Part 1. The QR Code Payment Revolution: A Data-Driven Look at the Asian Market Poised for Explosive Growth

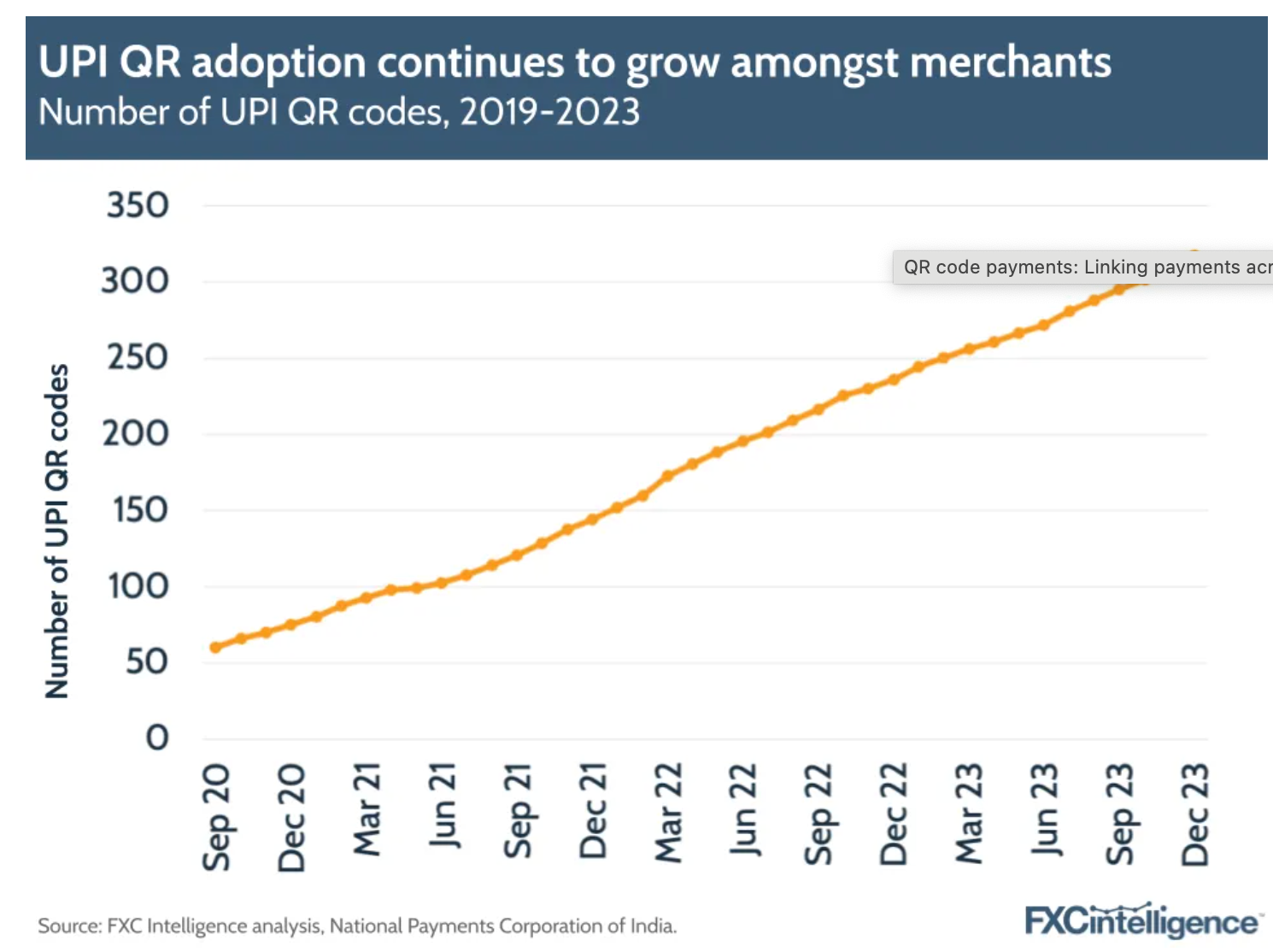

While originally designed for the automotive sector in early 1990s Japan, QR codes have since gained widespread adoption across diverse industries worldwide. Fueled by the ubiquity of smartphones, the demand for contactless transactions, and a growing need for financial inclusion, the QR code payment market is experiencing remarkable growth, with Asia leading the charge in adoption and innovation. The year 2011 marked a pivotal moment in the global payments landscape. It was then that Alipay, a Chinese fintech giant, pioneered the use of QR codes for digital transactions. This innovation proved to be a game-changer, setting in motion a revolution that would transform how consumers pay and businesses receive payments in numerous markets worldwide. Nowhere is this transformation more evident than in China itself. A mobile payments powerhouse, China has wholeheartedly embraced QR code technology. The remarkable reach of QR codes is further underscored by the fact that by the end of 2022, over 95% of mobile phone users in China relied on them as their primary payment method, with over half utilizing them even for public transportation fares. This widespread adoption is a testament to the convenience, accessibility, and deep integration of QR code technology within Chinese society. India, too, has witnessed an unprecedented surge in QR code payment adoption, fueled by its innovative Unified Payments Interface (UPI) system. Built on a robust QR code infrastructure, UPI has revolutionized digital payments in the country, recording over 10 billion transactions in a single month (August 2023), showcasing its widespread acceptance and ease of use. According to NPCI statistics, the number of UPI QR codes that are currently in use has grown by 41% in 2023 compared to 2022, and 145% since 2021.

The data paints a compelling picture of this revolution. The global QR code payment market, valued at USD 10.4 billion in 2023, is projected to reach an impressive USD 45 billion by 2032, demonstrating a robust compound annual growth rate (CAGR) of 15% over the forecast period, according to Global Market Insights. This remarkable trajectory is driven by a confluence of factors that have converged to create the perfect storm for QR code payment adoption such as the increase in the number of mobile users, the COVID-19 catalyst, and a huge demand for financial inclusion.

Southeast Asia: The Next Frontier for QR Code Payment Innovation

Around 2016-2017, Southeast Asia found itself at a critical juncture in its digital evolution. While eager to embrace the digital economy, the region faced persistent challenges that hindered progress. Large segments of the population remained unbanked or underbanked, traditional card penetration was low, and cash reigned supreme, even for online transactions. Legacy banking infrastructure struggled to keep pace with the demands of a rapidly digitizing society. As QR code payments gained traction in markets like China—which shared a similar context of high mobile penetration and a need for accessible financial solutions—Southeast Asia saw an opportunity. The region recognized the potential of this technology to address its unique challenges and unlock the full potential of its digital economy. This realization sparked a surge in QR code payment adoption across Southeast Asia, fueled by several key factors:

1. A Mobile Revolution Unleashes the Power of QR Codes

The surge in smartphone adoption across Southeast Asia has been nothing short of transformative, creating a fertile ground for the rise of QR code payments. In just a few short years, the number of smartphone users in the region skyrocketed from 498 million in 2017 to over 675 million in 2022, representing a remarkable 82% of the population, according to a Boston Consulting Group study. This mobile revolution has placed the power of digital payments directly into the hands of millions of Southeast Asians. As access to affordable smartphones has become more widespread, so too has the adoption of convenient and user-friendly payment methods like QR codes. This trend is particularly pronounced among younger generations, who are accustomed to the seamless nature of mobile-first experiences and are driving the demand for digital payment options. The rapid proliferation of smartphones has not only created a massive potential market for QR code payments but has also laid the groundwork for a fundamental shift in payment preferences across the region.

2. The Pandemic: A Catalyst for QR Code Payment Adoption

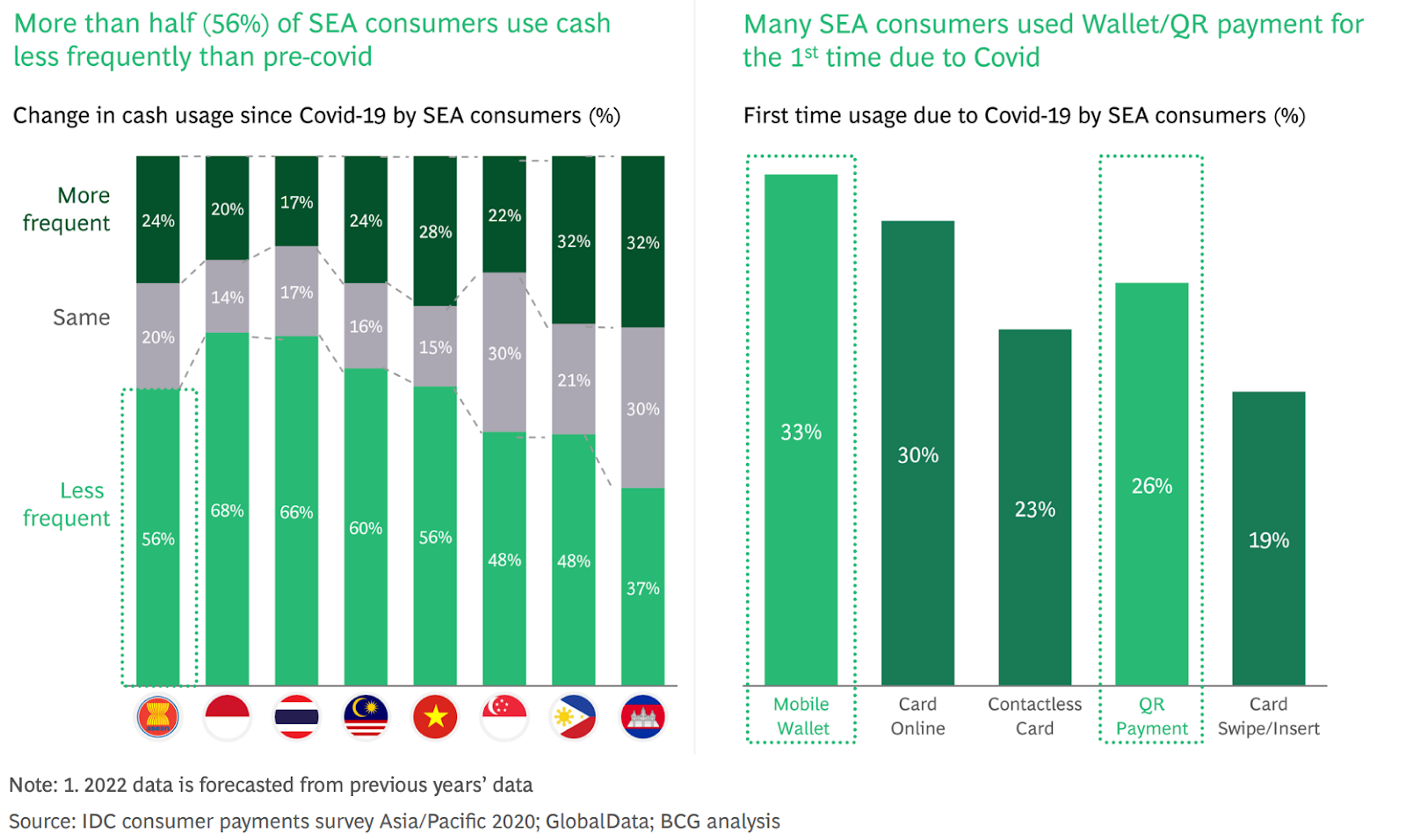

The COVID-19 pandemic, while disruptive on a global scale, became an unexpected catalyst for the widespread adoption of digital payments, including QR codes, in Southeast Asia. More than half (56%) of Southeast Asian consumers reported using cash less frequently after the pandemic, signaling a significant shift in payment preferences. Indonesia and Vietnam, two of the region's most populous nations, accounted for nearly two-thirds of these consumers, highlighting the widespread nature of this change. This decline in cash reliance coincided with a rapid uptake in digital payment solutions. One-third (33%) of consumers embraced e-wallets, while over a quarter (26%) used QR code payments for the first time during the pandemic, demonstrating a growing comfort and familiarity with these technologies.

After a decade of steady growth, QR code payments have become one of the most popular electronic payment methods in Southeast Asia. With over 80 e-wallets connecting over 205 million users and 25 million merchants across the region, the infrastructure for a digital payments-driven economy is firmly in place. Indonesia, in particular, stands out as a regional leader, boasting over 90 million users and 15 million merchants engaged in e-wallet and QR code transactions.

3. Cost-effectiveness of QR Code Payment

Unlike traditional point-of-sale (POS) systems, which often come with a hefty price tag—including installation fees, merchant discount rate (MDR) charges, and ongoing maintenance costs—QR codes offer a refreshingly low-cost alternative. Merchants can simply print and display a QR code, eliminating the need for expensive hardware, complex setup procedures, and ongoing fees. This affordability has been a game-changer for small businesses and street vendors across Southeast Asia, allowing them to accept digital payments without incurring significant financial burdens. QR code-based e-wallets are also remarkably accessible for consumers. Opening and operating an account is typically a quick and straightforward process. This stands in stark contrast to the often cumbersome and exclusionary process of opening a traditional bank account or applying for a credit card, which can be a significant barrier for many in the region.

4. Southeast Asia's Digital Economy Boom

Southeast Asia's economy is booming, and its digital sector is leading the charge. Projected to grow from US$3.8 trillion to US$20 trillion by 2047, ASEAN's economic expansion is fueling a parallel surge in digital payments. The region's digital economy itself is experiencing explosive growth, with its gross merchandise value (GMV) growing from US$102 billion in 2019 to US$194 billion in 2022, driven largely by e-commerce. This rapid digitization, coupled with the ASEAN Digital Economy Framework Agreement (DEFA), has the potential to propel the digital economy to a staggering US$2 trillion by 2030. This thriving digital economy is intrinsically linked to the rise of digital payments, including QR codes. As more consumers and businesses engage in online transactions, the demand for secure, convenient, and accessible payment methods is skyrocketing. QR code payments, with their ease of use and low cost, are perfectly positioned to capitalize on this growth, becoming an integral part of Southeast Asia's digital transformation.

5. Fast Growing in Fitech E-wallets

Southeast Asia, with its youthful demographics, tech-savvy population, and rapidly expanding economies, has become a magnet for fintech innovation, particularly in the e-wallet space. These e-wallets, largely powered by QR code technology, have found fertile ground for growth due to a confluence of factors:

-

Low Barrier to Entry: QR codes are easy to implement and require minimal technical infrastructure compared to alternatives like NFC, making them ideal for rapid deployment across diverse markets.

-

Favorable Regulatory Environment: Southeast Asian policymakers, recognizing the potential of fintech to drive financial inclusion and economic growth, have adopted a proactive approach, making it relatively easy for e-wallet providers to obtain operating licenses.

-

Open Competition: Regulatory reforms promoting a "same activity, same risk, same regulation" principle have leveled the playing field, allowing non-financial institutions to participate in the e-wallet space, fostering innovation and competition.

-

This combination of factors has led to a surge in fintech e-wallet providers leveraging QR code technology, creating a vibrant and dynamic ecosystem that is reshaping Southeast Asia's payments landscape.

QR Code Payment Market Highlights in SEA’s Countries

QR code payments are experiencing explosive growth across Southeast Asia, transforming how consumers and businesses transact. Here's a glimpse at the remarkable adoption rates in several key markets:

Singapore:

-

In 2018, the Monetary Authority of Singapore (MAS) introduced SGQR, a unified standard combining 27 different payment QR codes into one, simplifying adoption for consumers and businesses.

-

In 2023, the value of mobile payment transactions using QR codes reached an impressive $83.5 billion USD, representing over 70% of all mobile payments in the country, according to Statista. This upward trajectory is expected to continue, with QR codes projected to capture over 80% of the mobile payments market share by 2025

Cambodia:

-

QR payments surged 29% in 2023, reaching 601 million transactions, a tenfold increase in just three years.

-

This growth is driven by the national unified QR code, KHQR, which is accepted at 3.3 million merchant locations nationwide, including small vendors in major cities like Phnom Penh and Siem Reap.

Malaysia:

-

DuitNow QR, launched in 2019, has rapidly become a cornerstone of the digital payments ecosystem.

-

In the first half of 2024, there were 1.5 billion DuitNow QR transactions totaling RM1.37 billion (USD 320 million), representing year-on-year increases of 64% and 37%, respectively.

Indonesia:

-

QRIS, Indonesia's unified QR code system, saw a remarkable 226% year-on-year growth in transactions during Q4 2023.

-

The system boasts 50 million users and 32 million merchants.

Vietnam:

QR code transactions in the first half of 2024 surged 104.23% in volume and 99.57% in value compared to the same period in 2023.

Vietnam's robust digital financial ecosystem, with its 24/7 bank transfer systems and numerous e-wallets, has facilitated widespread QR code payment adoption across various platforms.

Philippines:

-

Digital payment transactions reached 2.6 billion in 2023, a 28.1% increase from the previous year.

-

QR Ph, the unified QR code standard, saw an impressive 17.2-fold increase in transactions, reaching 73.8 million in 2023.

These figures demonstrate the rapid and widespread embrace of QR code payments across Southeast Asia, transforming the region's financial landscape and paving the way for a more inclusive and digitally-driven economy.

Part 2. Fizen: Bridging the Gap Between Web2 and Web3 Payments

While QR codes have undeniably revolutionized payments in Southeast Asia, their reliance on traditional financial systems presents inherent limitations. These limitations, rooted in centralization, high costs, and inefficiencies, hinder the full potential of QR code payments, especially in a region striving for greater financial inclusion and digital innovation.

The Traditional Financial System Bottleneck

-

Centralization and Control: Traditional QR code payments often rely on e-wallets or bank apps that operate within centralized financial systems. This means users don't have complete control over their funds, as they are subject to the rules, fees, and potential vulnerabilities of these centralized institutions.

-

High Costs: Centralized financial operations are inherently expensive. Intermediaries, regulations, and compliance requirements all contribute to higher fees for both businesses and consumers, limiting the accessibility and affordability of digital payments.

-

Low Efficiency: Traditional payment systems, burdened by layers of intermediaries and complex processes, can be slow, cumbersome, and prone to delays. This inefficiency creates friction in transactions, especially for cross-border payments, and hinders the seamless flow of value within the digital economy.

Fizen's Blockchain-Powered Solution for the Future of Digital Payment

Fizen recognizes these limitations and offers a powerful solution: bridging the gap between Web2 and Web3 payments. By leveraging blockchain technology, Fizen empowers users with greater control, transparency, and efficiency, while still maintaining interoperability with traditional financial systems where necessary.

Here's how Fizen's blockchain-powered QR codes revolutionize payments:

-

Decentralization and User Control: Fizen's platform allows users to store and manage their crypto assets directly on the blockchain via a non-custodial wallet, giving them true ownership and control over their assets.

-

Reduced Costs and Increased Efficiency: Blockchain transactions can be significantly cheaper and faster than those processed through traditional systems. Fizen leverages this efficiency to reduce fees for both merchants and users, making payments more affordable and accessible.

-

Seamless Cross-Border Transactions: Cryptocurrencies, by their nature, transcend geographical boundaries. Fizen's QR Code Payment facilitates seamless and cost-effective cross-border payments, eliminating the complexities and high fees associated with traditional international transfers.

-

Unlocking the Power of Crypto Assets: But the revolution goes even further. Fizen empowers users to utilize their crypto assets—like Bitcoin, Ethereum, or stablecoins like USDT—for everyday purchases. Imagine paying for groceries, coffee, or even your rent with the crypto you already hold, anytime and anywhere Fizen is supported. This eliminates the need to constantly exchange crypto for cash, exchange fiat for fiat, or manage multiple e-wallets and bank accounts, simplifying the payment experience and expanding the utility of digital assets.

Fizen is not about replacing traditional finance entirely but about enhancing it. By integrating blockchain technology into the QR code payment experience, Fizen offers a hybrid approach that leverages the strengths of both Web2 and Web3. This allows for a more gradual transition to a decentralized future, providing users with the benefits of blockchain while maintaining familiarity and interoperability with existing systems.

Video about payment with crypto by using the Fizen Super App:

Part 3: Fizen's Proposition and Roadmap

Fizen's blockchain-powered QR code payment system isn't just about making transactions easier; it's about creating a more inclusive, accessible, and efficient financial world.

Here's how Fizen empowers different user segments:

For Travelers and Expats:

Effortless Cross-Border Payments: Travel light and worry-free. No need to exchange currencies, deal with high card fees, or open bank accounts in each country you visit. Your phone and Fizen app are all you need.

For Unbanked Users:

Financial Inclusion: Participate in the digital economy without a bank account. Use stablecoins like USDT as a secure store of value, protecting your savings from high-inflation countries. Access decentralized finance (DeFi) applications directly through the Fizen app and explore the growing world of Web3 opportunities.

For Remittance Senders and Recipients:

Fast, Affordable, and Borderless: Send and receive remittances with ease by using stablecoin like USDT, directly to a recipient's Fizen wallet, even if they don't have a bank account. Spend received funds instantly on the Fizen app or convert them to local currency as needed.

Gift Card Flexibility:

Send and receive gift cards through the Fizen platform, expanding gifting options and providing a convenient way to share value.

Fizen's Roadmap: Building a Pan-Asian QR Code Payment Network:

Fizen's ambitious roadmap reflects its commitment to bringing its innovative payment solutions to a wider audience:

-

Q3/2024: Proof-of-concept launch of QR code-based crypto payments in Vietnam.

-

Q1/2025: Expansion to Thailand, Malaysia, Indonesia, and the Philippines, building a strong presence in key Southeast Asian markets.

-

Q3/2025: Integration with JPQR, Japan's unified QR code standard, enabling Fizen's services in Japan.

-

Q3/2025: Expansion to Singapore, Cambodia, and India, leveraging the JPQR standard for wider interoperability.

With a focus on 9 key markets - Vietnam, Thailand, Malaysia, Indonesia, the Philippines, Japan, Singapore, Cambodia, and India - Fizen is strategically positioned to become the leading blockchain-powered QR code payment network in Asia, driving financial inclusion and innovation across the region.

Reference:

-

https://www.gminsights.com/industry-analysis/qr-codes-payment-market

-

https://www.statista.com/statistics/330695/number-of-smartphone-users-worldwide/

-

https://paytm.com/blog/payments/upi/india-achieves-10-bn-upi-transactions-in-august/

-

https://www.finextra.com/blogposting/26351/why-developed-economies-are-benefiting-from-qr-payments

-

Download Fizen Super App at: https://fizen.io/download

Visit us: Website | 𝕏 | Telegram | Discord | LinkedIn | Facebook | Youtube