The Aegis protocol has seen significant evolution over the past few weeks. To help our users stay fully informed, we’re launching a new recurring series called Protocol Update, your go-to source for all key integrations, technical improvements, and ecosystem developments.

Transparency has always been our cornerstone, and this series is here to reinforce that commitment.

The goal is to enhance communication and maintain alignment with our vision of a fully transparent protocol.

1) Pendle Integration

On June 19th, we launched our new sYUSD pool on Pendle, giving our users the ability to:

-

Lock in fixed rates with PT-sYUSD

-

Leverage their yield and points exposure with YT-sYUSD

-

Provide liquidity into the pool to earn yield, swap fees, incentives, along with the highest points multiplier (5x)

The pool’s maturity date is 04 Sep 2025.

This is just one of many upcoming integrations we have planned for Aegis users. Stay tuned for future announcements.

We are actively working on providing our users with more ways to deploy their capital, including integrating PT-sYUSD as collateral into money markets like Morpho and Euler.

2) Proof of Reserves Dashboard Powered by Accountable

Aegis has partnered with Accountable, a data verification platform that enables protocols to prove reserves, trades, and financial health without exposing sensitive business information.

Accountable also provides real-time proof of market neutrality for protocols that are hedging price fluctuations of their reserves.

The Aegis dashboard, powered by Accountable, gives users live access to proof of reserves, all open funding positions, collateral ratio, insurance fund data, all verified in real-time.Learn more:

3) Smart Contract Audit by Sherlock

The Aegis protocol has successfully passed a full smart contract audit conducted by Sherlock. Check out the full report:

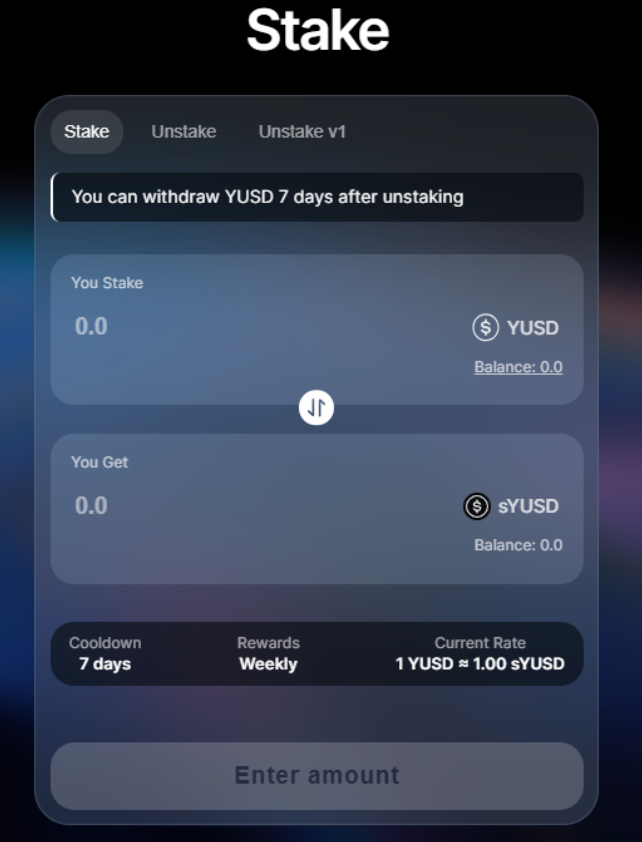

4) New Staking Mechanism

Staking is back!

Users can now stake their YUSD for sYUSD again. The only difference compared to the previous staking mechanism is that a 7-day cooldown period begins after a user initiates unstaking, not after staking their YUSD.To stake your YUSD, head over to the stake tab.

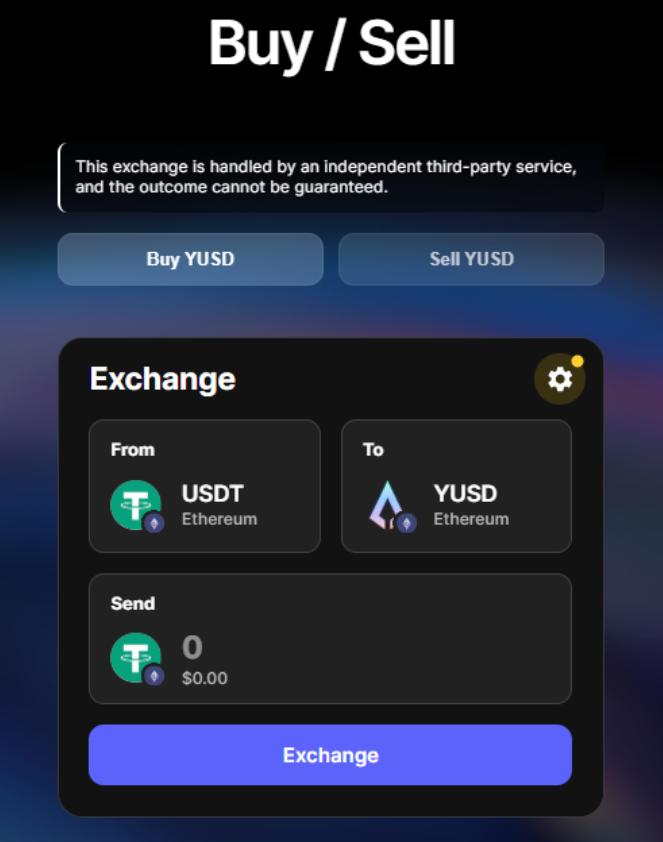

5) Li.Fi Widget Integration

Our buy/sell YUSD mechanism has now integrated the Li.Fi widget. The widget selects the most optimal route for a swap, minimizing slippage and enhancing the user experience. The swap UI has also been changed. Try it out by buying YUSD on our buy/sell tab.

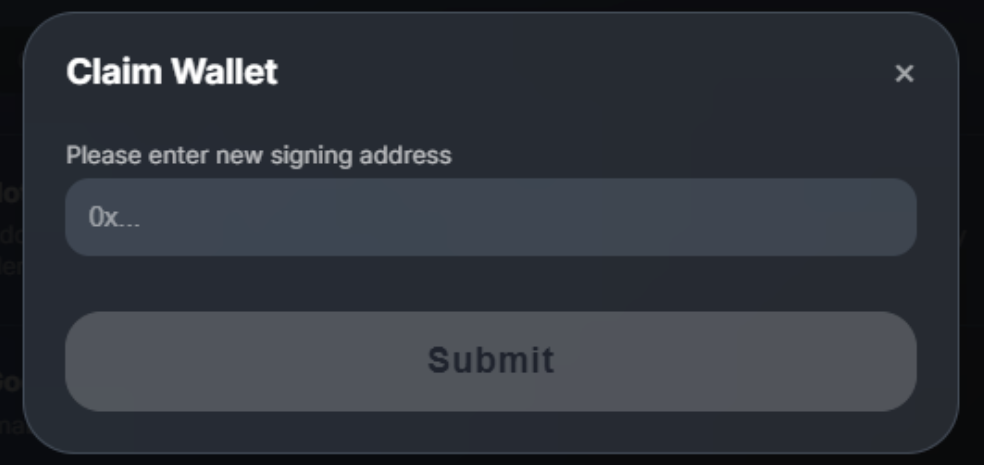

6) Delegated Claim

Users can now set a separate wallet address to claim their YUSD rewards.

This is perfect for hardware wallet users, who don’t want to expose themselves to smart contract risk. This way, your central YUSD position is held on your cold storage wallet, while claiming the rewards is delegated to your hot wallet. To set a separate claim wallet, head over to the settings tab and click on “Add Claim Wallet”.

Conclusion

Moving forward, we will continue to publish protocol updates more frequently to ensure our users are up to date with all the changes that have been implemented. Transparency is at the core of everything we do, including the development of the Aegis protocol.

Choose Aegis, because your money deserves better.