Blockchain technology has anonymity and decentralization characteristics, so no data can be tampered with on the chain. At the same time, users can conduct transactions without revealing personal information, which provides some privacy.

These characteristics also bring about some risks:

- Security: Although blockchain technology is widely considered to be secure, attacks can still occur, particularly for smaller cryptocurrency assets. Additionally, since Web3 projects are mainly used in the financial industry or have financial attributes, they are prone to information asymmetry, fraud, and market manipulation.

- Difficulty in tracing: Since transactions on the blockchain are anonymous, it becomes difficult to trace transactions that involve fraud, money laundering, or stolen funds.

According to the Global Web3 Security 2022 report, a total of over 167 significant attacks were observed in the Web3 field in 2022, with a total loss of approximately $3.6 billion. Of this amount, approximately $1.396 billion in stolen funds was deposited into Tornado Cash, accounting for 38.7% of all attack losses.

This shows how important monetary flow tracking is. A large number of security organizations and institutions rely on tracking transaction history records to identify the source of fraud or theft and try to recover funds. Out of the nearly $1.4 billion in funds that were stolen in 2022, approximately 8% were successfully recovered, showing significant room for improvement.

Use Case: Tracking Monetary Flow Through Chain-of-Transaction Analysis

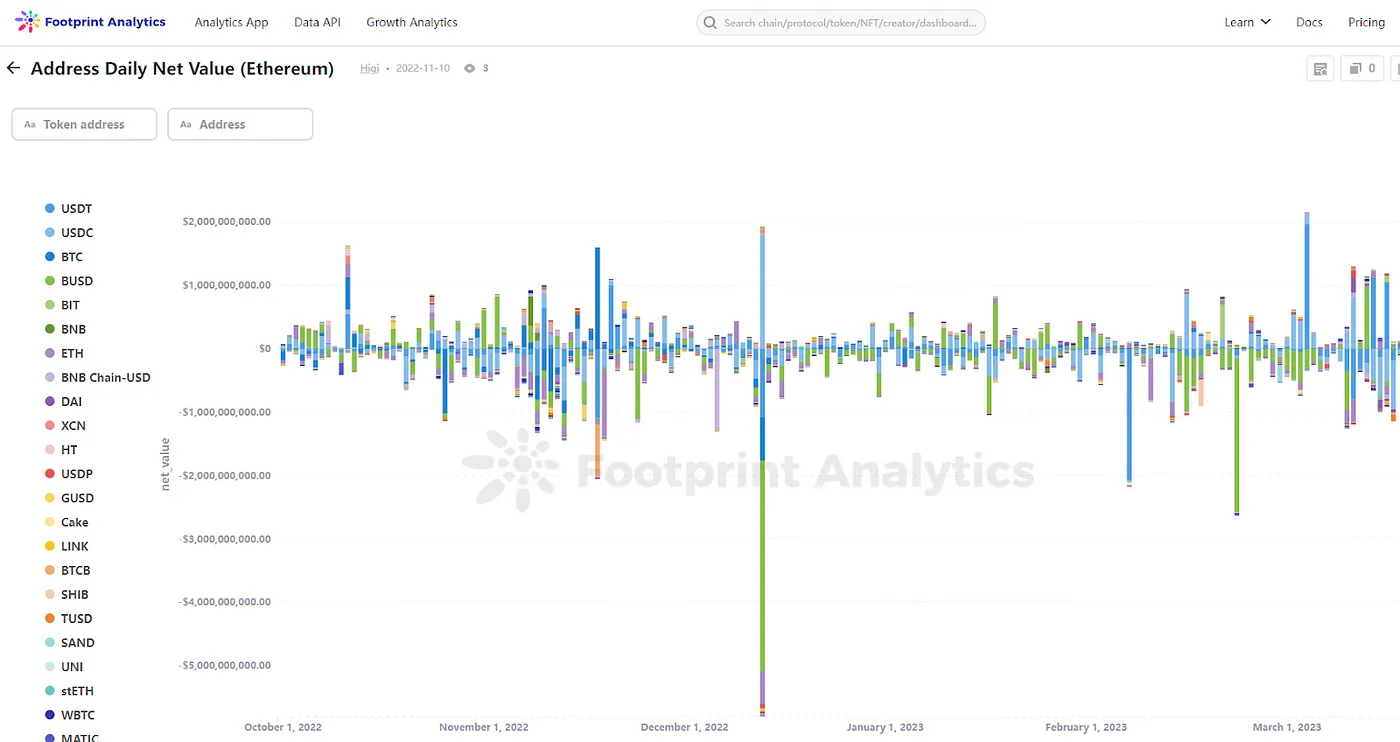

In the context of blockchain technology, monetary flow tracking typically involves various analytical methods such as clustering analysis, time series analysis, graph algorithms, or machine learning. With the increasing development of blockchain networks, cross-chain flow transactions are becoming increasingly common, requiring the tracking of multiple blockchains.

Therefore, in order to track blockchain monetary flow, a significant amount of historical chain data is required, as well as cross-chain data analysis to provide a comprehensive perspective.

Footprint’s comprehensive chain data provides comprehensive and powerful support for tracking blockchain money flow:

- Covers 25 public blockchains with full historical data coverage: Provides a wide coverage, while unifieding the data structures of EVM and non-EVM, making cross-chain flow analysis of monetary flow more simple.

- Structured data processing: In addition to raw data, provides structured data such as processed transaction data, making it easier to calculate balance snapshots.

- For tracking money flow, Footprint provides processed trace, transfer, and event data, enabling security teams to quickly conduct analysis.

To support the retrieval and collection of full historical data, Footprint provides an efficient solution in a single batch. Through Batch Download, all of the data on each chain can be downloaded at once.

Benefits of Footprint’s Batch Download

If historical data is obtained directly through RPC and other node providers, it often requires tens of thousands of dollars and takes several weeks to download.

Footprint’s atch download solution can 10x download speeds while costing only 20% of traditional nodes.

Through Footprint’s solution, AML or security teams can reduce the resources and funding invested in data acquisition and processing, allowing them to focus on building AML models to better understand your customers and complete large and suspicious transaction monitoring, thus enabling the orderly and compliant development of the Web3 financial system.

Contact Footprint and book a demo today.