Abstract. The purpose of this article is to highlight the critical role that decentralization and non-fungible tokens (NFTs) play in gaming’s transition to the metaverse. The structure seeks to breakdown the following: (Part 1) the significance of the creator economy in relation to gaming, (Part 2) the foundations of the metaverse, (Part 3) the current state of the gaming ecosystem, and (Part 4) the transition of gaming’s ecosystem into the metaverse through NFTs.

(1) The Significance of the Creator Economy in Relation to Gaming

In 2011, Facebook was desperately trying to enter mobile as its mobile apps ran slow and felt bloated. The company needed to improve its app and pivot to mobile, where the company projected future growth to be. As Facebook struggled with mobile, Zuckerberg decided to buy Instagram for $1B when it was pre-revenue with just 13 employees.

I can make the argument that user-friendly gaming engines are akin to what made Instagram a $100B+ business. Just how similar is Instagram to some gaming companies? Well Instagram enables its users to become creators and benefits from network effects with celebrities and influencers. Users upload content for other users to view, creating a network effect and high margins because unlike other media such as studios, Instagram isn’t paying for content.

Web 3.0 is producing the next wave of the creator economy, but with key differentiators. Web 3.0 permits a future where distributed users and machines are able to interact with data, value and other counterparties via peer-to-peer networks without third party intermediaries exploiting the works of creators. This decentralization qualifies gaming to follow the same playbook as Instagram, while shifting away from Web 2.0 centralized platforms. The technological advances of Web 3.0 will rapidly accelerate the expansion of gaming into the metaverse.

Strong examples of the direction that gaming is moving are Roblox and Epic Games. These companies empower their users to become creators. Roblox receives high-quality games from its users, who then upload it for other users to play. Developers can make money through Roblox with its Developer Exchange program, or DevEx, which gives developers 25% of a game’s earnings. If a Roblox user (13 years of age or older) has at least 100,000 Robux in their account and is a member of Roblox Premium, they can exchange Robux for USD at the current exchange rate set by Roblox (“Cash Out”). This drives growth through network effects and generates high margins because Roblox is only paying for gaming content that is successful. Epic is doing a similar thing with Creator Mode in Fortnite and its Unreal Engine is also so popular that developers improve it just by using it. Furthermore, Roblox and Epic have both found ways to benefit from network effects with celebrities (e.g., virtual concerts and celebrity avatars — LeBron James) and influencers (i.e., Twitch). The main difference between Roblox/Epic and Web 3.0 is that these companies are still somewhat centralized platforms, more akin to what I would call Web 2.5. Nonetheless, as gaming evolves, we are beginning to see the transition to Web 3.0 and the future of gaming offers a great example to how the numerous use cases for blockchain can evolve.

(2) Foundations of the Metaverse

The metaverse is the universe of virtual worlds that are all interconnected. In these virtual worlds, users can go to work, learn, create art, game, shop, socialize, and do dozens of other in real life (IRL) activities. The basic foundations of the metaverse include the internet (specifically 5G), open programming languages (e.g. HTML and JavaScript), open standards for media (e.g., Pixar’s USD and Nvidia’s MDL), and cloud computing (e.g., AWS and Azure). For the metaverse to compete with IRL activities, it will need to continue advancing experiences (e.g., gaming studios like Epic, Niantic, Axie Infinity), community discovery (e.g., social platforms like Discord), the creator economy (e.g., Roblox, Epic, Unity), spatial computing (e.g., gaming engines like Unity and Unreal Engine), human interfaces (e.g., smart glasses like Oculus, PCs, haptics), and decentralization (e.g., blockchain networks like Ethereum). For a more detailed market map that serves, I recommend visiting this medium article.

NFTs via blockchain are becoming a critical component of the metaverse and the gaming industry. Developers are building in-game content on decentralized blockchains (e.g., Ethereum) where gamers can purchase this content with crypto-currencies that offer security, interoperability, immutability, lending of assets, and transfer of ownership. Immutability permits digital items within the virtual world to exist even if games shut down. In the past, in-game transactions for skins, dances, weapons, etc. have been locked within the applications of games like World of Warcraft and Overwatch. This interoperability and immutability are critical for an expansive and liquid marketplace for digital assets.

There are some early virtual worlds that are exciting plays in the metaverse such as Decentraland and Sandbox. These worlds have their own crypto-currencies, virtual real estate, ecommerce, visual art galleries, collectables, games, social communities, events, and much more. The success of virtual worlds will lie in their ability to deliver network effects. Activision Blizzard CEO Rob Kotick echoed social gaming’s engagement and monetization attributes. On one of the company’s earnings calls in 2021, Kotick said that, on average, Call of Duty players who play in groups with friends spend over three times more hours in the game and invest roughly three times more on in-game content compared to other players. On some platforms such as Roblox there is already a robust digital economy where users can develop content that gamers pay for in Robux, the company’s currency. Roblox also revealed the launch of Stranger Things: Starcourt Mall featuring quests, mini-games, and cosmetic items themed around Netflix’s hit show. Investors and developers are already seeing the opportunity for shopping and showcasing items in the metaverse, which could disrupt the current state of eCommerce.

Industry analysts believe that if the metaverse creates a generational shift, it will produce trillions of dollars in value. By 2024, Bloomberg estimates the metaverse total addressable market (TAM) will expand beyond $800B. For just NFTs, there are many opportunities. We have already seen the penetration of NFTs into gaming, visual art, sports, music, writing, and real estate. More than $6B was spent during Q3 2021, which represents 3x growth from 1Q 2021. In April 2021, the average price for a NFT was ~$1,549, with Beeple selling the most expensive NFT painting for $69m. NBA Top Shots, an NFT platform run by the NBA, received a $2B valuation from DappRadar. Celebrities such as Snoop Dogg and Jay-Z have been investing deeply and even releasing their own NFT collections. Furthermore, several mainstream NFT marketplaces such as OpenSea, Rarible, Mintable, Solsea, and Solanart have seen rapid sales volume growth. As of November 9, 2021, OpenSea surpassed $10.4B in marketplace volume since launch. These marketplaces have also seen attraction from investors with Mark Cuban’s $23m funding of OpenSea and Coinfund’s lead on the $14m financing round for Rarible.

In gaming, Epic’s latest $1B funding round is powered by its bid to build the metaverse of linked games and services powered by Epic’s Unreal Engine for building VR content. Most recently, Facebook announced its focus on the metaverse by transitioning to the name “Meta”. It confirmed that it will begin publishing the financial results of its augmented and virtual reality labs (AR/VR) as separate units and that it plans to spend $10B to help develop a VR environment that it eventually plans to fill with virtual clothes, tools and other content. For a deeper dive into NFT use cases, I recommend visiting this article.

Few academics and professionals discount the future of the metaverse; however, much debate remains as to (i) how it will develop, (ii) when it will develop, and (iii) who will develop it. Will Ethereum, Solana, or another blockchain be the long-term winner for the metaverse blockchain? Will it take 5 years or 10 years for AR/VR to flourish? Lastly, which virtual world will have the most defensible network? Will it be Roblox, Epic, Minecraft, Decentraland, Sandbox, Meta, or a platform not yet created?

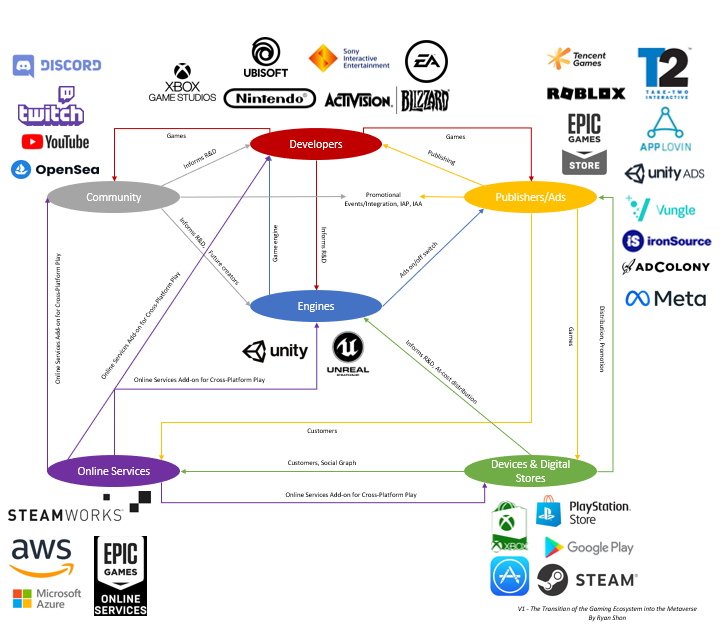

(3) The Current State of the Gaming Ecosystem

In 2020, the gaming industry generated nearly $200B in revenue. By 2030, industry analysts expect game revenues to outpace TV and all other entertainment, with over 4.5 billion gamers spending a combined $400B. The parts of the value chain that I wish to highlight are (i) gaming engines, (ii) developers, (iii) publishers, (iv) advertising, (v) distributors, (vi) platforms, (vii) online services, and (viii) community. The visual below should help demonstrate how these pieces of the ecosystem interact.

(i) Gaming Engines: The creation tools offered by gaming engines are a critical component for developers. Game engines manage everything from the processing of decision logic, rules, and physics (e.g., the X button was pressed, so a bullet was fired, which traveled from point A to point B, hit player 2, etc.), to real-time visuals, sound production, artificial intelligence, memory and network management, and so forth. The gaming engine market is projected to grow at 13% CAGR over the next 5 years from $1.8B in 2019 to $3.7B by 2024. The major publishers, such as Activision Blizzard or Take-Two, typically use proprietary engines. The independent development market is dominated by Unity 3D and Unreal Engine, which have 48% and 13% market share, respectively. More than 50% of all new mobile games are created on Unity 3D, suggesting that Unreal Engine has higher PC/console market share than its total share. Some of the world’s most popular games such as Fortnite (Unreal Engine) and Pokémon Go (Unity 3D) are powered by these engines. At a high level, Unreal Engine charges 5% of game revenue, while Unity Gaming Engine charges $35 annually for the personal plan and $1,500 annually for the pro subscription. Roblox has deployed a unique model by allowing players to create games using its proprietary engine, Roblox Studio (coded by Lua programming language), which can then be played by other users.

(ii) Developers: Game development includes designers and artists, as well as their leadership, with support of middleware and other development tools. There are three types of developers — first-party (1P), second-party (2P), and third-party (3P). 1P developers are part of a company which manufactures a video game console and develops exclusively for it. Some 1P developers include Nintendo, SIE Worldwide Studios for Sony, and Xbox Game Studios for Microsoft. 2P developers are game studios who take development contracts from platform holders and develop games exclusive to that platform, i.e. a non-owned developer making games for a first-party company. A 2P developer example is Hal Laboratory for Nintendo. 3P developers may also publish games, or work for a video game publisher to develop a title. Some 3P developers include Activision-Blizzard, Electronic Arts, and Ubisoft.

(iii) Publishers: Publishers finance the production, marketing, and distribution of a game and often provide their proprietary engine, too. In exchange, they’ve typically received the vast majority of the profits from a hit game, and in most cases, the underlying IP copyright as well. The video games software publishing market size in the U.S. was ~$28.4B in 2020. Major publishers include Sony Interactive Entertainment, Tencent Games, Nintendo, Microsoft, Activision Blizzard, Electronic Arts, and Take-Two Interactive. Over the past decade, the four biggest new IPs (and not coincidentally, new genres) came from others outside the large cap publishers. All are multi-billion-dollar franchises: League of Legends (Riot Games), Minecraft (Mojang), Fortnite (Epic Games), Roblox, and this doesn’t include the many billion-dollar franchises created in mobile. Furthermore, mobile advertising is becoming a separate part of the value chain with the onset of Apple’s new App Tracking Transparency (ATT).

(iv) Advertising: The mobile gaming ads value chain is shaped by advertisers, ad networks, demand side platforms (DSP), mediation / supply side platforms (SSP), viewers, attribution, and app stores. The mobile game advertising market segment is valued at $45.4B, or 37% of total mobile games revenue in 2020. Apple’s IOS update in early 2021 gives data usage control to players by requiring that all apps ask users for their permission to share their data with 3P advertising services. Today, mobile games use 3P ad networks that aggregate 3P data in order to find players for their games. I expect most players to opt-out of this type of data sharing, which means that Apple will be placing an enormous premium on the value of 1P data (which will not require player opt-in). In their Q4 2020 earnings call, Zynga said they are building a new ad network and a common ID system across all of their games. AppLovin started as a mobile advertising service, and has since shifted their focus and acquired 12 studios (providing ~30m 1P DAUs) to start building their 1P portfolio.

- Advertiser (Demand): Spend money on ad revenue. Examples include McDonald’ and Starbucks.

- Ad Network: Take ad revenue cut. Examples include Meta (Facebook), Applovin, AdColony, ironSource, Unity Ads, and Vungle. An ad network is a provider of ad space for advertisers. In-App Advertising (IAA) is a function of impression and pricing growth. Ad networks work with mobile app and game publishers, allowing them to post openings for ads and allow advertisers to bid on ad space inventory to promote their games and acquire new users. Game publishers use in-game and external signals to personalize offers to mobile players, in much the same way that e-commerce personalizes offers on web pages.

- Demand Side Platform (DSP): Take ad revenue cut. Examples include Mobvista and DoubleClick Bid Manager. DSPs aggregate different ad campaigns from multiple ad networks.

- Mediation / Supply Side Platform (SSP): Usually free for developers. Examples include Fyber, Supersonic by IronSource, and MoPub. Most have been acquired by ad networks and force a percentage of views to their ad network of choice for which they might be reimbursed. They switch seamlessly between ad networks in order to maximize fill rate (number of videos shown per request made for a video) and to show the highest paying network depending on location or other data collected.

- Viewers: Ultimately what drives revenue within the value chain.

- Attribution: Advertiser pay a cost per install tracked. Examples include Tune, Adjust, and AppsFlyer. These companies are responsible for tracking the install and reporting back to the networks who was responsible for driving this user to install the game. They act as a 3P intermediary on the whole video ad value chain. They are also one of the only parties in the value chain that are able to charge directly for their service. Usually, they make money by charging advertisers a cost per install (CPI) tracked and so add a layer of cost to any ad campaign.

- App Store: Installation of the gaming app. Examples include Apple and Google.

(v) Distributors: Distribution occurs in retail or digital channels. Retail distribution typically includes manufacturing and duplication of game media and packaging for retail games. Today, ~83% of total video games sales are digital (excl mobile revenues). Digital distributors include Steam, GOG.com, and Microsoft for the PC store fronts; Nintendo Switch, PlayStation 4 (PlayStation Store), and Xbox One (Xbox Games Store) for consoles; and App Store and Google Play for mobile apps. These 1P stores take 30% of all one-off transactions and 30% of subscriptions during the first year, after which the rate drops to 15%. In exchange for the revenue share, console makers and mobile platforms secure accounts, process transactions (and returns), handle entitlements (e.g. access rights and paywalls), and deal with the mess of customer service. They also market their platforms (“there’s an app for that”) and manage the operating systems that run games. Most importantly, these platform owners get their hardware into consumer hands, which thereby gives game makers a customer base in the first place. In contrast, Epic Games launched the Epic Games Store (EGS) to compete, taking just a 12% cut with the 5% development fee built-in and the ability to create cross-platform play. Epic’s massive undercut and workaround from Apple’s App Store has created a highly publicized legal battle between the companies. EGS also provides Epic with added insight into which games are being played, as well as the future pipeline of games. This helps with the development and optimization of Unreal Engine.

The PC ecosystem evolved differently than both consoles and mobile. Unlike PlayStation or Apple, Microsoft owned only the OS, not the hardware. To address the downloading issues of the slow internet days, Valve launched a digital games store called Steam, which offered ease of use with a single account and then evolved its online multiplayer experience and social graph. Steam benefited through the collection of customer data, sticky customers, and a 30% transaction fee, which EGS also undercut.

(vi) Platforms: Platforms include Mobile, PC, Consoles (e.g. Xbox, Playstation, Nintendo), and Cloud (e.g. GeForce, Microsoft Xcloud, Playstation Now, Google Stadia, Amazon Luna). As described above, they play a role in distribution by placing limitations for content, requiring developers or publishers to pay license fees. Global console and PC gaming generated $54B and $36.5B in 2020, respectively. Both markets are expected to continue to decline in 2021+ due to mobile gaming. Mobile games are the primary engine of growth with a projected 12.6% CAGR world-wide from 2021 to 2026. An estimated 2.6 billion people globally played mobile games generating over $122.6B in 2020, representing 60% of games revenue. 96% of mobile games are Free-to-Play/Freemium (F2P), with 63% and 37% from IAP and IAA, respectively. Cloud gaming is projected to grow at a 48.2% CAGR world-wide from 2021 to 2027, reaching $7.2B.

(vii) Online Services: A current industry trend is to support cross-platform play through online services. Over the decade, several large-scale businesses have been built and invested in to specifically sell Steamworks-like services outside Steam and to support full cross-play and portability. AWS and Microsoft’s Azure, which built large gaming hosting businesses, also began developing their own gaming services solutions and buying existing market leaders such as Gamespark and PlayFab. Unity also built up a large suite of services including entitlements, communications, and analytics. Epic now offers its entire hyper-scale suite, Epic Online Services (EOS) for free. An additional benefit to online services is that it enriches the dataset further.

(viii) Community: The community includes creators, players, video streaming viewers, broadcasters (e.g., Twitch, YouTube), artists (e.g., Fortnite concerts with Travis Scott, J Balvin, etc.), social platforms (e.g., Discord), and 3P marketplaces (e.g., OpenSea). In game viewing, Twitch has 90% MSS in terms of hours streamed. The IAP market excluding China is expected to grow from $42B in 2020 to ~$100B long-term. Downloadable Content (DLC) is additional paid content downloads after initial purchase of a full game. Microtransactions (MTX) are in-game purchases of economy-based downloadable content, such as in-game currency, vanity items, weapons, songs, vehicles and class unlocks. NFTs are transforming DLC and MTX by maintaining interoperability and immutability of content, which enables social transactions in the metaverse via 3P marketplaces.

(4) The Transition of Gaming into the Metaverse Through NFTs

It’s no doubt that NFTs are becoming a critical component of the gaming ecosystem’s transition to the metaverse. From here, one can imagine a transition from the current state of gaming, but first I will discuss the history, the current metaverse state, and the potential future of NFT gaming.

How did NFT gaming start?

The history of NFT gaming is synonymous with CryptoKitties, which debuted on the Ethereum blockchain in 2017. The gamers bred cartoon cats, and the traits of the cats would help determine their future value in the marketplace. By December 2017, the BBC reported that $4.5m had been spent on CryptoKitties and resulted in enough transaction traffic to slow the Ethereum blockchain. This led to the need for Layer 2 solutions that would bring down transactional ‘gas’ fees and speed up the network.

What are the hottest trends in NFT gaming?

Rather than creating FTP games, where the business model is dependent on monetizing the 2% of players that spend money in-game, NFT gaming offers an attractive way for developers to create gaming communities around play-to-earn. The best way to understand this model is to look at the success of Axie Infinity.

Axie has two million daily active users (DAUs) and has pioneered the way for play-to-earn and collect NFTs in gaming. The premise for the game is to breed Axie monsters and then battle them like in Pokémon Go. The game’s ERC-20-based Small Love Potion (SLP) tokens function as currency for breeding, but also trade outside the game on global exchanges. The game is also available on mobile devices and benefits from streaming on Twitch. Axie has done $3.1B in NFT marketplace volume and stands with a market cap of $9.3B as of November 12, 2021.

Furthermore, the success of Axie has helped create new use cases for asset-backed loans in gaming. The best example is Yield Guild Games (YGG) which loans NFTs to new players who cannot afford to buy their own under a revenue-sharing agreement. Under the YGG Sponsor-A-Scholar program, donors help onboard newcomers to play-to-earn games. This program has become well-known with providing new sources of income in developing economies such as the Philippines.

What are the next big NFT gaming projects?

I am looking forward to a multiplayer action RPG called Big Time, where players will find and purchase NFTs. The studio received $21m in funding and the game’s team is led by the Decentraland co-founder, Ari Meilich. The game is expected to launch in 2022 on the Ethereum blockchain and will offer a patented off-chain custody system for its NFTs, which will allow the export and import of NFTs from and to the game. Remember when I mentioned interoperability earlier?

Another game that I am looking forward to is Phantom Galaxies, which has much more of a AAA look than many previous blockchain games. The game is being built by Blowfish Studios, a veteran studio that Animoca Brands bought for ~$9m.

What else can we expect for the future of NFT gaming?

NFTs and blockchain are making the play-to-earn gaming model a global phenomenon. The incumbent gaming companies such as Square Enix, Sega, Ubisoft, and Electronic Arts have already been looking to leverage the potential of NFTs in gaming. Virtual metaverse worlds such as Decentraland and Sandbox will allow users to create 3D games. More creators on Roblox will move ecosystems to the blockchain. For example, South Korean blockchain company PlayDapp has already moved PlayDapp Town to the Polygon blockchain. Sidechains (e.g., Polygon), layer 2 solutions (e.g., Optimistic and zK-rollups), and Ethereum’s transition to Eth2 will help decongest the blockchain and bring down the cost of transactions, lowering the barriers to entry for gamers buying NFTs used to play in game. Future advances and adoption of AR/VR technology will lead to the development of popular NFT-based games on these devices. As NFT-based games gain more adoption, it is inevitable that the metaverse ecosystem develops into a much larger marketplace than it is today.