We are excited to share several important developments from the past month. From strong momentum on Pendle to new integrations and yield improvements, Aegis continues to grow steadily with a focus on security, transparency, and performance.

1) Pendle Pool Growth Update

On June 19, we launched the sYUSD pool on Pendle, giving users access to fixed and leveraged stablecoin yield through PT-sYUSD and YT-sYUSD.

Since launch, the pool has grown to over $6.8M in TVL, and PT-sYUSD has consistently ranked among the top fixed APY pools for stablecoins, frequently exceeding 15% annualized.

Liquidity has remained healthy and user participation continues to rise across LPs, traders, and yield seekers. As demand grows, we plan to expand integrations to money markets like Euler and Morpho to further increase sYUSD utility.

2) Mellow Integration: Restaking via Re7 Vault

Aegis has officially launched on Mellow, allowing users to restake their sYUSD into a curated vault managed by Re7 Labs. This vault enables users to convert their sYUSD into rsYUSD, a restaked variant that earns:

-

Native APY from Aegis delta-neutral strategy

-

Restaking yield via Symbiotic and EigenLayer

-

Points from Mellow, Symbiotic, and Aegis

Mellow is a modular restaking protocol designed to help yield-bearing assets plug into restaking systems. Our collaboration with Mellow supports our long-term mission of bringing modular, secure, and yield-efficient infrastructure to DeFi.

3) Native sYUSD APY hits 16%

Over the past week, sYUSD has delivered a 7-day trailing APY of over 16%, marking the highest yield level since launch.

The rise in APY is a result of stronger Bitcoin market performance, which has led to elevated funding rates on perpetual futures. Since Aegis earns yield through a delta-neutral short on BTC via COIN-M contracts, periods of bullish BTC price action tend to correlate with higher yields for sYUSD holders.

As always, yield is earned in a non-directional, hedged way with BTC as collateral, maintaining our stablecoin’s peg and security while passing funding rate rewards to users.

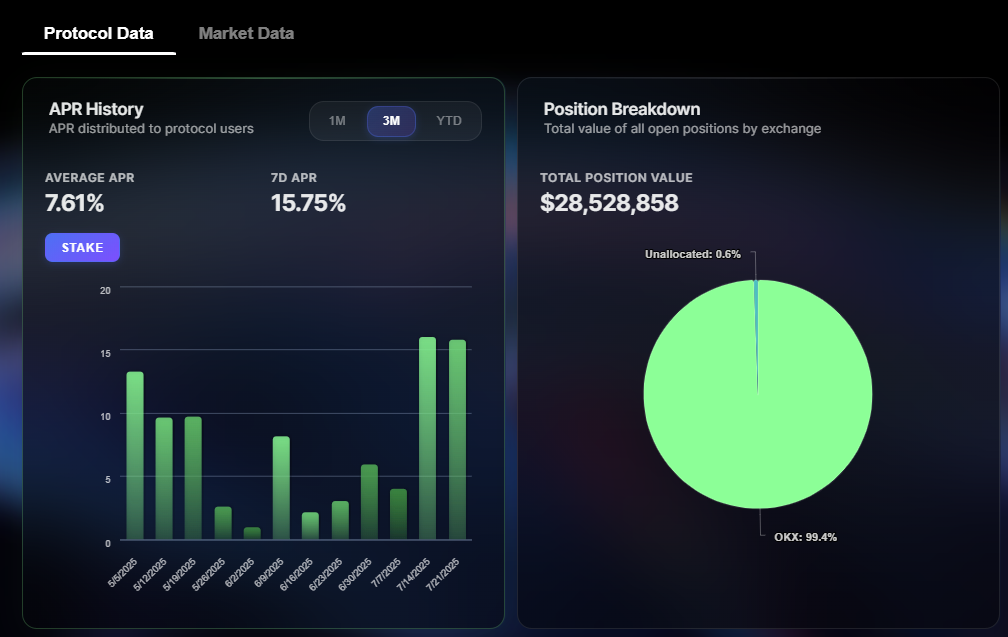

4) Transparency Dashboard Upgrade

We’ve completed a full UI overhaul of the Aegis transparency dashboard to make data more accessible and easier to interpret.

One key feature now live is the Weekly APR History chart, which visualizes historical yield performance on a weekly basis. This makes it easier for users to evaluate past APY trends, funding rate behavior, and understand the protocol’s performance over time.

Additionally the Accountable Proof of Reserves dashboard continues to show real-time metrics around:

-

BTC collateral balances

-

Insurance fund holdings

-

Funding position exposure

-

Off-exchange settlement monitoring

Our commitment to full transparency remains a core principle of Aegis, and we’ll continue expanding the dashboard with more analytics and visual tools in the coming months.

5) Spectra Listing

On July 31, we launched the sYUSD pool on Spectra Finance, introducing new structured yield opportunities for users.

The pool was seeded with $1M by K3 Capital and supports PT, YT, and LP strategies. PT-sYUSD lets users lock in a fixed payout at maturity, while YT-sYUSD provides leveraged exposure to sYUSD yield and 5x Aegis Points. Liquidity providers can earn swap fees, native yield, and 5x points as well.

This listing marks a major step in making YUSD and sYUSD more accessible across chains. With support for fixed and variable yield, Spectra opens up new ways for users to optimize capital efficiency and build strategies around Aegis yield. As with all deployments, user rewards and metrics are fully visible on the Aegis transparency dashboard.

Closing thoughts

Looking ahead, each of these updates marks a significant step forward in building a yield-bearing stablecoin ecosystem that is secure, composable, and aligned with crypto-native principles.

With strong traction across Pendle, new restaking integrations, rising APYs, and a more transparent user experience, Aegis is positioned for sustained growth in the second half of 2025.

Thank you to the community, partners, and early adopters who continue to support this journey. As always, more to come soon.