There are certain steps to follow in order to trade on ZKX:

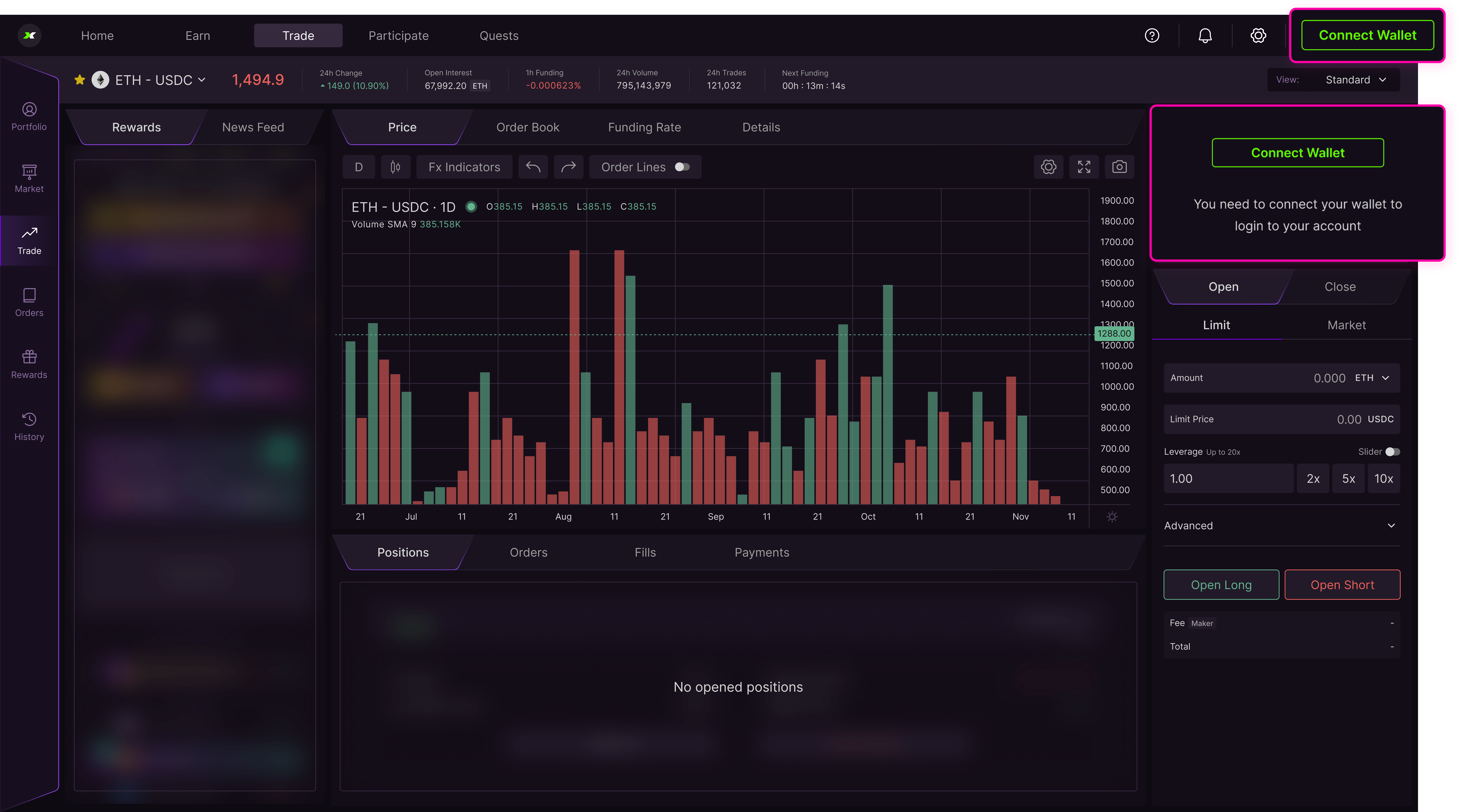

1. Connect your wallet

To access the ZKX Trading Platform starting from March 30th, click on the "Connect wallet" button located in the top right corner of the page. From there, select your preferred wallet option (Metamask, Coinbase, or Wallet Connect) and connect your Metamask wallet by verifying ownership and switching to the Ethereum network. If you don't already have a web3 wallet, you can download one of the supported options or directly download Metamask from their website.

2. Choose your trading experience level

To enhance your trading experience on the ZKX Trading Platform, you can access the "View" button located in the top right corner. The platform offers three different user interfaces (UIs) based on different experience levels: Standard, Advanced, and Professional. The Standard View is suitable for beginners and displays the chart and order book. The Advanced View is designed for intermediate to advanced-level traders and allows for the viewing of trades and the order book on the left side of the screen, providing data-driven insights for informed decision-making. The Professional View is tailored for well-versed traders and offers an enlarged chart and options for exploring and analyzing market dips.

3. Trading

Step 1:

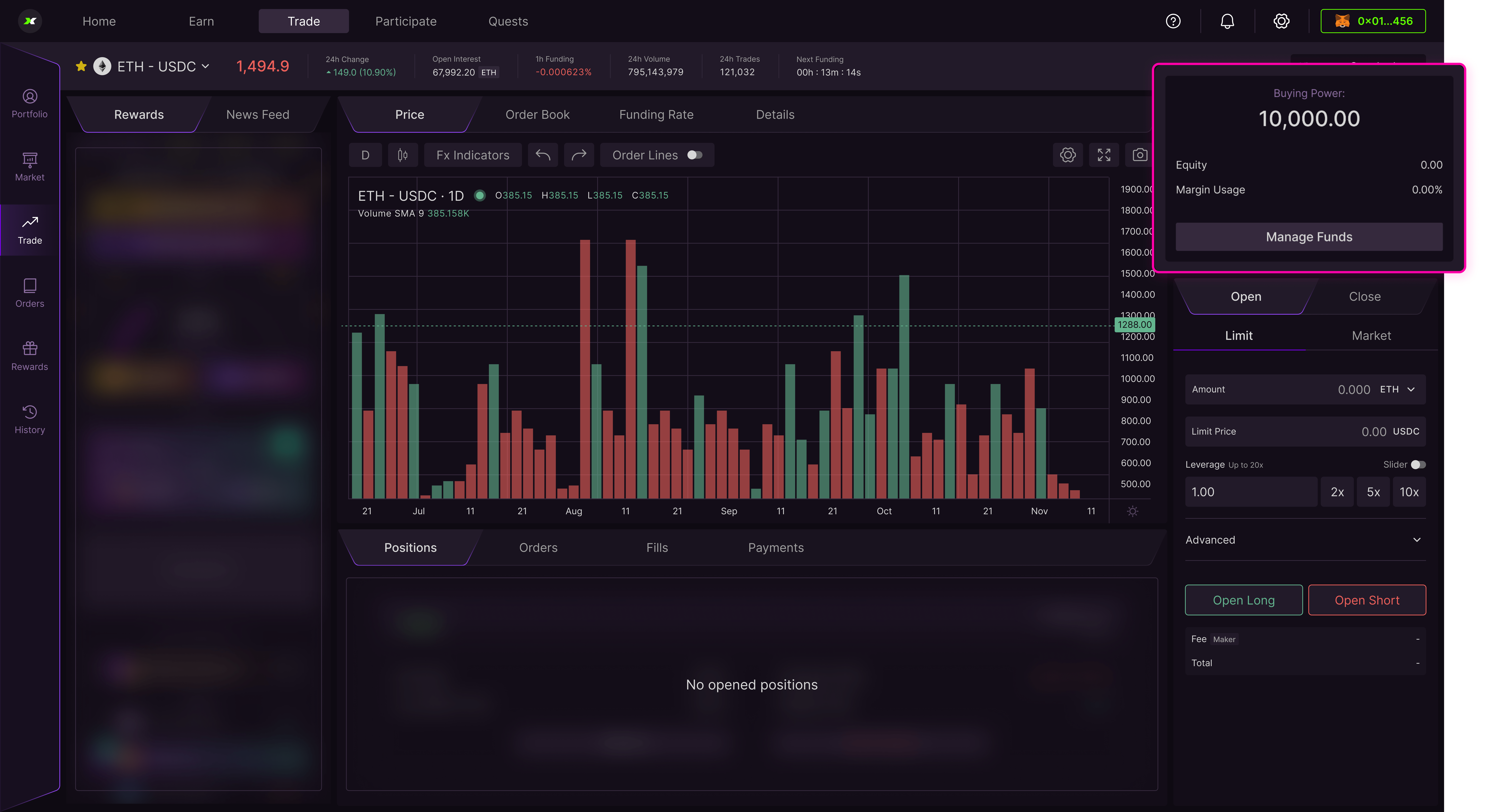

Upon creating a Testnet account using your Ethereum L1 wallet, a Starknet L2 wallet will be automatically created for you. This wallet will hold all of your funds, positions, orders, and trades, streamlining your account management. You can control your L2 wallet directly from either your L1 or L2 wallet, providing flexibility in how you manage your account. Each new account in the system starts with a balance of 10,000 USDC. However, the deposit function is currently unavailable at this time.

Step 2:

On the ZKX Trading Platform, the order panel located on the right-hand side provides access to six different order types: Market, Limit, Stop Limit, Stop the Market, Take Profit Limit, and Take Profit Market. Initially, the markets available are BTC and ETH, but additional digital assets can be added through the data provider system. It's possible to take both long and short positions in each market simultaneously. For more advanced options, traders can expand the Time in Force policies. Additionally, there is a leverage slide that can be adjusted based on the trader's risk management and margin preferences, with a maximum of 20x leverage.

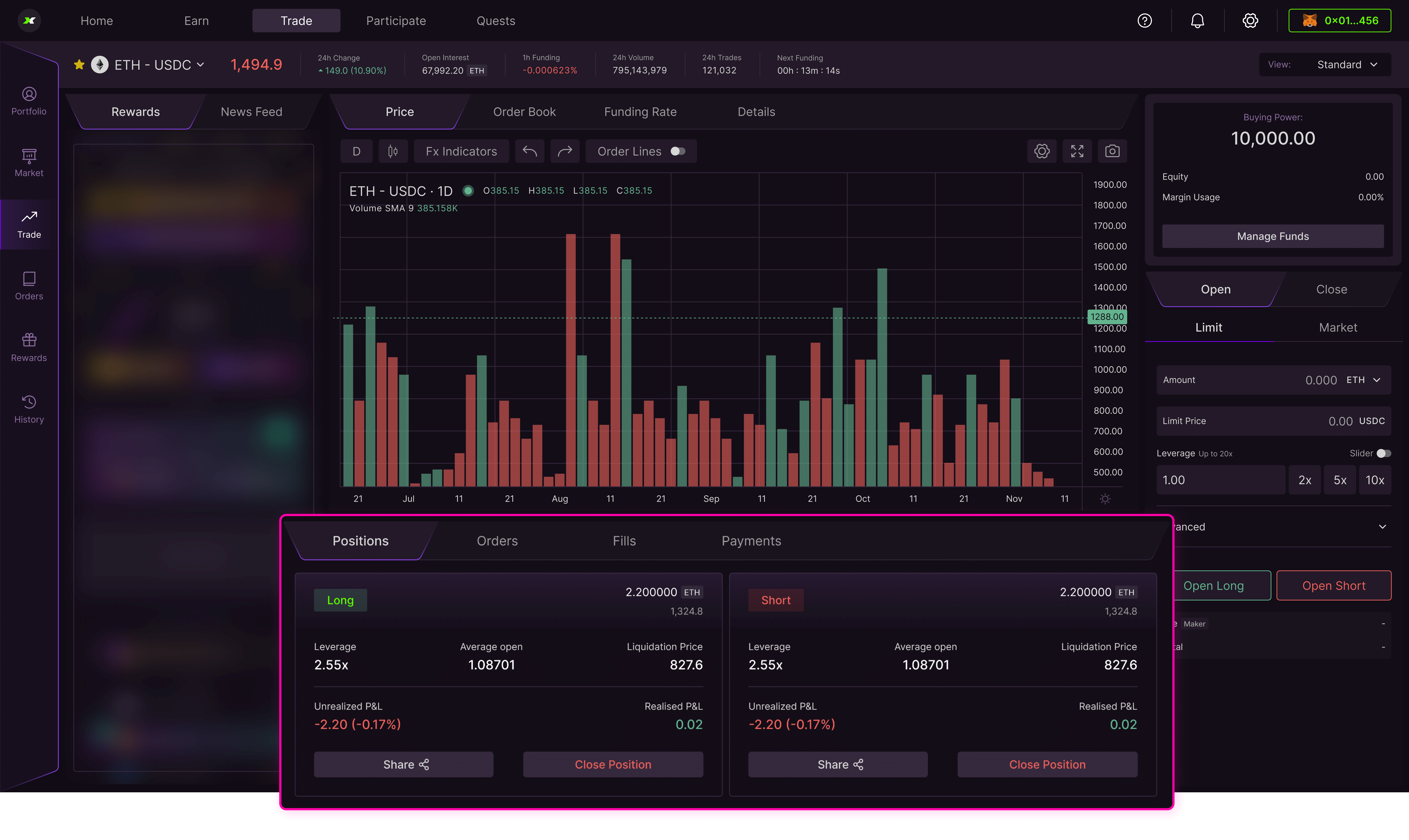

4. Review your positions, orders, fills and payments

At the bottom of the ZKX Trading Platform, traders can view their positions, orders, fills, and payment overview. By clicking on the "Positions" tab, traders can view their account balances, margin requirements, PnL (profit and loss), leverage, and volume figures. The "Positions" tab displays the trader's current holdings on the platform, which can be categorized as either long or short positions. Long positions refer to the ownership of a security or contract and profit when the price of the asset increases, but results in losses if the price falls. On the other hand, short positions profit when the price of the security or asset falls. Short positions often involve borrowing and selling securities, with the aim of buying them back at a lower price.

Here are some additional minute details about the ZKX trading platform:

-

The platform supports both long and short positions, which allows traders to profit in both bullish and bearish market conditions.

-

The leverage slider on the order panel ranges from 1x to 20x, which determines the amount of margin used for a position. Higher leverage increases the potential profit but also increases the risk of liquidation.

-

The time in force policies available for orders include Good Till Cancel (GTC), Immediate or Cancel (IOC), and Fill or Kill (FOK). These policies allow traders to specify how long they want their orders to remain active in the order book.

-

The payment overview section of the platform shows the funding fees that are exchanged between long and short position holders. These fees are settled every 8 hours and are calculated based on the position value and funding rate at settlement time.

-

The tick size for a market is the minimum price change allowed, and the step size is the smallest amount by which an order can be increased or decreased. The minimum order size is the smallest amount of an asset that can be traded on the market, and it varies by asset.

-

The initial margin fraction and maintenance margin fraction are two risk parameters that determine the highest leverage allowed in a market. Exceeding the initial margin fraction prohibits increasing a position, while exceeding the maintenance margin fraction leads to automatic closure of a position and a liquidation fee.

About ZKX

ZKX is the first perpetual futures exchange on StarkNet with self custody and true community governance. The protocol is designed to provide further scalability with a decentralized node network, an elevated trading experience and offer perpetual swaps and derivatives to any user on Starknet and Ethereum. ZKX’s mission is to democratize access to global yields through its offerings to anyone, anywhere.

In July, ZKX raised $4.5m in seed funding from backers including StarkWare, Amber Group, Huobi, Crypto.com and others.

Follow ZKX

ZKX Yakuza: https://yakuza.zkx.fi/

Website: https://zkx.fi/

Twitter: https://twitter.com/zkxprotocol

Discord: https://discord.gg/7YrNHdwNyu

Telegram: https://t.me/zkxcommunity