I have never spoken about the price of Kleros—not in my almost three years managing the treasury, nor when I was just another community member. Today, I will make an exception. And If I’m going to talk about it, I want to make it worthwhile.

Disclaimer 1

This is not financial advice*; it’s simply an optimistic perspective, driven by both facts and assumptions that are impossible to predict with absolute accuracy.*

I strongly reccommend NOT to put money that you are not willing to loose; PNK is extremely volatile, more than others more established crypto assets like ETH or BTC*. If you don’t feel comfortable with the risks that this investment implies, the best option is to invest in Kleros by educating yourself about the system , participating on our Telegram channel and Fellowships programs*

Introduction

Blockchain and game theory are already disrupting existing ODR (Online Dispute Resolution) systems, benefiting retail users who may not even realize it. My thesis is that it’s only a matter of time before these benefits are reflected in PNK’s price. But to understand why, you’ll need to read the full article—I won’t provide a TL;DR or summary.

Note: This article is written for a broad audience: I’ll start with the very basics of Kleros so literally anyone can follow up. If you’re already familiar, feel free to skip to the section.

Some Background

What Is Kleros? As outlined in the original whitepaper: "Kleros is a decentralized application built on top of Ethereum that works as a decentralized third party to arbitrate disputes in every kind of contract, from very simple to highly complex ones."

Basically a way more efficient court system for solving disputes.

Kleros is built on four core pillars:

-

Online Dispute Resolution (ODR)

-

Blockchain

-

Smart Contracts

-

Game Theory.

Online Dispute Resolution (ODR)

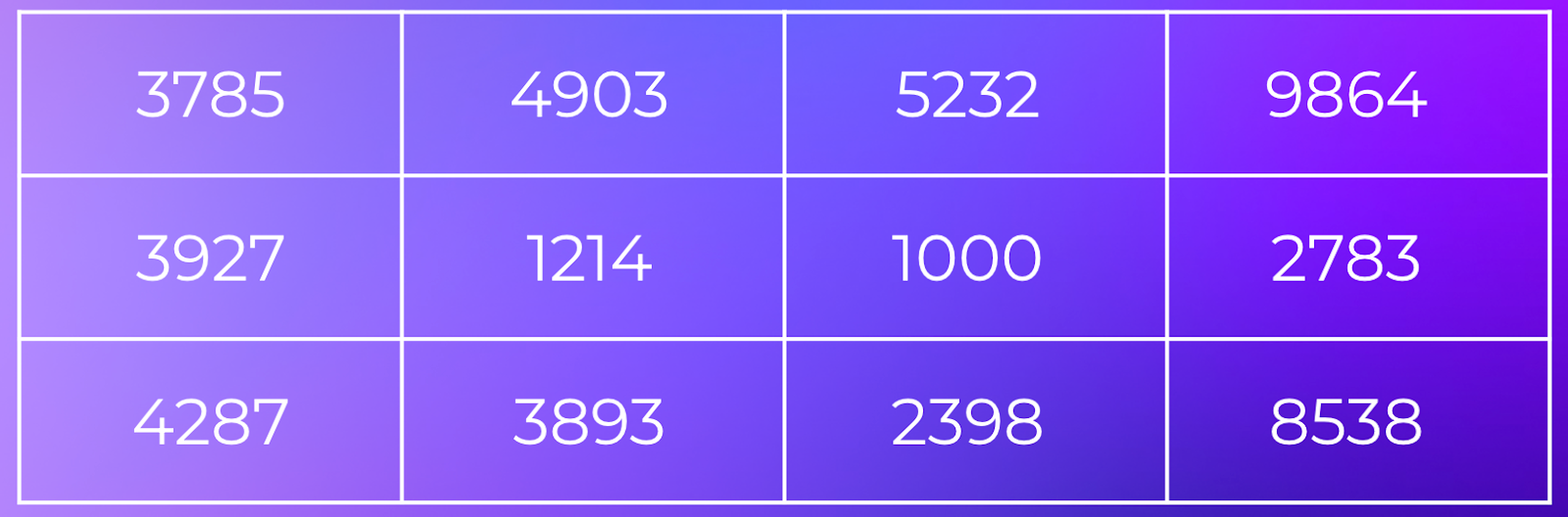

Growth of e-commerce and transactions done online has exponentially growth over the last 20 years. Check any source, and the numbers are just impressive:

For instance, in In the third quarter of 2024, online shoppers spent an average of about 2.61 U.S. dollars per visit across all verticals according to Statista and in 2023, e-commerce accounted for over 19 percent of retail sales worldwide.

It is supposed that jobs online, freelance also keep on growing at a fast pace; Only in US In 2023, there were an estimated 64 million people doing freelance work and is projected to be 86.5 million by 2027.

Amazon, a pretty good indicator of today’s online transactional dependence is that they processes around 12 million sold items per day or 143 per second! ((revenue is around 1.6b per day)

And from all of those transactions that happen online (beyond Amazon) is estimated that around 2–5 % ends in some sort of dispute .

This means millions of people, every second, are dissatisfied with some aspect of their online commerce experience.

Now, Imagine this scenario:

Alice, an entrepreneur in France, hires Bob, a programmer from Guatemala, through a P2P freelancing platform to build her company's website. After agreeing on a price and terms, Bob delivers the product weeks later. Alice is dissatisfied, claiming the quality is subpar. Bob argues that he met the agreed-upon terms. Frustrated, Alice wonders what to do next.

Hiring a lawyer for such a small claim is impractical, especially across jurisdictions. Legal costs would far exceed the amount in dispute, and the time investment isn't worth it.

The same applies to Bob if Alice refuses to pay.

This scenario plays out countless times in our growing digital economy:

- Amazon customers claim sellers failed to deliver goods as agreed.

- Airbnb guests argue properties don't match the advertised pictures.

- Backers on crowdfunding platforms demand refunds when promises go unfulfilled.

The current systems are broken. The legal gap is enormous, and existing ODR mechanisms are inadequate, inefficient, and rife with conflicts of interest.

Blockchain

In 2008, during the financial crisis, Satoshi Nakamoto introduced Bitcoin - the first blockchain, enabling peer-to-peer transactions without intermediaries. This censorship-resistant system created the first decentralized digital currency, controlled by neither governments nor corporations.

Bitcoin has since become a valuable asset, competing with gold as the best store of value and a hedge against inflation, reaching 100,000 USD at the time of writing this.

Smart Contracts and Ethereum

In the 1990s, Nick Szabo introduced the concept of smart contracts. He foresaw the transformation of the global economy from local and physical to predominantly online. However, he recognized that existing dispute resolution systems were unprepared for this shift, remaining outdated and inefficient.

Smart contracts offered a solution: programmable agreements that automatically execute specific actions based on predefined conditions.

For example:

-A smart contract could reimburse 10% of a ticket's value if a flight is delayed by more than one hour.

-No forms, emails, or customer service calls would be required - the process would be instant and automated.

Despite its potential, the concept didn't gain traction until 2014, when Vitalik Buterin introduced Ethereum.

Vitalik saw Bitcoin's limitations and realized the blockchain's potential for creating decentralized applications: By combining blockchain with smart contracts, Ethereum enabled the development of financial, social, judicial, and political services. Ethereum's introduction paved the way for innovations like Kleros to arise, and we will see why..

Game Theory

Smart contracts and blockchain laid the foundation for systems like Kleros. But how could we address the inefficiencies of traditional justice systems?

Game theory provides the answer.

Let's play a thought experiment:

You're in a room with 20 others, all trying to choose the same number (see image below). You can't communicate, but if you choose the majority's number, you'll receive $20. If not, you lose the $1 entry fee.

Think for 10 seconds…

Remember the goal is to select the same number than all the rest of people in the room and for doing so, you need to think what is the answer most likely to be answered by your peers;

What’s your choice?

The answer is likely 1,000. This is an example of the Schelling (or Focal) Point, a key concept in game theory and a cornerstone of Kleros’ cryptoeconomic design.

Another example:

If you must meet a stranger in New York City, where would you go? The most common answer is “noon at the information booth in Grand Central Terminal.” There’s no inherent reason this location is better, but its cultural significance makes it a natural focal point.

Kleros leverages these principles to align incentives for jurors and ensure robust, decentralized decision-making.

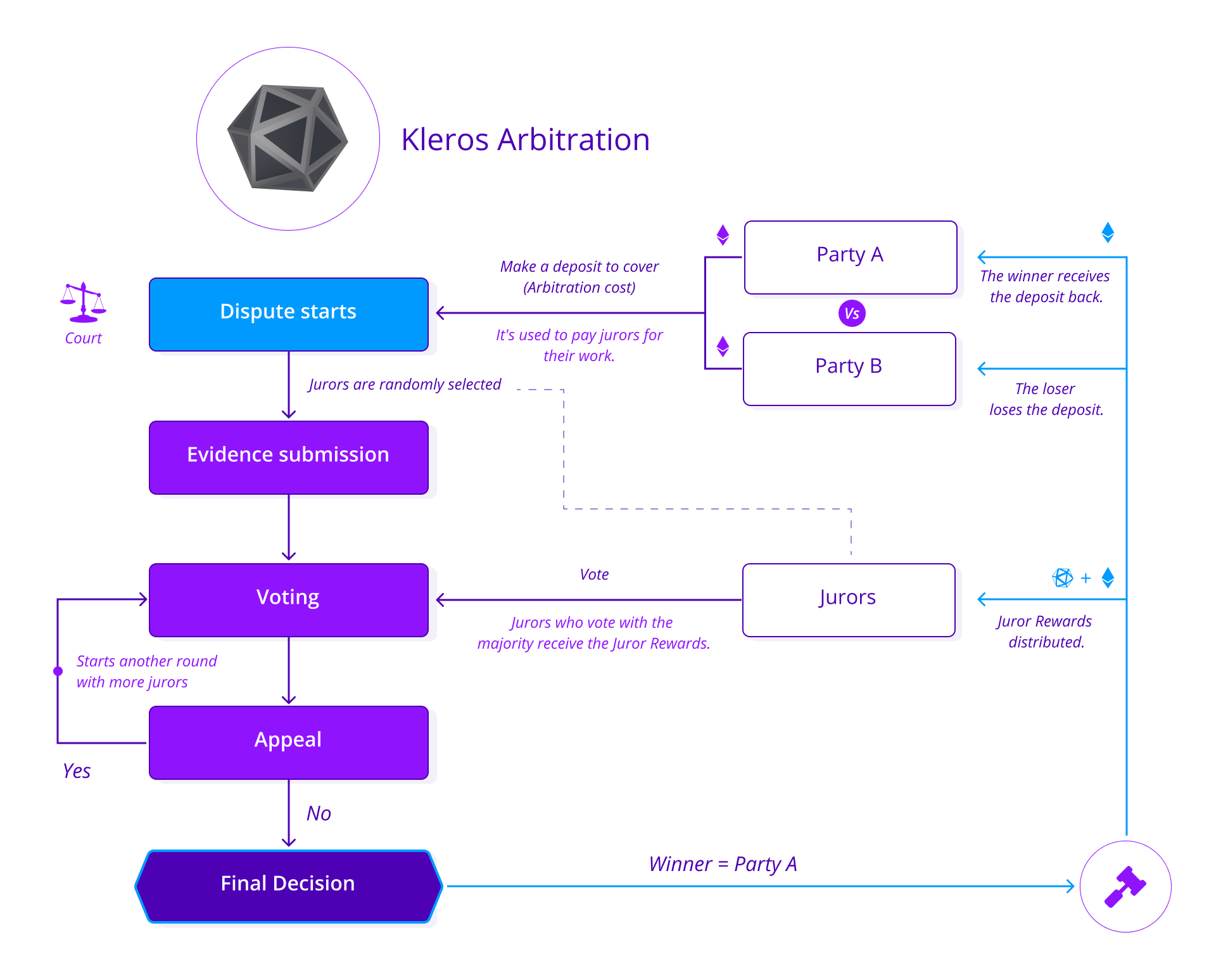

Kleros Solution

You remember the example we mentioned earlier about Alice and Bob, right?

What if their contract included a clause stating that, in the event of a dispute, it would be resolved by a Kleros court?

Kleros is a decentralized application built on Ethereum. After Bob stops responding to her emails, Alice clicks a button labeled “Send to Kleros” and fills out a simple form explaining her claim.

Thousands of miles away, in Nairobi, Chief, a software developer, is checking the Kleros Court website during his commute. In his spare time, he works as a juror, earning a couple of dollars a year arbitrating disputes in the Website Quality subcourt. This court requires expertise in HTML, JavaScript, and web design to resolve conflicts between freelancers and their clients.

Chief stakes 2,000 PNK (Kleros’ native token) to be eligible for selection as a juror. The more tokens he stakes, the higher his likelihood of being chosen.

About an hour later, Chief receives an email:

“You have been selected as a juror on a website quality dispute. Download the evidence here. You have three days to submit your decision.”

Similar emails are sent to Benito, a programmer from Cusco, and Alexandru, a developer from Romania. Like Chief, they staked PNK in the Website Quality subcourt and were randomly selected from a pool of nearly 3,000 candidates. They will never meet, but together, they will settle the dispute between Alice and Bob.

On his bus ride home, Chief reviews the evidence and votes on who is right.

Two days later, after all three jurors have cast their votes, Alice and Bob receive the final decision via email:

“The jury has ruled in favor of Alice. The website was not delivered in accordance with the terms and conditions agreed by the parties. A smart contract has transferred the payment to Alice.”

Jurors are rewarded for their work, and the case is closed.

Sounds pretty cool, right? But you’re probably wondering:Who are these jurors, why can they decide on this matter, and how do we know they’re qualified?

Let’s revisit Game Theory and the concept of Schelling (or Focal) Points. Thomas Schelling described a Schelling Point as a solution people tend to use to coordinate their behavior in the absence of communication because it seems natural or relevant to them.

Remember the examples:

-

The number 1,000 in the game.

-

The question about meeting in NYC.

-

The classic Prisoner’s Dilemma.

When applied to Kleros jurors, the Schelling Point is honesty and fairness.

To vote with the majority, jurors need to understand the contracts in dispute and be experts in the relevant subject. This enables them to analyze the evidence and arrive at the most logical conclusion — the one the majority of jurors will also aim for.

Jurors are incentivized to do this because they earn arbitration fees when they vote “correctly.”

Admittedly, some disputes are highly subjective, with no clear “right” answer. However, Kleros’ appeal system addresses such scenarios. Even in these cases, a traditional court would likely arrive at the same conclusion, though it would take much longer and cost significantly more.

It’s important to acknowledge that no arbitration system is perfect. Jurors won’t always be right, and occasionally, honest jurors may lose tokens. However, as long as the value jurors earn from arbitration fees and penalties on incoherent parties outweighs these losses, the system remains effective.

For understanding why Kleros needs a native token and can’t rely on ETH or Stablecoin for the court mechanism design, I strongly recomend this Article, from William George (is the article that got me into Kleros back then).

Is criticial to understand that a schelling-point based system like Kleros needs its own crypto-token (PNK) in order the right incentives and prevent Sybil attacks; Why we can’t use stablecoins or ETH and all details can be find either or the whitepaper or on the article mentioned above which you can also access to the spanish transltation I did here

The Upside

By the end of 2024, is fair to say that this system has proven to be successful:

-

It is recognized by international courts of law.

-

It has resolved over 1,600 cases.

-

More than 850 jurors from around the globe participate.

-

Over $1.5 million has been paid in arbitration fees.

But what if I told you this is only the tip of the iceberg?

Until 2022, all our focus was on solving disputes within the blockchain economy. We had several use cases where Kleros was instrumental in bootstrapping projects while providing security as a credible, neutral third party.

In 2022, the Kleros team began working on Kleros Enterprise—a solution that delivers all the benefits of the Kleros system, leveraging blockchain transparency and game theory to enable real-world companies to provide a superior user experience to their customers without them even realizing blockchain is involved.

Let’s look at two examples worth mentioning:

-

Lemon: The "Argentine Coinbase," with over 2.5 million users and ongoing expansion across most of LatAm.

-

Government of Mendoza: One of the most important provinces in Argentina.

Both are using Kleros to resolve disputes (users in the case of Lemon and citizens in the case of Mendoza). Here’s how:

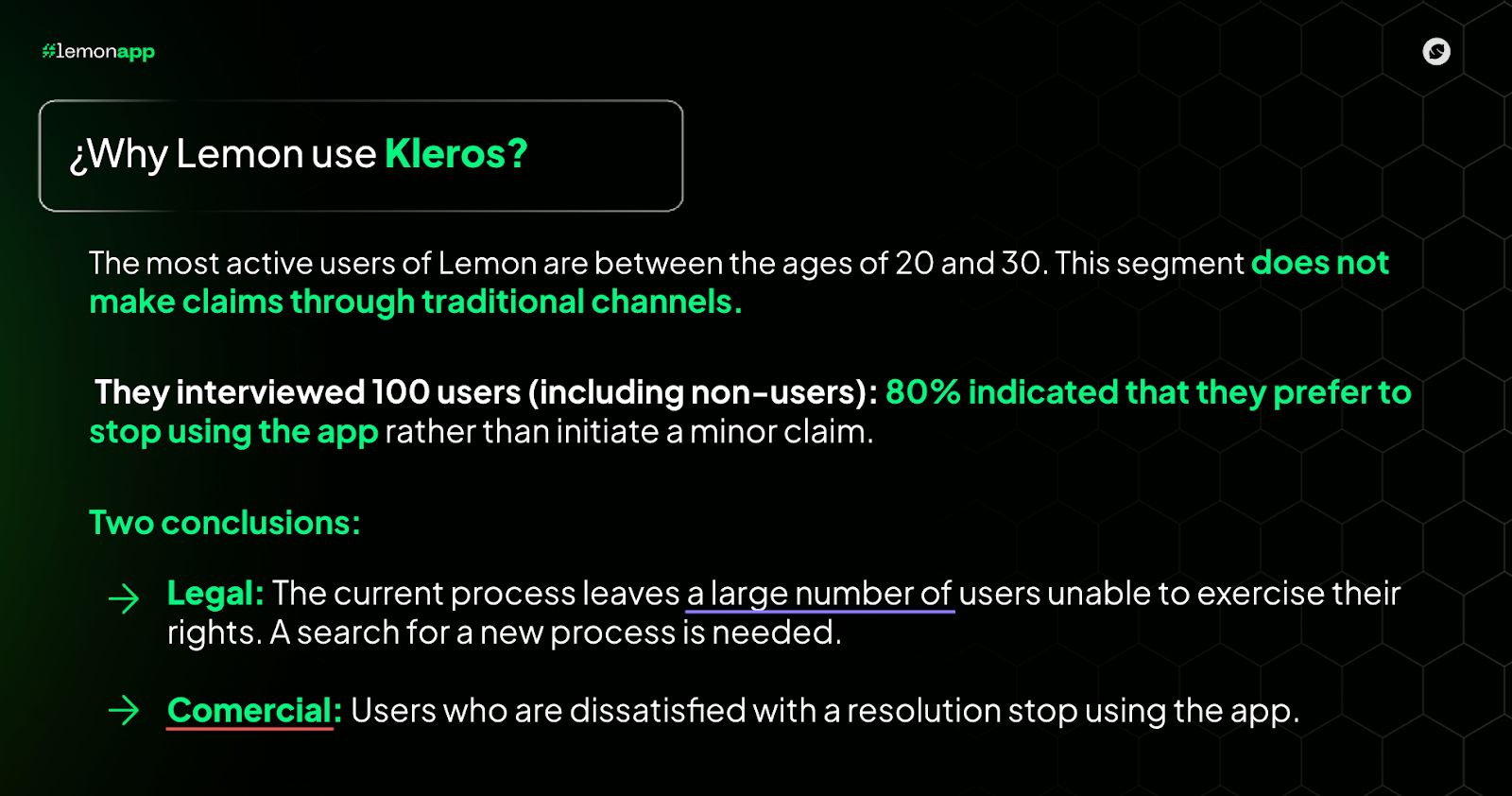

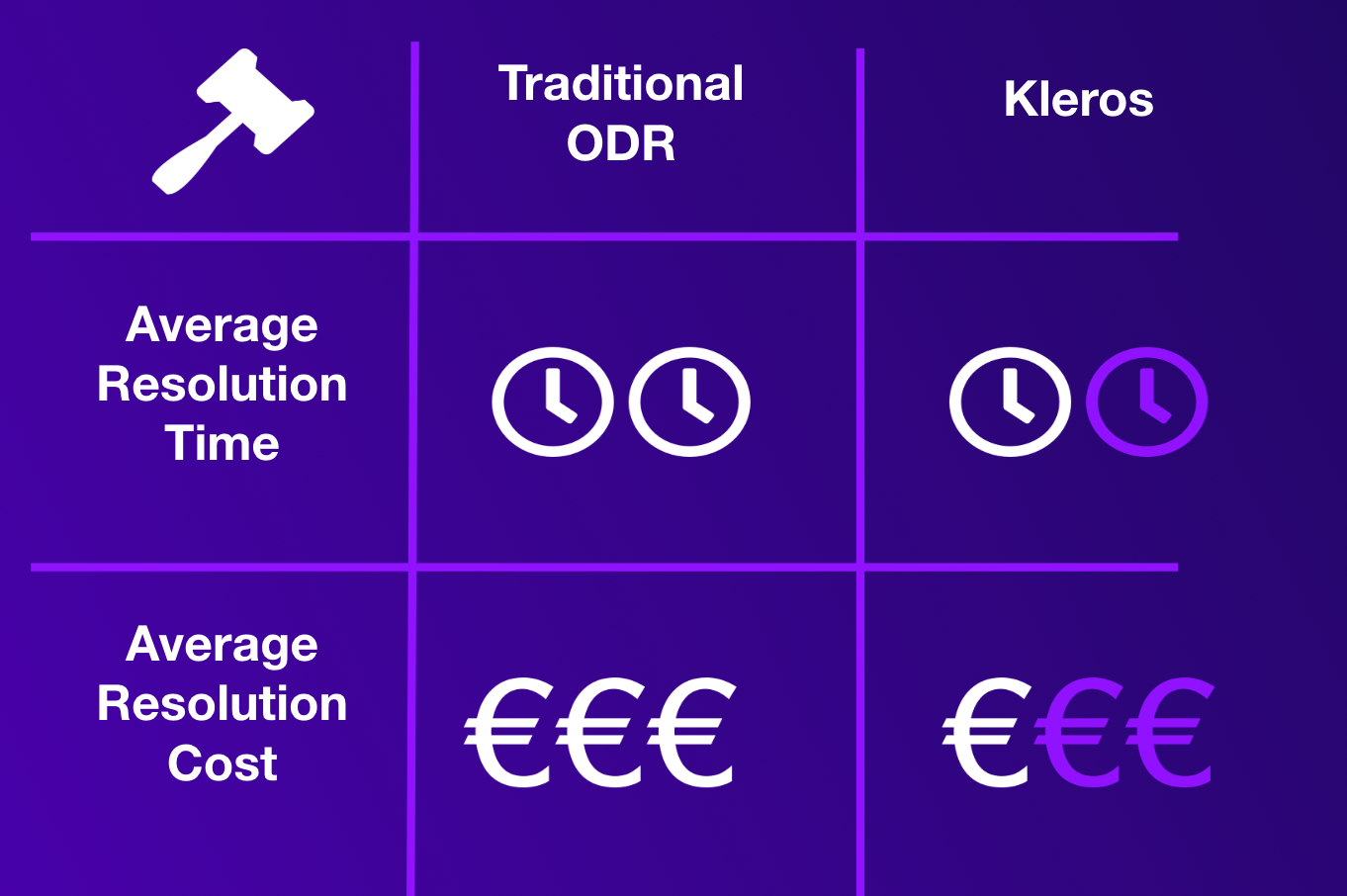

Lemon

Lemon discovered that most of its users were between 20 and 35 years old. When they had an unsatisfactory experience with customer support, they often abandoned the app—a significant opportunity cost given the rising customer acquisition costs for companies worldwide.

Lemon integrated Kleros to provide users with an optional dispute resolution tool for unsatisfactory requests. The process is seamless:

-

Users complete a form in under 3 minutes.

-

Kleros creates a case (with AI assistance to improve the user's defense).

-

The case is resolved in about a week, costing $45–$60 (expected to drop to $15 in the long run), and users receive a clear explanation of the result.

So, how does it work in a nutshell?

-

If Kleros jurors rule in favor of the user, Lemon (per its contract with Kleros under a system called Recognition of Jurisdiction) executes the decision. For instance, Lemon might return the user's funds based on the terms of a specific promotion.

-

If Kleros rules against the user, they still have the option to pursue a small court claim. However, what's surprising is that most users are satisfied with Kleros' process, even when they lose. The detailed reasoning provided by jurors often impresses users, reducing the likelihood of further action.

For Lemon, this means:

-

Lower costs: Avoids time-consuming court claims and reduces expenses on additional lawyers and customer service personnel.

-

Higher retention: Retains users who previously left the app due to poor experiences.

Mendoza: Transforming Into a Legal Innovation Hub

Fortunately, Milei is not the only politician bold enough (Mario = GOAT) to step out of their comfort zone and take risks to benefit the citizens they serve. Inspired by Lemon’s success and thanks to Mendoza’s forward-thinking leadership — a tech and legal innovation enthusiast passionate about progress — the Supreme Court of Mendoza welcomed us in February 2024 to explore how Kleros could empower its citizens and transform their judicial system into one of the most efficient in the world.

This meeting (tied to other previous talks) was the initial starting point to the signing of a Convenio Marco, allowing Judges in Navarro, Mendoza to use Kleros as a consultative legal tool, enabling Navarro judicial system to have a fast and efficient alternative to empower their citizens.

Combined with other milestones — such as Kleros being regulated as a tool for decentralized justice in Mexico — this agreement sets the stage for Kleros Enterprise to grow exponentially worldwide.

There are a couple of ongoing talks about integrating Kleros with both governments and major companies, which would help achieving this vision about taking Kleros to mainstream.

Imagine Mercado Libre or Amazon integrating Kleros to provide users with a credible, neutral third party for resolving disputes. This would reduce costs and improve efficiency, in a credible-neutral transparent manner.

In fact, such an integration doesnt need to be internally pushed by Kleros necessarily — it’s a business ide that any law studio could adopt soon: The company could charge a small fee on top of arbitration fees, building a profitable service around Kleros integration.

Adding to this is the wave of legal innovation and business openness we’re witnessing in Buenos Aires with initiatives like Crecimiento and the Sandbox proposal — making the utopic ideas we had 5 years ago seem way closer to reality

^^^ DEVCON 24':Milagros Santamaría explaining the bull case for Buenos Aires Sandbox; Kleros in very present in Argentina…why not being the legal arm of Buenos Aires?

I don’t know about you, but when I see some of the use cases, I find this incredibly impressive, and there has been lot of repercussion around it;

For example:

-

Media Presence: Kleros frequently appears in major Argentine newspapers, changing public perception about blockchain’s value.

-

Academic Recognition: Kleros is discussed at top institutions, including Stanford, Oxford, European Commission and Thomson Reuters, among others.

Even Vitalik Buterin himself has talked about kleros often in his blogs and talks; and again recently mentioning current advancements in Argentina in Argentina’s Tech Forum.

Of course, these kinds of integrations and news don’t create much buzz on Crypto Twitter and aren’t as appealing today as pure DeFi (which I’m a fan of) or meme coins. Still, I expect that in the long term, the market will be rational enough to appreciate this, especially as money from TradFi starts flowing into the space.

So besides Kleros has come a long way since its inception, PNK’s price hasn’t reflected the project’s technological advancements, even with superlative integrations for “crypto projects” in the real world.

Actual MarketCap with Kleros (at around 0.22$ per PNK) is 17m, with a total supply of around 776m PNK…ranking #1456 according to Coingecko.

So…Why Is PNK Undervalued?

There could be several reasons:

-

We never emphasized short-term shilling of PNK. Instead, we focused on attracting people who took the time to deeply understand Kleros’ system, its implications, and its crypto-economic design.

This comes with a tradeoff: you don’t get the typical retail degen money driving “dopamine pumps,” but you do get a long-term oriented community—something 90% of other projects lack. Once you understand the courts and their implications, it’s hard not to feel bullish about Kleros in the long run.

-

Maybe we’re just not built for the Crypto Twitter crowd, or perhaps Kleros is designed for a different audience than the one currently investing in Web3.

(Side note: We probably have one of the best community managers in Latam—seriously, the guy could squeeze water out of rocks.)

-

Some people argue we should burn a big chunk of the Treasury to get listed on Binance. I disagree.

The cost of listing, combined with future market-making expenses, isn’t worthwhile. Especially when we aim to attract holders who truly understand how the court works and the importance of staking PNK.

Let’s be honest: you won’t find those users on Binance. Sure, some might off-ramp and become jurors, but I think the percentage is negligible—they could just as easily become jurors without going through Binance.

So…Let’s revisit the tokenomics and financials:

Treasury Size:

Kleros’ treasury sits in $30M and you can check it at kleros.io/treasury. This gives the project 10+ years of runway at current ETH prices.

When I first joined Kleros, one of our initial decisions together with Clément , was to shift focus towards optimizing our strong treasury. We decided to exit all ETH-denominated positions that carried the risk of impermanent loss and implement a risk-adjusted APR framework. This strategy allowed us to grow the treasury from $14 million to approximately $30 million in just 2.5 years.

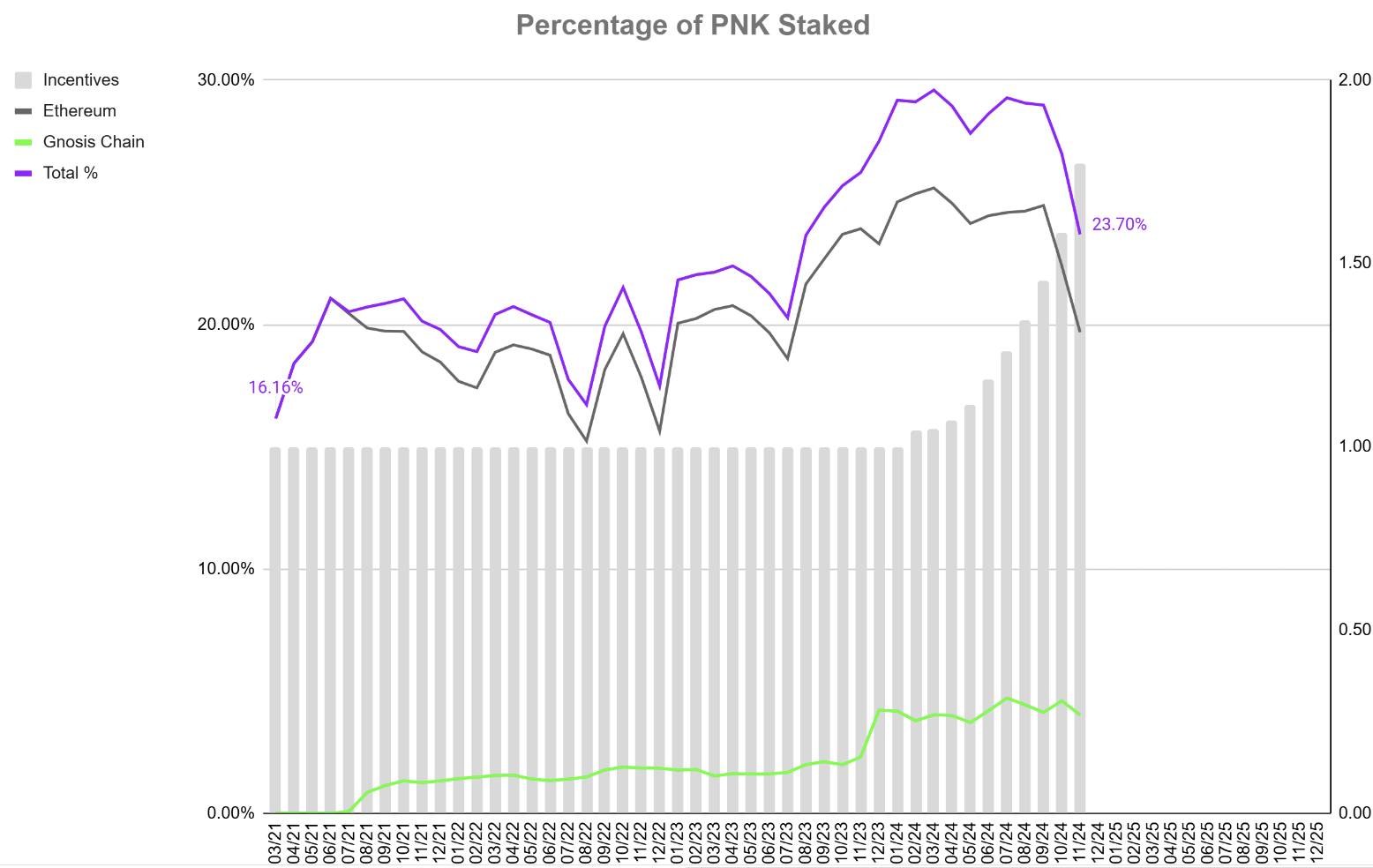

PNK Supply: Out of the 776M total supply, 23% is staked, close to Ethereum’s 28% stake rate;

-

Market Cap: At $16M–$18M, Kleros is one of the few projects where the market cap is lower than its treasury value — a P/B ratio below 1.

This is almost unique in the whole crypto landscape, and proves that Kleros can survive at least 2 more bear markets without additional capital inflow;

Besides you are not entitled to that treasury if you buy PNK, you know that there will be a team building for the long term to keep on adopting the product, generating juror (and therefore PNK) demand.(Assuming ETH & GNO stay at current prices)

So now that we have a solid base constructed, and respurces for the medium and long term future…..how we align even more incentives for PNK holders in a healthy way?

Remember that jurors can stake PNK to reduce attack vectors and participate in disputes, winning Arbitration fees and also PNK.

Enter Long Term Juror Incentive Program:

Last year, KIP-66 was approved which means that jurors get an APR on their PNK stakes, while non-stakers are diluted; incentivizing long-term jurors and strengthening the court system.

You might argue that you want long-term exposure to PNK but don’t have the time to vote or act as a juror, and therefore might hesitate to stake. However, this shouldn’t be an issue: You can simply stake in the General Court, where it’s unlikely you’ll ever need to vote. In the meantime, you’ll still earn PNK rewards month after month. If you do happen to be selected to vote, it will likely be for a significant case, offering the potential to earn a substantial reward. Plus, you’ll receive a notification if action is required.

Cooperative PNK Holdings

The Kleros Cooperative holds around 120M PNK, with over 90% used for liquidity on DEXs and Bitfinex. The remainder is allocated for monthly rewards and team member vesting.

-

All initial team member allocations are fully vested and liquid, with new contractors receiving part of their compensation in PNK.

-

To support this, the Cooperative has executed buybacks and may continue doing so as long as the Treasury Value exceeds the market cap.

Liquidity and Market Impact

Most liquidity is on Uniswap V2, ensuring trading availability even without infinite liquidity. However, the relatively limited liquidity means that buying or selling pressure significantly impacts market price.

For example, if a liquid fund or successful lawyer wanted to invest $750K in Kleros, this could cause an instant 33% price appreciation. (Of course, the reverse is true for equivalent selling pressure.)

Clearly, a sophisticated actor won’t simply go and execute this trade, but he will do a TWAP or limit order, or he/she could contact the team to seek advice for placing orders.

And if we want to play with estimations, by returning to the ATH price (~$0.40) , PNK will experience a 15x return from current levels.

Now lets take a quick look at the on-chain data…

PNK Distribution On-Chain

From the total 776,626,704 PNK tokens distributed across 9,058 addresses, the top 10 holders collectively represent approximately 48% of the current supply. Here’s a breakdown of these holders, which includes the Kleros Cooperative wallet and other addresses that seem unlikely to sell in the near term:

-

Copperative deposits on Uniswap: Holds 8% of the supply, enabling liquidity on DEXs.

-

0xAdF0E9b0AC37AedadC66C0680791ebeA8F8e4Dac: A multisig wallet inactive for over three years, likely an early team member or ICO purchaser. This account holds 7% and appears to be a diamond HODLer with no short-term sell pressure expected.

-

0xA7595226298A0089E744A9bF39a22Cc7F3510C7c: An ICO purchaser holding 7.6% of the supply, with no movements since acquisition. It could indicate either lost private keys or a committed long-term holder.

-

Gnosis Bridge (0x88ad09518695c6c3712AC10a214bE5109a655671): Holds 6% of bridged PNK supply.

-

0xc6d63A94B556239ccDe8905129032Dcd8627e079: Recently unstaked from the court but hasn’t sold, holding 4.3% of the supply.

-

0x6C71eDE669516cDa94A265cC91267D2dA1BFEe36: A $LINK and $PNK holder with minimal activity. Holds 3.2% of supply.

-

0x94826AECa3b27e46E5b8b64Ec5FDCa5c647DD5c3: A definition of an OG and Diamond Hand. An ICO participant with no activity since acquisition. Holds 3.2% of supply.

-

0x930c54fD12Bc507DE14ce3967E715e6D9cD70ec4: An active juror holding 3% of supply and appears to be a long-term holder.

-

0x5157C43DC0bfE6019fa1111B2177Ec152c865783: A long-term holder with 2.5% of supply, though not a juror.

-

0x849D52316331967b6fF1198e5E32A0eB168D039d: A Gnosis wallet holding 2.5%, aligned long-term with the project.

Some comparison with other DAOs:

-

Uniswap: Top 10 holders own 52%.

-

Maker: Top 10 holders own 41%.

-

Lido: Top 10 holders own 53%.

-

UMA: Top 10 holders own 75%

-

AAVE: Top 10 holders own 54%.

But how is possible that a huge amount of demand comes from new jurors and integrations?

The answer is Kleros Enterprise, but let me add some personal context before explaining why;

I used to analyze stocks when I was in high school and first years of Uni (before I spent all my time researching how DEXs and CDPs works and all that lovely rabbit hole called crypto) …so I tried to do that for my favourite crypto projects:

Started thinking about Discounted Cash Flow estimations for Ethereum and Ether and for PNK on Kleros….but in crypto nobody cares about fundamentals or real utility so far it seems;

Celestia’s token, TIA worths 7.5b while they generate 1k per day for example or any memecoin you can find around there…though, I really feel that sentiment might shift now ..starting with DeFi tokens renaiance…but that’s topic for another post.

Today, a DCF analysis for Kleros doesn’t show strong numbers as I wish: Web3 use cases haven’t yet reached the scale required to generate the volume of cases we need, and the Ethereum ecosystem still faces significant challenges around scalability, Account Abstraction, and other core features. These innovations, which I believe will enable seamless blockchain usage (even for people who don’t realize they’re using blockchain), are still some years away to be enabled 100% seamlessly to retail.

But Kleros Enterprise already closes that gap and any Web2 company can take advantage of it:

We can provide those benefits without normal people even knowing and companies and governments being happy; more than 50 cases in Lemon and multiple cases with Mendoza or soon the biggest insurance company in Mexico are a good proof of it.

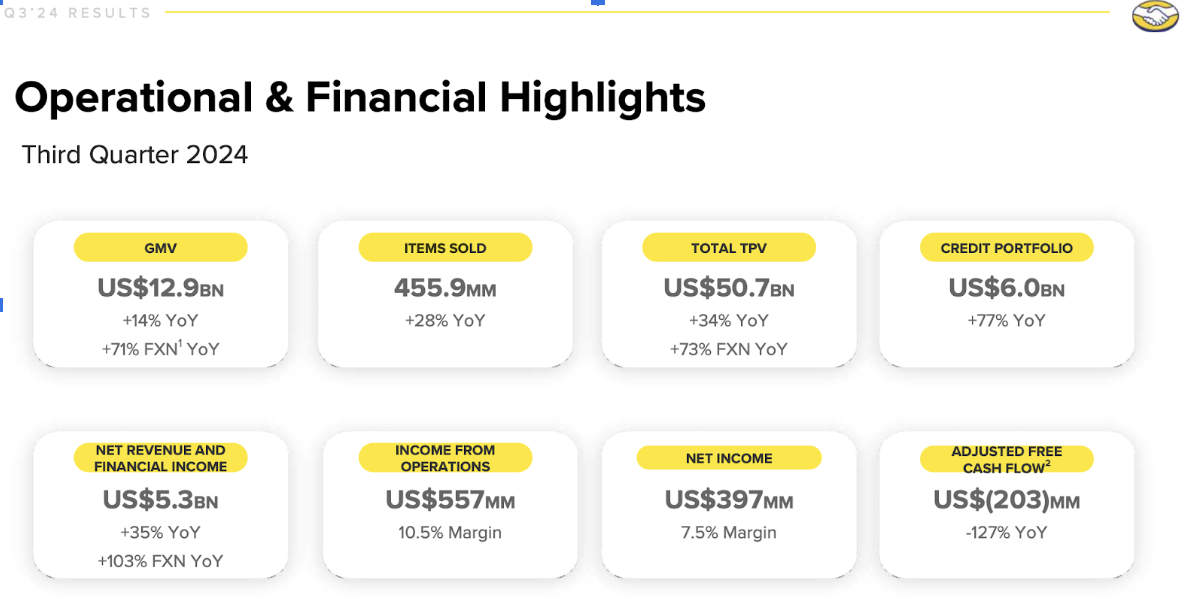

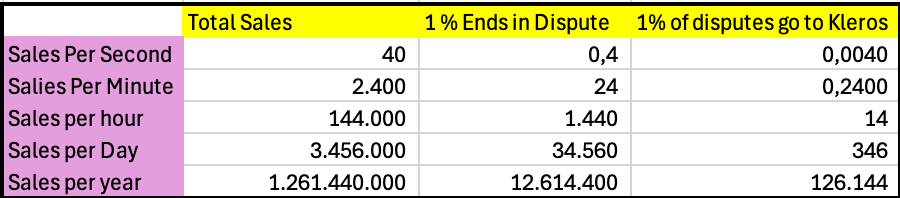

Let’s imagine for a moment that Mercado Libre (Amazon in Latam) does integrate Kleros to be able to provide their users a credible neutral third party that has no conflicts of interest on their purchasers, implies less cots and is faster:

According to the 2023 Balance Sheet report, Mercado Libre (Amazon in Latam) had around 40 sales per second . Let’s assume that only 1% of those ends In some sort of dispute or complaint from the customer(estimated 3–5%)….and let’s assume also that from than 1%, only the 1% of those goes to Kleros;

That would mean that if there are 40 purchases per second on average, Mercado Libre concretes 1.26m sales per year and that translates into 14 disputes per hour and almost 126,000 disputes per year … .only coming from 1 single company!

It wouldn’t surprise me that the demand for PNK price increase as never before if only a fraction of that comes true… .it could be possible only with all the traditional lawyers that might be interested to win a piece of that cake (cases) and it even mentions VC funds looking into the Ethereum ecosystem and looking to play strategic bets backed by governmental drivers.

Fintech companies like Lemon, Insurance companies (already testing), and goverments have already shown interest on it…

And beyond Kleros Enterprise, there are many drivers of usecases that might bring more disputes from Companies using Kleros that launched recently or will launch in 2025:

- Prediction Markets

Seer is the next-gen prediction marketplace. Launched in Q4 2024, Seer portrays itself as the main Polymarket long term competitor, with multiple more design mechanisms options and usecases like Futarchy while solving problems Polymarket is struggling with right now by using Kleros

- Finance

Lagoon aims to redefine asset Management for the on-chain era by buidling Vault infrastructure for Asset managers, DAOs, DeFi protocols and Market makers.They might use Vault Kleros for having a more robust governance infrastrucutre. Expected to be live in Q1/12 2025.

DAMM: Another amazing project (Disclaimer: They are my friends so take it with an inch of salt) which will enable anyone to access top-tier stablecoin strategies with very low risk. Expected to be live in Q1 2024.

Neokoros: Stay Tunned….but soon anyone will be able to ape into Kleros Strategies in the most capital efficient way for Institutions, DAOs and retails users. DAMM and Lagoon may or may not be part of this ;)

- Restaking

Eigen Layer, Symbiotic, Karak, Nektar, Babylon, Kernel…and the list goes on; Restaking industry have growned exponentially, reaching 27b USD of Total Value Locked at the moment of writing….the problem is that most of them with need a subjective oracle to solve medium value disputes and there is no best option thatn using Kleros….specially once V2 goes from Beta to Mainnet.

- Insurance

Athena is a non-custodial liquidity protocol that allows users to participate either as liquidity providers or cover seekers….and Kleros is the tool they will use to solve disputes on claims

Safu: Can’t give much info on this yet but I am building insurance infrastructure that aims to disrpute insurance platforms we have seen so far as well as Restaking. More info Soon…and I will likely need Kleros :)

- Identity

Proof Of Humanity V2 is live on Gnosis Chain and Ethereum. Launched in late 2024, PoH is a Sybil-resistant registry of Humans using social verification; V1 got a lot of traction, and V2 aims to solve many of the problems V1 faced, starting with the cost of creating your profile and focusing mostly on the infra layer around secure and verifiable identity.

- Curation

There are many usecases aroud curation, so let’s portray an example:

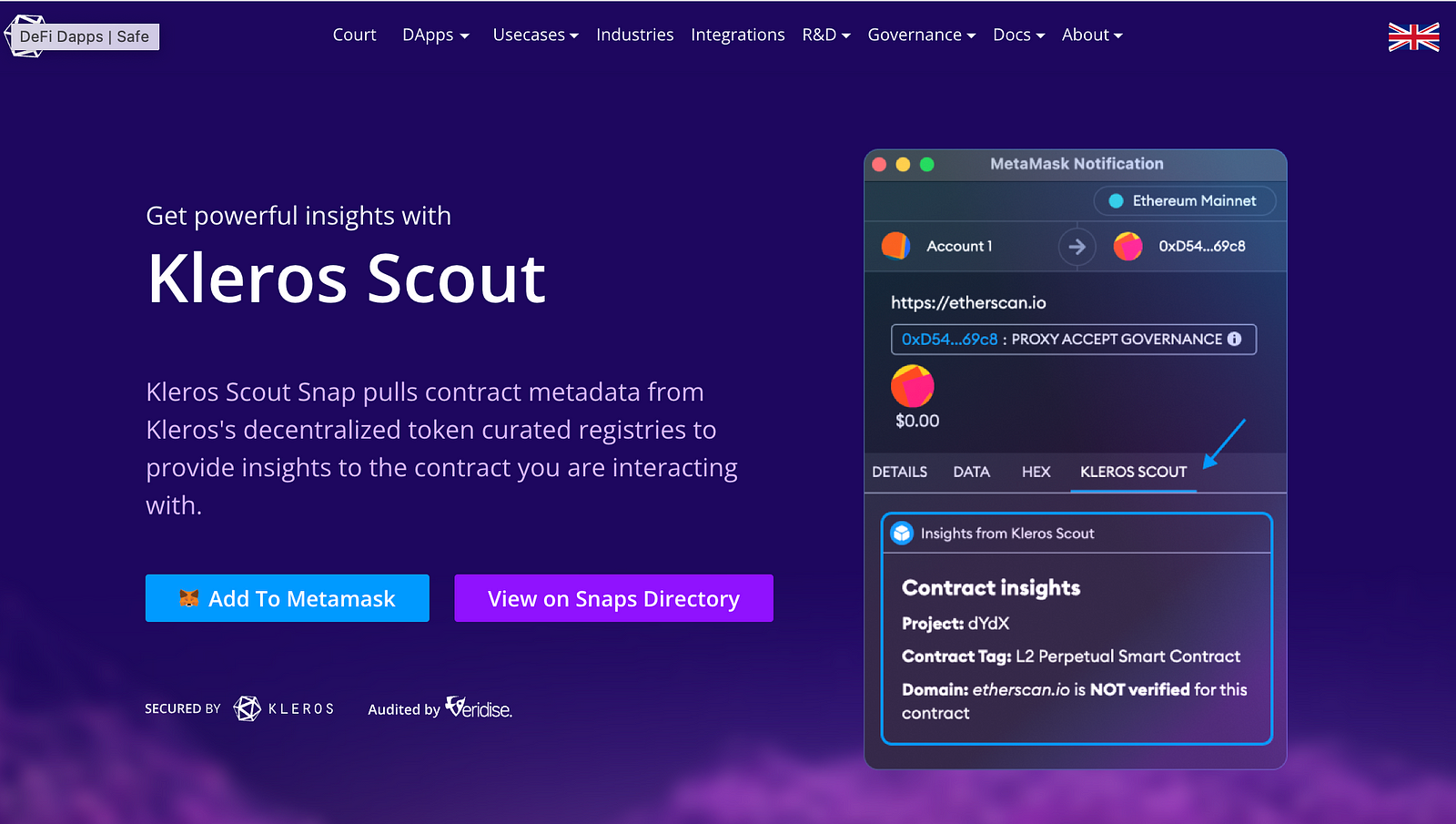

Kleros Scout is the first Snap on Metamask that supports Signature Insights. It decodes the content of signature requests and identifies the addresses of any contracts you may be authorizing in the signature via Kleros’s decentralized token curated registries. It can then warn you if the contract you are interacting with is malicious. Is also used by Ledger and on Token Curated Registries

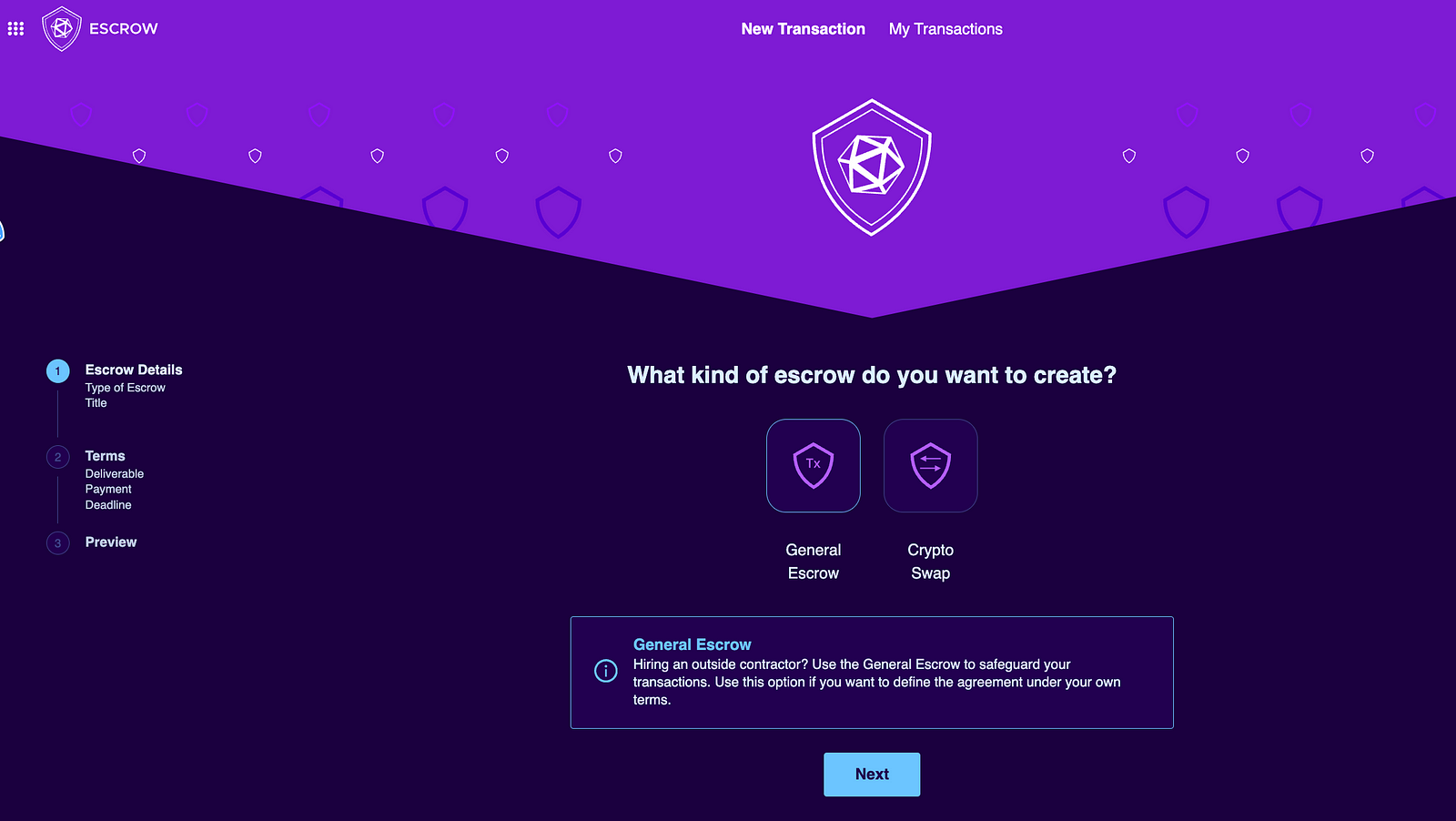

- Escrow

Kleros escrow is the classic example of why Kleros is useful and our V2 Version with a new interface and 99% lower costs than V1 should enable much more builders to rely on Kleros for any sort of transactions…From P2P platforms like Paydece to global marketplaces and MM deals..the possiblites are also endless.

- Governance

As 1inch and Shutter, many DAOs choose to rely on Kleros Snap to secure their DAO governance by integrating Kleros Court to enable optimistic decision-making aligned with your constitution.

- Sports

With some friends, we are building on our free time Fantasy Tier:

A decentralized fantasy gaming platform leveraging Kleros and Reality.eth for transparent oracles. It enables skill-based competitive play with real-dollar rewards, avoiding inflationary tokens as reward and minimizing gambling risks. It is designed to empower players by promoting smarter saving and financial inclusion, particularly in underdeveloped countries without them even noticing.

If you want to take advantage of this or any other use-case, do reach this guy, he is pretty awesome!

Some Ideas

Now, let me now share some of the long-term use cases that make me most bullish about Kleros. Some are close to become true while others are a more personal will and belief but we might not see them in the short term future:

- Kleros fixing transit fine disputes

One of the coolest use cases I see for Kleros is helping urban governments handle transit fine disputes. Imagine this: you get a traffic fine you think is unfair. Instead of wasting time at some government office, you open their app, click a button, and raise a case with Kleros.

Here’s how it works: the government adopts Kleros’ Recognition of Jurisdiction (RoJ), meaning whatever Kleros decides is binding. If the jurors rule in your favor, the government cancels your fine, gives you back your deposit, and even compensates you for the hassle. If you lose, you forfeit a small bond and still have to pay the fine — but at least you’ll know exactly why you lost, with a detailed explanation from jurors.

To make this fair, you’d need to deposit a small bond (in your local currency, so no need to understand crypto) when you challenge the fine. Behind the scenes, it’s converted into stablecoins, and the government keeps a bond on Kleros too, to ensure compensation is covered for cases they lose. This system discourages frivolous complaints while giving people an easy, fair way to fight unjust fines.

The whole thing happens on your phone. You don’t even have to get off your couch, and the process is fast, transparent, and completely unbiased. Governments save time and resources, and citizens avoid bureaucratic nightmares.

This system creates a balance: people are less likely to complain unless they truly believe they’re right, and governments can focus on more important things while Kleros handles the disputes.

- Kleros & eSports

It’s no secret that Federico, a gaming enthusiast, has been exploring this industry for quite some time. In fact, last year we had numerous discussions about it and made significant advancements. For example, we participated in a World Intellectual Property Organization (WIPO) webinar where we talked about how Kleros could play a crucial role in addressing challenges in the gaming industry.

Kleros has the potential to become one of the best long-term solutions for resolving issues like cheating, bots, and content curation in gaming — a rapidly growing industry projected to be worth approximately $244 billion

- Kleros in Top University programs

Kleros becoming a core part of top programs in leading law schools and PhD curricula worldwide isn’t just a prediction — it’s something already happening. Institutions like Stanford, Oxford, and universities in France and Italy have seen Kleros represented through researchers conducting PhDs on Kleros or theses focused on its system.

I believe it’s only a matter of time before Kleros is officially integrated into the programs of the most prestigious universities globally. Students everywhere will learn about Kleros as a prime example of how legal innovation can create significant value for businesses and governments by leveraging blockchain technology.

This will not only highlight Kleros as a leader in legal-tech but also serve to demonstrate how blockchain is far more than just a tool for financial speculation — it’s a transformative technology with real-world applications that drive efficiency and fairness in entirely new ways

- Airlines

I’ll be honest: I don’t see this happening in the near future, but it absolutely should. The worst experiences I had in 2024 as a paying customer were both with airlines — specifically Flybondi and American Airlines.

Right now, I’m finishing this piece at the Dallas Airport, and I’ve never been so furious. If I had the option to raise a proper claim and not rely on sending an email to American Airlines’ black hole of customer service, it would make life so much easier — for all of us. Airlines could position themselves as offering a completely fair and transparent system, operating under clear rules, and it would build a lot more trust with their customers.

I’m pretty convinced that more than 60% of the people on this plane today will never fly with American Airlines again after the experience we’ve all had. Neither will I. This is exactly what I call the Lemon effect — companies lose customers, not because of the service they provide, but because of their inability to handle disputes and retain trust.

A solution like Kleros could fix this, benefiting both airlines and their passengers in ways that should be obvious.

- Kleros in Fiverr

I don’t use Fiverr, so I can’t say for sure if there are frequent conflicts between contractors and employers, but I mention it because it perfectly represents the freelance industry.

I envision Kleros escrow being integrated into freelancing and P2P platforms. With proper implementation (leveraging Account Abstraction, a single juror, and a two-day resolution time), these platforms could attract and retain significantly more users than their competitors, offering a streamlined and fair dispute resolution process.

- Liquid Funds and Traditional VCs (not exactly a “usecase”)

I don’t expect many crypto VCs to add PNK to their portfolios. They tend to focus on new tokens designed to drive short-term speculation and allow them to enter at heavily discounted prices.

However, I do believe traditional VCs, especially those with a strong intersection of expertise in law, will analyze Kleros and consider adding PNK to their portfolios. For these VCs, it’s not just about gaining long-term exposure to PNK and the niche of legal dispute resolution on blockchain. They could also loan PNK to the legal teams of the other companies they’ve invested in, showcasing how Kleros works and why it’s valuable.

This creates a virtuous flywheel effect: the more companies using Kleros, the more demand for PNK, driving up its value and benefiting both the ecosystem and the investors’ portfolios.

- Goverments

If more governments take the time to analyze Kleros and explore replicating what Mendoza, Argentina is doing, they’ll likely reach the same conclusion: the opportunity cost of not using Kleros as a tool for their citizens is extremely high.

There’s no rational reason not to run pilot cases and at least try it out. The worst-case scenario? They’re not happy with the results and decide not to move forward. Plus, governments don’t even need to spend money during the first three months. Thanks to Kleros’ large treasury, we cover all arbitration fees (which go directly to the jurors, as Kleros has no control over those funds), ensuring a frictionless testing process.

Once they realize it’s a no-brainer, governments might also conclude that buying PNK as a strategic reserve for their judicial systems could be a smart move. Even allocating a small portion of their annual budget — say, 0.5% — could have a massive impact on PNK’s price while being negligible for them. To put it into perspective, this amount might only be equivalent to a few government salaries, which they’d save anyway by relying on Kleros.

The result? Governments improve their judicial efficiency while making a forward-looking investment in a groundbreaking technology. It’s a win-win scenario.

Conclusion

Blockchain and game theory are already disrupting existing ODR (Online Dispute Resolution) systems, translating benefits to retail users who may not even realize it.

As we approach the end of 2024, the landscape for Kleros could hardly be more promising:

-

Crypto-friendly leadership: Countries like Argentina and the U.S., both with significant crypto user bases, are led by policymakers who actively support blockchain technology and are committed to empowering builders in this industry.

-

Kleros Enterprise success: The success of Kleros Enterprise continues to grow, with more entities expressing interest in adopting its innovative dispute resolution system (kudos to Marcos and Facu specially).

-

Kleros V2 launch: After more than 2.5 years of research and development, Kleros V2 has been launched (currently in Beta). This upgrade is game-changer for the protocol: enhanced composability, expanded use cases, and significant cost reductions. (congrats to all the Dev team, specially JB)

My thesis is that there is an assymetric upside oportunity on PNK; If we achieve to reach mainstream volumes of disputes thanks to Kleros Enterprise integrations, this should be the dip of the dips for PNK.

If this post wasn’t long enough, feel free to dive into Federico’s 2024 Project update here.

Disclaimer 1: I strongly reccommend NOT to put money that you are not willing to loose; PNK is extremely volatile, more than others more established crypto assets like ETH or BTC. If you don’t feel comfortable with the risks that this investment implies, the best option is to invest in Kleros by educating yourself about the system , participating on our Telegram channel and Fellowships programs

Disclaimer 2: For full transparency, I currently hold $15,000–$25,000 worth of PNK at a price of $0.0225, which means that it is likely that none level of appreciation of PNK/ETH terms will bring me generational wealth (aka I really trust in Kleros long term added value to the digital economy in which we live today).