Throughout the Cryptocurrency Cycle, Meme Coins are Becoming Alternatives to "VC, CEX, and High FDV."

Community-driven and fair releases have captured the mindset of retail investors and are beginning to make an impact during actual bidding stages.

Large popular meme coins have performed exceptionally well this year, maintaining strong returns even during market adjustments.

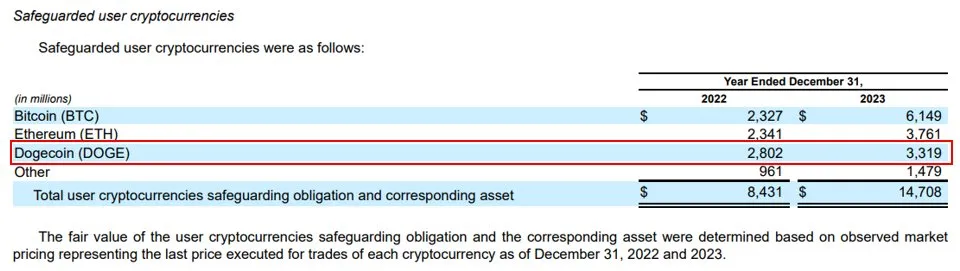

Memes have now become a mainstream asset class, as evidenced by the holdings of Robinhood users.

One thing to consider is that global asset managers are just beginning to enter the crypto stage.

I believe it’s unlikely that seasoned Wall Street veterans will provide exit liquidity for crypto venture capital firms. Instead, they may seek to change the status quo, and memes could be one of the tools they use to achieve this goal.

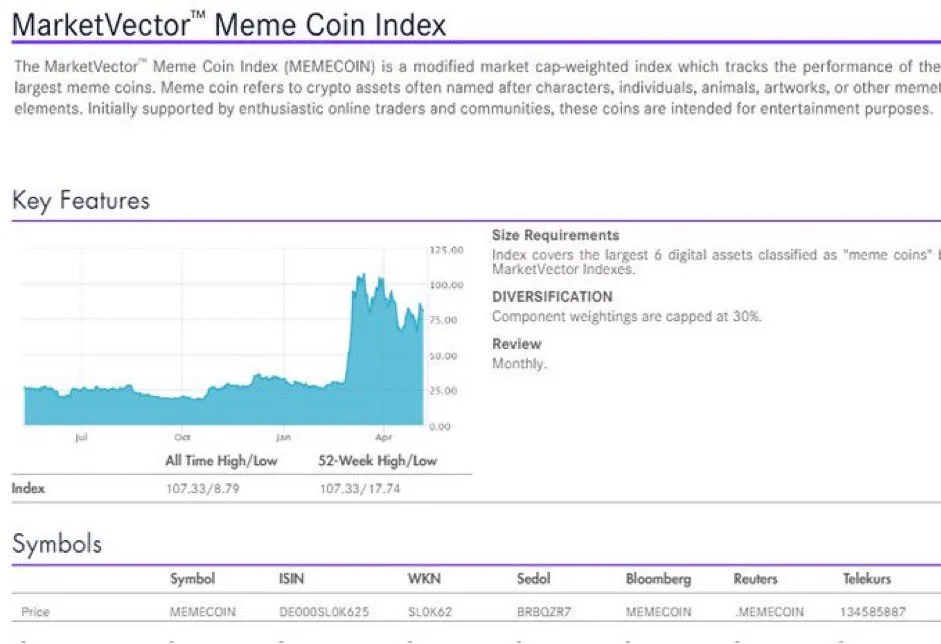

Two Prominent Examples: Franklin Templeton and VanEck

-

VanEck's MarketVector recently launched the MEMECOIN index.

-

Franklin Templeton has been consistently publishing articles about meme coins.

An interesting case is Franklin Templeton's $WIF Shilling.

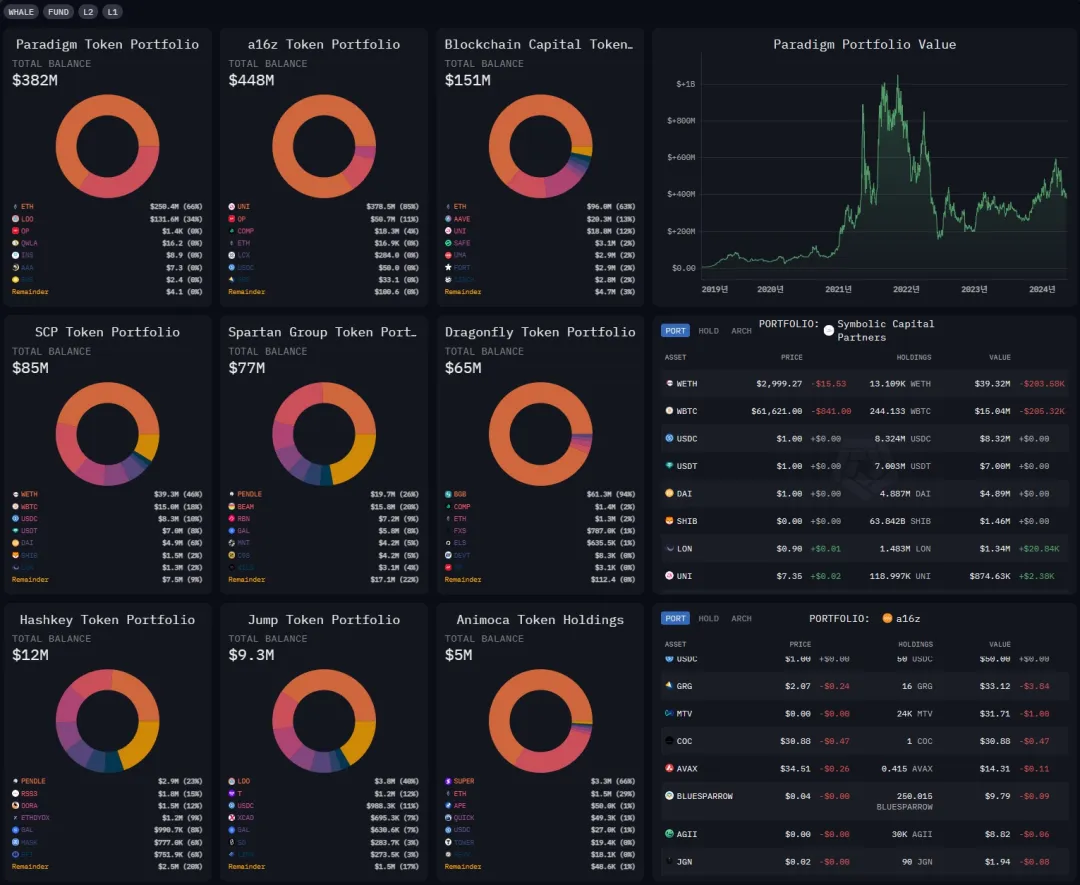

It's worth noting that traditional crypto VCs are still reluctant to embrace memes; major meme coins like $WIF and $PEPE are absent from top VC portfolios.

If they eventually yield and decide to invest in memes, this could signal the beginning of a second meme cycle.

Perhaps the upcoming U.S. presidential election will soon force venture capitalists to make a painful choice (whether to add memes to their portfolios).

It's still uncertain whether Trump or Biden will win, but every related event seems to benefit the hype around memes.

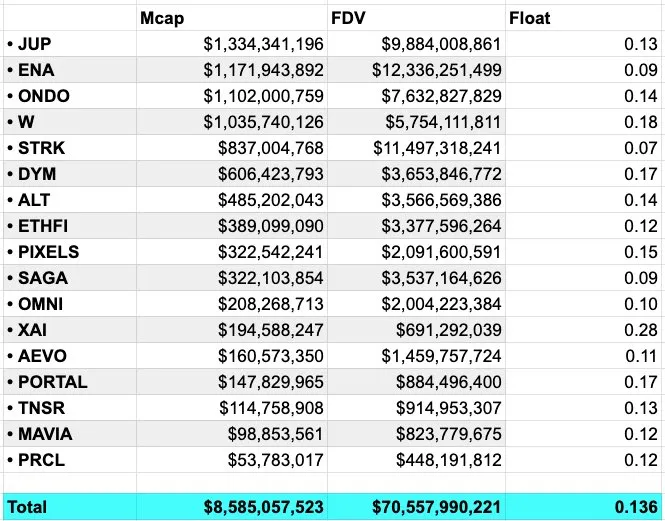

Retail Investors Disappointed by "Low Circulating Supply, High FDV" Projects

Venture capitalists advocate for "serious/fundamental" projects, but the market response remains tepid.

In this environment, hedge funds and market makers face pressure to generate returns within a specified timeframe.

"Is the Meme Era Over?"

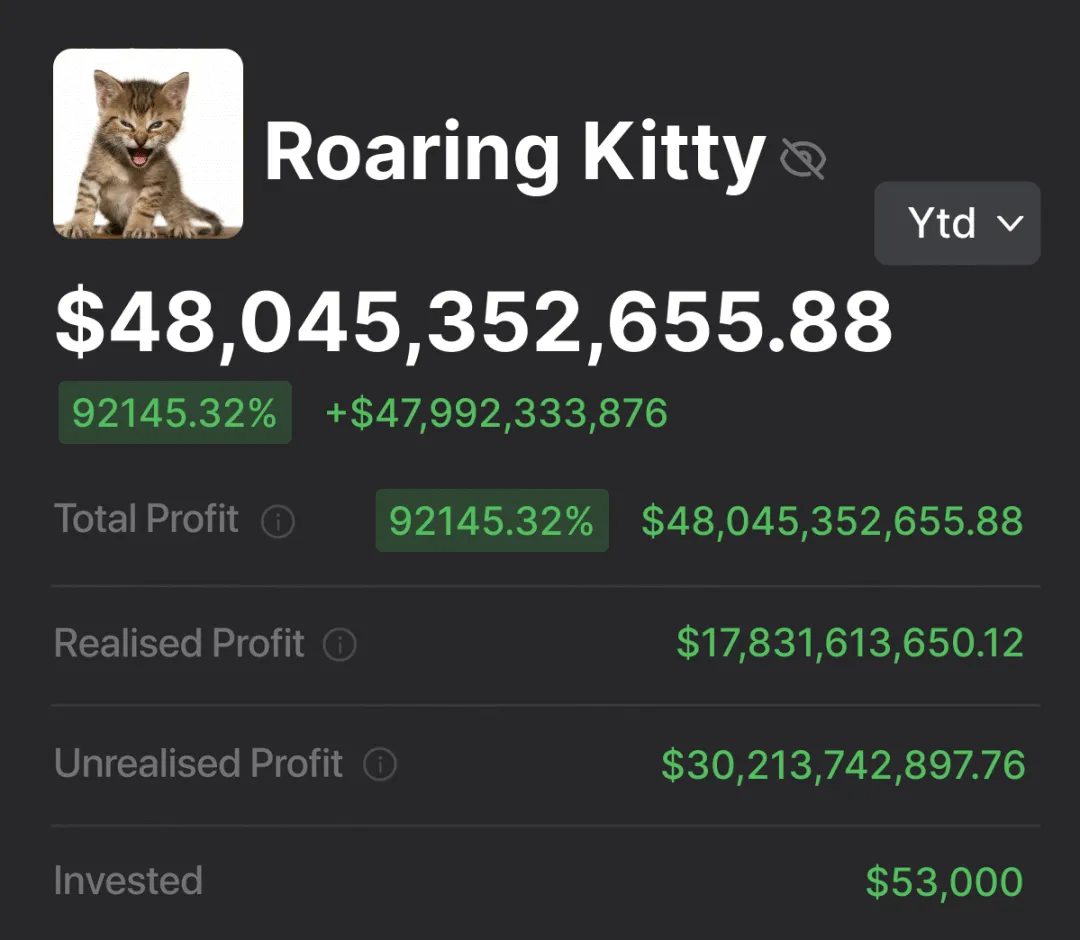

Just today, Roaring Kitty, famous for $GME, posted for the first time in three years. His return likely signals the beginning of the second wave of the meme cycle.

Do not underestimate his influence.

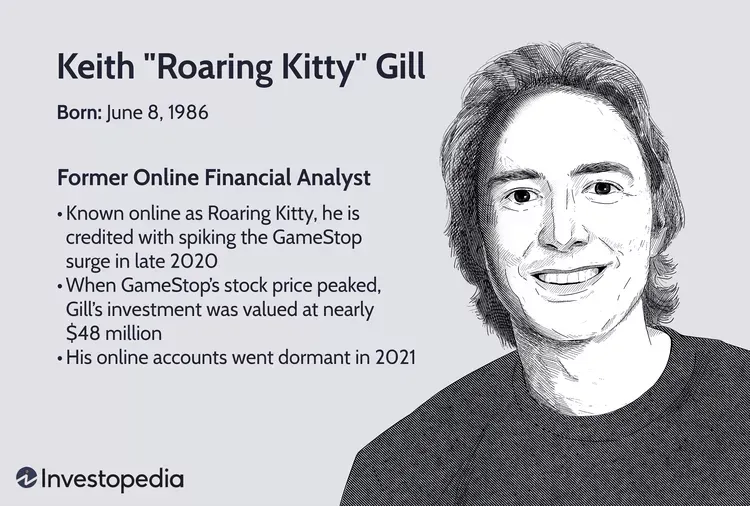

Perhaps not everyone is familiar with Roaring Kitty.

Keith Gill, born in Brockton in 1986, was a college track and field star.

In 2019, he turned a $53,000 bet on $GME into $48 million, achieving over 10,000 times return.

From a TA perspective, most mainstream memes are currently in a retesting phase.

Some mainstream memes, such as $PEPE and $WIF, are about to enter the top 20.

In this realm, all players are on equal footing. Venture capitalists will not sell you at valuations less than 1,000 times after private rounds unlock.

Perhaps this meme cycle will continue indefinitely.

Remember, if you consider your position a long-term investment, market downturns should be seen as a gift. They provide the opportunity to buy more tokens.

Finally, it is crucial to devise a strategy before making any purchases and never invest all your funds.