Gondi’s mission is to build the most capital-efficient, transparent and open credit market for NFTs — a world where the liquidity of digital assets is universally accessible, anywhere, anytime, and for anyone.

In this article, we’ll explore the unique suite of features that Gondi offers to a lender in the NFT credit market, and go through a step-by-step guide to lending and refinancing.

Check out the guide for borrowers here.

Advantages for Lenders on Gondi

Gondi offers a lot of advantages compared to other platforms:

-

Lowest gas fees in the market.

-

More avenues for capital deployment — lenders can originate a new loan, instantly refinance an existing loan, or participate in renegotiations. Gondi’s ‘Instant Refinance’ feature allows any user to instantly become the new lender of record for an outstanding loan, given they provide objectively better loan terms to the borrower.

-

Lenders have the ability to make collection-level loan offers for Art Blocks collections like Fidenzas, Chromie Squiggles and Ringers.

-

Lenders can make as many active offers as they want to the same collection or listed item.

-

Users can manage their budget by limiting the number of individual listings that can accept a collection offer.

-

Maximize your capital utilization. Users can partially refinance a large loan if they face liquidity limitations.

How can a user instantly refinance a loan?

Two primary conditions must be satisfied to execute an Instant Refinance:

There must be a reduction in the borrower's daily interest.

The due date of the loan, as per the existing terms, must either be maintained or extended.

APR and Principal must show minimal improvements of 1%. If the loan's due date is extended, there must be a minimum improvement of 10% of the loan's remaining duration.

In the case of partial refinancing, each tranche must always be at least 5% of the loan principal. To partially refinance a loan, the lender must decrease the APR by at least 1%.

Step-by-Step Guide to Lending, Refinancing and Renegotiating

1/ Visit gondi.xyz and click ‘Launch App’ in the top right corner.

2/ Login via the ‘Connect Wallet’ button. Make sure the network is set to the Ethereum Mainnet. On your wallet, head over to Settings → Networks → Ethereum Mainnet.

3/ As a lender, the ‘Explore’ tab will be the main hub of your activities. You can:

-

Make loan offers to listings.

-

Make collection offers.

-

Explore options to instantly refinance existing loans.

Offer Loans on Individual Listings

4/ You can make loan offers on individual listings in the ‘Listings’ tab under ‘Explore’.

-

Borrowers can specify the currency they wish to borrow in (USDC or wETH), and their desired loan duration. Make sure you adhere to those requirements.

-

Reach out to the borrower with your terms through the ‘Make Offer’ tab on the right.

5/ While making the offer, you can set an optional origination fee, which you will receive from the borrower at the beginning of the loan. You can also set a deadline after which your offer expires.

6/ Click ‘Make Offer’ and approve the transaction on your wallet — an easy, single-step process. Your offer is now active! Enter your email, and we will keep you abreast of all updates.

7/ To keep track of all your pending offers, head over to the ‘My Offers’ section.

8/ Click on any of your active offers. You can make a simultaneous second offer to the same listing, and a third, a fourth, and more. You are free to make as many active offers as you want. This gives you the flexibility to try out both high LTV/high APR offers and low LTV/low APR offers.

9/ If the lender accepts one of your offers, you will either:

- Get alerted via email (if you entered your email address).

OR

- Find a notification in the top right corner of the application.

You can also find details of your active loan from the ‘Lent’ tab on top.

Congratulations, you are now officially a lender on Gondi!

Collection-level offers

10/ On the platform, lenders can make offers on entire collections. This option is available in the ‘Collections’ tab under the ‘Explore’ section. With Gondi, users can make collection offers at the Art Blocks level — Squiggles, Fidenzas, Ringers.

11/ You can manage your budget by limiting the number of individual listings that can accept your collection offer.

12/ You can also make multiple active offers, simultaneously, on the same collection.

13/ After your offer is accepted by the borrower, one of three eventualities will happen:

-

The loan is automatically refinanced by another lender, who provides better terms to the borrower.

-

You renegotiate the existing terms with the borrower.

-

The borrower pays back the loan before maturity, or they default.

14/ We’ll cover all three options, starting with instant refinancing.

Instant Refinance a Loan

15/ Head over to the ‘Loans’ tab under the ‘Explore’ section to find an existing loan that you can refinance. You can fully refinance it, or you can partially refinance (up to 10 tranches).

16/ You can refinance the above loan by providing a minimum improvement of 1% in both the principal and duration of the loan. Keep an eye on the ‘Refinance Terms’ tab on the right to calibrate your terms.

17/ Alternatively, you can refinance the loan by providing a 10% improvement in loan duration and a 1% improvement in APR.

18/ Lenders can also partially refinance the loan. Choose the tranche (at least 5% of the overall principal) and offer a minimum 1% improvement in APR.

19/ Approve the transaction with your wallet, and give yourself a round of applause! You just completed your first refinancing.

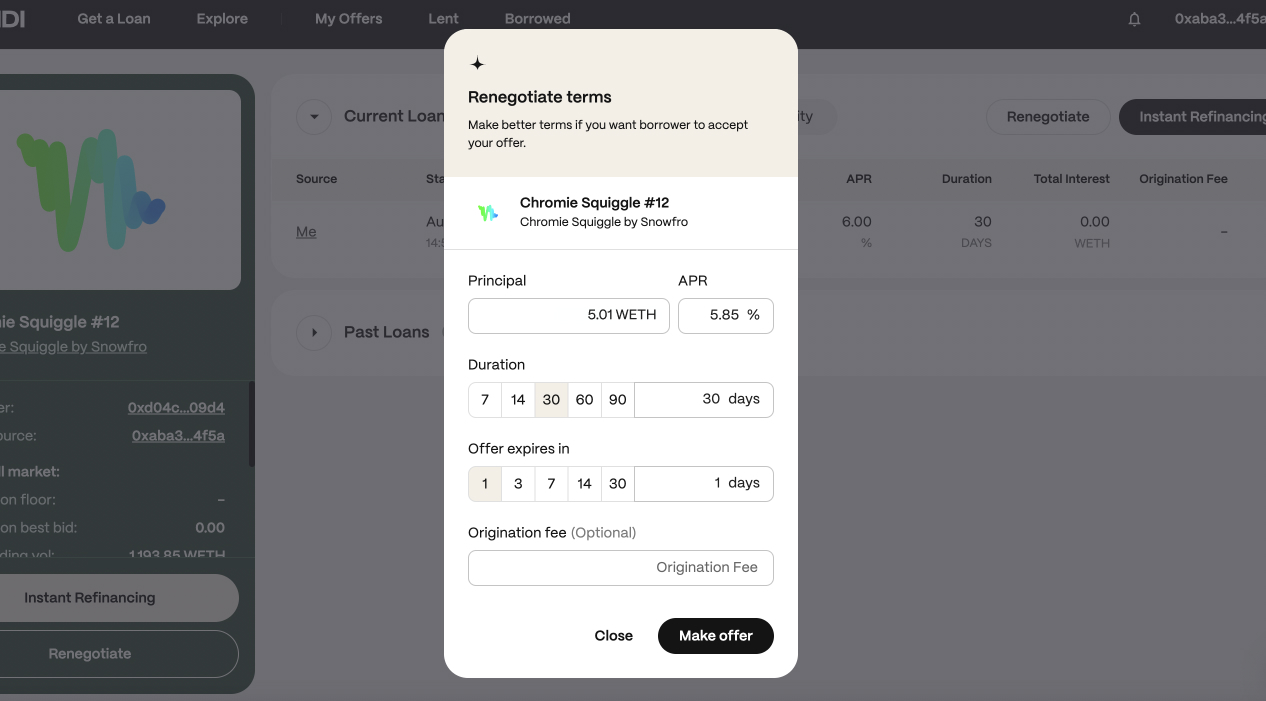

Renegotiate Existing Terms

20/ You are a lender with an existing loan agreement with a borrower. On Gondi, you can renegotiate the terms of that loan.

21/ Offer the borrower a fresh set of terms, and negotiate directly with the counterparty. What is the difference between renegotiation and refinancing? In the case of refinancing, the new terms offered are all objectively better for the borrower — this triggers instantly, without the borrower needing to accept it. In renegotiation, one of those loan terms might be worse, and the borrower needs to accept this new condition.

Loans Repaid/Defaulted

If a loan is repaid ahead of maturity, you, as the lender, will receive the principal plus the interest accrued over the time the loan was outstanding.

Loans that are not repaid before the due date are considered defaulted loans. In the case of a single-tranche loan, you, as the lender, will take possession of the collateral.

Defaulted loans with two or more tranches will undergo an auction process. The auction is a 72-hour English auction where participants openly bid against one another, with each bid required to be 5% higher than the previous one. The highest bidder wins the collateral at the end of the auction.

About Gondi

Gondi is a decentralized non-custodial NFT lending protocol engineered to create the most efficient NFT credit market.

User experience will be paramount for the growth of the NFT credit market. This is Gondi’s top focus — providing a frictionless, risk-free experience, where all complexity is abstracted out. Gondi offers the best gas fees in the market, the most transparent terms, and automated features that are customized to the benefit of each market participant.

Borrowing is cheaper for asset owners, while lenders enjoy higher capital utilization rates and improved returns. There are no automatic liquidations, and the platform enables continuous underwriting, refinancing, and renegotiation of loans.

READ MORE: All you need to know about Gondi