Short presentation of Storm Trade ⚡️

Questions and Answers ❓

Questions from Tonstarter

Q1: What is trading and how to get into this craft? And what are the basics of trading skills?

A: Trading is about profiting from asset price fluctuations like cryptocurrencies. Start by blending theory and practice with technical or fundamental analysis, learning from books and courses. Basics involve buying, selling, setting entry/exit points, and risk management. Analyze charts, identify trends, and practice discipline and learning. Advanced techniques include short selling, leverage, and various strategies, but they carry higher risks. To manage risks, diversify, set stop-loss orders, size positions wisely, stay informed, and keep a trading journal.

Q2: What is your product's vision?

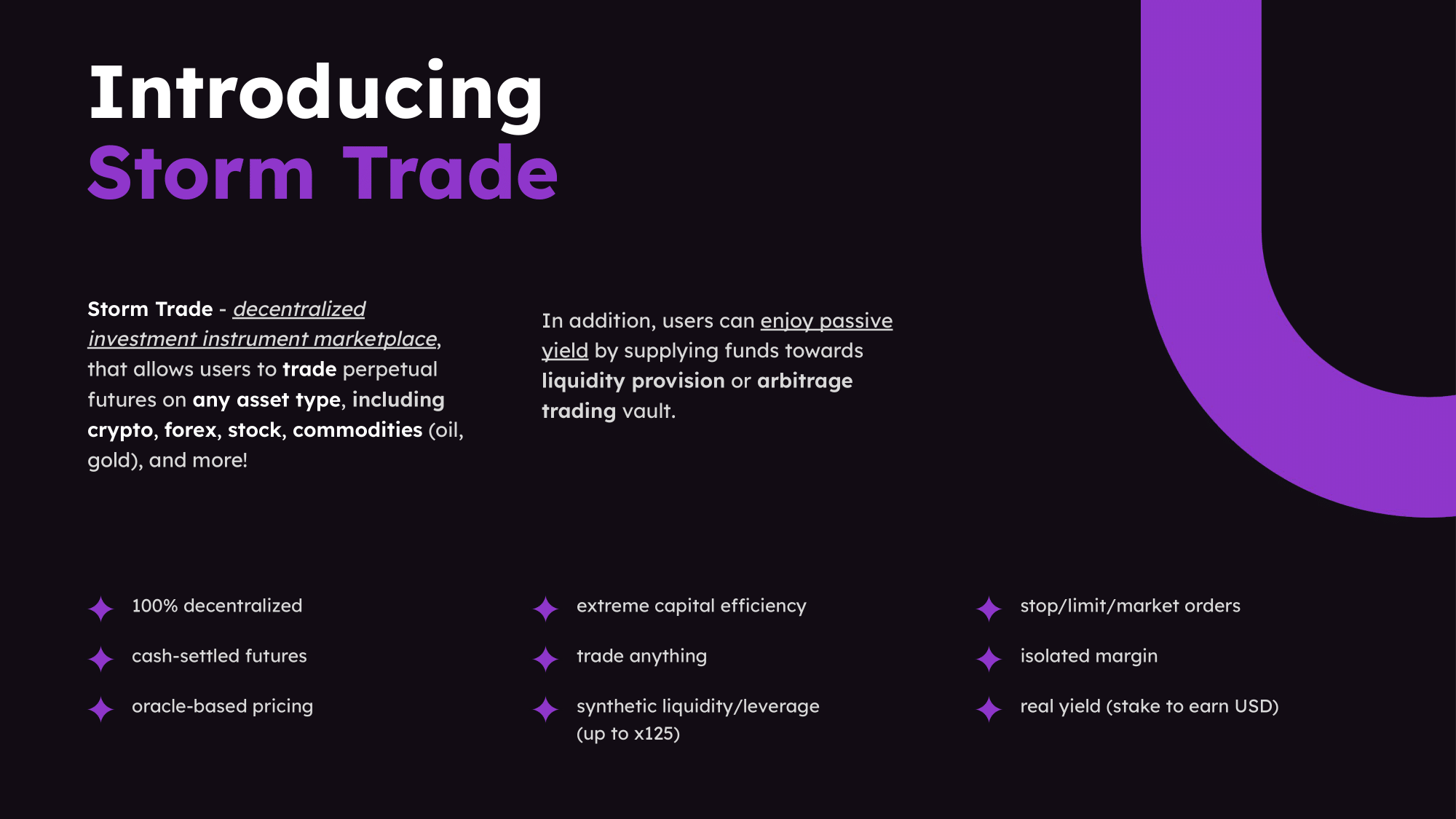

A: Storm Trade distinguishes itself from other platforms in the Ton ecosystem by offering spot exchanges exclusively for tokens within Ton's ecosystem. However, it lacks the ability to trade well-known assets like Bitcoin, Ethereum, and others with low slippage and leverage. Storm Trade is being developed to address this gap, providing an exchange for trading derivatives on liquid assets with leverage and the option to open short positions, catering to a broader range of assets compared to what's currently available in the Storm ecosystem.

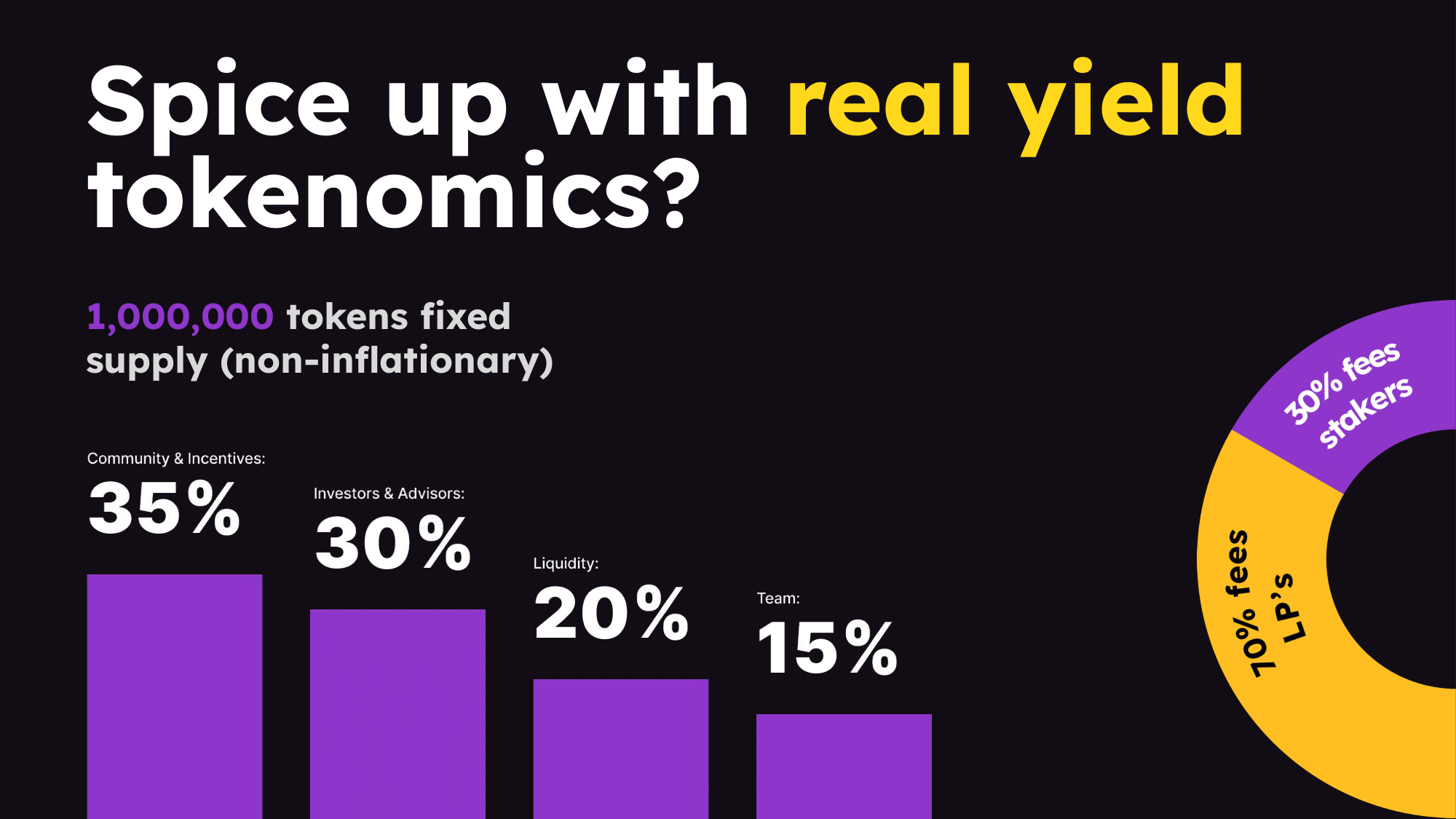

Q3: How can I profit on Storm Trade without actively trading, like how will the storm token help me with it?

A: There are several ways to profit without active trading on Storm Trade.

1- Market Making: You can become a market maker by providing liquidity to the Storm exchange, particularly by supplying assets like JUSDT (a stablecoin on Storm). This approach allows you to earn an annual percentage yield (APY) ranging from 10% to 20% with a relatively low-risk profile.

2- Referral Program: If you have a community or network, you can share a referral link generated in the Storm user interface. By doing so, you'll earn a portion of the fees your referrals generate while providing them with fee discounts—a mutually beneficial arrangement.

3- Investing in Storm: By investing in the Storm blockchain, you not only speculate on the token's price but can also stake Storm tokens to receive a share of exchange trading fees. This utility ensures that Storm tokens offer more than just speculative value and contribute to the platform's functionality.

Q4: What uh attract you to tom blockchain to develop your product here and how do you see the future development of trading platforms in telegram mini apps?

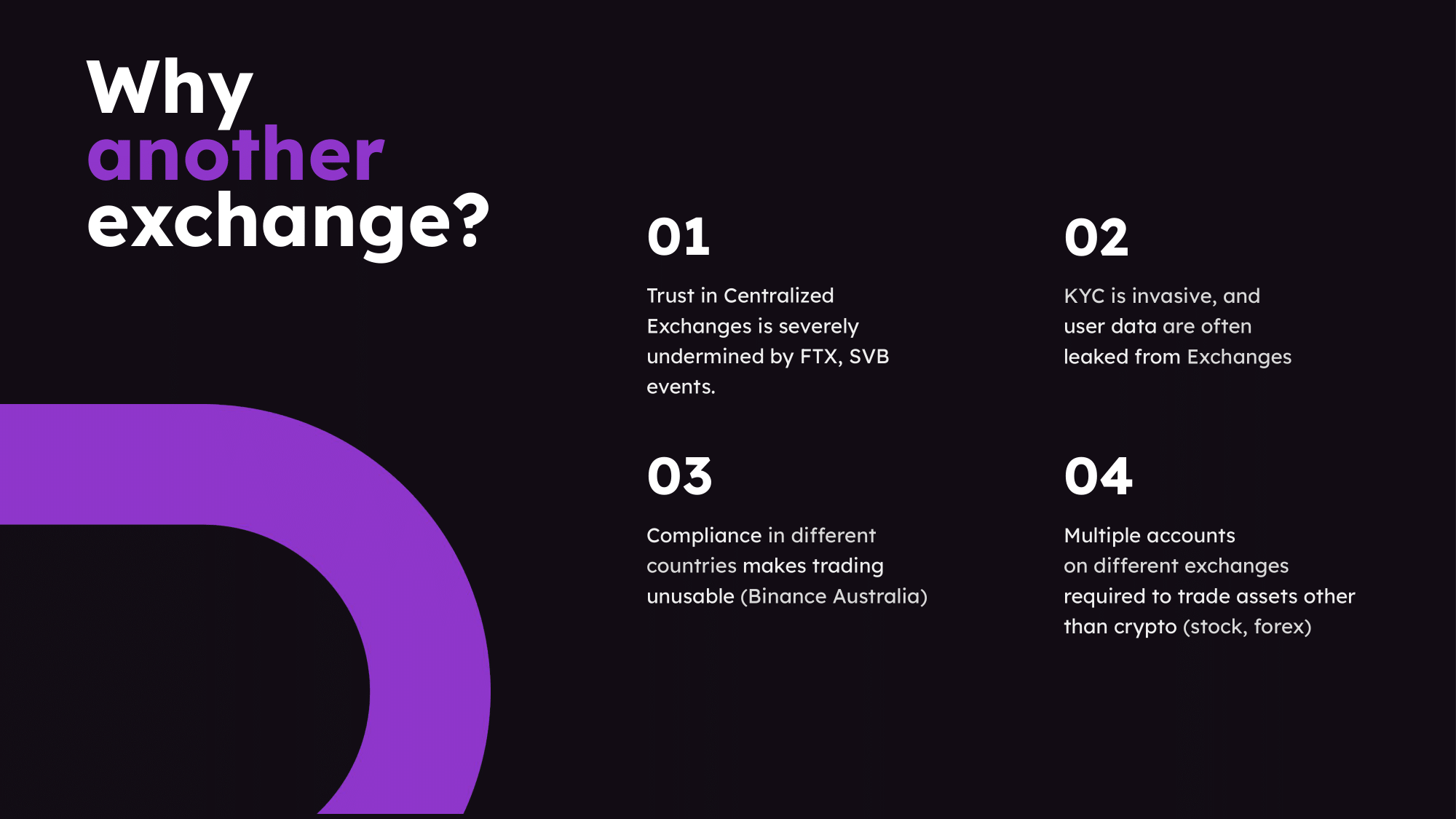

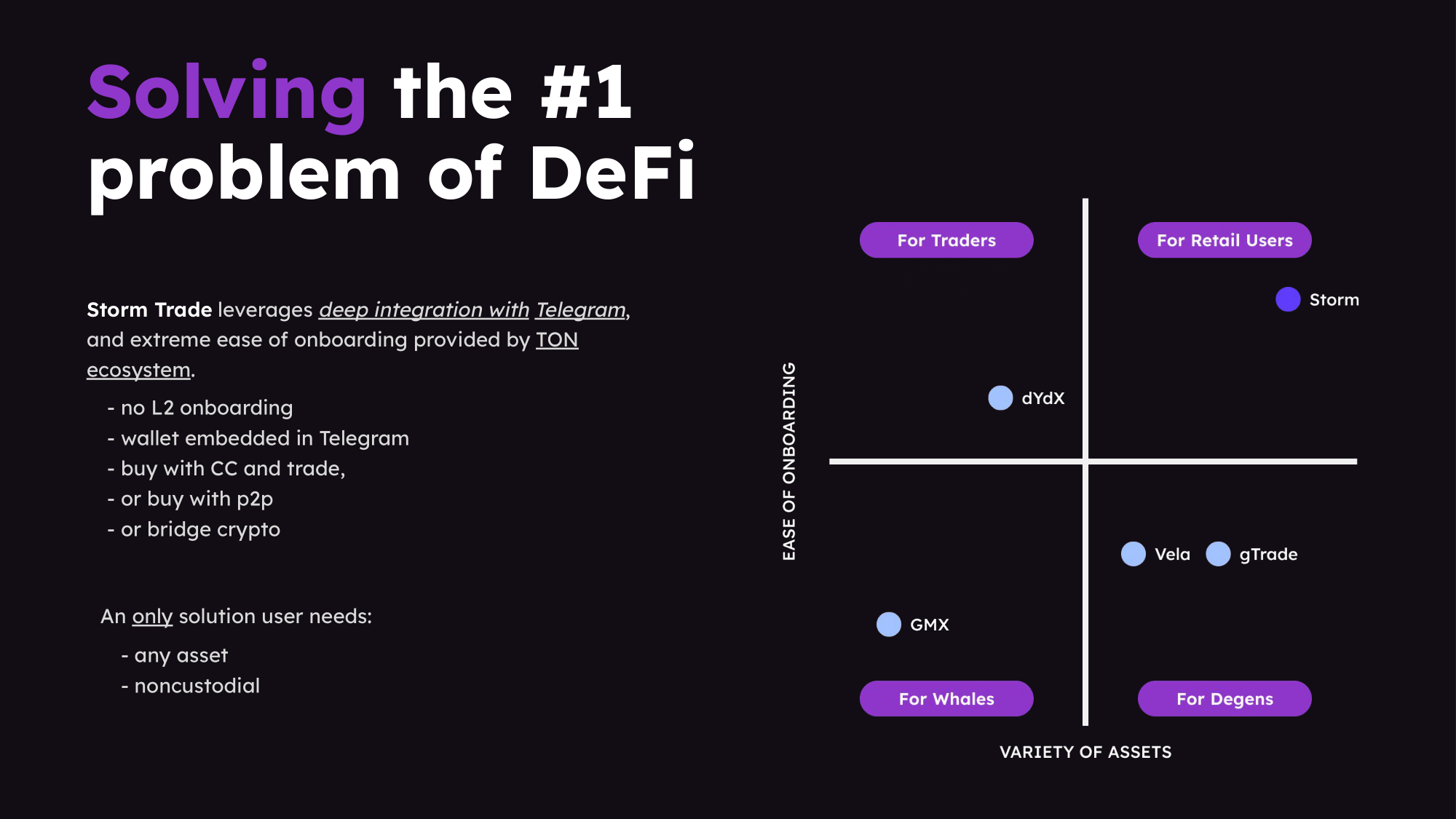

A: The Ton blockchain offers a unique opportunity to onboard web 2 users to web 3 through its deep integration with Telegram. While other blockchains may have strong technical performance, they often pose high onboarding barriers. Ton combines technical capabilities for high-performance, automatically sharded blockchains with the potential to attract millions of users due to its Telegram integration. This is why we've chosen Ton as our platform. Regarding Telegram Mini Apps, it aligns with the trend towards super apps, where users prefer a single application for their daily needs. Telegram allows for decentralized mini apps integrated with built-in wallets, enabling a simple and user-friendly approach to using various services within a single app, reducing the need for multiple centralized applications.

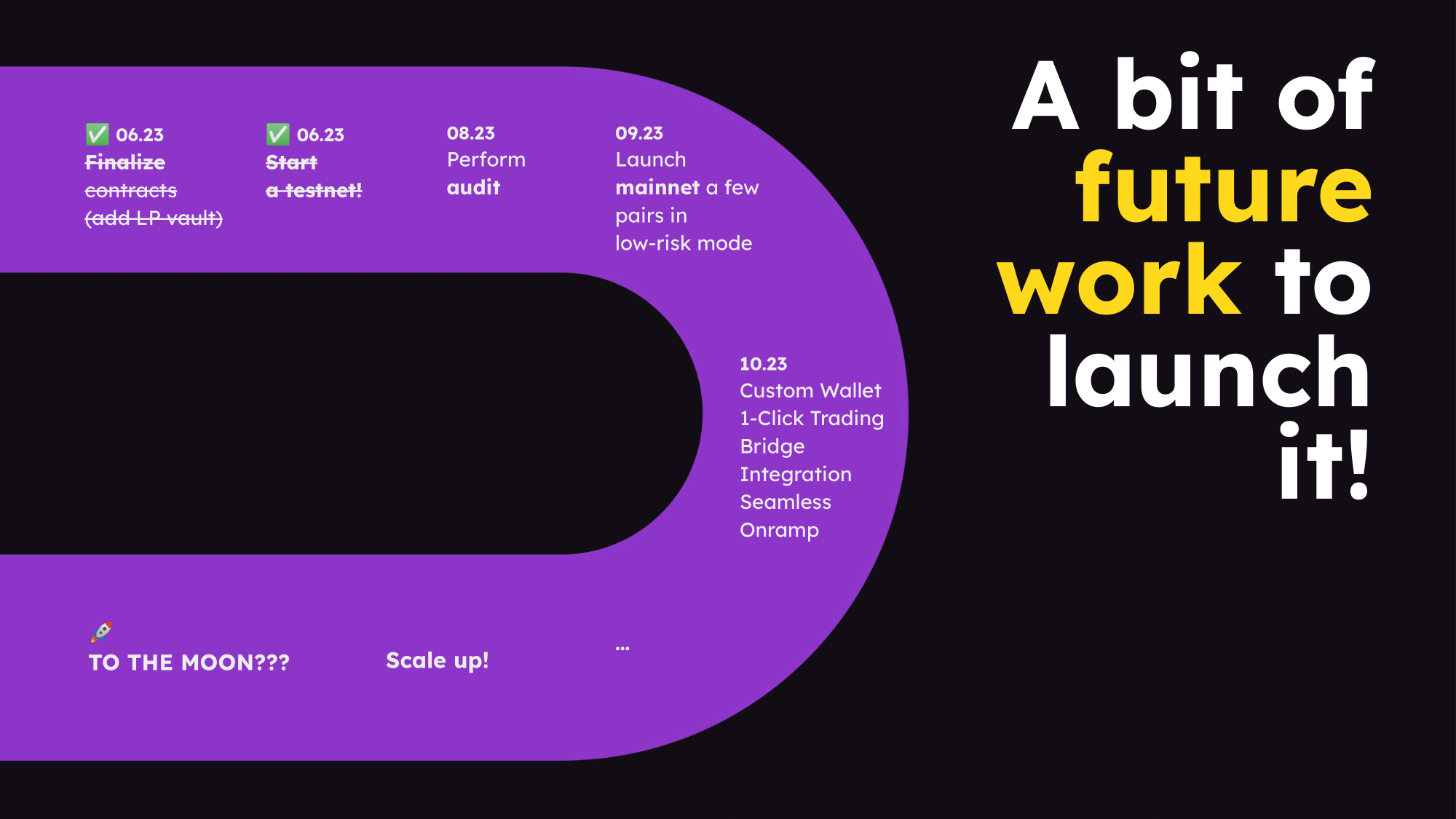

Q5: What are your project's goals for the upcoming quarters, possibly in the next few months or half a year?

A: Our project will roll out step by step. Initially, we aim to release the beta version with limited assets and parameters to ensure smooth operation on the mainnet. Then, we'll expand liquidity and user participation from the Ton community. Our next significant milestone is facilitating user onboarding for those not already on Ton, working closely with wallet developers to enable easy stablecoin purchases and one-click trading. Additionally, we plan to release Genesis NFTs that grant participation in exchange governance. These NFTs allow users to execute orders and maintain decentralized protocol integrity. Finally, we'll have a token generation event, distributing rewards and utilities tied to significant project milestones and upcoming functions.

Q6: What advice do you have for beginner traders, especially in leverage trading? What are the risks, and how can they be minimized?

A: For novice traders, the most critical advice is to master risk management. Learn and follow rules like not risking more than five percent of your total deposit in a single trade. Stick to these rules diligently, never invest more than you can afford to lose, and always remember to take profits. Avoid the temptation to keep pushing for more gains, which can lead to significant losses or liquidation. Stick to risk management, and you'll be on the right track.

Questions from comments and listeners

Q1: Are there any plans for collaborations with other projects? If so, which ones?

A: Collaboration is at the heart of the crypto ecosystem. We are actively working with the Pyth Network, an oracle data provider. Additionally, we have collaborations in the pipeline with various projects within the Ton system, including wallet providers, on-ramp/off-ramp services, and more. Expect numerous collaborations in the near future.

Q2: Does Storm also offer futures trading or just derivatives?

A: Storm offers perpetual futures trading, which falls under the category of derivatives. It's important to note that all futures are derivatives, but not all derivatives are futures.

Q3: Will you be adding a spot exchange to Storm Trade?

A: Not yet. Adding a spot exchange would require significant protocol enhancements at the core level and a substantial amount of liquidity in the form of other tokens, such as Bitcoin, Ethereum, and more. Currently, there isn't a substantial liquidity pool for these tokens within Ton. Our immediate focus is on other derivatives, possibly including options, in the near future.

Q4: How do you ensure transparency in your trading platform operations?

A: Our trading platform operates on a decentralized blockchain, where all transactions are recorded on-chain. This transparency allows anyone to verify trades, access price data, and track all executed orders. Blockchain explorers can be used to monitor fund movements, check the current state of the network, and ensure transparency and traceability. Everything is on-chain and accessible to those with sufficient technical knowledge.

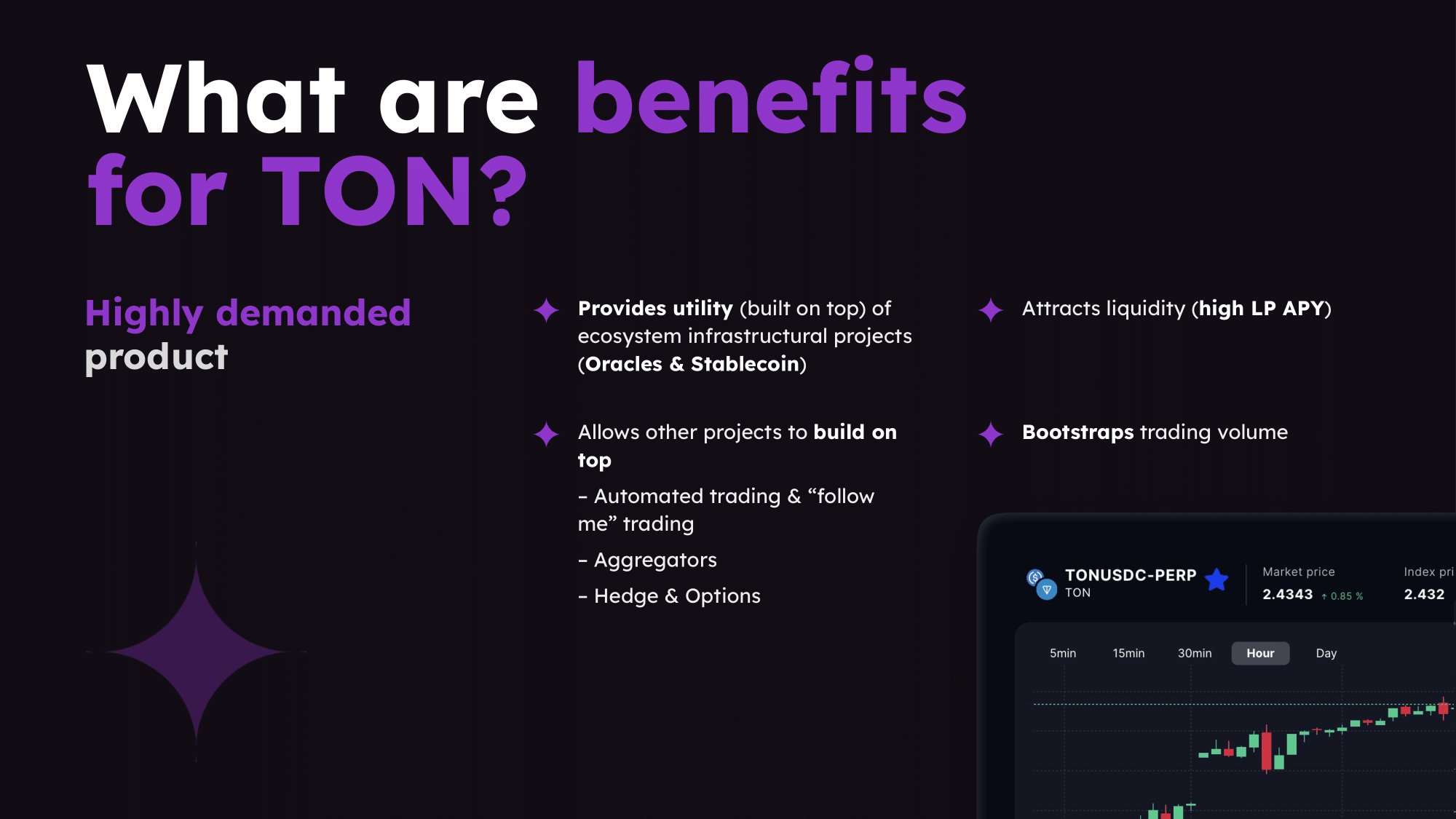

Q5: What impact might the development of Storm Trade and similar protocols, like Eva, have on the Tone ecosystem?

A: The primary impact on the Ton ecosystem is the creation of applications that serve specific use cases for end-users. This entails attracting more liquidity and users to the Tone ecosystem who not only speculate on Ton's price but also use it to pay fees and access various products. Ultimately, this expansion should increase the user base, enhance Ton's recognition, and contribute to the ecosystem's growth, which is our primary goal in developing projects on Ton.

Q6: Where do you source your oracle prices from, and why did you choose that source?

A: We obtain our oracle prices from the Pyth Network, a recognized data source for real-time trading applications. Pyth Network is well-suited for derivatives trading because it offers real-time data, covers a wide range of asset types (crypto, commodities, forex, and equities), and operates in a decentralized manner. It aggregates data using a volume-weighted average from the top exchanges by volume for each asset, ensuring fairer pricing and reducing the risk of unwanted liquidations for traders. Our choice of Pyth Network as our oracle price source aligns with these valuable features for traders.

Q7: Will the platform require paid subscriptions, or will it be free to use?

A: The platform does not require any paid subscriptions to use. Users only need to pay trading fees, which is a standard practice in trading platforms. However, holding Storm tokens can provide additional benefits, such as fee discounts, which can be considered a form of subscription for frequent traders. But there is no mandatory subscription fee to trade on Storm.

Q8: Are there any future plans to launch Storm on other blockchain networks?

A: Currently, there are no plans to launch Storm on other blockchain networks. The unique programming language and model of the Ton chain make porting Storm to other chains challenging, and there are limited TVM (Tone Virtual Machine) chains available.

Q9: Is the Storm token going to be a rough token or what? Like you can provide liquidity on any pair and create any pair and trade on it into that blockchain?

A: You can trade different pairs by adding liquidity, but it depends on having enough liquidity for the pair you want to trade.

Q10: Why does Storm prefer futures trading over the spot market?

A: Storm prefers futures trading because it offers more options, including better slippage, leverage, and the ability to take short positions. For traders primarily interested in price movements rather than using tokens for their utility, futures trading is advantageous. It often has lower fees and better liquidity compared to the spot market, making it a preferred choice for traders looking to manage risk and optimize trading conditions.

Some useful links for you 👇

Super-Chat | News | Twitter | Denis’ Blog

More info about Storm Trade 👇