The new sYUSD pool on Pendle is now live with a maturity date of 18 December 2025. This guide will walk you through the three strategies you can use: PT, YT, and LP.

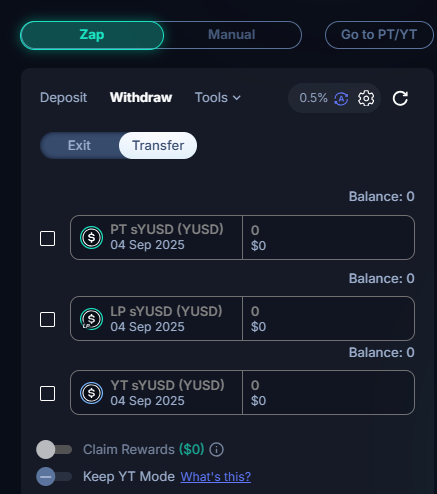

Migrating to the New Pool (Dec 18, 2025)

Before using the new sYUSD pool, you need to migrate from the previous one.

How to migrate:

-

Go to the migration page

-

Select Zap → Withdraw → Transfer

-

Tick LP & YT → Claim LP, keep YT mode (this ensures you keep YT exposure)

-

Approve and rollover

Important: Since part of the LP consists of PT that does not generate points, it’s crucial to select Keep YT mode during the rollover to maintain your boosted exposure.

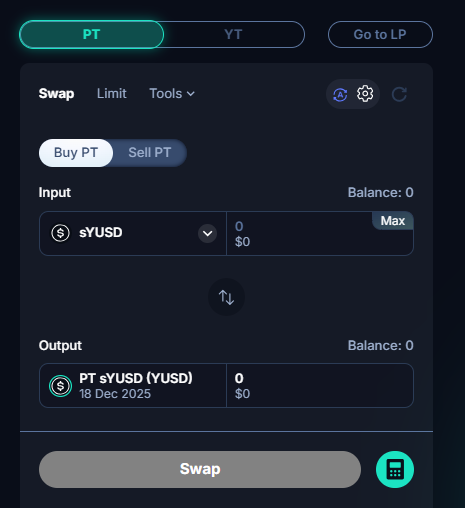

Strategy 1: PT-sYUSD (Fixed Yield)

Best for: users who want guaranteed returns and are fine giving up point rewards.

What you get:

- A fixed yield locked in until maturity

- No exposure to Aegis points

How to get started:

-

Go to the PT trading page

-

Select “Buy PT”

-

Choose your token and amount

-

Approve and execute

Result: You lock in a guaranteed yield until Dec 18, 2025, without participating in points farming.

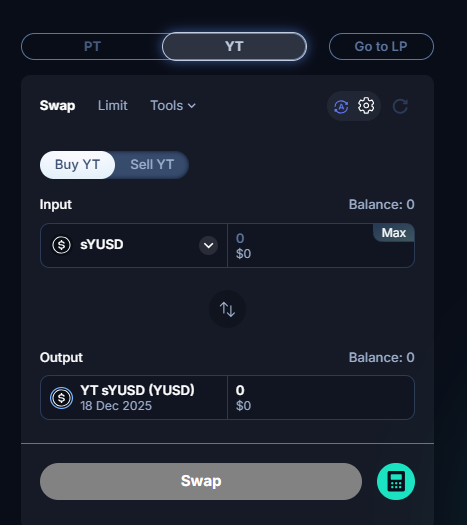

Strategy 2: YT-sYUSD (Leveraged Yield and Points)

Best for: users seeking amplified points and higher yield exposure.

What you get:

- Underlying sYUSD yield

- 5× Aegis points

- Higher risk profile since YT trends toward zero as maturity approaches

How to get started:

-

Go to the YT trading page

-

Select “Buy YT”

-

Approve and complete the swap

Result: You gain leveraged yield exposure plus 5× Aegis points until Dec 18, 2025.

Each YT (Yield Token) represents the rights to the underlying yield plus 5x Aegis points for one sYUSD. However, the YT value tends to zero as maturity approaches.

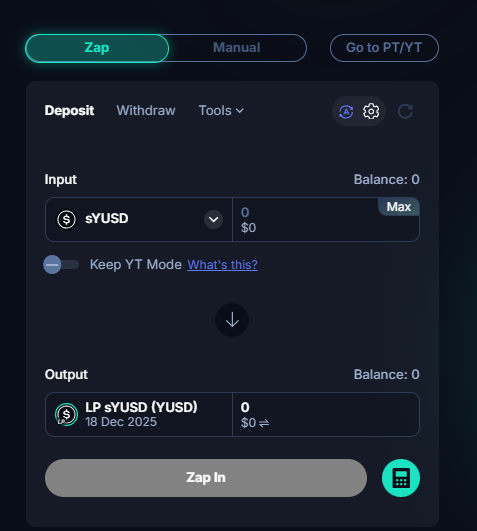

Strategy 3: Provide Liquidity to the Pool

Best for: users looking for diversified yield streams.

What you earn as an LP:

- Swap fees

- 5× Aegis points

- Pendle incentives

- PT yield

- Underlying sYUSD yield

Note: The PT/SY ratio in your LP position changes over time, so your actual points earned may vary.

How to get started:

-

Go to the LP page

-

Choose your token and amount

-

Approve and deposit

Result: You earn layered yield sources plus boosted points until Dec 18, 2025.

Which strategy should you choose?

-

PT-sYUSD: stability and predictability with fixed yield

-

YT-sYUSD: maximum point exposure with higher risk

-

LP: multiple yield streams with moderate risk

What's Next?

Soon, PT-sYUSD will be integrated as collateral in money markets like Morpho and Gearbox, unlocking new use cases for fixed yield positions. Expect deeper integrations and more optimized capital deployment across DeFi.