Abstract

FraxBP is Frax Protocol’s endeavour to create a basepool representation of Frax on Curve. It has the strategic value to enable FRAX liquidity for other protocols through deploying FraxBP metapools, providing a direct path to inject FRAX liquidity without being exposed to DAI and USDT. Further more FraxBP levers up the total basepool liquidity, and increased money supply of FRAX. With a better bribe efficiency than the classic 3CRV metapool, FraxBP has acquired 27 metapools deployment in merely 7 months since the launch in June 2022.

Background

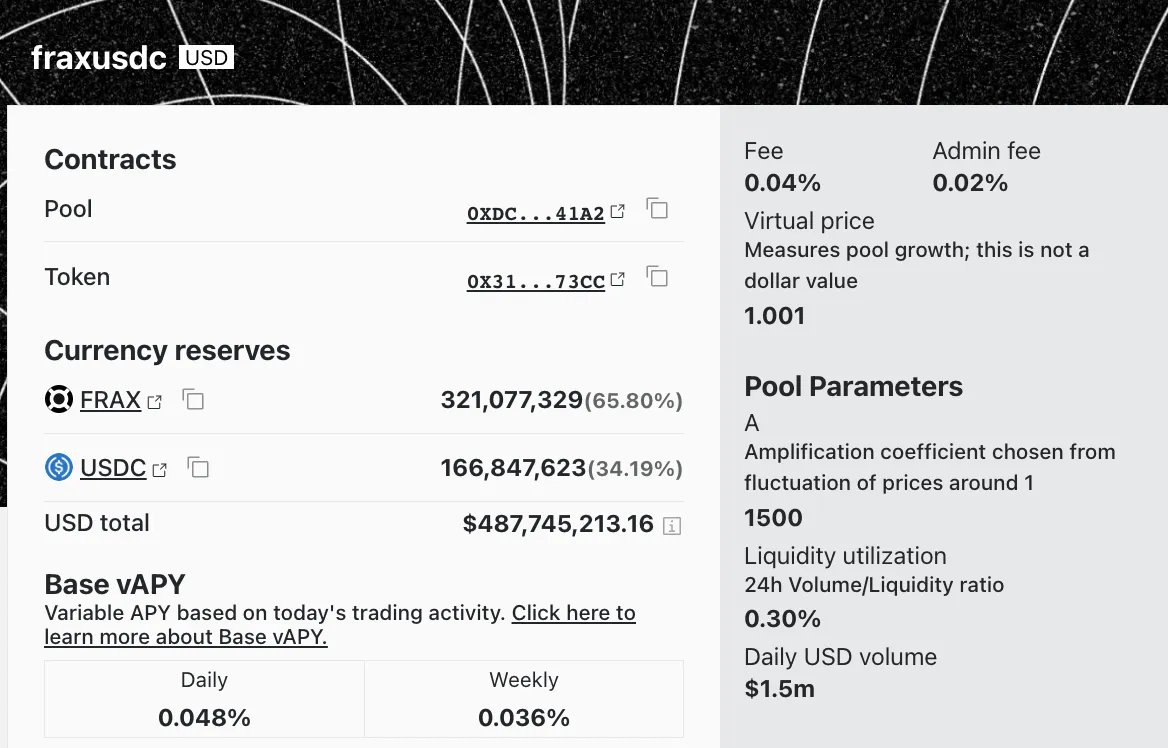

FraxBasePool(FraxBP) is a base pool token on Curve that is an alternative to 3CRV. FraxBP consists of only FRAX and USDC, while 3CRV consists of DAI, USDC and USDT.

FraxBP is deployed on mainnet in June 2022, as the second base pool token in addition to 3CRV on Curve Finance.

Motivation:

1. Bootstrap liquidity by enabling partnership with smaller protocols

Before having FraxBP, the only available Curve stableswap pair with FRAX was FRAX / 3CRV. With the new FraxBP as the base pool asset, there are more variations of DIRECT stable and risky-asset pairs that are made possible. Further, FRAX team was committed to recycling their share of Curve bribe back to whatever new FraxBP metapools. In the original forum post on Curve, Sam Kazemian, the founder of FRAX protocol suggested that the Frax team would allocate their Curve bribe generated from the demand for FraxBP back to the corresponding metapool:

This is made possible since the CurveAMO from Frax would mint FRAX into the base pool to create the additional supply needed for a particular new metapool. The additional supply would never be redeemed to USDC and only sits on the “balance sheet”; and would be burnt when later on the curve pool receives the excess FraxBP back. Meanwhile, the AMO would receives a considerable part of the Curve bribe (CRV + CVX) which the FRAX team is committed to re-invest back to that particular pool.

2. Circumvent Exposure to DAI and USDT.

In the underlying mechanism, FRAX is minted by providing a fractional amount of USDC, coupled with FXS on a dynamic ratio, to mint the equivalent amount of FRAX. The only stablecoin exposure is USDC under the hook. When Curve was launched in 2020, the only available base pool token was 3CRV. This creates an unavoidable pairing to 3CRV when FRAX needs external liquidity to facilitate inter-protocol exchange of value at that time. However the choice of 3CRV / FRAX also leads to additional exposure on USDT and DAI, in addition to USDC. Over the year, DAI has increased exposure to various underlying assets in its Peg Stability Module(PSM). You can refer to the initial governance vote (MIP29) on makerDAO forum to understand the detail and motivation of PSM. What it means is that DAI has taken small, but many assets’ risk.

At the same time, USDT has undergone multiple times of major de-peg. There are also concerns that Tether have not fully disclosed their treasury exposure, nor verifying that they have sufficient liquid assets to back up the circulating USDT.

Therefore creating FraxBP that only pairs with USDC, could provide a more direct pathway for liquidity providers that are concerned about the risk of DAI and USDT.

Rapid Development since Launch

As of now (Jan 2023), FraxBP has been paired with 16 stablecoins as well as 11 risky assets, totalling 27 pairs on Curve since its deployment on June 2022. It has diversified the liquidity that once clustered in FRAX/3CRV to both FRAX/3CRV and FRAX/USDC respectively, and hence using the derived FraxBP to further provide liquidity leverage to the many more curve pools.

Comparison with 3CRV as a BasePool

Currently, FraxBP has 20% less liquidity than 3CRV, but 50% higher bribe APY, but virtually no swapping reward from the base fee.

What this implies, while the FRAX team is proactively bribing for the base pool (with the aim to make it as attractive as joining 3CRV), the current total APR is not significantly more attractive than 3CRV.

Comparison with FRAX/3CRV

FRAX/3CRV has 30% higher APR since it takes additional exposure to DAI & USDT. The size of liquidity is comparable.

Balance-wise, FraxBP has a slightly higher ratio of FRAX (65%) versus Frax/3CV (61%), while FraxBP and Frax/3CRV both have a relatively high amplification factor (1500) to tolerate a small swapping slippage in an imbalanced pool.

Risk Taking Implication

-

DAI & USDC & USDT => 3CRV

-

USDC & *FXS => FRAX, FraxBP

-

DAI & USDC & USDT & FXS => Frax/3CRV

-

USDC & FXS & X(custom) => FraxBP/X

*FRAX / FraxBP is not directly exposed to the price of FXS; but if FXS gets free-minted to infinity, then essentially the peg of FRAX and FraxBP could NOT be maintained. (due to the design mechanism of FRAX)

Liquidity Leverage and Money Supply

Imagine u have 1 USDC:

You let the USDC sit in your wallet. The blockchain world has 1 dollar.

What a stablecoin protocol likes Frax does: It creates a liquidity leverage:

=> You put the USDC into Frax (neglect the technicality during mint for now), you get 1 FRAX. And Frax protocol has your USDC. Frax would deploy your USDC to somewhere for yield generation, while you can deploy your FRAX to a FRAX/X metapool. The blockchain world has 2 dollars now.

With the addition of FraxBP (FraxUSDC pool)

=> You put the USDC into Frax to get 1 FRAX. And Frax protocol has your USDC. Frax would deploy your USDC to somewhere for yield generation.

=> You put your FRAX into FraxUSDC to get 1 FraxBP, and then you put your FraxBP into a FraxBP/X metapool for yield generation. Frax Treasury has your USDC. FraxUSDC has your FRAX; and the FraxBP/X pool has your FraxBP.

The blockchain has 3 dollars now.

This is why FraxBP has the strategic value to leverage 50% more money supply from the previous scenario.

Curve Bribe Retention

As a protocol, let’s say you would like to create a Curve metapool to supply liquidity for your native token (be it stablecoin or risky governance token) by pairing it with 3CRV.

To incentivise liquidity providers to join your pool, you can choose to provide “bribe” for veCRV voters to vote for your pool such that the liquidity providers of your pool can receive more CRV emission, effectively having a higher APR.

However there are two caveats:

-

CRV would inflate. It means that the impact of bribing for 1 veCRV vote would decrease gradually over time. You either have to increase the number of veCRV to bribe, or tolerate a reduced CRV emission.

-

Usually liquidity providers are not loyal. As soon as the APR in your pool drops out of the relative yield of other pools, they would hop to other liquidity pools, hurting the price stability of your native tokens.

In light of this, what Sam said in the original FraxBP proposal specifies how FraxBP would help to address these two problems:

-

When you create a FraxBP metapool with your native token, Frax protocol would help to provide the necessary FraxBP to pair with it (on the stablecoin scenario, probably be case-by-case for a risky asset), by minting FRAX from the CurveAMO into FraxUSDC and sending the FraxBP to the designated metapool.

-

With 1.), Frax Protocol is now one of the liquidity providers for your metapool, and receiving CRV and CVX bribe. Frax protocol would then utilize these CRV and CVX farmed to continue “bribing” or “voting” for your pool next time.

What this implies:

-

Less resources to maintain a stable peg, since Frax Protocol would provide some liquidity for pairing.

-

Your Curve bribe creates a recurring impact, effectively mitigating the effect of CRV inflation.

-

higher price stability, as the Frax AMO would not withdraw liquidity as a result of reduced APR but would only do it for a price rebalance.

Summary

FraxBP is a strategic play by Frax protocol to retain liquidity and establish more partnership. It smartly plays the Curve game and provides a win-win situation for other protocols to integrate. With 6 months in mainnet, It has rapidly led to the creation of 27 pools.

Appendix

Initial Post of FraxBP on Curve Forum:

https://gov.curve.fi/t/deploy-a-fraxbp-pool-whitelist-frax-for-vecrv-staking/3958

Incentive Strategy to bootstrap liquidity:

https://snapshot.org/#/frax.eth/proposal/0xd4cda7880b314cadc8cb3960aeefa25770c736dcb23af591d329a2ddbcfed345

FRAX protocol DAO actions Overview:

https://messari.io/dao/frax-finance-governance/proposals