Introduction

Billions of dollars in assets sit on centralized exchanges every day, serving as collateral for trading but generating zero yield. This creates a major opportunity cost. Traders leave potential returns on the table, while exchanges lock up capital that could otherwise be more capital efficient.

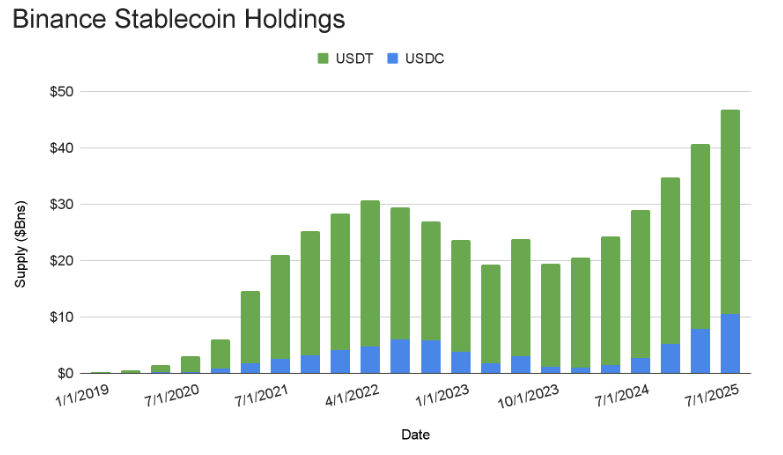

For example, nearly $50 billion in stablecoins sits idle on Binance alone, not earning any yield for the users.

Orderly and Aegis are aiming to change this. We are addressing this inefficiency by introducing yield-bearing collateral into the derivatives market.

Orderly Infrastructure and Scale

Orderly has built a robust omnichain CLOB (central limit order book) infrastructure, providing liquidity aggregation across chains and a modular SDK for perpetual DEXs.

This framework has gained real traction:

-

Perpetuals Volume: $141b

-

Total TVL: ~$55m

-

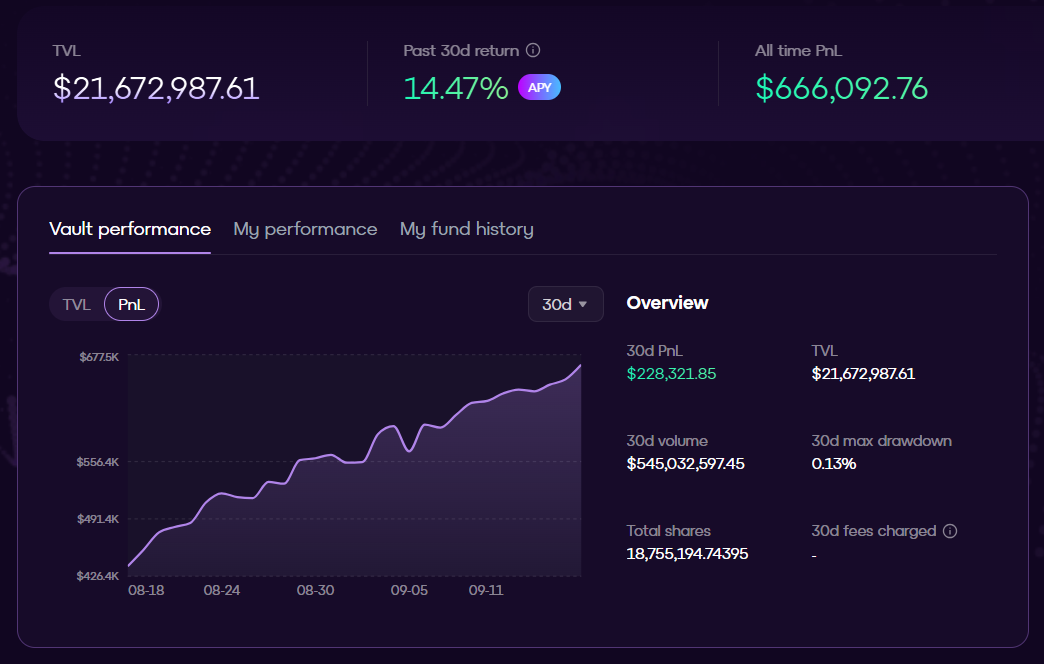

Stablecoin Vault ROI: ~15%

-

OmniVault PnL: $680k+

The SDK has become a backbone for new perp DEX deployments across EVM chains, enabling projects to plug into shared liquidity and advanced matching engines while keeping custody separate from execution.

Aegis and YUSD

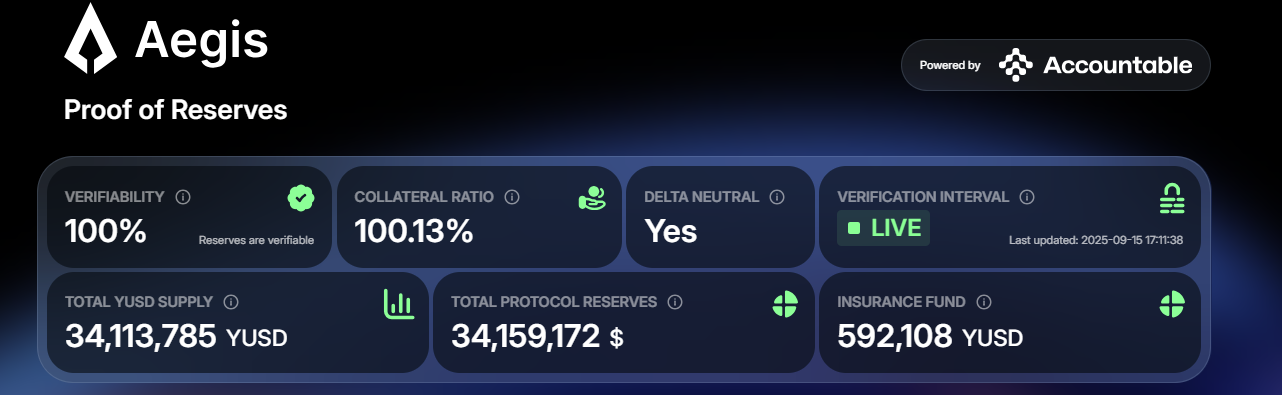

Aegis brings YUSD, a delta-neutral stablecoin designed with security and resilience at its core.

Key features include:

-

BTC-backed collateral with delta-neutral hedging.

-

Off-exchange custody using Copper’s ClearLoop.

-

Native yield generation through funding rate arbitrage.

-

Transparent on-chain issuance and redeemability.

YUSD has already scaled meaningfully across DeFi integrations, and its stability combined with a built-in APY makes it uniquely positioned to serve as a more efficient collateral.

Yield-bearing Collateral for Perps

Through the new integration, traders can now post YUSD as margin collateral across perp DEXs built on the Orderly SDK. Unlike centralized stablecoins, YUSD continues to earn its native APY while being used as margin collateral.

This creates a beneficial effect for all parties involved:

-

For traders: native yield offsets funding fees, allowing positions to be held longer and improving overall capital efficiency.

-

For exchanges: higher open interest, TVL, and trading volume flow into the exchange. Liquidity deepens, markets become more efficient, and larger traders can enter with confidence.

Summary

The YUSD Orderly integration represents a step forward in aligning yield, safety, and trading efficiency. What begins with YUSD margin collateral on Orderly SDK perps will expand further, as YUSD is integrated into additional trading platforms as yield-bearing collateral.

This is only the beginning of a broader partnership between Aegis and Orderly to bring more productive, transparent collateral into the heart of DeFi’s trading infrastructure.

Disclaimer: This article is provided for educational and informational purposes only and should not be interpreted as financial, legal, or investment advice. The strategies, protocols, and platforms discussed carry inherent risks, and readers are encouraged to conduct their own research before making any financial decisions. Trading futures and using leverage involve a high degree of risk, including the possibility of losing more than your initial investment. Liquidations can occur quickly in volatile markets, and traders should exercise caution, use proper risk management, and never trade with capital they cannot afford to lose.