If you are not new to the DeFi world, then the stablecoin madness surely hits home. You might have escaped the crash of Terra USD, but I'd bet you got hit by the USDC temporary de-peg following the Silicon Valley bank crash. But the fun doesn't stop there.

The SEC has been playing a good old game of tug of war with Paxos, the issuer of USDT. It's like they can't make up their minds about how to regulate these stablecoins. One minute they're all for it, and the next, they're causing chaos.

When you take your gaze away from all this chaos, reality stares at you. The fact that we may never break away from the shackles of centralization. A quick look at Coingecko's stablecoins table reveals that 9 of the top 10 stablecoins are pegged to the good old US dollar.

Should this not be a significant concern for DeFi aficionados who do not want to sit around twiddling their thumbs while inflation eats away at their USD-pegged assets?

That's why a new approach is needed—the ISC approach.

What is ISC?

International Stable Currency, or ISC for short, is a type of stablecoin designed to grow in value over time.

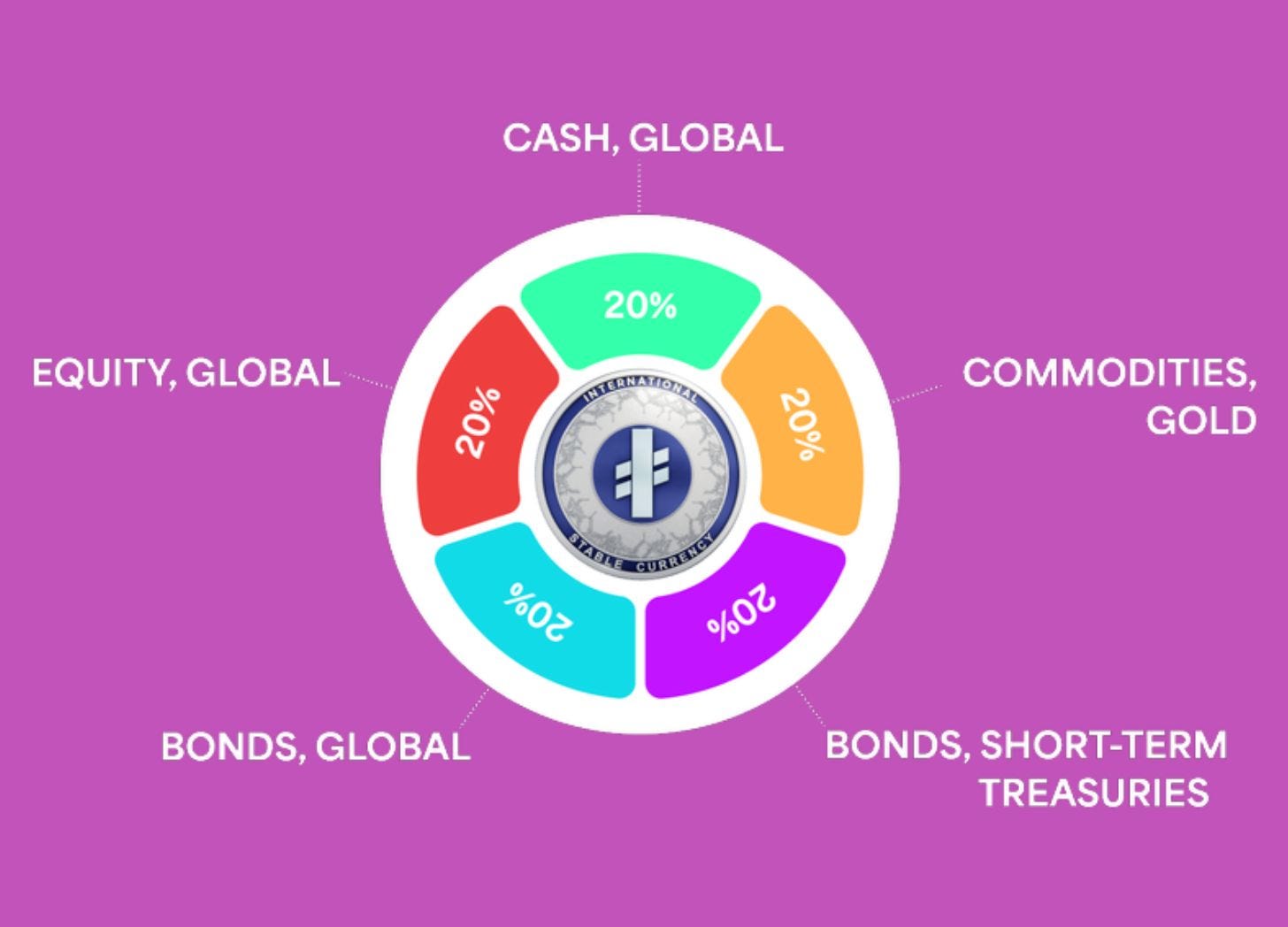

Unlike most other stablecoin, ISC is not tied to the US dollar. Instead, it is backed by different financial assets such as commodities (gold, oil), bonds, and equity (owning a piece of a company).

It is a global currency that can be used for any transaction. It is also designed not to lose its value over time.

But what's the science behind ISC?

Backstory to ISC

The primary reason ISC was created was to serve as an inflation-resistance crypto hard money that does not lose value.

But what does crypto hard money mean?

Let's take a quick puzzle-solving adventurous trip.

On this adventurous trip, you'll solve a puzzle. Let's call the puzzle - Crypto Hard money.

The Crypto Hard Money Puzzle

As you enter this mysterious world, your first quest is the Fiat system.

Ever played Monopoly? If you have, you know that everyone agrees that colorful paper bills can be used to buy properties and pay rent.

The same rule applies to fiat. It is a piece of paper with no intrinsic value (i.e., not backed by any commodity) but still accepted as a means of exchange because the government says it is.

Fiat money is the currency you use in your everyday life, such as dollars, euros, or the Japanese yen.

But the fiat system has its fair share of flaws.

A means of exchange because the government says it is.

Flaws of Fiat Money

The first enigma with fiat is the issue of centralization. Power over money is concentrated in the hands of a few big players. It is a game where the referee has ultimate control. Oh, isn't that good? No, it is not. You never know what happens behind closed doors, as there is barely any transparency or accountability.

Next, you face the challenge of working hard and earning cash, but suddenly, boom! Prices skyrocket, and your purchasing power dwindles.

Now you are left wondering if you should give up on life or move to a tiny island with no economy.

But it doesn't stop there. You get recurring migraines while trying to send money to your family in another country. It feels like navigating a maze of complicated processes and mind-boggling fees.

With all of these flaws, stablecoins stepped into the puzzle. Oh, bless our new shiny savior swooping in to save the day with their promise of stability and decentralization.

Stablecoins

There are four common types of stablecoins, but for the sake of our puzzle, we'll focus on two: dollar-backed stablecoin and algorithmic stablecoin.

The dollar-backed stablecoin is like a clever magician that makes you believe you're still dealing with the US dollar (or any other traditional money), even in the cryptocurrency realm. Its value aligns with the dollar's value, thanks to holding reserves of actual dollars in the bank.

Unlike the aforementioned, algorithmic stablecoin doesn't rely on traditional fiat currency reserves. Instead, complex algorithms and smart contracts help maintain its stability.

Algorithmic stablecoins like Terra USD thought they had it figured out, but sadly their stability was as solid as a house of cards. One minute they were worth a dollar. The next, they were crashing down faster than a rollercoaster. I bet nobody signed up for the wildfire started by Do Kwon.

You may ask, 'Is dollar-backed stablecoin any better?' Well, not as much as you think.

Let's see some of the flaws of dollar-backed stablecoins.

Flaws of Dollar-backed Stablecoin

You see, stablecoins pegged to the US dollar are not immune to the inflationary pressures that the dollar faces. The Bureau of Labour Statistics noted that a dollar in 2022 can only buy 92.6 per cent of what it could buy on average in 2021. Imagine relying on a stablecoin as a haven only to watch its value shrink before your eyes like a slowly deflating balloon.

As if that is not enough, dollar-backed stablecoins are often issued by a centralized entity. How the issuer manages the funds in reserves can greatly affect the stablecoin's stability.

A few months ago, you watched how USDC depegged from the dollar after information revealed that they kept 8% of their reserves with Silicon Valley Bank.

The predominant business model of stablecoins does them no good. Stablecoins invest billions of dollars held in their reserve without any input from the community, keeping all the returns to themselves.

This model benefits only the issuers and not the holders (who take on the risk). It also incentivizes issuers to make riskier investments while keeping holders in the dark.

Despite all these challenges that envelop your adventurous trip, a breakthrough awaits.

It is now time to reveal the key that unlocks the secret of a perfect stablecoin. This puzzle-solving trip has led you to a new kind of stablecoin - a stablecoin that has learned from the mistakes of its predecessors.

International Stable Currency (ISC)

You've cracked the code and found the ultimate solution to the hard money puzzle: International Stable Currency (ISC). ISC is not your typical stablecoin hitching its wagon to the US dollar. It marches the beat of its drum as it is tied to a diverse basket of financial assets like commodities, bonds, and equity. These assets generate revenue, which makes ISC grow in value over time.

But wait, there's more! ISC has a superpower that shields it from the nasty effects of inflation. While other stablecoins lose value as the USD supply increases, ISC becomes an inflation-fighting warrior.

Things get cool as ISC puts the power in the hands of the community.

With the ISC governance token (IGT), token holders become part of the decision-making process. They get to decide the exact mix of assets in the reserve while watching its safety.

That said, let's talk more about the ISC governance community - The DAO

Supercharged IGT: Shaping ISC

IGT is the Decentralized Autonomous Organization (DAO) token of ISC. It's all about giving power to the people! And guess what? It's built on this excellent platform called Realms. Why Realms? Well, it's the DAO wizard that simplifies the whole proposal creation process.

Now, here's the kicker: as an IGT holder, you get to be a part of the action. You have the power to create proposals and cast your votes. It's like having a say in the fate of ISC (whatever that is!). Think of it as being a member of an exclusive club, where your opinions matter.

But why stop there? The ultimate goal is to decentralize ISC to the max. And that's where our trusty friend IGT comes in. It's like the Gandalf of the ISC ecosystem, guiding critical decisions and determining how ISC's Reserve gets allocated. Talk about a VIP token!

Let's talk about the exciting world of IGT voting rights.

IGT Voting Rights

These voting rights give you a golden ticket to decide on essential matters.

Let's give you a taste of what you can vote on, but remember that this is just a teaser. There's a whole buffet of options out there, so buckle up!

Like a master chef who decides the ingredients that go into the secret sauce, you get to shape the exact composition of the underlying basket of assets.

Next, we have the prestigious role of electing an ISC Community Auditor. It's like choosing the Sherlock Holmes of the ISC world, someone who will keep things in check and ensure everything runs smoothly.

Feeling a little adventurous? Then, play the financial superior as you vote to recall ISC loans from an ISC Reserve.

But wait, there's more! You also have a say in the ISC Reserves' Incentive Structure. And also on the ISC Issuer Interest Rate.

Last but not least, there are grant proposals. It's like being a genie, granting wishes to deserving projects and ideas.

And there you have it! These voting rights are just a sneak peek into the world of possibilities. So, grab your popcorn, get comfortable, and get ready to cast your votes.

Why ISC DAO Leaves Tether and Circle in the Dust?

The ISC DAO shines a spotlight on the inner workings of the ecosystem. Transparency is the name of the game here. Unlike Tether and Circle, where a centralized authority behind closed doors makes decisions, ISC puts the power in the hands of the community.

ISC puts the power in the hands of the community

Trustworthiness is also a vital aspect of the ISC DAO. You see, with Tether and Circle, trust is placed in a single entity or authority. But with the ISC DAO, trust is distributed among the community.

Another reason the ISC DAO shines in the trust department is its ability to foster accountability. Decisions made within the DAO are recorded on the blockchain for everyone to see.

So join the ISC DAO and be part of a transparent and trustworthy ecosystem that's built for the people, by the people. Together, you can shape the future of finance and create a world where transparency and trust are the pillars of success.

You've waited long for this, and now it's here: ISC tokenomics

ISC Tokenomics

ISC has a total supply of 1 billion tokens, giving you plenty of opportunities to get involved and have a stake in the governance of ISC.

To promote widespread usage and acceptance of ISC, a large portion of IGT tokens will be distributed to ISC holders through an airdrop. Over the first 48 months after launching ISC, 5 million IGT tokens will be airdropped to ISC holders each month. The amount of IGT you receive will be proportional to the length of time and amount of ISC you hold. It's like getting a bonus for being part of the ISC community and actively participating in its growth. No complicated staking is required! You can freely spend and earn ISC without any hassle.

So, holders of IGT not only participate in the governance of ISC but also have the opportunity to earn rewards. These rewards add even more value to your IGT holdings.

Also, grants will be provided to fund third-party projects that contribute to the development of the ISC ecosystem. The community will have the power to approve or reject each grant proposal, ensuring that the funds are used in line with the community's vision for ISC.

ISC Lab will use its allocation to drive various internal initiatives, such as raising capital and hiring top talent. This ensures a strong foundation for the project, including technology development, strategic partnerships, and community engagement strategies.

To ensure long-term commitment, the IGT tokens allocated to the core contributors will be unlocked gradually over ten years. This approach encourages thoughtful decision-making and avoids any adverse effects of immediate token liquidity.

Burning IGT is a clever way to align the economic incentives of ISC and IGT, as 30% of the revenue generated by the ISC Issuer will be used to acquire IGT tokens from the market and burn them. As ISC's market capitalization grows, so does the burning power, resulting in a growth cycle and controlled token destruction.

IGT holders have no incentive to jeopardize ISC's long-term success. Adverse decisions affecting ISC's stability would likely result in decreased market capitalization and revenue available for burning IGT.

The potential for IGT to be extremely valuable is clear. It's a combination of active governance, scarcity, utility, and the overall success of ISC that positions IGT for greatness. Keep your eyes on this gem, and who knows, it might just unlock a world of value for those who hold it.

How to Get ISC Tokens and Own IGT

It's a simple process. Let's walk you through it.

-

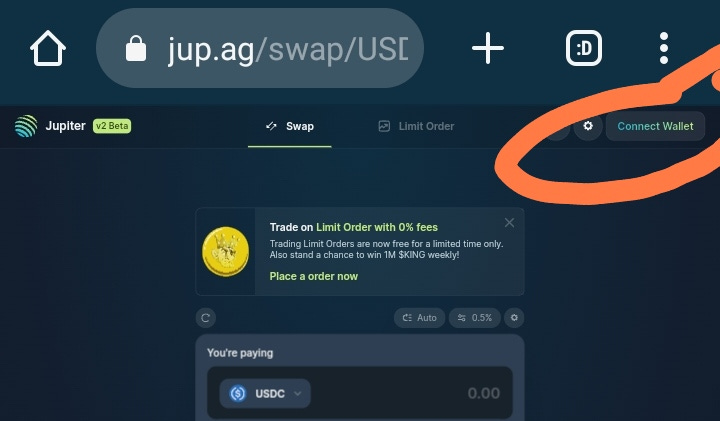

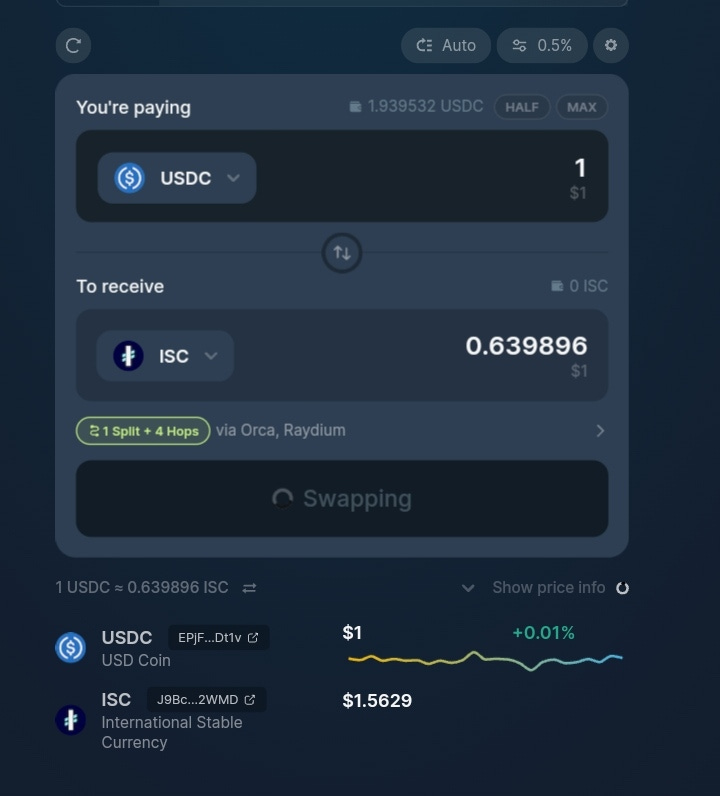

Visit Jupiter Swap

-

Connect Wallet (Phantom, Solflare, etc.)

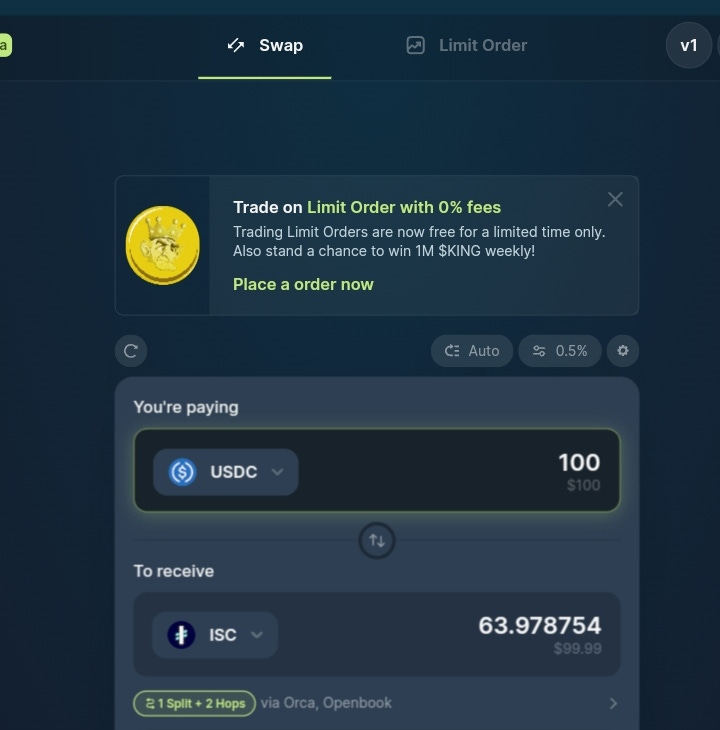

- Select USDC to ISC swap. Use this link here

-

Input the amount of USDC you want to swap for ISC

-

Click on Swap

-

Approve the transaction in your wallet

-

Receive ISC in your wallet

-

Hold and expect to receive IGT tokens soon

Key Takeaways

1. ISC offers a new approach to stablecoins as it is backed by diverse financial assets allowing it to grow in value over time.

2. Community participants will receive rewards; projects contributing to the development of the ISC ecosystem will get grants.

3. Holding IGT tokens positions individuals to benefit from active governance, scarcity, utility, and the overall success of ISC.

Wrapping Up

The journey into the world of ISC and IGT has been an enlightening one. As a writer passionate about DeFi, I am excited by the potential of ISC to redefine stability in the crypto space and provide a robust alternative to the all-too-common dollar-backed stablecoins.

The empowerment that IGT brings allowing individuals to participate in governance and actively shape ISC's future, is a testament to the power of decentralization and community-driven initiatives.

With transparency, trust, and financial empowerment at its core, ISC and IGT have the potential to pave the way for a more inclusive and prosperous economic future. As I embrace these novel concepts, I invite others to join me on this journey toward stability, governance, and financial empowerment.

What's Next?

Hey friend,

It's been over 2000 words getting here. You may wonder, “what’s next?”

First, join the ISC Stablecoin Telegram community today for exciting discussions, insights, and updates

Then, follow ISC on Twitter for real-time news and be part of the revolution.

Also, I tried to give you all you need to know about stablecoins, hard money, and International Stable Currency. But I could discuss how the ISC reserve works and issues such as its;

-

Monetary Philosophy

-

Implementation

-

Advanced Mechanics, and

-

Community Auditor

Not a cause for alarm, as you could get these information from the ISC whitepaper.

You can also learn more about ISC from:

Learn more about Stablecoins