Hi everyone, in this article we are going to look at what fundings are and how they are calculated on Storm Trade.

Funding - what is it?

If you have tried trading perpetual futures at least once, you have probably come across the concept of funding. But what are these strange numbers, who is funding who and why is funding paid hourly? So many questions and so few answers. Let's get to the bottom of it.

From time to time the market is predictable for most traders, for example, a long fall is followed by a rise, traders open a long position, place orders and wait.

Due to this, there can be a big gap between the market price of an asset and its price on the exchange. To minimize the deviation between the prices, Storm Trade has implemented a funding system that encourages traders to open opposite positions.

Funding (or funding rate) is an hourly payment between traders of opposite sides of the market, used by exchanges to trade perpetual futures. It is generally accepted that funding is paid hourly, but you may see longer or shorter time intervals in some cases on other exchanges.

Open Interest

To dive into a detailed study of funding, we will need to learn another concept - open interest.

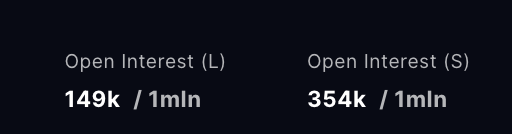

Open interest is the sum of open positions in one direction. For example, in the figure below, the Open Interest of Long positions is 149k, which takes into account not only the collateral of the position, but also the leverage of all open positions.

The maximum open interest is not infinite, it is limited by the liquidity provided to the exchange by liquidity providers. But about it a little later. In order not to have too strong gap between Index Price and Market Price, there is a spread limit equal to 1.5%, which does not allow opening positions in the popular direction when the price divergence is too strong.

Who funds whom?

All traders pay or receive funding depending on the open interest in the trading pair in which their position is open:

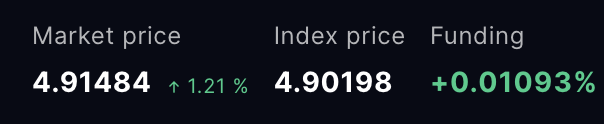

- If the perpetual futures price of an asset (Market Price) is higher than the price of the asset itself (Index Price), the funding is positive. In this case, the total open interest of long positions (long) exceeds the total open interest of short positions (short). Funding is paid by traders who opened long positions and is credited to traders who opened short positions.

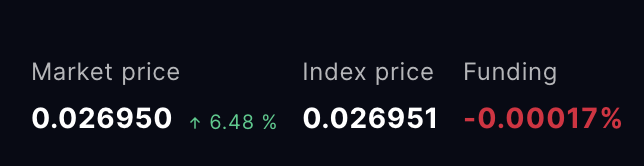

- If the price of perpetual futures of an asset (Market Price) is lower than the price of the asset itself (Index Price), the Funding is negative. In such a case, the Funding payment is charged from traders who opened short positions and credited to traders who opened long positions.

Symmetric Funding Model on Storm Trade

We won't load you with scientific terms, but let's just say that there are several types of funding. The most popular ones are symmetric and asymmetric.

Symmetrical model implies the same distribution of funds of the receiving and paying parties, and asymmetrical model is vice versa.

Symmetric funding is used on all major exchanges for the exchange of perpetual futures, including Storm Trade, making the delivery of liquidity and STORM staking more favorable and balanced.

If the funding for the receiving party is the same as for the paying party, "excess" funding is created.

Let's look at an example:

The open interest on the Long side is 100,000 USDT The open interest on the Short side is 10,000 USDT.

Then the Long side pays a 0.01% funding fee. And the Short side receives 0.1% for the asymmetric model and 0.01% for the symmetric model used on Storm Trade.

Funding payments on Storm Trade

In the asymmetric version of fundings, traders with long positions pay fundings of 100k * 0.01% = 10 USDT, while traders with short positions receive a payout of the same 10 USDT, which is asymmetrically 10 times their open positions.

However, when using liquidity contributed by suppliers, in addition to traders with short positions, there are also liquidity providers in opposition to long traders, who will receive the difference from the asymmetry of funding. We should not forget about future STORM token stakers, who also need additional motivation for holding and staking tokens.

Thus, all excess funding generated by the difference in open interest will be shared between liquidity providers and STORM token stakers in a 70:30 ratio.

In the symmetric funding model used on Storm Trade, short position traders receive funding at the same rate that the opposite party (long) pays. That is, according to our example, 1 USDT will be sent to short position traders and 9 USDT will be split between liquidity providers (70%) and STORM stakers (30%).

The liquidity providers provide a 90k open interest counter position with their funds, receiving 9*0.7=6.3 USDT of funding per hour, and the STORM stakers will receive the remaining 9-6.3=2.7 USDT per hour.

Symmetrical Funding is Fairer?

When introducing symmetrical fundraising on Storm Trade, we considered several sides at once. On the one hand, the receiving side earns fundings proportional to the volume of positions. On the other hand, liquidity providers stand in opposition to traders, also risking their deposited funds and receiving a fair 70% of excessive funding. On the third side of the funding triangle stand the stakeholders of the STORM token, who are offered additional motivation to keep the token in staking for as long as possible.

Thus, symmetric funding helps us to incentivize the provision of liquidity and future token staking, and makes the user interface more understandable by offering a single funding rate for long and short holders.

Still have questions? Feel free to ask them in our community 👇

Super-Chat | News | Twitter

More info about Storm Trade 👇