Complete Guide: Using Aegis sYUSD Pool on Pendle Finance

Aegis has launched its new sYUSD pool on Pendle Finance, giving users three powerful ways to optimize their yield:

-

Lock in fixed rates with PT-sYUSD

-

Leverage yield and points exposure with YT-sYUSD

-

Provide liquidity to earn multiple revenue streams.

This guide will walk you through everything you need to know to get started.

Strategy 1: Lock in Fixed Yield with PT-sYUSD

Best for: Users who want guaranteed returns and don't mind giving up points

How it works: By buying PT (Principal Tokens), you trade away all your points to lock in a fixed yield until the maturity date (September 4, 2025).

Step-by-step instructions:

-

Go to the PT trading page

-

Select "Buy PT"

-

Choose your token and input the amount you want to swap for PT tokens

-

Approve your tokens and sign the swap transaction

What you get: Fixed yield until maturity date.

What you give up: All points accumulation.

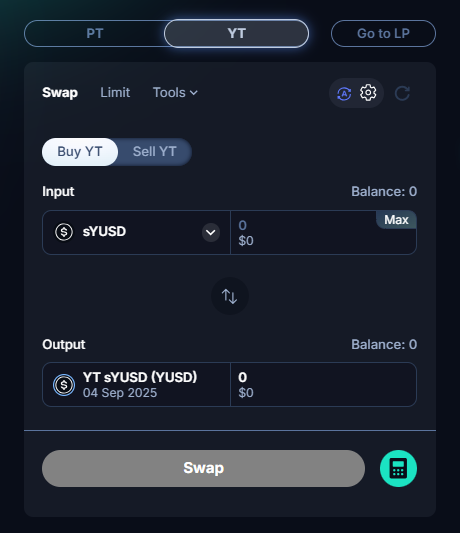

Strategy 2: Leverage Your Yield with YT-sYUSD

Best for: Users who want amplified points exposure and are comfortable with higher risk

How it works: Each YT (Yield Token) represents the rights to the underlying yield plus 5x Aegis points for one sYUSD. However, the YT value tends to zero as maturity approaches.

Step-by-step instructions:

-

Go to the YT trading page

-

Select "Buy YT"

-

Choose your token and input the amount you want to swap for YT tokens

-

Approve your tokens and sign the swap transaction

What you get: Underlying yield + 5x Aegis points. Significant risk: YT value decreases over time and tends to zero at maturity

Strategy 3: Provide Liquidity to the Pool

Best for: Users who want diversified income streams from multiple sources

Step-by-step instructions:

-

Go to the liquidity page

-

Choose your mode:

-

Zap: Automated, easier for beginners

-

Manual: More control, better for experienced users

-

-

Choose your token and input the amount you want to provide as liquidity

-

Approve your token and sign the transaction

What you earn as a liquidity provider:

-

5x Aegis points

-

Pool swap fees

-

$PENDLE incentives

-

Underlying sYUSD yield

Important note: As a liquidity provider, your position consists of both PT and SY tokens in a dynamic ratio that changes over time. Since PT tokens don't receive points, your actual points earning will be less than 5x and will vary based on the current PT/SY composition of your LP position.

Choosing the Right Strategy

Go with PT-sYUSD if you:

-

Want predictable, guaranteed returns

-

Prefer stability over potential upside

-

Don't care about points accumulation

Go with YT-sYUSD if you:

-

Want maximum points exposure (5x multiplier)

-

Are comfortable with higher risk and volatility

-

Understand that YT tokens lose value over time

Go with Liquidity Provision if you:

-

Want income from multiple sources

-

Are comfortable with moderate risk

-

Want to earn both yield and points

What's Coming Next

This Pendle pool launch is just the beginning. Aegis is actively working on additional integrations, including:

-

Using PT-sYUSD as collateral in money markets like Morpho Labs and Euler Finance

-

More capital deployment options for users

-

Additional protocol partnerships

Key Reminders Before You Start

-

Always migrate to new sYUSD first - this is required for all strategies

-

Understand the risks, especially with YT tokens that lose value over time

-

Maturity date is September 4, 2025 - plan your strategy accordingly

-

Each strategy has different risk/reward profiles - choose based on your preferences

Ready to optimize your yield? Select the strategy that best aligns with your risk tolerance and return goals.