It’s no secret that Telegram has long outgrown the definition of a standard messenger. It has evolved into a self‑sustaining ecosystem with its own economy and native digital assets — from anonymous numbers to collectible gifts, domains, and even stocks.

Every day, thousands of trades take place on marketplaces for Telegram Gifts — digital objects you can give, exchange, and sell.

The recognition of these collections is growing rapidly, with global celebrities joining the Telegram gift hype. Yet until now, there has been no accurate or transparent way to view the gift market as a whole. We’ve built the solution.

Meet sGIFT — the first tradable Telegram Gifts Index on Storm Trade.

Under the Hood

If you’ve heard of Storm Trade, you know we’re more than just a crypto futures platform. We were the first to launch RWA trading (forex, commodities, and stocks) on the TON blockchain — before it became a global trend.

Total trading volume on Storm.tg has already exceeded $3.5B, securing Storm’s position as the leading perpetual DEX in the Telegram + TON ecosystem.

Now, let’s talk gifts.

sGIFT is the first index that tracks the overall movement of the Telegram Gifts market. Instead of relying on random, often volatile prices of individual collections, sGIFT merges the entire market into a single, easy‑to‑read metric.

1. Data Collection

We aggregate sales from the largest marketplaces — Fragment, Getgems, Tonnel, Portals. For each transaction, we record:

-

sale_price— sale price -

platform_fee_pct— marketplace fee

To compare prices across platforms, we calculate a normalized price:

normalized_price = sale_price / (1 + platform_fee_pct)

This removes platform fee discrepancies and reflects the real amount the seller actually received.

2. Fair Price Calculation

We only analyze recent trades — older ones carry less weight. We also filter out outliers:

-

Ignore trades priced more than 3× away from the floor (less than 0.1% of cases).

-

Exclude trades outside 3 standard deviations from the average when calculating the median.

3. Building the Top‑15 Collections

sGIFT always includes the top 15 Telegram Gift collections by market cap. The selection is automatic — the system constantly tracks the market cap of each collection and updates the index in real time.

Liquid Market Cap for each collection is calculated as:

MCAP = fair_price × supply

Here, fair price = median of the latest valid trades, after outlier filtering. This approach reflects the true market value in the moment, rather than the unpredictable and volatile floor price.

If a new collection enters the top 15, it automatically replaces the #16 collection. To prevent sudden index spikes, the new collection’s weight is temporarily set equal to the one it replaced. The adjustment fades in over a week.

At the time of writing (July 31, 2025), the top‑15 collections by market capitalization include:

-

plush pepe

-

snoop dogg

-

durov’s cap

-

heart locket

-

loot bag

-

scared cat

-

snoop cigar

-

westside sign

-

toy bear

-

precious peach

-

swag bag

-

swiss watch

-

low rider

-

heroic helmet

-

vintage cigar

4. Weight Calculation

weight = collection MCAP ÷ sum of MCAPs for all 15 collections

Weight changes are smoothed over 24 hours to reduce volatility and prevent manipulation.

5. Final Index Calculation

Just like the S&P 500, sGIFT uses a divisor for normalization:

sGIFT = Σ (weight × MCAP) / 1,000,000

The 1,000,000 divisor keeps the index value in a readable range (e.g., 5–150 instead of hundreds of thousands).

The index is calculated and displayed in USDT, making it a universal price metric for trading and comparison. Since Telegram Gifts are traded in TON, the index auto‑adjusts in real time with every tick of the TON/USDT pair — ensuring up‑to‑the‑second accuracy.

Why the Formula Works

-

Relevant — uses real market activity and removes outliers.

-

Reliable — fair prices are based on a rolling window of recent trades.

-

Trade‑friendly — real‑time updates with stable, low‑noise behavior.

-

Transparent — collection weights are based on volume, deal count, and unique traders.

Turning the Gift Market Into a Tradable Asset

sGIFT doesn’t just measure the Telegram Gifts market — it makes it tradable.

The sGIFT trading pair is a linear futures contract that tracks the index in real time. Unlike trading individual NFTs, sGIFT futures let you speculate, hedge, and invest in the entire Telegram Gifts market as a single asset.

The contract is USDT‑denominated and synced directly to the index — price changes in the index are reflected instantly in the futures price. This makes the market accessible, fractional, and liquid — perfect for traders who want to tap into Telegram Gifts without owning individual NFTs.

How You Can Use sGIFT

-

Hedge downside risk — protect your gift portfolio against price drops.

-

Speculate on Telegram economy growth — profit from the trend without buying NFTs.

-

Pair trades — e.g., long sGIFT / short TON.

-

No‑custody market access — no need to store assets on marketplaces.

-

Fractional participation — start with as little as $5.

-

Avoid low‑liquidity NFTs — access instant liquidity via derivatives.

-

Non‑Telegram traders — trade the market without a Telegram account.

-

Short the market — profit from declines.

-

Adjustable leverage — scale risk/reward up to 3х.

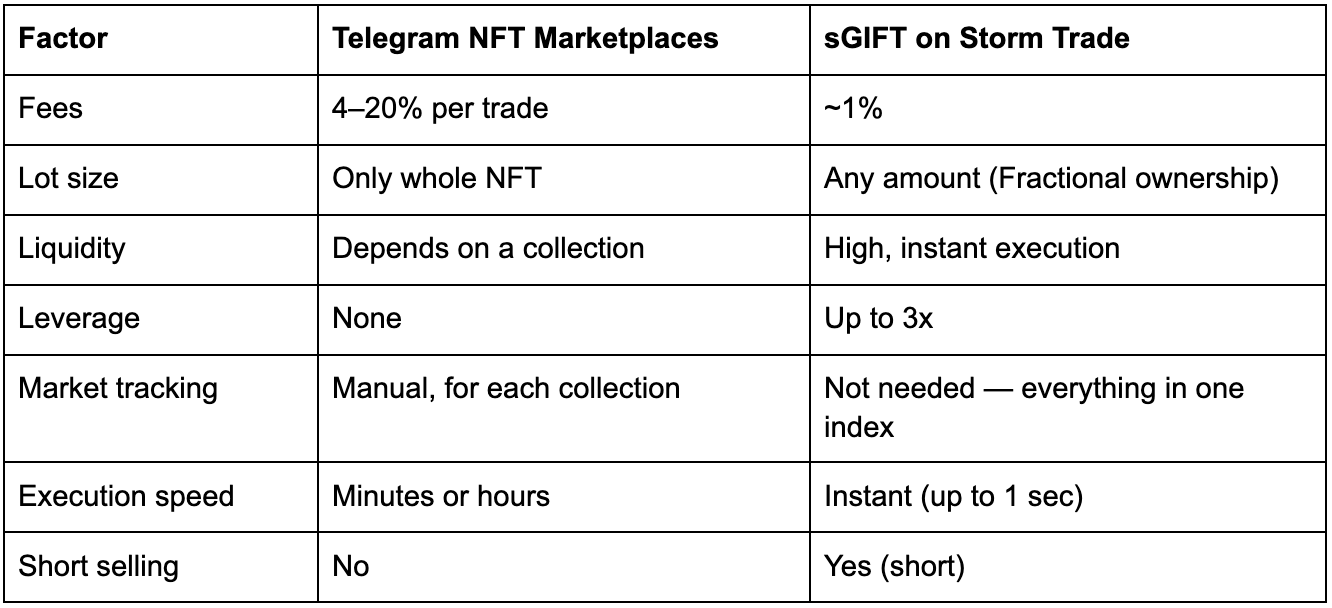

sGIFT vs. Spot NFT Trading

Telegram‑Native Assets — A New Web3 Layer

Telegram is evolving into a platform with its own digital economy — and new asset classes are emerging:

-

sGIFT Index — the first index reflecting total value & dynamics of Telegram Gifts.

-

Sticker Index (coming soon) — tracks collectible Telegram sticker prices.

-

Anonymous Numbers Futures (coming soon) — derivatives for anonymous Telegram numbers.

-

Pre‑Market Telegram IPO Index (in research) — tracking potential Telegram ecosystem valuation pre‑IPO.

We’re at the start of a full‑scale Telegram economy — and we’re building the infrastructure: indexes, derivatives, and trading platforms.

This isn’t just hype. This is TON + DeFi as the foundation for a new digital economy inside Telegram.

Conclusion

Storm Trade has already built the infrastructure to trade:

-

Cryptocurrencies

-

Stocks

-

Commodities

Now, we’re moving into the next frontier — Telegram‑native assets.We’re turning gifts, stickers, and anonymous numbers into tradeable financial instruments.We’re creating indexes, launching futures, and unlocking liquidity where yesterday there was only collectible value.

We’re building a whole ecosystem of cutting‑edge tools for traders.We’ve already launched Upscale — the first Web3 prop‑trading product that unlocks capital in a brand‑new way. And this is just one step.

Next up: the massive Storm V3 upgrade — redefining what trading feels like, with deeper markets, brand‑new tools, and unmatched execution speed!

Got questions? Ask them in our vibrant community.

And if you’re already a proud owner of Market Makers NFTs, join our private chat for exclusive discussions.