Omni by Variational isn’t just another DEX.It’s a fresh take on what decentralized trading can be - zero fees, internal liquidity, and an architecture built with precision. This project wasn’t made for hype - it was made for real traders who value efficiency.

In an era where most DEXs chase hype, launch tokens with sky-high FDVs, and vanish into irrelevance, Omni takes a completely different route. This isn’t just a trading interface - it’s an entire protocol engineered from the ground up by traders, for traders.

Omni runs on top of the Variational Protocol - a decentralized peer-to-peer engine with no order book, no trading fees, and no external market makers. Instead, trades are matched via internal liquidity (OLP), and profits stay within the protocol - distributed among its users, not extracted from them.

The system was built by two former quant traders with traditional finance backgrounds: @variational_lvs and @mr_plumpkin. After years of market making across major CEXs and DEXs, they reinvested their profits into building this infrastructure. The result? A two-sided ecosystem: Omni for retail perp trading, and Pro (in development) for institutional OTC derivatives.

As of writing, Omni has raised $11.8M from some of the most reputable investors in crypto. These include Bain Capital Crypto, Coinbase Ventures, Mirana, Caladan, and Zoku - funds known for backing serious infrastructure plays and derivatives protocols.

What sets Omni apart is its fee model. Users don’t pay anything to open or close positions. Instead, the protocol earns through a small spread between bids and asks, optimized via internal market making. The more users trade, the tighter the spreads - and the cheaper it gets for everyone .

Omni is already live on Arbitrum mainnet, processing tens of thousands of trades. Without any token incentives, it has surpassed **$160M in trading volume and 85,000+ orders executed.

But the token is coming. The team has confirmed an upcoming launch of $VAR, with 50% of the total supply reserved for the community. While the exact mechanics of the airdrop are still under wraps, it’s clear that trading activity and user engagement will play a key role.

Omni is being called a “fair casino” for a reason. With no fee extraction, 80%+ APY from OLP, and a growing user base, it’s shaping up to challenge even the biggest names in both DeFi and CeFi - including Deribit and Paradigm.

Recent updates to the documentation reaffirm this philosophy. The team actively revises and expands public docs - not as a formality, but as a cultural value. Newly added visual schemes, detailed mechanics around OLP, and a strong emphasis on transparency show that Omni isn’t just a product - it’s a set of principles, built around the idea that users should benefit first.

Let’s take a closer look at the founders and the origin story of Omni.

If You Can’t Beat the Market Makers — Become One. Or Build One.

Before Omni became a protocol with 850+ tokens, 0% fees, and a custom-built pricing engine, it was just an idea in the minds of two guys who were sick of playing the same game as everyone else.

Meet the founders: @variational_lvs and @mr_plumpkin - both former quantitative traders and market makers. Not crypto Twitter philosophers. Not "growth hackers." Just traders, building tools they actually wanted to use.

Instead of raising a bunch of capital early and diluting themselves into irrelevance, they did something unusual for a DeFi startup: They used their own market-making profits to fund the protocol from day one. No VC babysitting. No begging for TVL. Just solid execution and self-sufficiency.

But that doesn’t mean they ignored venture money forever.

When the time was right, and the architecture proved itself with real usage, they raised $10.3M from top-tier names like Bain Capital Crypto and Coinbase Ventures - followed by a small $1.5M strategic round in May 2025 with Mirana, Zoku Ventures, and Caladan. Why raise during an anti-VC meta?

Because the goal wasn’t the cash. It was the alignment - bringing in partners who could help with liquidity, listings, and adoption at the institutional level.

Protocol backed by traders, built by traders, and now supported by partners who understand the endgame - not just the launch.

Wake up. I need your focus right now

No Slippage. No Surprises. Just Your Price

Omni is one of the rare protocols where you can trade with literally 0% fees. No small print, no hidden costs. But let’s be real - nothing’s ever truly free. So if you're not paying, someone else must be. Right?

Let’s unpack how it works :

Unlike most DEXs with traditional order books, Omni uses an RFQ model - Request-for-Quote. You just say, “I want to long 1 BTC,” and boom - the protocol gives you a single, all-in price. Like Uber. You either take the ride or walk away. No slippage, no surprises.

Now here’s the twist: the quote isn’t coming from some random LP. It’s coming from the OLP - Omni’s in-house market maker. This is your direct counterparty. And instead of charging you a fee, the OLP earns from a tiny spread - the small difference between the buy and sell price. It’s not a commission - it’s just a slight price curve. Barely noticeable.

But that spread? It doesn’t disappear into some VC's wallet. It goes into the protocol treasury. That’s right - the profits stay inside the system. And soon, anyone will be able to provide liquidity to the OLP and earn a share of those returns. You don’t just trade on Omni - you can become the house.

So here’s the big picture:

Traders are happy: no fees.

The protocol is sustainable: it earns from transparent spreads.

The treasury grows - and it’s for the community. And in the future, they plan to introduce trading loss rebates. Yeah - lose a trade, and you might get some back. Wild.

This isn't just a DEX. It's a closed-loop economy. The more people trade, the tighter the spreads, the more profitable the OLP becomes. And all that value - it stays within the system. No leaky pipes. No middlemen.

Let’s simplify it:

Imagine Uber - but for trading . When you order a ride with Uber or Bolt, you enter your location and destination. The app checks traffic, driver availability, and gives you a fixed price: “This trip will cost €12.40.” You can accept it - or close the app. Nobody forces you into a car, and the price doesn’t change after you confirm.

Omni works the same way. You say, “I want to buy 1 BTC.” The protocol (via OLP) instantly gives you a quote - just like Uber calculating your fare. It takes market conditions into account and delivers a clean, fixed price.

No slippage, no thin order books, no guessing games. Just one number - take it or leave it. That’s RFQ.

Omni keeps improving the RFQ engine. A recent upgrade centralized all quotes through its internal pricing engine — the OLP. This eliminates price desyncs and ensures consistent execution, even during high volatility or arbitrage-heavy conditions.

Traders can now set slippage = 0 and actually receive the quoted price — not as a marketing gimmick, but as a native architectural feature.

Omni also added liquidation price preview right inside the UI, so traders know exactly where their risk lies. And the liquidation penalty was reduced from 1% to 0.5%, making the platform more forgiving and trader-friendly.

Sounds like a casino? Maybe. But here, you're not just the gambler - you can be the house. And when the house wins, you win too.

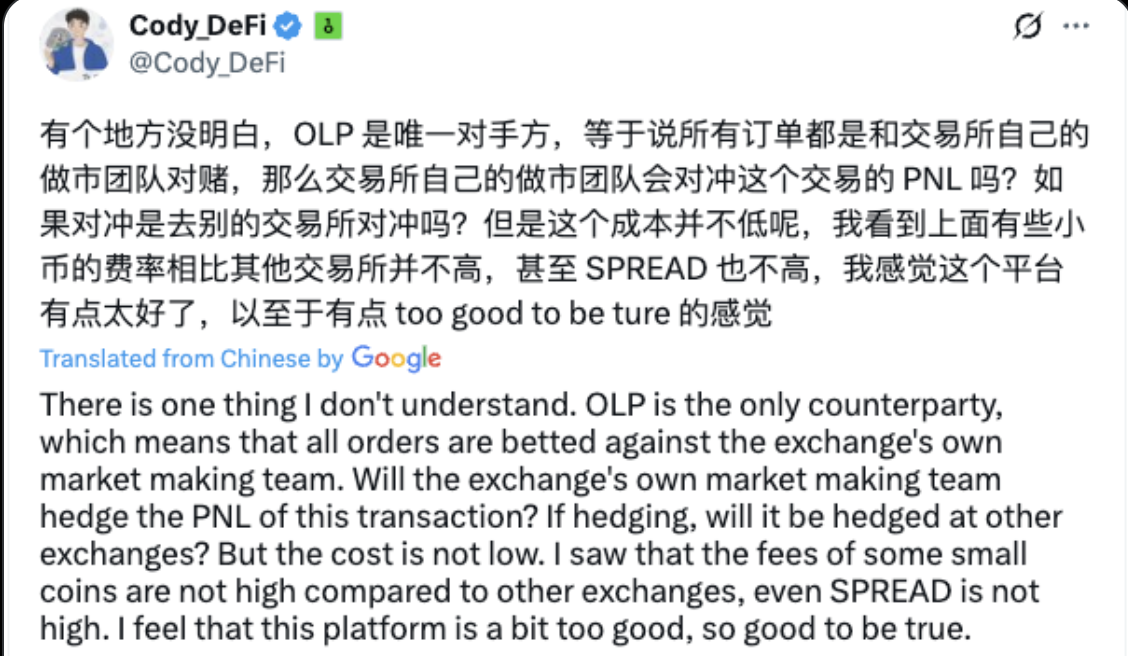

How say this guy " TOO GOOD TO BE TRUE "

Not Built Like the Others - And That’s the Point

Most DEX protocols today fall into two main buckets: order book-based or AMM/synthetic pool models. Let’s look at how the big players do it:

dYdX

Mechanism: CLOB (Central Limit Order Book) It mimics centralized exchanges: limit orders, order books, maker/taker logic. It works fast, but relies heavily on active market makers and deep liquidity. dYdX moved to Cosmos to run its own chain, but it’s not fully permissionless. It’s efficient - but centralized under the hood.

GMX

Mechanism: GLP Pool (AMM-style with oracle pricing) You don’t trade against another user, but against a pool. The price is based on Chainlink oracles + math. The issue? If traders win too much, the pool suffers. Liquidity providers bear the risk. The model requires balance - and that balance can be fragile.

Level Finance, MUX, Vela

Mechanism: Synthetic or hybrid AMMs They simulate trading through synthetic indexes or internal pools. Often the fees are higher, and volatility or execution can be unpredictable.

Hyperliquid

Mechanism: Fast centralized orderbook This one is lightning fast. No blockchain overhead, no tokens - just raw performance. It feels like Binance with a Web3 veneer. A fantastic experience, but not decentralized or transparent under the hood. Great tech, but not for everyone.

Omni

Mechanism: RFQ + OLP (Request-for-Quote with embedded liquidity) No order book. No pools. You say “I want to buy,” and the protocol quotes you a price. Behind the scenes, the protocol itself is your counter party - powered by the OLP (Omni Liquidity Provider), a built-in decentralized market maker.

No external LPs. No fragile balancing acts. Just a fair spread and efficient execution.

Why Omni’s Design Might Win in the Long Run

It doesn’t rely on external market makers. Order book models need active players to fill the book. Omni is the market maker. It’s not afraid of profitable traders. In AMMs, if traders win, the pool loses. With Omni, profitability is built into the spread, and the protocol always earns. It’s transparent and simple. You get a quote. You take it or leave it. No slippage games. No hidden fees. It scales better with volume. As volume increases, spreads tighten, OLP earnings grow, and the system becomes more efficient for everyone - traders and liquidity providers alike.

RFQ as implemented by Omni isn’t a static design. The team continues to evolve and refine it, pushing improvements like real-time quote streaming, ultra-precise execution, and smoother liquidation logic. Unlike AMMs or CLOBs, which often plateau in design, RFQ is proving to be a living architecture - and Omni is driving its innovation.

How OLP Turns the DEX Game Inside Out

On most exchanges, your counterparty is another trader, a bot, a market maker, or sometimes a hedge fund. And all of them want the same thing - to profit off you.

Omni takes a different path. Here, every trade goes directly against the OLP -Omni Liquidity Provider. And this isn’t just an architectural detail - it’s the heart of the system.

OLP is a built-in market maker. It doesn’t rely on external liquidity, charges no fees, and doesn’t flinch when you win. It gives you the price when you place a trade request and becomes your direct counterparty. Imagine Binance trading with you directly, but instead of pocketing the profits, it gives them back to the ecosystem.

OLP is a built-in market maker. It doesn’t rely on external liquidity, charges no fees, and doesn’t flinch when you win. It gives you the price when you place a trade request - and becomes your direct counterparty. Imagine Binance trading with you directly, but instead of pocketing the profits, it gives them back to the ecosystem.

That’s the idea behind OLP.

So how does it work inside Omni? When you say, “I want to long 1 BTC,” the protocol doesn’t go looking for someone to take the other side. Instead, the OLP instantly calculates a price - based on markets, liquidity, risk, and treasury conditions. You get a final quote. No slippage, no bait-and-switch. Take it or leave it. If you take it - the trade goes directly against the OLP. Your profit is its loss, and vice versa.

But how does it earn? OLP doesn’t charge a fee. It earns from a tiny spread - the small difference between the buy and sell price. That spread is baked into the quote, and it tightens as trading volume increases. The more people trade, the cheaper it gets for everyone.

And here’s the magic: All OLP profits stay in the protocol. No fund siphoning. No value leakage. All revenue is retained inside the treasury - and eventually flows back to the community. You’re not just trading - you can become the house.

Why this matters for traders :

• No fees

• No fees

• No intermediaries

• No slippage

• Transparent pricing

• And the ability to earn from OLP participation

Recent protocol updates also brought:

Liquidation prices now shown directly in the order form Live updates to portfolio and position tracking Adjustable leverage directly in the trade input Improved margin refill mechanics Greater OLP stability under high volume and volatility .

WAR → VAR

Let’s talk about the future

Omni isn’t just considering a token - they’re building around it. The launch of $VAR has been confirmed by the team and appears directly in the roadmap. What’s more, 51% of the total supply is reserved for the community. This isn’t marketing fluff - it’s core to their strategy.

Here’s what we know so far:

• An airdrop is coming. It will likely reward active users - traders, contributors, and those engaged in the ecosystem.

• $VAR will have governance utility. It’s not just a trading token - it’s a way to help steer the future of the protocol.

• Liquidity is a key focus. Expect $VAR to play a central role in incentivizing OLP participation and future institutional features.

• Buybacks are planned. A portion of protocol revenue will go toward buying $VAR off the market, reinforcing its value and demand over time.

But there’s more - let’s talk about the Value Pool.

This isn’t a temporary “rewards fund.” It’s a permanent redistribution mechanism, tied directly into the protocol’s economics. According to the latest documentation updates, the Value Pool will go live post-token launch and will be continually funded by protocol profits. Its distribution will likely depend on staking, governance activity, or other forms of contribution - turning passive users into stakeholders.

The key? This isn’t airdrop farming. It’s a long-term system designed to return value to the community that helps build and sustain the protocol.

Omni Pro: The Bridge to Real-World Assets

Omni Pro is the upcoming interface tailored for institutional traders and OTC desks. It will build on the core principles of the current protocol - RFQ execution, embedded liquidity through OLP, and zero trading fees - but offer a UX and feature set suited for high-volume, professional environments.

But the team behind Variational is thinking even bigger.

In a recent update, the founders hinted at the possibility of supporting RWA - real-world assets. Think tokenized bonds, commodities, funds - or even traditional stocks like Apple. If realized, this would turn Omni into more than just a decentralized derivatives exchange - it would become a bridge between crypto and traditional finance.

That unlocks some wild possibilities: short gold, long BTC, and take a position in tokenized Apple shares - all within one protocol, fee-free, and powered by a transparent architecture.

Sounds crazy? Maybe. But would you use a DEX that lets you go from BTC to Apple stock in two clicks - no KYC, no middlemen?

No Access? I Found the Backdoor

Omni is currently in beta mainnet. Access isn’t open to everyone yet, but there are two main ways to get in:

– Be on the whitelist. If you were an early participant, you might already have access.

– Get a referral code. In Omni’s Discord server, there’s a #ref-codes channel where users share their invite codes.

To earn your own referral code, you need to generate at least $250,000 in trading volume. Once you do, you’ll receive an extra code you can share. The founders have also mentioned the idea of sharing a portion of invited users’ PnL - but that’s still just a possibility for now.

Discord is currently pretty quiet. There aren’t any active quests, role hunts, or engagement events. However, the team has hinted that future reward programs for active community members might be introduced.

The team actively hosts AMA sessions in Discord and Twitter Spaces. Founders answer questions directly, share updates, and are very public-facing. This is a great chance to engage and get insights straight from the source.

If you want to stand out - now’s your moment. You can get involved in discussions, create content, help new users, or contribute as a developer. The ambassador program is live, and the team is open to working with contributors who take initiative - especially on the technical side.

The team hasn’t officially confirmed a TGE date, airdrop details, or any reward structure yet. The founders made it clear they’d rather avoid empty promises than risk disappointing the community - especially in a volatile market where timelines can shift. But they stay close, hosting Spaces and AMAs, and when the time comes - we’ll know.

ALL LINKS

Info :

Docs

Blog

Platform and Access :

Platform

Code for Access : OMNI9EVF4PUY

Media :

Discord

X

Hope you made it to the end without losing focus. Thanks for taking the time to read — I’m sure you found something useful here. And this is just the beginning. See you on the next wave .