Cygnus is a decentralized stablecoin lending and leveraged yield farming protocol. It is the first lending platform which attempts to bridge the gap between the low stablecoin yields typically found in Decentralized Finance with the high farming yields (42,069% APY anyone?) typically found with volatile assets.

Cygnus is a constellation of smart contracts designed to solve some of the biggest problems in DeFi today. Looking at the DeFi ecosystem in 2022, we ask ourselves:

-

Are Liquidity Providers (LPs) actually profitable?

-

Should I just lend/LP stablecoins and earn 2–5% APY instead? Better than my bank and I am at least guaranteed a return… right?

-

Should I just lend? How profitable is this?

These problems are at the center of discussion today in DeFi. With this article we expand on these 3 questions and show what Cygnus exactly is and how it solves these problems

LPs Profitability

Liquidity in Decentralized Finance (DeFi) is accessed primarily in the form of Automated Market Makers (AMMs) such as Uniswap, Curve or Sushiswap. These Decentralized Exchanges (DEX) require Liquidity Providers (LPs) to deposit any Token A and any Token B in pairs in a liquidity pool. By doing so, LPs are rewarded with trading fees accrued in the pool plus any additional reward the platform gives to LPs. Usually these rewards consist of native platform tokens (like CRV or SUSHI). So if you want to earn that 42,069% APY you must first get an equal value amount of both tokens and pool them together in your DEX of choice.

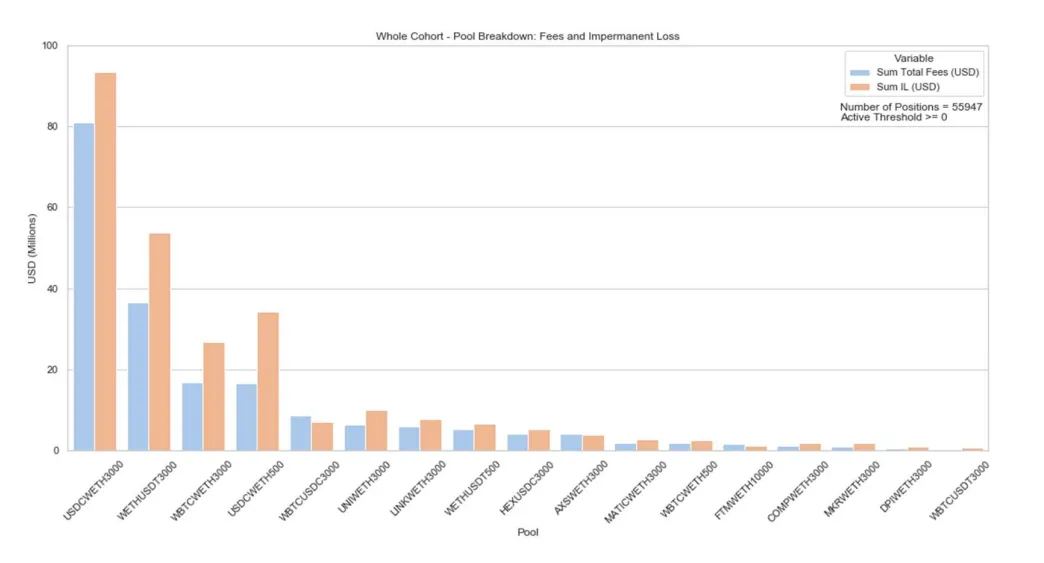

The profitability of contributing to Liquidity Pools instead of just holding the assets remains somewhat unclear. A most recent study done by Bancor suggests that 49.5% of LPs on Uniswap have yielded negative returns due to “impermanent loss”. Impermanent loss refers to the value a user “loses” by being an LP due to the changing of the price ratio of Token A relative to Token B or vice-versa. The value itself implies the opportunity cost or the loss of profit for being an LP, and does not imply the loss of capital. However, in the aforementioned study, almost half the pools analyzed had negative returns…

Taking for example the left-most pool above, USDc — wETH, we see that the pool itself earned over $80m since its inception, however the aggregated impermanent loss in the pool is over $90m. As we define IL as simply the loss of being an LP versus just holding, it appears that as a whole, LPs in that pool would have been better off just holding their wETH and USDc.

This is why in the past, LPs have been described as hedgers against market volatility:

-

If the market remains stable, LPs can profit from trading fees and platform rewards.

-

If the market is volatile, LPs can incur losses due to impermanent loss.

So before you pool, you must ask yourself things such as how are the present market conditions, how volatile are these 2 assets or even worse… wen rug?

Ok… I will just LP stablecoins or just lend my assets.

That is also an option.

LPs who choose a more risk-averse strategy can opt to become lenders and lend their assets individually on popular platforms such as Aave and Compound, or just provide liquidity in stable pairs such as a USDc/DAI in safer dexes.

While lending individual assets or being an LP of stables eliminates any chance of impermanent loss, the yields earned through these methods are much lower than the potential yields of being an LP for volatile assets. Even more so, as DeFi starts reaching the mainstream, the Total Value Locked of these lending platforms grows and the returns start diminishing even more across the board.

The lending market in DeFi is primarily composed of over-collateralized loans. To ensure lenders always receive their investments back, borrowers must deposit and lock a collateral value in the lending platform which exceeds the maximum borrow value.

Most of these platforms rely on a health factor or collateral ratio and a decentralized network of “Liquidators” who can choose to repay all or part of the loan if it goes underwater and in the process earns a part of the user’s collateral. For example, a user deposits USD and borrows as much as he can of ETH. If the price of ETH rises in price significantly, the user’s health factor starts becoming dangerous as his collateral (USD) to loan (ETH) ratio starts worsening. This means their loan is now up for liquidation and anyone in the network can liquidate them for a quick profit or they must quickly put more collateral to not get liquidated. This over-collateralized lending mechanism depicts a clear contrast between the lending markets in traditional finance vs decentralized finance.

Most of the lending platforms in DeFi differ in some small factors, but the system works in a fairly similar manner. Despite its success, there is a serious problem with the over-collateralization model that affects the industry as a whole. Looking at the 3 biggest DeFi lending protocols for example, we can see their liquidation penalty and most importantly their minimum collateralization ratio:

The minimum collateralization ratio is the ratio between collateral and loan. For example, a minimum collateralization ratio of 150% means that the user must deposit and lock a collateral which is 150% the value of the loan (1/0.667). In other words, the user can borrow at most ~66% of their collateral’s worth. The remaining 34% difference between collateral and borrowed amount then remains inactive and inefficient, earning, at best, minimum interest by being lent out again or, at worst, declining in value.

The most important thing to note here is that for the user to get back his deposited collateral, they must always repay the loan by returning the same **asset and **not just the nominal value of it (e.g. return the ETH, not the price of ETH). This is also something which is hard to grasp for many users in DeFi as most are used to dealing only with fiat currency loans and not volatile asset loans. As such, it is important to note that borrowing any volatile asset in an over-collateralized context is the same as shorting the asset itself.

-

If the user thinks the price of the volatile asset will rise, the best strategy then is to borrow a stablecoin to purchase that asset immediately, sell the asset at a higher price and repay the stablecoin debt and keep profit.

-

If the user thinks the price of a volatile asset will decline, the best strategy is then to borrow the volatile asset, sell the asset immediately for a stablecoin value, buy it back at a lower price and repay the volatile asset debt.

Under a perfect-competition and complete information symmetry model, occasions where borrowing an asset to deposit it in another place which earns higher than the borrow fee would not exist, as if this was the case the supply of the asset for lending would simply be 0. These cases have appeared in DeFi, but are not the norm as DeFi becomes even more established.

Conclusion

Given this context, we go back to the 3 questions we outlined in the beginning and summarize the context of DeFi in 2022:

-

Liquidity Providers — High APY but generally unprofitable.

-

Stablecoins — Low APY but generally profitable.

-

Lending—Over-collateralized loans which are highly capital inefficient. More borrowing leads to increasing locked collateral which leads to more locked liquidity which is not being used or earning very low returns at best.

And these are the problems Cygnus has been designed to solve. This is only part 1 of a 3 part article. This has outlined the problems we face and what Cygnus aims to solve. The next part will focus on how Cygnus works and all the technicalities behind it. We will be publishing Part 2 soon, so stay tuned!

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Cygnus Community

Come and say hi to our community! Follow us on Twitter for more announcements. We will soon include Telegram and Discord once we launch.

🐦 Twitter: twitter.com/CygnusDAO

👾 Discord: https://discord.gg/CygnusDAO

✍ Blog: medium.com/@CygnusDAO

🌐 Website: cygnusdao.finance