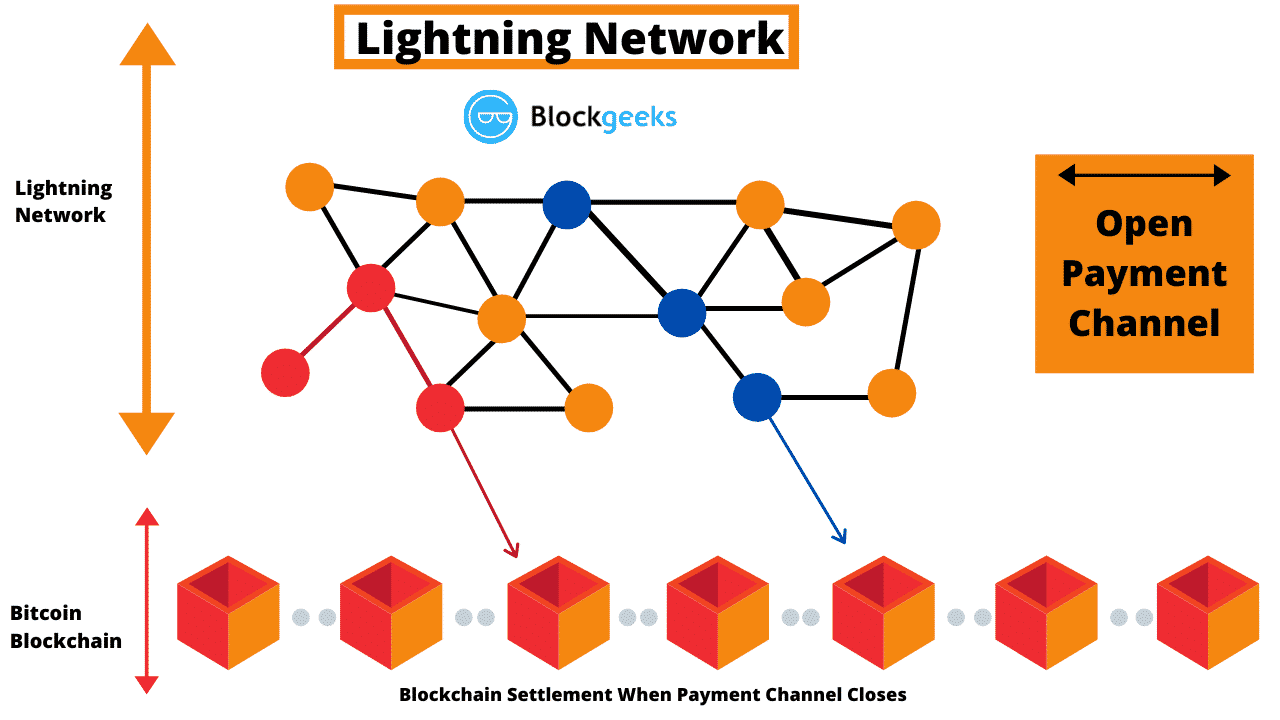

In this article, we will be covering the topmost and the most popular L2 layer protocol for the Bitcoin blockchain known as the “Lightning Network”. It was developed to mainly address the Blockchain trilemma problem and while Bitcoin is definitely more decentralized and secure as compared to the other blockchain networks, it faces a huge problem of scalability where sometimes transactions on it can take hours to complete. To solve this, we now have the Lightning Network which aims to solve this through the process of taking the transactions off the Bitcoin mainnet and processing them through other payment channels.

Disclaimer: Nothing in this article is financial advice. It should be purely treated like an Informational article and any investments in cryptocurrencies are extremely risky in nature and the reader is required to do their own research before investing in anything in this space.

Introduction

The Lightning Network was first founded by Joseph Poon and Thaddeus Dryja in January 2016 to address the problems of Bitcoin taking too long to perform transactions and with the entrance of the Lightning Network and the increasing demand of this cryptocurrency for transactions, led to the founding of the Lightning network, a solution to the scalability problem that has been haunting Bitcoin for a while.

The Lightning Network is a bi-directional or two-way payment channel which is a specialized form of a state channel that enables users to conduct transactions that would typically occur on the Bitcoin mainnet off of it giving a boost to the time taken for the transaction and making it happen much faster as compared to the on-chain transactions. This approach of moving the transaction off the chain helps reduce the load on the main blockchain, increasing transaction speed and overall making the transaction process highly efficient in nature.

In the Lightning Network, The payment channels are established between 2 parties interested in performing a transaction with each other without the need for every transaction to be recorded on the main blockchain. Why do we need to record this? If you remember, Bitcoin is technically a ledger for digital transactions performed using it, and all of the transaction details are stored for ready access on the blockchain network in general. However, this process of maintaining the ledger whenever every single person transacts, causes it to become slow in nature and introduces a latency in the performance. If you think about it from the end-user perspective, they are solely worried about their money getting transacted smoothly between them and the party they are interested in without any hassle and aren’t worried about this at all.

So, this is where the Lightning Network steps in. As the Lightning network does not require any of the transactions to be written or stored on the main Bitcoin network, it speeds them up and makes them almost instantaneous and also inexpensive in nature. The Lightning Network also has the capability to support micropayments, which are crucial for the future of Web3 applications like gaming and manages to perform them with very low transaction fees.

The transactions performed on the Lightning Network are essentially smart contracts between both parties and these channels allow for multiple transactions to occur without the need for each individual transaction to be confirmed on the main blockchain providing a big speed up to the transfer of Bitcoin. And, when a payment channel is closed, all the transactions within the payment channel that occurred are then finally recorded on the Bitcoin blockchain and this ensures that all of the parties have successfully performed their transactions in a safe and secure manner and the Lightning Network also provides users privacy due to the fact that the payments occurred off-chain.

Understanding Hashed Timelock Contracts (HTLCs)

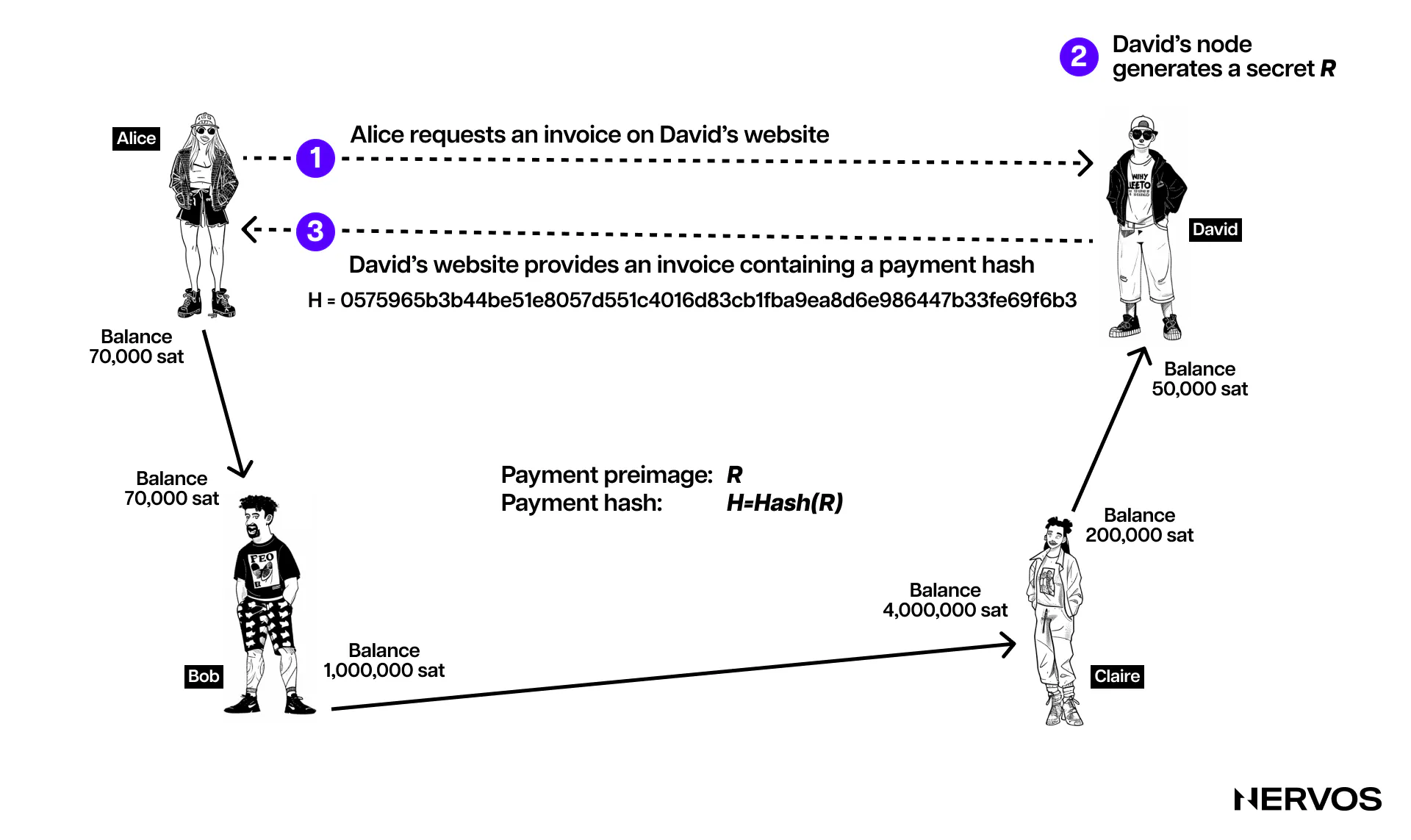

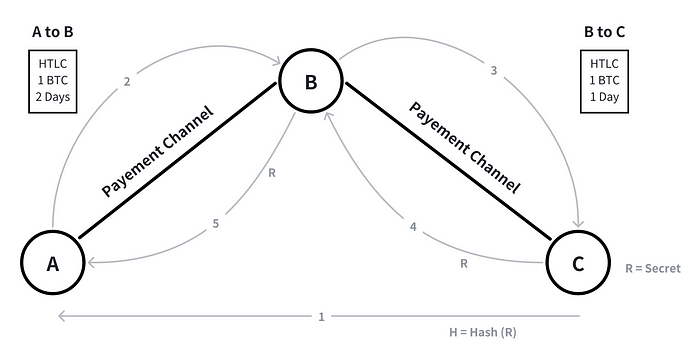

Now, before forging ahead and breaking down how exactly the transaction flow happens between 2 parties on the Lightning Network interested in transferring Bitcoin, let’s understand a critical component of the Lightning Network called Hashed TimeLock Contracts.

Hashed Timelock Contracts play a significant role in the Lightning Network and are responsible for the enabling of secure, off-chain transactions and they are mainly built with the mission of reducing counterparty risk in decentralized smart contracts by creating a time-based escrow that requires a crypto passphrase to unlock. They are crucial for the Lightning Network and they facilitate the transfer of funds between multiple peers without direct channels and use cryptographic hashes and timelocks to ensure that the payments are only released if the recipient can provide the correct pre-image of the hash within a specified timeframe ensuring and boosting the security. Here’s a detailed explanation of it and its role :

Components of HTLCs

-

Hashlock: The hashlock is a cryptographic hash generated from a secret key. This hash acts as a condition for the release of funds. The recipient must provide the correct pre-image of the hash to claim the payment. If the pre-image is not provided within the specified timeframe, the funds are returned to the sender.

-

Timelock: The timelock is a time constraint that ensures the payment can only be claimed within a specific timeframe. There are two types of timelocks used in HTLCs: CheckLockTimeVerify (CLTV) and CheckSequenceVerify (CSV). CLTV uses a specific time or block height to release the funds, while CSV uses the number of blocks generated as a measure.

Process in HTLCs

-

Initiation: Let’s assume we have 2 characters, Alice and Bob, and let’s assume Alice wants to exchange Bitcoin for Litecoin instead along with Bob. Alice will in general generate a hash from her Litecoin private key and send it to Bob. She also creates a pre-image of the hash, which will be used to validate and finalize the transaction. Bob does the same with his Bitcoin private key.

-

Transaction Execution: Once Alice and Bob agree to the transaction, they sign it with their private keys. The smart contract executes the transaction, and neither party can change it once executed. This ensures that neither party can trick the other by quickly canceling the exchange.

-

Claiming the Payment: To claim the payment, the recipient must provide the correct pre-image of the hashlock. If the conditions are not met within the timelock, the funds are returned to the sender. This mechanism ensures that payments are only released if the recipient acknowledges them within the specified timeframe.

Role in the Lightning Network

HTLCs are central to the Lightning Network, enabling secure, off-chain transactions. They allow for the creation of payment channels, where funds can be transferred between parties without the need for each transaction to be recorded on the Bitcoin blockchain. This significantly reduces the load on the main blockchain, enhancing scalability and speed. HTLCs also facilitate multi-hop payments, where funds can be routed through multiple payment channels, further increasing the network's efficiency.

Benefits and Applications

-

Trustless Exchanges: HTLCs enable trustless exchanges, where neither party needs to rely on the other's honesty. This is crucial for escrow payments and other applications where assets are held by a third party until both parties fulfill their obligations.

-

Cross-Chain Compatibility: HTLCs are valuable for cross-chain transactions, allowing assets on different blockchain networks to be swapped securely. This requires both blockchains to support HTLCs and adhere to the same hashing algorithms.

-

Atomic Swaps: HTLCs enable atomic swaps and secure cryptocurrency trading between different blockchains. This is particularly useful for decentralized finance (DeFi) applications.

In summary, HTLCs are a powerful tool in the Lightning Network, enabling secure, off-chain transactions by utilizing cryptographic hashes and timelocks. This mechanism significantly enhances the speed, efficiency, and security of transactions on the Lightning Network, making it a fundamental tool for blockchain scalability and decentralized finance.

Bi-Directional Payment Channels on the Lightning Network

The Bi-Directional Payment Channels form the core of the Lightning Network that allows for the transactions between multiple parties with a common interest to be routed between them without the need for a direct channel or pipe between every single pair of participants. First, let’s understand what it is.

What are Bi-directional Payment Channels?

Bi-directional payment channels are a type of payment mechanism that enables two parties to transact with each other off the blockchain. This is achieved by opening a payment channel between the two parties, where they can exchange transactions and update account balances without broadcasting these transactions to the blockchain. This off-chain transaction process is facilitated by smart contracts on the Bitcoin blockchain, which ensure that the transactions are secure and that the parties involved can trust each other.

How Do Bi-directional Payment Channels Work?

To initiate a bi-directional payment channel, two parties must open a transaction on the blockchain to create the channel. This initial transaction involves both parties freezing a certain amount of Bitcoin in the channel. Once the channel is open, the parties can conduct transactions between each other by updating their balances on the channel's ledger [Transaction Record]. These transactions are not broadcast to the blockchain, which reduces the transaction fees and speeds up the process.

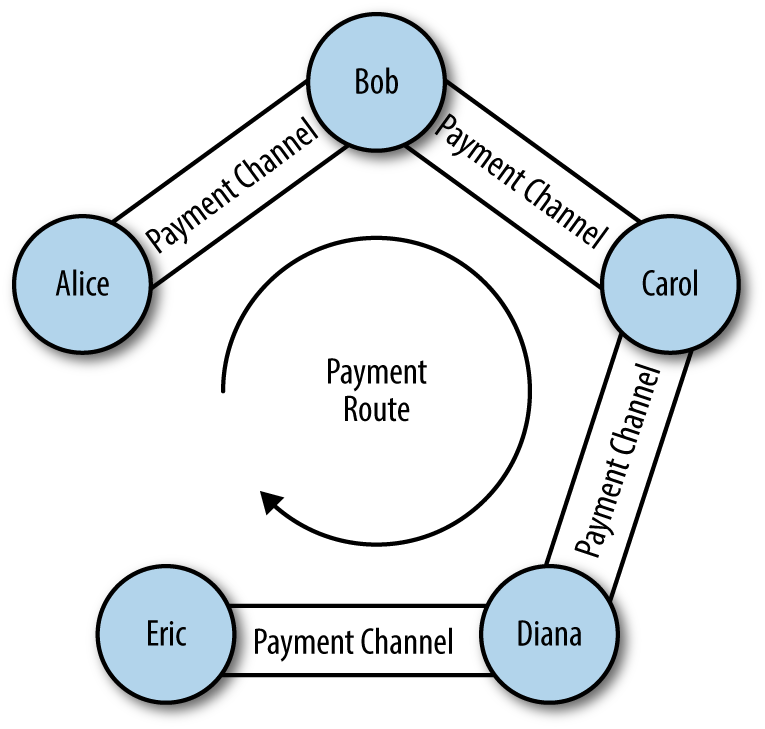

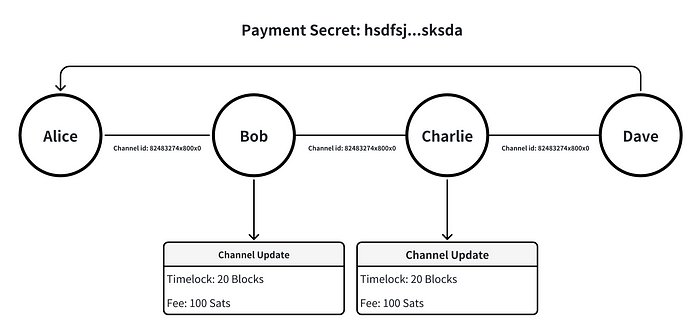

Routing Payments Across Multiple Peers

The Lightning Network allows for payments to be routed across multiple peers without direct channels between each pair of participants. This is possible because transactions can be forwarded through the network from one channel to another, enabling payments to be made between parties that do not have a direct channel. This routing mechanism is facilitated by the Lightning Network's routing algorithms, which determine the most efficient path for a payment to be made.

Step-by-Step Walkthrough of a Bi-directional Payment Transaction on the Lightning Network

Let’s assume there are 2 actors Alice and Bob who’d like to transact Bitcoin amongst them.

Step 1: Agree on Channel Terms

- The first step is kicked off by Alice and Bob deciding on the amount of Bitcoin to commit to the channel and the fees for routing payments. This agreement sets the initial state of the channel.

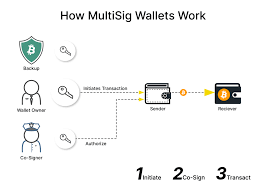

Step 2: Create a Multi-signature Wallet

- Alice generates a multi-signature wallet (multisig) that requires both her and Bob's signatures to spend funds. This wallet acts as the channel's escrow, ensuring that neither party can spend the funds without the other's consent.

Step 3: Generate and Share Funding Transaction

-

Alice creates a funding transaction that allocates the agreed-upon amount of BTC from her wallet to the multisig wallet address. This transaction is not broadcast to the Bitcoin network yet.

-

Alice shares the funding transaction details with Bob, who verifies the details and adds his own input to the transaction.

Step 4: Sign and Broadcast Funding Transaction

-

Bob generates a signature for the funding transaction and shares it with Alice.

-

Alice adds her own signature to the funding transaction and broadcasts it to the Bitcoin network. This broadcast finalizes the channel creation and the funds are locked in the multisig wallet.

Step 5: Channel Establishment

- The channel is now established, and Alice and Bob can transact with each other off-chain. All transactions are recorded off-chain, which allows for near-instant transaction speed, more privacy, and lower transaction costs.

Step 6: Conducting Transactions

-

Alice and Bob can now conduct transactions by updating their balances on the channel's ledger. These transactions are not broadcast to the Bitcoin network, reducing fees and speeding up the process.

-

For example, if Alice wants to send 1 BTC to Bob, she updates her balance to reflect the 1 BTC deduction, and Bob updates his balance to reflect the 1 BTC addition.

Step 7: Routing Payments

- If Alice wants to send a payment to other members like David and Claire, and they do not have a direct channel, Alice can route her payment to David via Bob and Claire’s channels using a Hashed Timelock Contract (HTLC). This involves pathfinding to find the most efficient route and routing the payment through the chosen path, including the cooperation of all intermediary nodes (routing nodes) along that path.

Step 8: Closing the Channel

-

When Alice and Bob decide to close the channel, they broadcast a transaction to the Bitcoin network that settles the final balance between them. This transaction is signed by both parties and includes the closing fee.

-

The final settlement is recorded on the blockchain, reflecting the final balances of Alice and Bob.

Advantages of Bi-directional Payment Channels

-

Scalability: By enabling transactions to be conducted off the blockchain, the Lightning Network significantly reduces the load on the Bitcoin network, thereby improving scalability.

-

Speed and Cost: Transactions on the Lightning Network are much faster and cheaper than those on the blockchain, making it a viable option for everyday transactions.

-

Privacy: Since transactions are conducted off the blockchain, they are not publicly recorded, providing a degree of privacy for the participants.

Thus, Bi-directional payment channels on the Bitcoin Lightning Network represent a significant advancement in the scalability and efficiency of Bitcoin transactions. By enabling transactions to be routed across multiple peers without direct channels, the Lightning Network provides a solution to Bitcoin's scalability issues, making it a more practical option for everyday use.

The Significance of the Multi-Signature Wallet for Transactions on the Lightning Network

Now, let’s take a step back and understand what a Multi-Signature Wallet is.

What is a Multi-Signature Wallet?

A multi-signature wallet is often referred to as a “multisig” wallet which is a type of cryptocurrency wallet that requires multiple private keys for the authorization of a transaction. This means that at least 2 parties must agree to a transaction before it can be executed. This concept is akin to a secure locker with 2 keys and 2 locks where both of the keys are required to open the locks to access the contents of the locker and this setup ensures that no single party can access the funds without the consent of the other party thus boosting the security of the wallet or locker.

Importance of Multi-Signature Wallets in Bi-directional Payment Channels

Multi-signature wallets play a crucial role in the Bitcoin Lightning Network, particularly in the context of bi-directional payment channels. Here's why they are important:

-

Security: By requiring multiple signatures for transactions, multisig wallets significantly reduce the risk of unauthorized access to funds. This is particularly important in payment channels, where funds are locked until the channel is closed. Without multisig, a single party could potentially spend the funds without the other party's consent.

-

Trustless Transactions: In the Lightning Network, transactions are conducted off-chain, which means they are not recorded on the blockchain. This process relies on the trust between the parties involved. Multi-signature wallets ensure that even in a trustless environment, transactions can only be executed with the agreement of both parties, further enhancing the security and trustworthiness of the network.

-

Scalability and Efficiency: The Lightning Network is designed to handle a large number of transactions efficiently. By using multisig wallets, the network can process transactions quickly and at a lower cost compared to on-chain transactions. This is because transactions do not need to be broadcast to the entire network, reducing the load on the blockchain and lowering transaction fees.

-

Flexibility and Use Cases: Multi-signature wallets are versatile and can be used in various scenarios, from joint accounts to enhanced security measures. In the context of the Lightning Network, they serve as the foundation for payment channels, allowing for the creation of a global payment system without intermediaries. This system is highly scalable, secure, and cost-effective, making it ideal for everyday transactions.

In summary, multi-signature wallets are essential in the Bitcoin Lightning Network for their role in enhancing security, facilitating trustless transactions, and supporting the network's scalability and efficiency. Their use of bi-directional payment channels ensures that transactions can be conducted securely and efficiently, without the need for direct channels between each pair of participants.

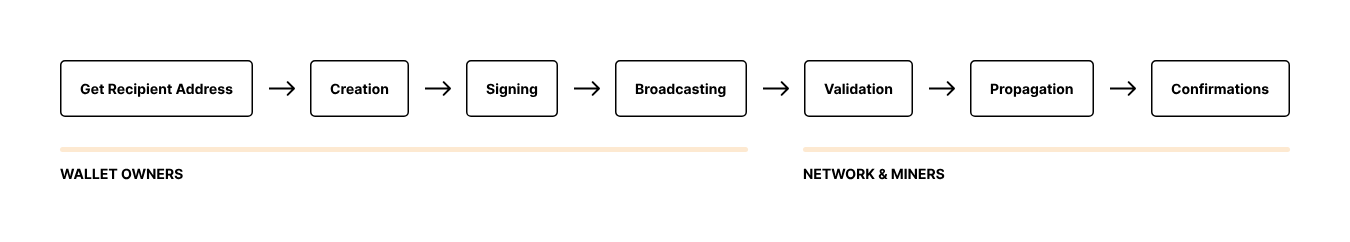

How the Lightning Network Works: A Step-by-Step Explanation

The Lightning Network is a second-layer protocol that operates on top of the Bitcoin blockchain, designed to address Bitcoin's scalability issues by enabling faster and cheaper transactions. Here's a step-by-step explanation of how transactions are processed within the Lightning Network, including some key concepts and diagrams for clarity.

Step 1: Opening a Payment Channel

-

Parties Agree on Channel Terms: Two parties, Alice and Bob, decide on the amount of Bitcoin to commit to the channel.

-

Create a Multi-signature Wallet: Alice creates a multi-signature wallet that requires both her and Bob's signatures to spend funds.

-

Generate and Share Funding Transaction: Alice generates a funding transaction that allocates the agreed-upon amount of BTC from her wallet to the multi-sig wallet address. This transaction is not broadcast to the Bitcoin network yet.

-

Sign and Broadcast Funding Transaction: Bob generates a signature for the funding transaction and shares it with Alice. Alice adds her own signature to the funding transaction and broadcasts it to the Bitcoin network, finalizing the channel creation and locking the funds in the multi-sig wallet.

Step 2: Conducting Transactions Off-chain

-

Micropayments: Alice and Bob can now conduct transactions by updating their balances on the channel's ledger. These transactions are not broadcast to the Bitcoin network, reducing fees and speeding up the process.

-

Commitment Transactions: To update the state of the channel, Alice and Bob create commitment transactions that are signed by both parties. These transactions are not broadcast to the Bitcoin network but are used to keep track of the channel's state.

Step 3: Routing Payments

- Routing Nodes: If Alice wants to send a payment to David, and they do not have a direct channel, Alice can route her payment to David via Bob and Claire’s channels using a Hashed Timelock Contract (HTLC). This involves pathfinding to find the most efficient route and routing the payment through the chosen path, including the cooperation of all intermediary nodes (routing nodes) along that path.

Step 4: Closing the Channel

-

Settlement Transaction: When Alice and Bob decide to close the channel, they broadcast a transaction to the Bitcoin network that settles the final balances between them. This transaction is signed by both parties and includes the closing fee.

-

Final Settlement: The final settlement is recorded on the blockchain, reflecting the final balances of Alice and Bob.

Technical Aspects of the Lightning Network

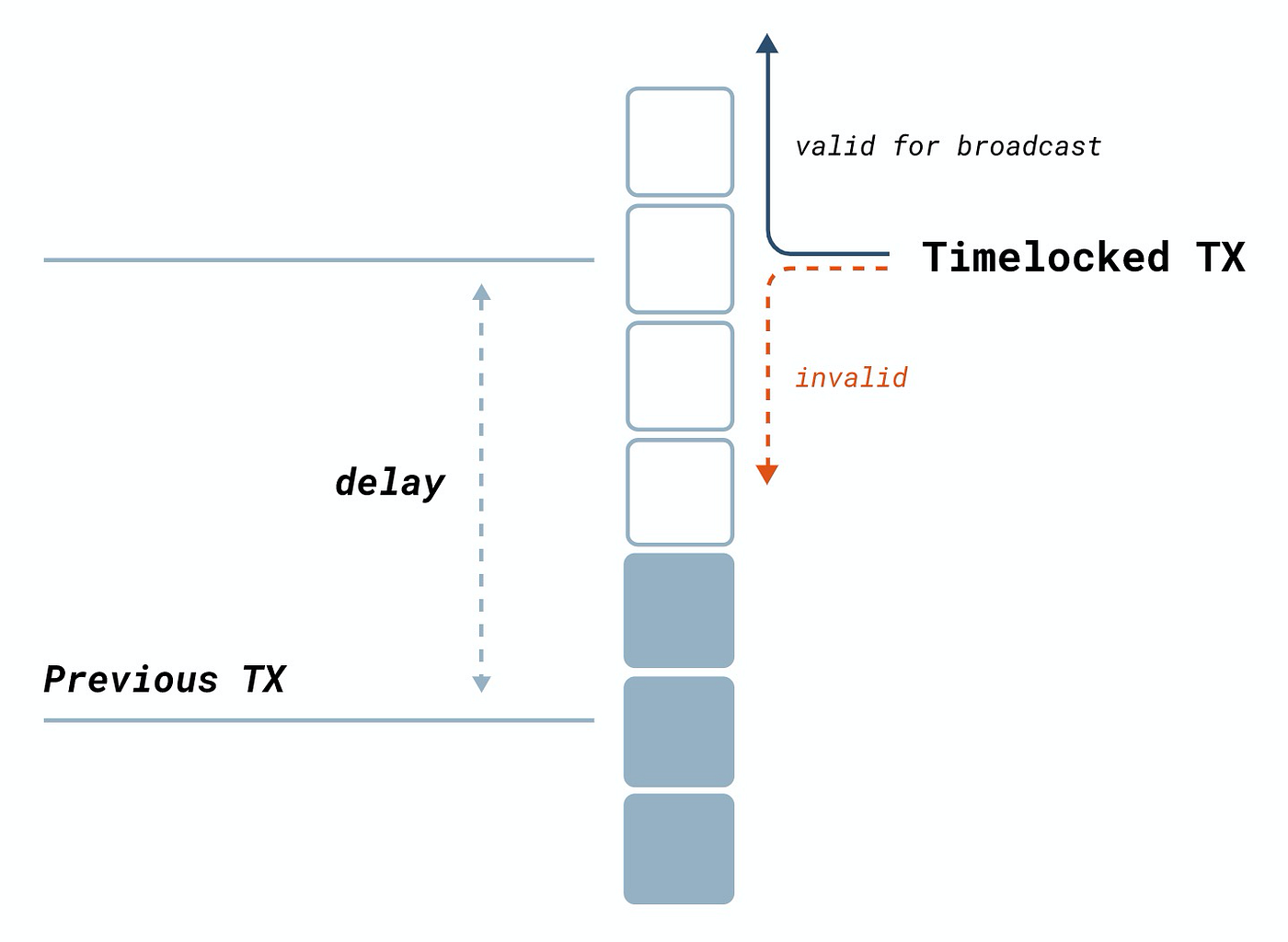

The Lightning Network is a layer-2 protocol that operates on top of the Bitcoin blockchain, enabling faster and cheaper transactions. It achieves this through the use of payment channels and Hashed Timelock Contracts (HTLCs). Here, we'll delve into the technical specifications and implementation details, focusing on the use of relative locktime and Revocable Sequence Maturity Contracts (RSMC).

Relative Locktime

Relative locktime is a critical feature in the Lightning Network that allows transactions to be delayed for a certain number of blocks. This is enabled by BIP68 and made scriptable by BIP112. The use of relative locktime is particularly important in the context of breach remedy transactions. When a channel is opened, a commitment transaction is created that locks the funds in the channel. If one party attempts to broadcast an old commitment transaction, the other party can use a breach remedy transaction to claim the funds back. The relative locktime ensures that the breach remedy transaction can be broadcast within a time period starting from when the old commitment transaction is added to the blockchain. This mechanism allows Lightning channels to remain open indefinitely as long as the participants continue to cooperate, without having a hard deadline for the closing or ending of the transaction or the bi-directional payment network setup for the transaction.

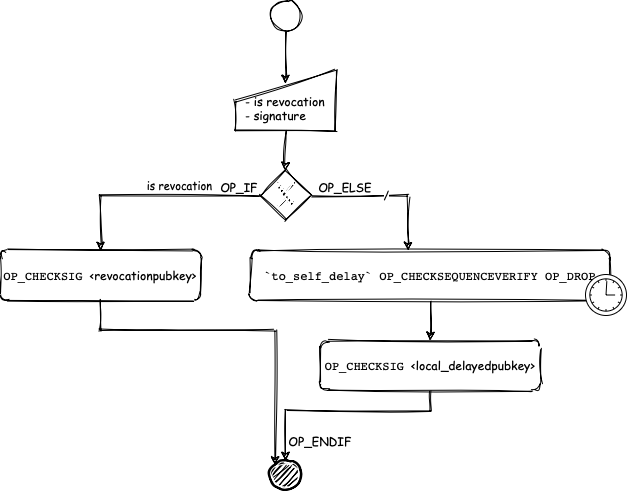

Revocable Sequence Maturity Contracts (RSMC)

RSMCs are a type of output script within a Bitcoin transaction that allows a sender to revoke a payment. This is particularly useful in the Lightning Network for invalidating previously negotiated channel balances and commitment transactions. The RSMC script is designed to allow a transaction output to be spent by the recipient after a certain number of blocks (e.g., 144 blocks) have passed. However, if both parties cooperate, they can spend the output more quickly by providing their secret keys. This mechanism is crucial for updating the channel balance and ensuring that the channel remains secure and operational.

The RSMC script works as follows:

OP_IF

144 OP_CHECKSEQUENCEVERIFY

OP_HASH160 <Bob's key> OP_EQUALVERIFY OP_CHECKSIG

OP_ELSE

2 <Alice's secret revocation key><Bob's secret revocation key> 2 OP_CHECKMULTISIGVERIFY

OP_ENDIF

This sample script ensures that the output can only be spent by Bob after 144 blocks. However, if Alice and Bob cooperate by providing their secret keys, the output can be spent more quickly. This cooperation is essential for the Lightning Network's operation, as it allows for the revocation of transactions in breach remedy transactions, ensuring that previously negotiated channel balances and commitment transactions can be invalidated if necessary.

Implementation Details

When Alice and Bob open a channel, they agree to fund the channel with a certain amount of Bitcoin. They construct a funding transaction that requires both Alice and Bob's signatures to be spent. This transaction includes outputs for RSMCs and the channel's balance. Alice and Bob then sign each other's commitment transactions, which include the RSMC outputs. This setup ensures that the channel can be updated and secured through the use of RSMCs and relative locktime.

In summary, the Lightning Network's implementation relies heavily on the use of relative locktime and RSMCs to enable secure, efficient, and flexible transactions. These technical aspects are crucial for the network's operation, ensuring that channels can be opened, updated, and closed without the need for on-chain transactions, thereby significantly reducing transaction fees and speeding up the process.

Key Features of the Lightning Network

The Lightning Network introduces several innovative features that significantly enhance the scalability, speed, and efficiency of Bitcoin transactions. Here's an expanded look at these features :

Rapid Payments and Transaction Speeds

- Off-Chain Transactions: Payments within an established channel are conducted off-chain, allowing for transactions to be made almost as fast as data can travel over the Internet between the two peers. This is significantly faster than on-chain transactions, which are subject to block confirmation times.

No Third-Party Trust Required

- Direct Peer-to-Peer Transactions: The Lightning Network enables direct peer-to-peer transactions using regular Bitcoin transactions, where only one transaction is broadcast to the blockchain. This ensures that at no point does any third party control the funds, maintaining the privacy and security of transactions.

Reduced Blockchain Load

- Minimal On-Chain Transactions: Only channel open transactions, channel close transactions, and infrequent anti-fraud respends need to be committed to the blockchain. This significantly reduces the load on the Bitcoin network, allowing for more frequent payments without placing excessive load on full nodes.

Infinite Channel Duration (with Cooperative Closures)

- Cooperative Closures: Channels can stay open indefinitely as long as both parties cooperate. This reduces the load on the blockchain and allows the fees for opening and closing the channel to be amortized over a longer period. Non-cooperative closures are also possible but take longer.

Outsourceable Enforcement

- Breach Remedy Transactions: If one party attempts to close a channel in an old state to steal funds, the other party has a defined period to act and block the theft. This function can be outsourced to a third party, allowing wallets to safely go offline for periods longer than the defined period without giving third parties control over any funds.

Onion-Style Routing

- Privacy and Anonymity: Payment routing information is encrypted in a nested fashion, ensuring that intermediary nodes only know whom they received a routable payment from and who to send it to next. This prevents intermediary nodes from knowing the originator or destination, enhancing privacy and security.

Multisignature Capable

- Additional Security Techniques: Each party can require that their payments into the channel be signed by multiple keys, providing access to additional security techniques and enhancing the security of transactions.

Securely Cross Blockchains

- Interoperability: Payments can be routed across more than one blockchain, including altcoins and sidechains, as long as all the chains support the same hash function and the ability to create time locks. This feature enhances the network's utility and interoperability.

Sub-Satoshi Payments

- Probabilistic Payments: Payments can be made conditional upon the outcome of a random event, allowing for probabilistic payments. This feature enables the creation of complex payment scenarios, such as paying a lower amount with a higher probability.

Single-Funded Channels

- Efficient Channel Establishment: When a payment needs to be sent to a peer without an existing channel, a regular on-chain payment can establish a channel without requiring the recipient to add any of their funds to the channel. This simplifies the process of opening channels and reduces the amount of additional data required.

These features collectively make the Lightning Network a powerful tool for enhancing the scalability, speed, and efficiency of Bitcoin transactions, addressing many of the limitations of the underlying blockchain.

Security and Fraud Prevention on the Lightning Network

The Lightning network employs a lot of security measures to ensure the safety of the Bitcoin transaction, offer protection against fraud, and maintain the integrity of the network. Here’s a detailed explanation of these security measures.

Payment Channel Updates

- Mutual Consent: Any changes to the payment channel, such as updating balances or closing the channel, require the consent of both parties. This mutual agreement ensures that no unauthorized changes can be made, significantly reducing the risk of fraud.

Penalty System

- Deterrence Against Fraud: The Lightning Network includes a penalty system that discourages malicious behavior. If a party attempts to cheat by broadcasting an outdated transaction, they risk losing their funds. This creates a strong disincentive for fraudulent activities, making the network a secure environment for transactions.

Secure Multi-Party Computation (MPC) Protocols

- Privacy and Security: The use of MPC protocols allows multiple parties to jointly compute functions without revealing their inputs. This ensures that sensitive information, such as private keys, remains secure even in the presence of malicious actors, enhancing the overall security of the network.

Onion Routing

- Privacy and Anonymity: Onion routing is employed to provide privacy and prevent transaction tracing. This method encrypts payment routing information in a nested fashion, ensuring that intermediary nodes only know who they received a routable payment from and who to send it to next. This prevents intermediary nodes from knowing the originator or destination, enhancing privacy and security.

Watchtowers

- Monitoring and Prevention: Watchtowers are used to monitor the network for potential fraud. These watchtowers act as a safeguard, ensuring that any attempts at fraud are detected and prevented. This proactive monitoring helps maintain the integrity of the network and protects users from fraudulent activities.

Multi-Signature Wallets

- Additional Security Layer: The use of multi-signature wallets requires multiple signatures to authorize a transaction, adding an extra layer of security. This prevents a single party from making unauthorized transactions, enhancing the security of the network.

Hash Time-Locked Contracts (HTLCs)

- Commitment to Transactions: HTLCs ensure that transactions are only completed if both parties fulfill their obligations. This mechanism helps prevent fraud by ensuring that both parties are committed to the transaction, making the network a secure and reliable solution for transactions.

Bi-directional Payment Channels

- Reduced Risk of Hacking: Bi-directional payment channels allow users to securely transact with each other without broadcasting every transaction to the blockchain. This reduces the risk of hacking, as the transactions are only visible to the parties involved.

Scriptless Scripts

- Complex Smart Contract Functionality: The Lightning Network uses scriptless scripts, which allow for complex smart contract functionality without revealing the details of the contract on the blockchain. This adds an extra layer of security, as the contract details are kept private and cannot be exploited by attackers.

These security measures collectively ensure that the Lightning Network provides a secure, efficient, and private environment for Bitcoin transactions, protecting against fraud and hacking while maintaining the integrity and functionality of the network.

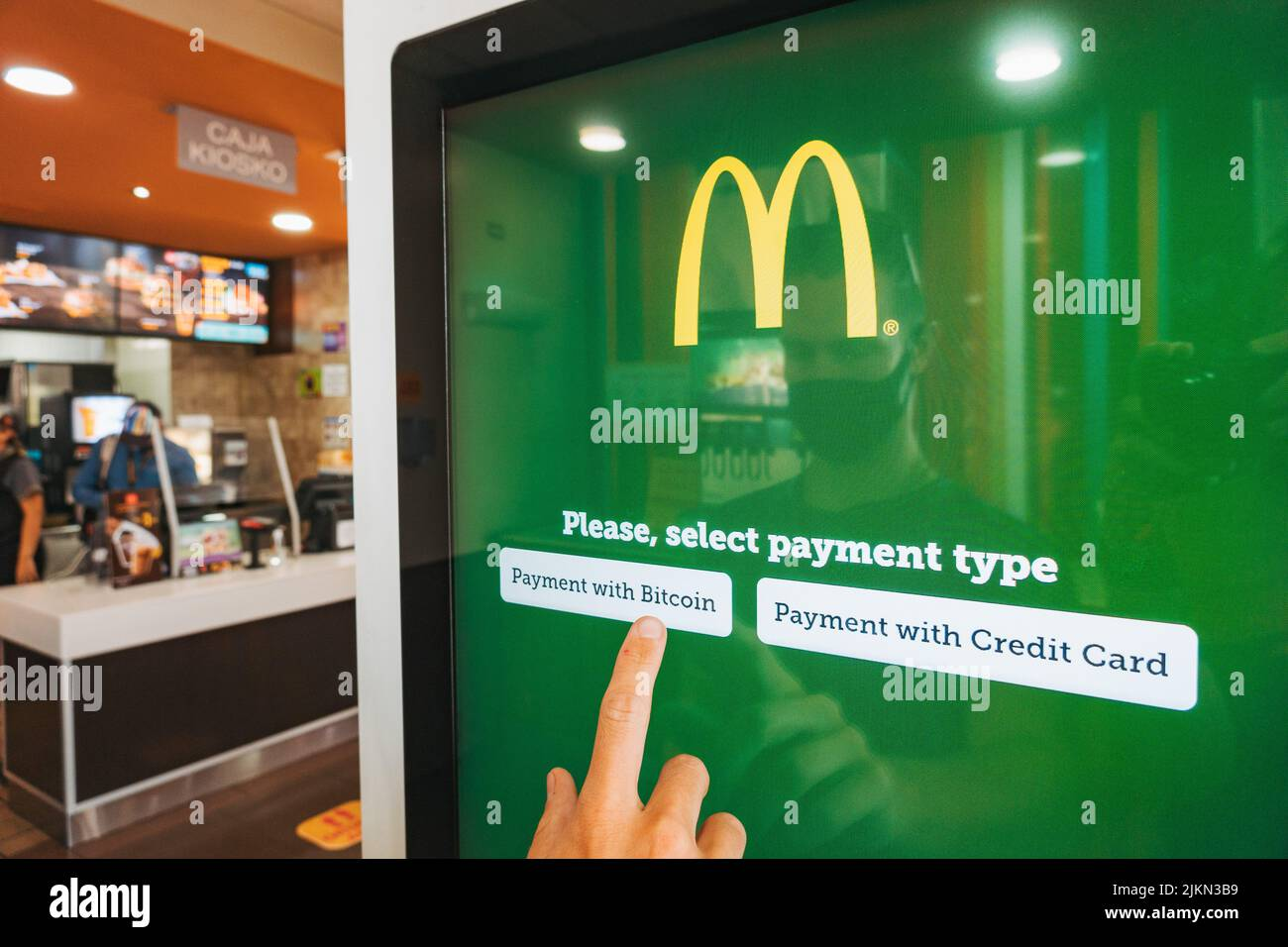

How is the Lightning Network being used in the Real World?

The Lightning Network, a second-layer protocol for Bitcoin, has been adopted by various businesses and services across the globe, offering a faster, cheaper, and more scalable way to transact with Bitcoin. Here are some real-world case scenarios and examples of how the Lightning Network has been used:

1. El Salvador

In 2021, El Salvador became the first country to adopt Bitcoin as legal tender, making it the world's first Bitcoin-based economy. The government has implemented a Lightning Network payment system to facilitate transactions, making it easier for citizens to use Bitcoin for everyday purchases. This initiative has significantly reduced transaction fees and increased accessibility for the unbanked population.

2. Bitrefill

Bitrefill, a mobile phone top-up service, has integrated the Lightning Network to allow users to pay for services using Bitcoin. This integration has made it easier for users to top up their phones with Bitcoin, offering a more accessible and cost-effective way to recharge their devices. Bitrefill's use of the Lightning Network has demonstrated the potential of Bitcoin and the Lightning Network to simplify and democratize financial transactions.

3. Lightning Labs

Lightning Labs, the company behind the Lightning Network, has developed a range of services that leverage the network. These include Lightning Loop, which allows users to convert Bitcoin into a stablecoin and back, and Lightning Terminal, a non-custodial Bitcoin trading platform. These services demonstrate the versatility of the Lightning Network in enabling new financial applications and services.

4. Square

Square, a financial services and mobile payment company has partnered with Lightning Labs to integrate the Lightning Network into its Cash App. This integration allows users to send and receive Bitcoin payments directly through the Cash App, demonstrating the potential of the Lightning Network to make Bitcoin more accessible to the mainstream.

5. Lightning Network Effects

The Lightning Network has also been used to create "effects" or services that are not directly related to Bitcoin transactions but leverage the network's capabilities. For example, the Lightning Network has been used to create decentralized applications (dApps) that offer services like decentralized finance (DeFi) platforms, gaming, and more. These applications demonstrate the potential of the Lightning Network to enable a wide range of innovative services and applications.

6. Binance Blockchain

Binance has recently integrated the Lightning Network to allow users to withdraw and deposit BTC at higher rates as compared to regular on-chain transactions directly. This helps users to get their BTC from Binance at a much faster speed also allowing users to stake, trade and do more operations with their BTC via Binance on the Lightning network at a much faster rate reducing the amount of hassle users previously faced when solely transacting on the Bitcoin mainnet.

Analysis

The adoption of the Lightning Network by businesses and services around the world has demonstrated its potential to revolutionize financial transactions. By offering faster, cheaper, and more scalable transactions, the Lightning Network has the potential to democratize access to financial services and enable new types of financial applications. The case of El Salvador, in particular, shows how the Lightning Network can be used to facilitate everyday transactions in a way that is both efficient and accessible to the unbanked population.

The integration of the Lightning Network into services like Bitrefill and Square's Cash App shows the growing acceptance of Bitcoin and the Lightning Network in the mainstream. These examples highlight the potential of the Lightning Network to simplify and democratize financial transactions, making it easier for people to use Bitcoin for everyday purchases and services.

In conclusion, the Lightning Network has been adopted by various businesses and services around the world, demonstrating its potential to revolutionize financial transactions. As the network continues to evolve, it is likely to play an increasingly important role in the future of financial services and applications.

Challenges of the Lightning Network

The Lightning Network, while offering significant advantages in terms of speed, cost, and scalability for Bitcoin transactions, faces several challenges. Understanding these challenges is crucial for stakeholders to navigate the current landscape and anticipate future developments.

Current Challenges

-

Adoption and Usage: One of the primary challenges faced by the Lightning Network is its adoption rate. While there are several services and businesses integrating the Lightning Network, the overall adoption among the broader Bitcoin user base remains relatively low. This is partly due to the complexity of the technology and the lack of awareness among potential users.

-

Interoperability: The Lightning Network is currently designed to work with Bitcoin. As the cryptocurrency ecosystem evolves, there is a growing demand for interoperability between different blockchains. Achieving this interoperability will be a significant challenge for the Lightning Network.

-

Security and Privacy: While the Lightning Network offers many advantages over traditional Bitcoin transactions, it also introduces new security and privacy concerns. Ensuring the security of the Lightning Network against potential attacks and maintaining user privacy are ongoing challenges.

-

Regulatory Compliance: As the Lightning Network becomes more widely adopted, regulatory bodies around the world are beginning to take notice. Ensuring that the Lightning Network complies with existing and future regulations is a significant challenge.

-

Technical Scalability: While the Lightning Network has been designed to scale, there are ongoing discussions and research into how to further improve its scalability. Achieving a balance between scalability and security is a critical challenge.

Future Developments and Potential Improvements

-

Interoperability Solutions: As the demand for interoperability between different blockchains grows, solutions that allow the Lightning Network to interact with other blockchains will become increasingly important. This could involve the development of cross-chain bridges or other interoperability protocols.

-

Enhanced Security Measures: To address security and privacy concerns, future developments may include the introduction of new security protocols or the development of tools that allow users to better manage their privacy.

-

Regulatory Guidance: As the Lightning Network becomes more widely adopted, there will likely be increased efforts to provide clear regulatory guidance. This could involve the development of standards or guidelines that help businesses and individuals navigate the regulatory landscape.

-

Scalability Improvements: Continuous research and development are needed to improve the scalability of the Lightning Network. This could involve optimizing the network's architecture or developing new technologies that allow for more efficient transaction processing.

-

User Adoption and Education: To increase the adoption rate of the Lightning Network, there will be a need for more user-friendly interfaces and educational resources. This could involve the development of mobile wallets with integrated Lightning Network support or the creation of educational materials to help users understand the benefits of the Lightning Network.

In conclusion, while the Lightning Network faces several challenges, there are also significant opportunities for future development and improvement. By addressing these challenges, the Lightning Network has the potential to become a cornerstone of the future of Bitcoin and blockchain technology.

Conclusion

The Lightning Network has significantly impacted Bitcoin and the broader cryptocurrency ecosystem, offering a solution to some of the most pressing issues faced by Bitcoin users and developers. By enabling faster, cheaper, and more scalable transactions, the Lightning Network has the potential to democratize access to financial services and enable new types of financial applications.

Impact on Bitcoin

-

Scalability: The Lightning Network addresses one of Bitcoin's most significant challenges—scalability. By allowing transactions to be processed off the main blockchain, the Lightning Network has the potential to significantly increase the number of transactions that Bitcoin can handle.

-

Cost-Efficiency: The Lightning Network reduces transaction fees, making Bitcoin more accessible to users who might otherwise be deterred by the high costs associated with traditional Bitcoin transactions.

-

Speed: Transactions on the Lightning Network are much faster than those on the main Bitcoin blockchain, enhancing the user experience and making Bitcoin more practical for everyday use.

Impact on the Cryptocurrency Ecosystem

-

Interoperability: The Lightning Network's design could inspire similar solutions for other blockchains, potentially leading to a more interconnected and efficient cryptocurrency ecosystem.

-

Innovation: The Lightning Network has spurred innovation in the cryptocurrency space, with numerous services and applications being developed that leverage its capabilities.

-

Adoption and Accessibility: By making Bitcoin transactions more accessible and affordable, the Lightning Network has the potential to increase Bitcoin's adoption rates, making it a more mainstream currency.

Final Thoughts

The Lightning Network represents a significant advancement in the development of blockchain technology, offering a solution to some of the most pressing issues faced by Bitcoin and the broader cryptocurrency ecosystem. Its potential to democratize access to financial services, enable new financial applications, and improve the scalability and efficiency of blockchain networks is immense.

However, the Lightning Network also faces several challenges, including adoption rates, interoperability with other blockchains, security and privacy concerns, and regulatory compliance. Addressing these challenges will be crucial for the Lightning Network to reach its full potential.

In conclusion, the Lightning Network is not just a tool for improving Bitcoin transactions; it represents a paradigm shift in how blockchain technology can be used to facilitate financial transactions. Its potential to revolutionize the financial industry and make blockchain technology more accessible to the mainstream is immense. As the Lightning Network continues to evolve and address its current challenges, it is poised to play a pivotal role in the future of cryptocurrency and blockchain technology.