price, but it will also be lower than the highest price. Therefore, this strategy provides less profit compared to buying at the lowest and selling at the highest, if it’s possible, in exchange for less stressful position management.

Strategies for DCA

There are two types of DCA strategies for spot trading. Although it’s possible to create more complex strategies for perpetual trades, they are beyond the scope of this post. The two main strategies are DCA buy and DCA sell.

DCA Buy:

DCA buy is a strategy that involves buying an asset at regular intervals, regardless of its price. This strategy yields great results if the asset’s price shows an asymptotic increase after accumulating within a limited price range over a sufficient period. The price of ETH between 2017 and 2022 exemplifies this scenario. At the beginning of 2017, the ETH price was around $9, and by the end of 2021, it was approximately $3700. The table below shows the ETH price during that period.

Let’s consider Alice buys $100 worth of ETH each week during this period. There are 261 weeks in five years, so her total investment would be $26.1K. However, she would accumulate around 192.7 ETH, which would be worth more than $717K at the end of 2021. This means her ROI would be about 2647% in terms of USD. However, this path would not be easy for her. For instance, on January 14, 2018, her investment value was about $164K, with a 2879% ROI. Eleven months later, the value of her position dropped to $12.5K due to the price decrease of ETH from $1400 to $85. She might have considered canceling the strategy at that time, but in doing so, she would have missed out on the massive gains later on. However, this may not always be the case.

Now let’s consider a scenario where Bob uses the DCA buy strategy in a decreasing market trend. At first glance, this behavior may seem counterintuitive since he buys while the price is decreasing. However, if he cannot predict when the market trend will change, applying DCA is an efficient strategy because the average cost of his investment will eventually decrease. Due to the characteristic of symmetry, he faces a similar outcome to Alice if he applies DCA to the direct mirror symmetry of the price trend. Let’s consider the symmetric graph of ETH price between 2017–2022.

Let’s assume that Bob buys $100 worth of ETH each week during this period, just like Alice. Since the number of buys is the same as Alice’s strategy, their total investment is the same. Moreover, Bob buys at the same prices as Alice but in the reversed order. Hence, at the end of the strategy, he will have the same amount of ETH at the same average cost as Alice. Therefore, he would also accumulate 192.7 ETH in exchange for $26.1K, just like Alice. However, this doesn’t mean their ROI is the same. Alice had 192.7 ETH when the price of ETH was around $3700, whereas Bob had the same amount of ETH when the price was around $9.

Before discussing Bob’s loss, let’s clarify how the symmetry works and why they end up with the same amount of ETH. The illustration below shows how this symmetry works.

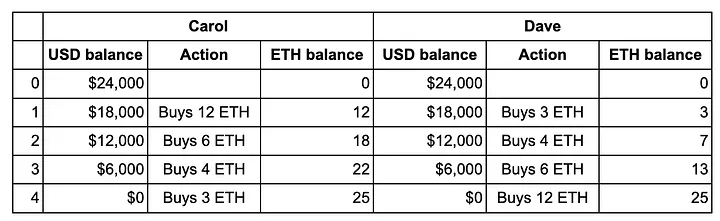

Consider that both Carol and Dave have $24K, and they are applying the DCA buy strategy by buying $6K worth of ETH weekly, with the ETH price behaving as shown in the graph above. Carol applies her strategy during weeks 1–4, while Dave applies it during weeks 4–7. The table below shows how much ETH they buy and their current balance in terms of USDC and ETH.

Both Carol and Dave accumulated 25 ETH in exchange for $24K. Carol has 25 ETH at the price peak, valued at $50K, while Dave’s 25 ETH is worth $12.5K. Dave’s ROI is about -48%. This seems negative, but if he believes the price will rise again, he can accumulate more ETH during that period and eventually profit. If the price doesn’t rise, his loss is still preferable to buying all his ETH at the peak price. For example, buying 12 ETH in exchange for $24K at the peak would leave him with $6K, a -75% ROI.

In a hypothetical scenario where Bob applies the DCA buy strategy while the price mirrors the ETH price from 2017–2022, he would end up with 192.7 ETH in exchange for $26.1K. Since the price is $9, his total investment would be worth $1734.3, meaning his ROI is -93.4%. This is a terrible scenario; however, it’s better than buying all in at the beginning. In that case, Bob would buy 7.05 ETH in exchange for $26.1K when the price was $3700, and at the end, he would have $63.5 instead of $1734.3. By doing DCA, he ends up with more ETH and USD balance compared to buying all in at the start.

Therefore, while a positive market trend applying DCA may cause profit, in a negative market trend, it may decrease the amount of loss.

The ROI data in this research report is calculated using Python scripts available at GitHub repository. To calculate the ROI of a DCA buy strategy based on past ETH prices, one can use the script provided here, namely DCAbuy-ROI-calculator, with the preferred setup such as period of buying, buying amount, strategy duration, etc. The script includes daily average ETH-USD data from January 2017 to June 2024. In addition, there is a script for retrieving more specific data using the CryptoCompare API.

DCA Sell:

Similar to DCA buy, DCA sell is a strategy involving the repetitive selling of an asset over a certain period. This strategy can be adopted by investors who cannot estimate the optimal cash-out point. By selling the asset in parts regularly, they achieve an average selling price.

The DCA sell strategy can be considered in two cases, in an increasing market trend and in a decreasing market trend. Let’s start with the increasing market trend. Consider the scenario where Alice applies the DCA sell strategy over the same duration we investigated above, i.e., between 2017 and 2022:

During that period, there are 261 weeks. To keep the calculation simple, let’s assume she buys 261 ETH at the beginning of 2017 and sells 1 ETH each week. At the end of this period, her average sold price would be around $785.6. Since the initial price was around $9, her ROI becomes 8622%.

Similar to the DCA buy strategy in an increasing market trend, Alice would have a positive ROI at the end of this strategy. Contrary to the DCA buy strategy, bounded price movements are not ideal for DCA sell. For the DCA buy strategy, it is desirable to have neutral market price movements at the beginning, allowing for more asset accumulation before the asymptotic increase starts. In the DCA sell strategy, during that neutral period, Alice would sell some of her assets for much less than the higher prices.

Let’s consider a scenario where Bob buys 261 ETH at the same time as Alice but starts selling them at the beginning of 2020. To end the selling period at the same time, he will sell 2.5 ETH per week. By the end of the period, he would have sold them at an average price of $1532. Considering he bought at around $9, his ROI would be 16922%, nearly double Alice’s ROI. Hence, before starting the DCA sell strategy, it may be wise to verify that the price rise has begun.

The DCA sell strategy is also useful in bearish markets. For instance, let’s assume that Bob acted greedily in the above scenario and waited until the end of 2021 without selling any ETH, then created a DCA sell position such that he sells 4.9245 ETH per week, i.e., selling all of them in a year. The chart below shows the price movement during the period.

At the end of 2022, he would have sold them at an average price of around $1989. Since he bought at $9, his ROI would be 22000%, which is even higher than the previous scenario of selling between 2020–2022.

Note that these numbers are quite extreme. We are assuming the average cost is $9. If the average cost were $2500, the ROI would be -25.7% when he sells 4.9245 ETH each week of 2022.

In the above comparison of Bob’s DCA sell strategies, the ROI is better in the decreasing market (i.e., 2022) compared to the increasing market (i.e., during 2020 and 2021), this is not always the case. Concluding that DCA sell is better during bearish times may not be accurate. Here, the most important factor is the average sold price. In the first scenario (selling during 2020–2021), the average sold price was $1532, and in the second scenario (selling during 2022), it was $1989. If the ETH price had increased more aggressively during 2020, the average sold price in the first scenario would have been higher than $1989. Alternatively, if the price had decreased much faster during 2022, the average of the second scenario would have been less than $1532. Hence, the better ROI of DCA sell during bullish and bearish markets is highly dependent on market conditions.

Another important point is symmetry, similar to the DCA buy scenarios. If Carol and Dave apply DCA sell strategies with the same amount of assets and over the same period in exactly mirror-symmetric market conditions, their end assets would be the same. Despite this, their ROIs wouldn’t be identical since the prices at the end of their strategies are different.

DCA sell can also be efficient during bearish market conditions to increase the total amount of assets, ETH in our case. For example, consider Eve had 52 ETH at the beginning of 2022 and was expecting a bearish market for a year. If she started a DCA sell strategy with weekly periods, she would have earned $105,426. At the end of 2022, she would be able to buy 87.88 ETH with that income. This method is effective if the price of ETH rises again. When it reaches the price at the beginning of 2022, her ROI would be 69%. If the price doesn’t reach the same values, she would incur a loss. In the next section, such loss scenarios are explained in detail.

In the GitHub repository prepared for this report, there is a script provided to calculate the ROI of a DCA sell strategy. One can investigate the results of different DCA sell strategies under various market conditions. It provides one additional output compared to the DCA buy script: “Current Value of Retrieved USD in ETH,” which shows how many ETH can be bought at the end of the strategy with the USD earned. This allows for analyzing DCA sell strategies to increase the total amount of assets.

Risks and Loss Scenarios

DCA is one of the most investor-friendly strategies, but this doesn’t mean it’s risk-free. Like every trading strategy, DCA has some risks, and it’s possible to face serious losses when using DCA. We can categorize these scenarios into four cases: DCA buy during bullish and bearish markets and DCA sell during bullish and bearish markets. In bearish markets, risks are higher compared to bullish ones. Let’s start with bearish markets.

We have seen that the most crucial component indicating the success of a strategy is the average cost of buying in DCA buy positions and the average selling price in DCA sell positions. For DCA buy strategies, one of the worst loss scenarios is a price decrease that never rises again. A price decrease is a desired movement for DCA buy strategies as it helps to lower the average cost, but only if the price will rise again. Otherwise, if the price is decreasing constantly, the investor will keep lowering the average cost, but the price will always be lower than the average, causing continuous loss. The graph below is an example of such a scenario.

In this graph, we see that the price is around $12 at the beginning of 2022, reaches $40 in Q1 of 2022, and then almost constantly decreases to $0.10. Consider Alice uses the DCA buy strategy for this asset during 2022–2024. Is it profitable? Of course not! She may decrease the average cost of buying below $1, but does it matter? This strategy ends with a certain loss unless the price starts to increase and reaches above the average cost. If a miracle happens and the price rises to $40 again, then she will get a massive ROI, but waiting for a miracle may not be a good strategy. To avoid such situations, it’s important to have a stop-loss strategy.

A similar price movement can cause loss in DCA sell strategies as well. Let’s consider a scenario where Bob applies the DCA sell strategy to the asset on the same graph above. If he starts that strategy at the beginning of 2022, buying at the beginning and selling gradually, he may see some profit at the start, but after the market becomes bearish and the price drops below his average (i.e., $12), he will continuously lose.

The risks and loss events are less dangerous during bullish market trends since the price continues to rise, making a negative ROI less likely. For instance, Alice can accumulate the desired asset during a price increase period by doing DCA, but she may struggle to decide on the best cash-out point. Still, she can sell the accumulated assets with a positive ROI unless a crash occurs and the price falls below the average. This may be considered a missed opportunity rather than a loss and can be frustrating for the investor.

Another missed opportunity occurs when the market increases and prices rise asymptotically after most (or all) of the assets have already been sold in the DCA selling strategy. Of course, this isn’t a loss scenario; the ROI will still be positive.

Therefore, during bearish market conditions, DCA strategies contain risks and may cause serious losses. To avoid these risks, investors should plan their stop-loss points. However, during bullish market conditions, facing negative ROIs is unlikely, but investors may still miss some opportunities.

Backtesting DCA buy and past ROIs

Until now, we’ve covered the fundamental aspects of DCA strategies and some ROI results. In this section, we will dive deeper into the data of ROI for different strategies and analyze them. Our approach will be to list all possible outcomes based on different starting dates of DCA buy and sell strategies with fixed investment amounts, periods, and durations. This approach will cover the period between 2020 and 2024.

Recall that 2020 and 2021 were bull seasons for ETH prices, while 2022 and 2023 were bear markets. Note that one can interpret 2023 as neutral instead of bearish, but in this context, it doesn’t change the analysis. Thus, we will categorize our analysis based on these years. An important point is fixing the parameters except for the starting dates. The buying amount is negligible since ROI is based on the average cost and final price. For example, if Alice and Bob apply the exact same strategy but Alice with $1000 and Bob with $100, their ROI would be exactly the same. Hence, only two parameters need to be decided: period and duration. Market sentiment changes for crypto assets much faster than traditional finance products, so taking long periods and durations may be misleading. As we saw above, taking long durations can bring both massive income and huge losses. To address reasonable scenarios, let’s set the period to weekly and the duration to 14 weeks.

Therefore, we will investigate the ROI of every DCA buy and sell position with a weekly period and a 14-week duration. In DCA buy strategies, after accumulating the asset for 14 weeks, we can apply a DCA sell strategy. To avoid too many possibilities in this report, let’s set the 15th week as the cash-out week. We will assume that all accumulated assets are sold in the 15th week and calculate the ROI accordingly. Similarly, for DCA sell strategies, we will assume that all of the assets are bought at the beginning of the first week and sold gradually over the next 14 weeks. Calculating the ROIs of all these strategies one by one would be time-consuming, but thankfully we have a Python script to do it.

Before diving into the data, let’s clarify a question: Is there a time duration such that both DCA buy and DCA sell strategies with the same setup give a positive ROI? The answer is, of course, yes! One might think that DCA buy and DCA sell are opposite strategies, like carrying a long position vs. a short position, but that’s not the case in this context. The table below shows a scenario where both positions result in a positive ROI.

The ROI of DCA buy is positive because the average buying price is less than the selling price (15th week), and the ROI of DCA sell is positive because the buying price (1st week) is less than the average selling price.

To visualize the backtest results, each strategy’s outputs are formatted into line graphs below. These graphs show the ROI results of each possible 14-week duration of weekly period DCA buy and sell strategies according to their ending dates. All the data for this and the following section can be found here.

2020–2021

At the beginning of 2020, the ETH price was around $130, and by the end of 2021, it was about $3775. Even though some black swan events occurred, no one can deny that these two years were positive in terms of market trends.

DCA Buy

The results were almost always positive. Especially strategies started before the big leaps yielded more than 100% in 15 weeks. One may wonder why the strategies that ended around July 2021 were negative. The price of ETH was about $4000 when these strategies started, but around that July, the price was about $2000. However, their loss is not close to -50%, thanks to DCA’s averaging effect. It reduces both risk and reward.

DCA Sell

Similar to the DCA buy results, DCA sell outcomes were mostly positive during 2020–2021. However, strategies ending around June 2020 and July 2021 were negative. The reason for July 2021 is the same as explained above for DCA buy. The losses in June 2020 were due to the price drop from $280 to $100 after the COVID-19 crash. One can see the correlation between DCA buy and sell results in the graphs. For a deeper statistical analysis, we’ll provide more graphs and numbers in the next section.

2022–2023

2022–2023 were not the best years for many investors, as the ETH price declined from $3800 to $990, and by the end of 2023, it was about $2294. This negative trend deeply affected the results of both DCA buy and sell strategies.

DCA Buy

During these years, some DCA buy strategies achieved a positive ROI, and those ROIs were capped at 35%. However, on the negative side, there were significant losses reaching -60%. This graph is one of the best proofs that even DCA can cause serious losses and contains risks. The results of 2023 were better than those of 2022, due to a less bearish market trend in 2023 compared to 2022.

DCA Sell

The outcomes for DCA sellers during 2022–2023 were quite similar to those for DCA buyers. In 2022, only the strategies ending in May and October showed positive results, with a maximum ROI of 50%. The results in 2023 were generally better than in 2022, but still capped at 50%. The worst performance was a -45% ROI for the strategy ending on August 10.

Comparison with HODLing

In the previous section, we gained some insight into the results of DCA buy and sell strategies during 2020–2024. In this section, we will compare them with the outcomes of HODLing. In our cases, we’ll assume that one bought ETH once in the first week and sold all of it once in the 15th week, instead of applying a DCA buy or sell strategy.

Before examining the numbers, let’s consider our expected outcomes. What factors determine the best strategy? Calculating the ROI of HODLing is straightforward; we only need the buying and selling prices. To compare DCA buy with HODLing, we will compare the first week’s price with the average price of weeks 1–14, as both end in the 15th week with the same selling prices. For comparing DCA sell with HODLing, we will compare the average selling price of the DCA sell strategy with the 15th week’s price, since both start in the first week and their costs are the same. As mentioned earlier in this report, DCA’s balancing effect generally results in less profit when the ROI of HODLing is positive and less loss when the ROI of HODLing is negative. However, it’s possible to achieve a higher ROI in a DCA strategy than in HODLing the same amount.

Here, at the beginning, the price is $1000 and at the end, it is $1100, resulting in a HODLing ROI of 10%. By the 14th week, the DCA buy average becomes $875, which makes the ROI of DCA buy more than 25%. It’s also possible for a DCA buyer to face more loss than a HODLer when their ROIs are negative.

In the two examples above, either both ROIs of the DCA buyer and HODLer were positive or negative. But there may be situations where one is positive and the other is negative. These examples can be generalized for DCA sellers as well. Therefore, even if our general expectation for DCA ROIs is much more conservative than HODL ROIs, there are some counterexamples to this expectation, and we will see them in the graphs below.

2020–2021

ROIs of HODLing strategies were more aggressive during this period, almost always higher than those of DCA strategies. The maximum ROI of a HODL strategy reached 364%, while the minimum was -24%. At the end of May and the beginning of June 2020, the ROI of HODL strategies was lower than that of DCA buy strategies. Similarly, in July 2020, the ROI of HODL strategies was lower than that of DCA sell strategies. These price movements exemplify the cases we discussed above.

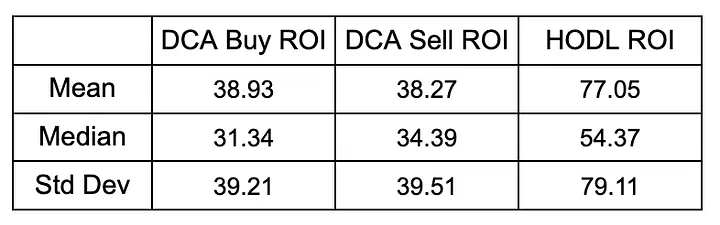

In addition to the graphs, we can also gain some insights into the statistical aspects of these distributions. The table below shows the mean, median, and standard deviation of the three strategies.

Both the mean and median of HODL ROI are higher than those of DCA strategies, which is expected due to the bullish market sentiment during that period. Also, the standard deviation of HODL is much higher than that of DCA strategies, indicating the balancing effect of DCA.

2022–2023

2022 was rough for DCA strategies, but it was much rougher for HODL strategies. As seen in the graph above, HODL ROI is mostly lower than that of DCA strategies. It fluctuates between -69% and 34%. Again, there are some rare times when HODL strategies give better results compared to DCA strategies, but in general, that’s not the case. The section of the graph above covering 2023 is one of the best explanations of how HODL ROI tends to act compared to DCA ROIs. If the results are positive, HODL ROI tends to be much higher than DCA ROIs, and when the results are negative, it tends to be much lower than the others.

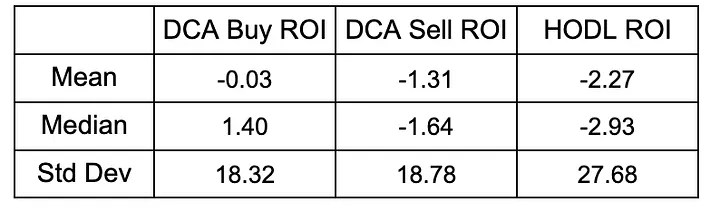

The table below shows the statistical aspects of these distributions.

This table proves that in bear market trends, HODL gives worse outcomes than DCA strategies, as the mean and median of HODL are lower than those of DCA strategies. Additionally, the higher standard deviation of HODL highlights the balancing effect of DCA strategies.

What DeGate Offers

Until now, we’ve discussed the key points of DCA strategies and investigated the ROI of past strategies based on price history. Before concluding the article, let’s mention what DeGate offers for DCA strategies. In addition to allowing users to apply both DCA buy and DCA sell strategies, DeGate offers two unique features to its users.

Zero Fee Option: When Zero Fee is active, DCA orders are executed as Maker-Only limit orders. The purchase price for each order is set at the highest bid price available in the order book at the time the order is placed. Note that this may cause a delay in filling orders, or they may not be filled at all.

Price Limit: DeGate allows its users to limit the maximum buying price for a DCA buy strategy and the minimum selling price for a DCA sell strategy. By enabling this feature, DCA buyers can limit the cost of their purchases, and DCA sellers can limit the average selling price. For instance, if Alice chooses to apply a DCA buy strategy for ETH when the price is less than $3000, her average cost will be less than $3000. This feature allows DCA buyers to set their parameters and avoid worrying about high costs. Similarly, DCA sellers can avoid worrying about their average selling price being too low.

Note that even though these features help DCA investors, every investment contains some risks and can cause losses.

Conclusion

To sum up, we’ve explored the types of DCA strategies and the risks they involve, including potential loss scenarios. Additionally, we calculated the ROI of past positions and examined the correlation between DCA buy and DCA sell strategies. We also compared these ROIs with a scenario where the same amount of asset was bought once and sold at the end.

Our analysis shows that DCA strategies offer a more conservative approach compared to simply hodling. While DCA strategies may not always deliver the high ROIs achievable through hodling during strong bull markets, they significantly reduce the risk of large losses during bear markets or periods of high volatility. This risk mitigation is due to the averaging effect of DCA, which smooths out the impact of price fluctuations by spreading purchases or sales over time.

Moreover, the unique features offered by DeGate, such as zero-fee options and price limits, enhance the effectiveness of DCA strategies by reducing trading costs and providing greater control over investment prices.

While backtesting offers useful insights, the main advantage of DCA is its ability to smooth out the average price over time, regardless of the market stage. Timing the market perfectly is nearly impossible, and DCA provides a safer and more conservative strategy for investors. It helps mitigate risks and allows investors to benefit from long-term market trends without the need for precise market predictions.

In conclusion, DCA strategies are particularly valuable for investors seeking a balanced approach that minimizes risk while still providing opportunities for profit. They are ideal for those who prefer a systematic investment method that does not require precise market timing or constant monitoring. By leveraging the features provided by DeGate, investors can further optimize their DCA strategies to suit their individual risk tolerance and investment goals.

While DCA strategies offer many advantages, it is important to remember that no investment strategy is entirely risk-free. Investors should always conduct thorough research, consider their financial situation and risk appetite, and remain aware of market conditions.