Abstract

Carbon Credits Markets are on an initial point on an exponential demand curve which is facilitated by regulatory headwinds, increasing concern about environmental changes among the public and technological innovations in carbon removal techniques.

With Voluntary Carbon Markets currently valued at $1.7 billion are projected to grow to $35 billion by 2030 and $250 billion by 2050 according to MSCI, they provide a compelling investment opportunity with gigantic failed try of tokenization of Carbon Credits in 2021 web3 can still be the platform needed for this expansion but needs major reforms in the industry as a whole.

Introduction to DReCoN and ReFi

First things first, I’ll use DReCoN (Decentralized Resource Coordination Networks) instead of DePIN throughout the writing because in the end everything has a physical infra in the backend from Bitcoin having mining rigs to Ethereum Validators having a $1000 PC setup, same can be said about resource allocation too as money is the ultimate resource allocation tool ever invented but it sounds cool, furthermore I would like to categorize DReCoN in 2 broader categories

-

Internet Transmissible Resources which contains wireless networks, data and storage and data from sensor networks

-

Non- Internet Transmissible Resources which contains electricity, Vehicle Sharing, Carbon offsets, Waste & recycling, Water certificate sharing

Regenerative Finance is a sub category among DReCoN which encompasses both, ITR from data sharing and NITR from physical resource

ReFi includes the following sub categories

-

Energy including decentralized electricity grids, water certificates, battery sharing

-

Mobility and transport including car sharing, decentralized EV charging stations, car data sharing

-

Agriculture which includes sensors in agriculture for data sharing and efficient farming

-

Environmental and Sustainability Network which includes carbon offsets, decentralized waste management

You may ask, why DReCoN(prev. DePIN), isn’t it dead, wasn’t it all a VC low Float, high FDV scam?

The answer is omni-present in front of us all, this cycle is gonna be a TardFi cycle(RWA to a trillion $ , remember ETFs), all the stars are aligning towards it.

DReCoN(prev. DePIN)’s speciality as an Tardfi investment

-

It really has no knowledge boundations cause of the simplicity of it’s model compared to DeFi or RWA

-

Each network solves a real world problem which affects regular people directly, so good visibility

-

Physical resources are nearly limitless(in investing timeframes or our lifespan), so it’s an exponential market with no cap on Total Addressable Market

-

Less bitcoin dominated cause of different addressable market

-

Untapped areas are many with just the tip of iceberg being called DePIN

-

Thousand of L2’s having specific purpose is a silver lining possible through DePIN only as each type of data gathered may need specific type of schemas and algorithm for storage and processing which may need specific tuning of blockchain

So, for the ReFi Renaissance Starter, what other best place to start than Carbon Credits :), let’s jump right into them.

What are Carbon Credits?

Global Warming came to notice in the 1970-80s and all the contributors were named under a single umbrella named Greenhouse Gases, out of which around 75% of contribution came from CO2(Carbon dioxide) which came from burning of fuels.

At that time, developed countries with huge industries needed time for transition due to lack of technological advancements in renewable energy production compared to today and on the other side, there were developing countries which had vast amounts of natural resources such as forests which can naturally absorb Carbon.

Enter Kyoto Protocol(1997) - a global treaty where most of the countries agreed to reduce their Carbon Emissions, there someone said what if meanwhile the Industries are transitioning, we can somehow compensate for their Carbon emissions by a simple idea

-

If a company reduces CO₂ beyond its requirement, it earns carbon credits.

-

If a company emits more than allowed, it must buy credits from others.

But as Uncle Sam says, why do something when there is a cost involved?

The European Union Emissions Trading System (EU ETS) came rushing in and said there is a cap limit on maximum amount of Carbon Emissions a company can produce and beyond that they have to compensate for their emissions.

Some came forward and said “Yes, it is mother Earth we are taking from, so we serve it” like the cute capitalist that everyone likes would say and others had to do that either for public image, investor pressure or Government orders.(See Nash, sometime {co-op, co-op} is the equilibrium)

Evolution of Carbon Credit Markets

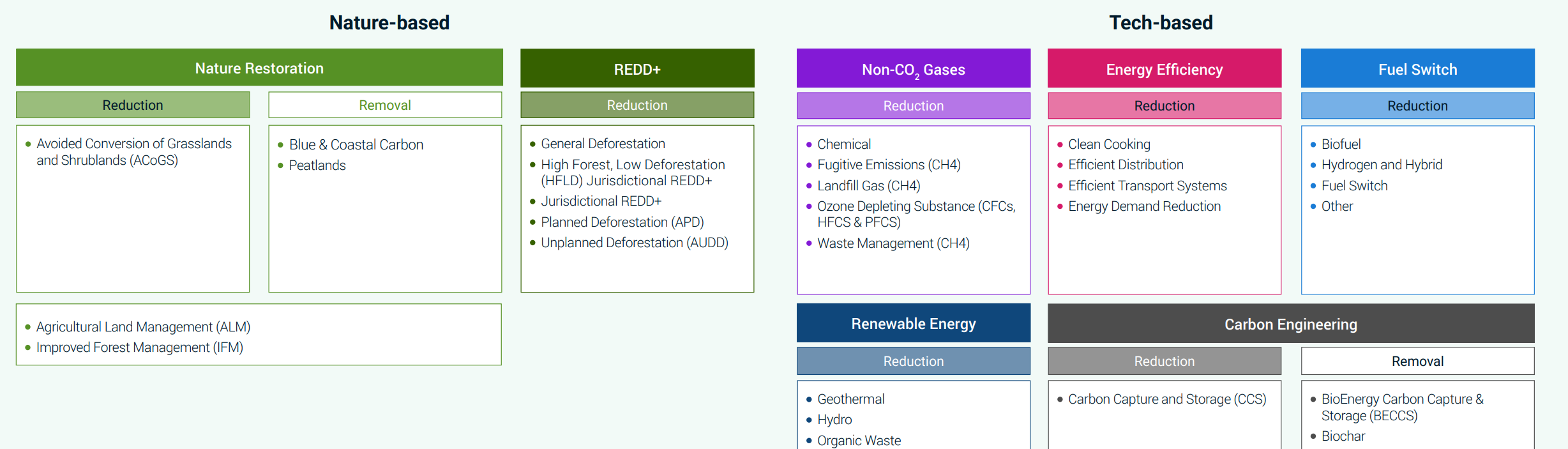

What started as simple forest restoration projects became much more because of the innovation in tech and slowly there were more ways to reduce Carbon emissions and way more rules and regulations around the trading of these credits.

Regulatory bodies, Registries, Standards began to form around Carbon Markets, all of which led to breakdown of market in 2 major parts

-

Compliance Carbon Markets(CCM)

-

Voluntary Carbon Markets(VCM)

CCM

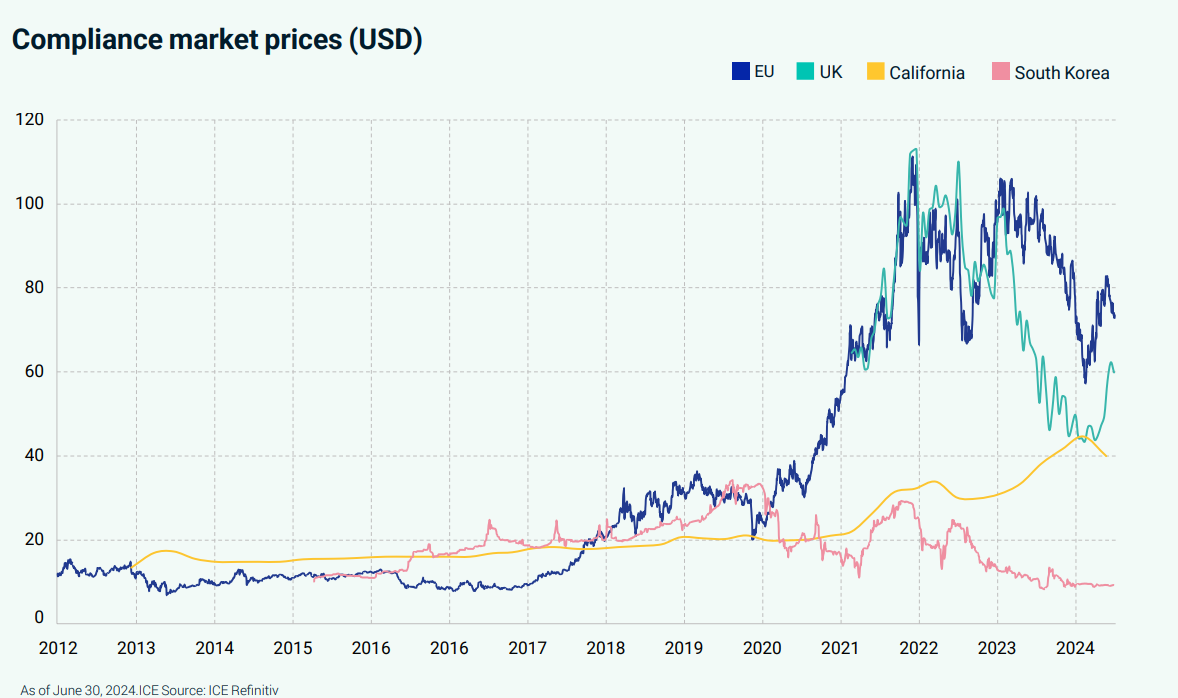

First came the Compliance Carbon Markets(also known as cap-and-trade market) with Kyoto Protocol which led to the establishment of the first and largest market named The European Union Emissions Trading System (EU ETS) in 2005, in EU ETS European countries were allowed to start buying carbon credits from other countries with multiple other regional markets also emerging in California, China and more.

In 2015 Paris Agreement replaced the Kyoto Protocol as the primary guidebook for international carbon credit trading through its Article 6 and introduced Nationally Determined Contributions(NDCs). It operates in 5 year cycles in which each country submits a NDC, the next phase will begin shortly in 2026.

CCM are regulated markets by government or international regulatory bodies like the EU Emissions Trading Scheme and are legally forced.

They are also referred to as cap-and-trade markets because there is a max cap of emission and above that trading of carbon credits come into play. These markets are fully dependent on government in which the company/industry is situated

In CCM, there is something called ETS(Emission Trading Scheme), which is basically a government permit which can be traded for carbon emission more than the cap, each allowing them to emit a specific amount (e.g., 1 tonne of CO₂ per allowance), these are specific to each country.

Some government-regulated market allows international trading via mutual agreement between 2 countries, some follow Paris Agreement Article 6 which acts a centralized entity for trading of carbon offsets between multiple countries

Example: Switzerland signed a deal with Peru to finance carbon reduction projects in Peru and count the offsets toward Switzerland’s climate targets.

Before going further in VCM, some terms to get familiar with these markets :-

Nationally Determined Contribution (NDC) under the Paris Agreement is a commitment by several countries, each country submits an NDC, which is its climate action plan to reduce greenhouse gas (GHG) emissions and adapt to climate change, it has a cycle of 5 years in which each country has to set their NDC for the next 5 years and the ultimate goal is to ensure global efforts to limit warming to 1.5°C–2°C by 2050.

Conditional NDCs depend on external support like finance or technology, while unconditional NDCs are firm commitments using a country's own resources.

Sold Carbon Credits – The number of credits that have been purchased by buyers.

Delivered Carbon Credits – The credits that have been transferred to the buyer and officially retired for offsetting emissions.

Corresponding Adjustments (CAs) are a mechanism to prevent double counting in carbon markets. They ensure that if a carbon credit is sold internationally, the host country adjusts its reported emissions reductions so that it doesn't count the same credit towards its own NDC.

Additionality means that a project is only being developed because it can sell carbon credits. If the project would have happened anyway without carbon credit revenue, then it is not additional—and the emission reductions are not real offsets.

SBTi - The Science Based Targets initiative (SBTi) is a corporate climate action organization that enables companies and financial institutions worldwide to play their part in combating the climate crisis.

CORSIA(Carbon Offsetting and Reduction Scheme for International Aviation) - the first global market-based measure for any sector, aiming to reduce emissions from international aviation in a harmonized way. Airlines must offset emissions above a CORSIA-set baseline, which is currently 85% of the average 2019 emissions along eligible routes. CORSIA affiliated Airlines are the biggest consumer of Voluntary Carbon Credits.

The Scope 1, 2, and 3 emissions framework was categorized by the Greenhouse Gas (GHG) Protocol, which was developed by the World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD) in 2001. It is widely accepted as the standard emission framework for companies who want to measure their carbon emissions.

Scope 1 - Direct emissions from owned/controlled sources

Scope 2 - Indirect emissions from purchased energy

Scope 3 - All other indirect emissions in the value chain

VCM

Voluntary Carbon Market is a government-unregulated market driven by corporates and NGOs seeking to achieve climate-related objectives. These are voluntary actions taken by organizations to reduce emissions. Organizations are mostly businesses, but they also include public entities, NGOs and even governments. Essentially this is a free market for Carbon Credit Trading.

So, who uses VCM, who uses CCM, who uses both, and why VCM over CCM in such a heavily government regulated market?

CCM heavily regulates only a few industries(power, heavy industry, aviation, etc.) which trade mostly in ETS but firms outside of the regulated sector(tech, retail, finance) which comprises most of the Stock Market Indexes buy Carbon Credits from CCM cause of following reasons :-

-

It limits their exposure in the future to higher future fossil-fuel prices or policy interventions such as carbon taxes or climate-related regulation.

-

Voluntary climate action can improve an organization’s reputation — an issue to which many companies are paying increasing attention

-

attract ESG-conscious investors

-

It includes diverse projects (reforestation, blue carbon, direct air capture, regenerative agriculture) which CCM does not approves

CCM dominated VCM in terms of market size valuation with CCM valuation at 113.1 billion and VCM at 1.7 billion in 2024, this is due to the unregulated nature of VCM and no legal force on non-traditional corporations(other than energy industries) to reduce their carbon footprints.

Our Interest lies in Voluntary Carbon Markets because of its free nature which aligns with crypto markets and vast potential for venture investing.

Voluntary Markets are run by certification bodies, these bodies verify the offset projects, ensuring emissions reductions are real, measurable, and additional (i.e., they wouldn’t have happened without funding).

To date, the four main registries of Verra, Gold Standard, CAR(Climate Action Reserve) and ACR(American Carbon Registry), and some smaller registries, such as Plan Vivo and Puro.earth which issue more nascent carbon removal credits such as Biochar, Direct Air Capture and BioEnergy with Carbon Capture & Storage (BECCS) which sell at a very high premium often going up to 10-20x the normal price.

For Context

-

SBTi & ISSB push for high-integrity carbon credit use in corporate net-zero strategies.

-

Verra, Gold Standard, CAR, ACR issue voluntary carbon credits for corporate buyers.

-

ICVCM & VCMI ensure quality & integrity in the voluntary carbon market.

-

GCMU improves market tracking & transparency.

Just look above, how many more registries, standards do we need, this is what is plaguing this highly regulated but unregulated industry, sigh :(

Carbon Removal Credits are often seen as superior to Reduction Credits in the global carbon market, and command significantly higher prices. This is because it is typically easier to justify the additionality of removal projects, and quantify the benefits, than for reduction projects.

The VCM is a huge promoter of Carbon Removal Techniques(Afforestation, soil carbon sequestration, Direct Air Capture (DAC), biochar) as opposed to Carbon Reduction( renewable energy efficiency) techniques in CCM.

Problems in Carbon Markets

You may have seen multiple big growth projection numbers reaching 100x growth in the carbon credits eco-space but very less of that seems to be happening, why is that?

That is due to multiple basic ground level inefficiencies in the market, which are as follow

Price and Information Asymmetry - Despite its rapid expansion, the carbon market still operates like a cottage industry, prices are all over the place.

As of the time of writing, there still isn’t a very well-developed retail market for the voluntary carbon markets. Corporations and institutional investors have a better selection, as they can negotiate directly with carbon offset projects because of their mega-scale.

One of many examples of a simple transaction where Credits from Brazil Afforestation Project were sold to a broker at $2.75 per ton. If the broker resold these credits at the market price of £15 per ton if this is true there is huge discrepancy in the market

Fake Credits - Recently a research report covering 2346 carbon mitigation projects and 51 studies estimated that less than 16% of the carbon credits issued to the investigated projects constitute real emission reductions and this 16% is the upper bound.

Unclear Authorization Process – No standardized process, timeline, or format for approving credits for international use. Article 6 of the Paris Agreement standards, in COP29 left critical gaps in transparency and accountability, raising concerns about carbon credit integrity all which points towards the need of a single centralizing entity for overlooking all of the process in carbon markets.

Fragmented Tracking Systems – Multiple registries (national, international, and mechanism-specific) make credit tracking complex.

Credit Surplus – There are some 360 million tonnes of carbon dioxide equivalent (MtCO2e) of surplus credits currently in all the main voluntary carbon offset registries, this represents 2.6 times the current level of combined voluntary and compliance demand for carbon offsetting of 138 MtCO2e in 2020 and the surplus is still increasing.

If all registered CDM projects from the days of Kyoto Protocol elected to have their carbon credits verified for the previous decade they would produce a total additional volume of nearly 7,000 MtCO2e. This would represent 50 – 60 times current annual demand.

If allowed into the voluntary market, these CDM credits would effectively make the voluntary market redundant as a mechanism to reduce global carbon emissions.

Double Counting - Without proper monitoring systems, even with the best registries, each CC can be used more than once by producers which defies the logic for making of this market.

The potential for projects to back-issue CC comes to the estimate that the total surplus in the voluntary carbon registries could amount to 700 -1,000 Mt, this would represent 5 – 7 times the current annual demand.

Self Dealing - Instead of claiming that carbon credits offset their own emissions, a company can financially support a project that helps a country meet its Nationally Determined Contribution (NDC) under the Paris Agreement.

A company funds a renewable energy or forest conservation project in a developing country. The company can invest in carbon Credits projects and then buy C.C from themselves to double their offsets, the only consideration is the cost difference from buying the credits from a 3rd party which will be obsolete on a large scale.

Ambiguities in Article 6 in Paris Agreement – Countries under Article 6.2 are not required to fully disclose how they prevent double counting of credits and authorization changes post-transfer are allowed in "exceptional cases," creating uncertainty.

But still there are many bullish cases for CC markets

-

High investment to market size(in the next section)

-

Increasing Carbon Emission and increasing awareness among industries, corporates other than traditional oil, transport industries

-

Improvement in tech which can be seen in new forms of carbon removal and capture through Carbon Engineering

-

Countries policies such as CHINA, India's Carbon Credit Trading Scheme (CCTS) being made

-

Price asymmetry due to lack of quality carbon credits where vintage carbon credits are 1000X cheaper than new tech carbon credits

-

Information Asymmetry in International Trades

-

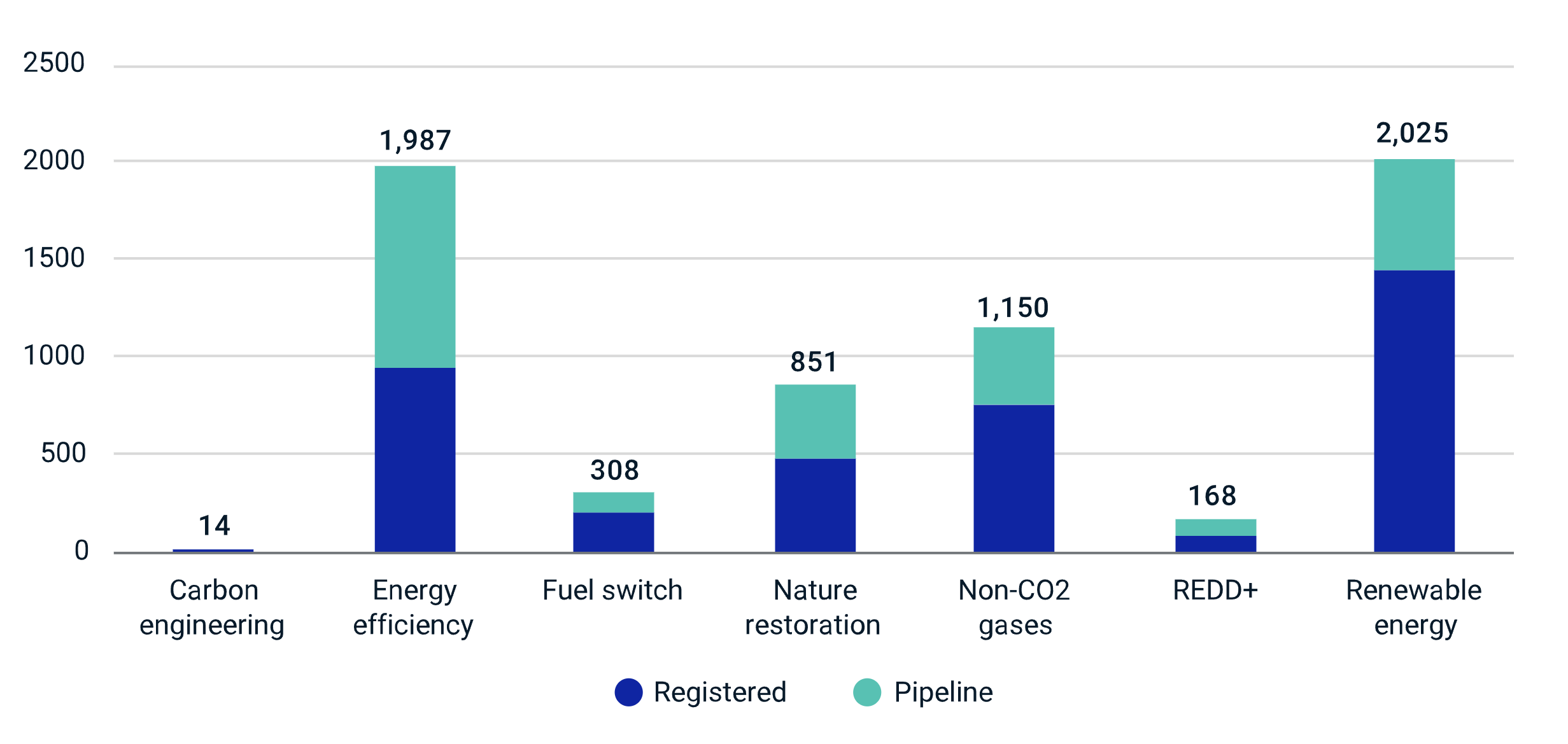

Increase in pipeline Projects that too of new tech

Current State of VCM

Recently SbTi’s provided a statement on promotion of Carbon Credits in Corporate Climate Transition plans, which was not welcomed in general public due to the transparency concerns over the carbon emitted from the fuel burned and the quality of Carbon Credits purchased.

This backlash had already knocked the carbon credit market. When, for instance, HSBC last month pushed back its target for hitting net zero in its own operations by 20 years, it cited a reluctance to “rely heavily” on offsets, “taking into account latest best practice”.

President Donald Trump’s administration has downgraded curbing climate change as a priority and instead declared an “energy emergency” to boost fossil fuel production in the US, citing the challenges faced by data centres in meeting energy demands, the impact from this is to be seen.

Under CORSIA, Emirates Airlines was ridiculed for their promotion of carbon neutrality advertisements after buying carbon credits and retiring them with less focus on removal of carbon emission in flights.

Despite this, big corporations are still very much optimistic about the future outlook on the Voluntary Carbon Credit Markets, this can be seen through Microsoft’s recent $200mn deal for carbon credits and Amazon once again trying to be the ultimate marketplace by launching a carbon credit service for few qualified companies through its Sustainability Exchange.

These actions come with the advancement in AI, big tech conglomerates like Microsoft, Google and Amazon need to invest heavily in data centers to cope with the huge demand stemming from the growth of generative AI.

CORSIA is the biggest buyer of Voluntary Carbon Credits, then comes the corporations such as Shell and Microsoft.

Oil and gas companies scaled back their spending on clean energy and relied more heavily on offsets to reach their climate targets than any other sector. Shell, BP, TotalEnergies, Eni and Equinor — are still committed to net zero emissions by 2050, suggesting they must invest in credits if they want to avoid overhauling their entire business model.

The confidence in the Carbon Markets can be seen through the numbers of pipeline projects with the Crediting Registries. When looking at just the four major crediting registries (Verra, Gold Standard, CAR and ACR), more than ever projects are in the pipeline.

Even Insurance Companies are dipping their hands in with Carbon Credit Insurance starting in late 2022 which helps companies against the risk of poor carbon credits, natural calamities etc.

Investments in Carbon Markets

The Taskforce on Scaling Voluntary Carbon Markets forecasts that in order to meet the climate change targets set forth in the Paris Agreement, the voluntary carbon markets will need to grow 15-fold by 2030 and 100-fold by 2050, from 2020 levels.

All the countries are going towards CCM over VCM because of lack of interest in relaxation in international laws of carbon trading but the investments in VCM markets are telling a different story, in total some USD 36bn has been invested in carbon credit projects from 2012 to 2022.

Investment levels over the past three years are running at five times the value of the global carbon-credit market (USD 1.5bn primary value). This is indicative of an industry planning for significant future growth.

A further USD 90bn of capital is likely to be needed by 2030 to achieve the volume of credits required. Around half of this capital would be for new projects and half to build out projects already in the pipeline.

The major 2 investment categories in VCM are the financing of projects for issuance of carbon credits and surveillance of CC for measuring their quality and double spends.

-

Under more conservative assumptions of demand growth, investment of between USD 10bn and USD 40bn is likely to be required by 2030. Nearly all of this capital would be needed to build out projects already in the registry pipelines.

-

By 2050, cumulative capital expenditure of USD 1,600bn would be needed in carbon credits, this is equivalent to an investment of USD 60bn per year.

-

The investment heavy sectors are

- the fractionalization of carbon credits

- improving transparency enabling

- pre-financing for carbon projects that need it most

In addition to niche registries, some large corporations have focused on investing in, and procuring carbon removal credits. A prominent example of this trend is the Frontier platform set up by global commerce and technology firms Stripe Inc., Shopify Inc., Meta Platforms Inc., Alphabet Inc. and McKinsey Sustainability, with JPMorgan Chase & Co., Workday Inc. and others added in April 2023. The aim of the platform is to invest over USD 1 billion in carbon removal credits between 2022 and 2030

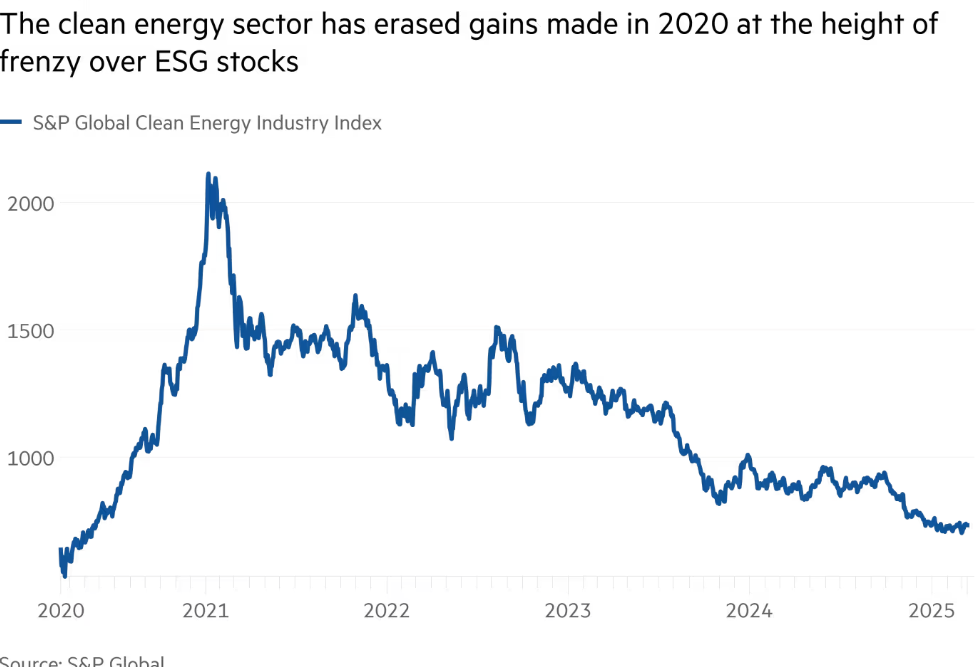

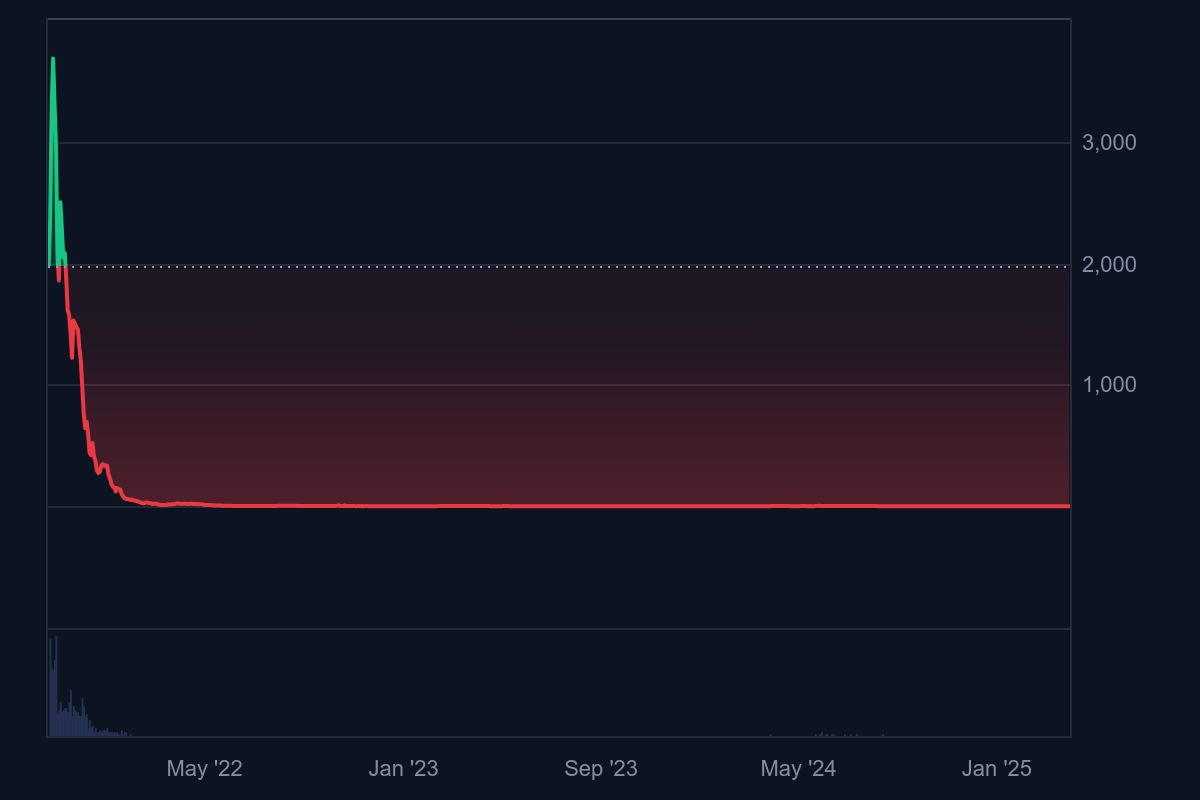

This Graph shows the boom of ESG stocks to which Carbon Credit directly co-relate boomed in 2020 because of Covid-19 and low interest rates which then quickly plummeted due to Fossil Fuel requirement in Russian-Ukraine war in 2022 and high interest rates, more on this below.

After peaking at the end of 2021 (in part, thanks to a small bubble in their use within certain crypto-token-related schemes), retirement volumes fell in early 2022, but stabilized in 2H22.

Tokenization of Carbon Credits

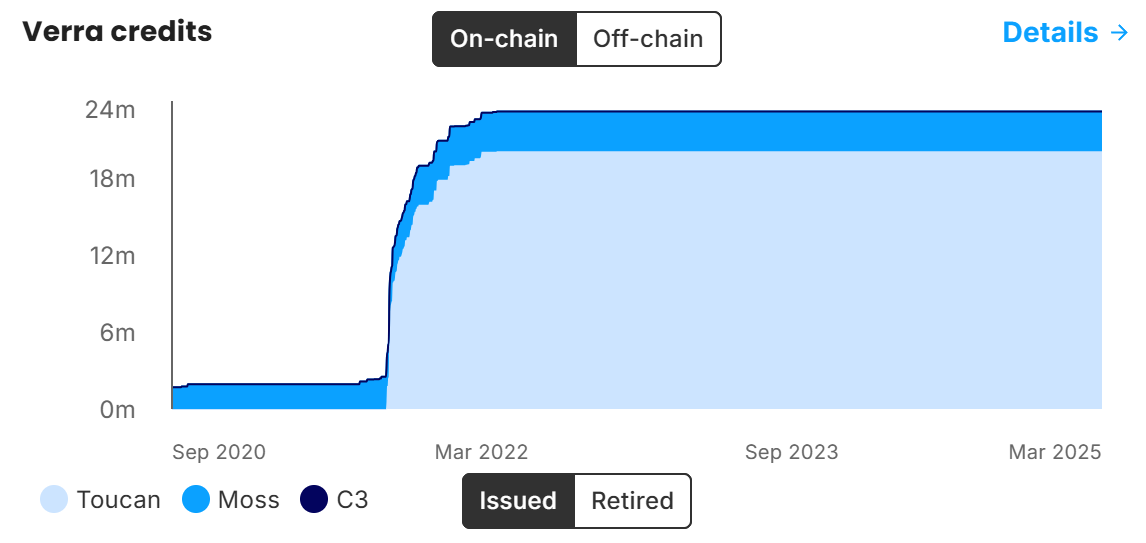

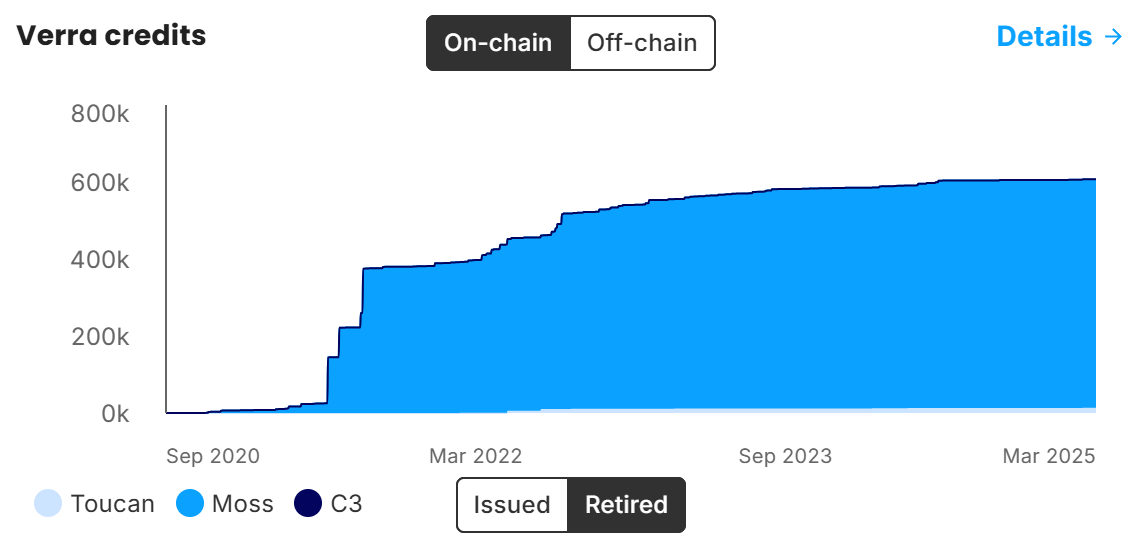

The main protagonist crypto protocols involved were Toucan Protocol and Klima DAO, where Toucan Protocol tokenized and sold many Carbon Credits after registering them with Verra and many of the carbon credits were buyed by Klima DAO which used them as a collateral for issuing its own token($KLIMA) which were mainly used for speculation purposes by independent anonymous users who didn’t really offsetting/retiring those credits which marked a saturation in the market cause the organizations are not buying from the Crypto Markets.

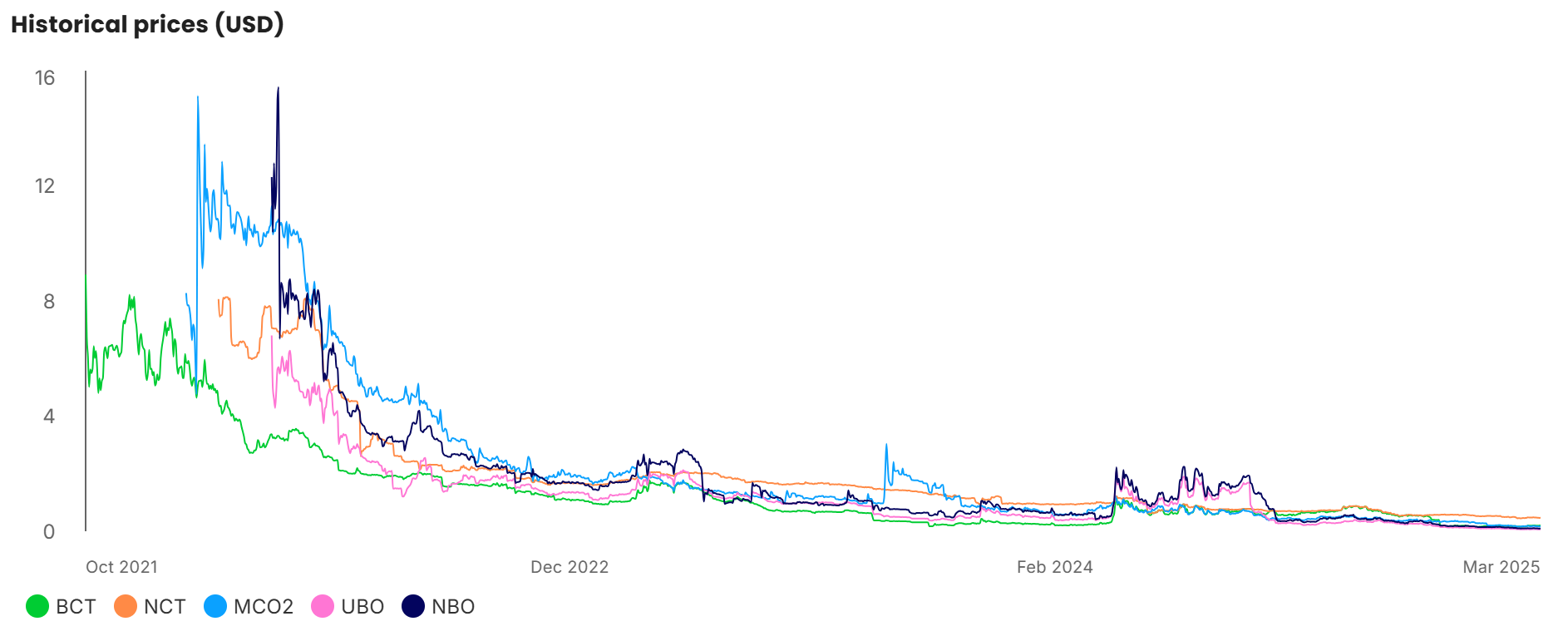

This can be seen in the price action of both protocol’s tokens

The failure of Klima DAO and Toucan protocol was due to both sides of the supply chain i.e. who is buying and who is selling, buyers were speculators who did not retire carbon credits and sellers provided fake, low quality credits.

So, something has to be done on both sides of the business, because these credits are less for speculation and more/fully for environment change prevention and for speculation separate virtual markets such as futures can be made.

The above graphs shows the difference between issued CC and retired CC, these both have a ratio of 120:1 which depicts that most of the credits were only used for speculation and didn’t exit from the system by retiring.

Another Web3 Protocol which was the category defining company named Nori shutdown in Sep 2024 due to various reasons but the major was lack of funding and Carbon sales are often a once a year purchase for customers so the sales cycles can be quite long

This all led to the tokenized carbon credits being 10x-20x cheaper than traditional ones due to:

-

Oversupply of Low-Quality & Older Credits – Many tokenized credits (like BCT) come from pre-2015 projects with low demand.

-

No CAs – Without CAs, they aren’t valid for corporate net-zero claims.

-

Crypto Speculation & Crash – 2021’s hype drove prices up, then collapsed.

-

Limited Adoption – Traditional buyers still prefer Verra & Gold Standard from trusted offline vendors.

Future tokenized credits need higher quality, CAs, & verification for better pricing. This can be seen in the path Toucan is taking. Toucan is now diverting towards Biochar which has very low quantity in the Toucan market around 1000t but it overcomes the problem of low quality carbon credits. This is done in partnership with Puro.Earth which is registry for engineered carbon removal credits and these credits sell at around 10x premium per ton.

dMRV(decentralized Monitoring, Reporting and Verification) is the next big thing in Carbon Markets which depends fully on physical infrastructures such as IoT sensors etc., hence DReCoN is the way to go.

Ocean Alkalinity Enhancement by Limenet and Soil Carbon Enhancement Project by Alberami both based in Italy are the first ones to use dMRV for better carbon credits.

Celo an L2 on Ethereum has a model of investing/donating some percentage of the transaction fee gathered into Carbon Credit Offsets which is also a good initiative.

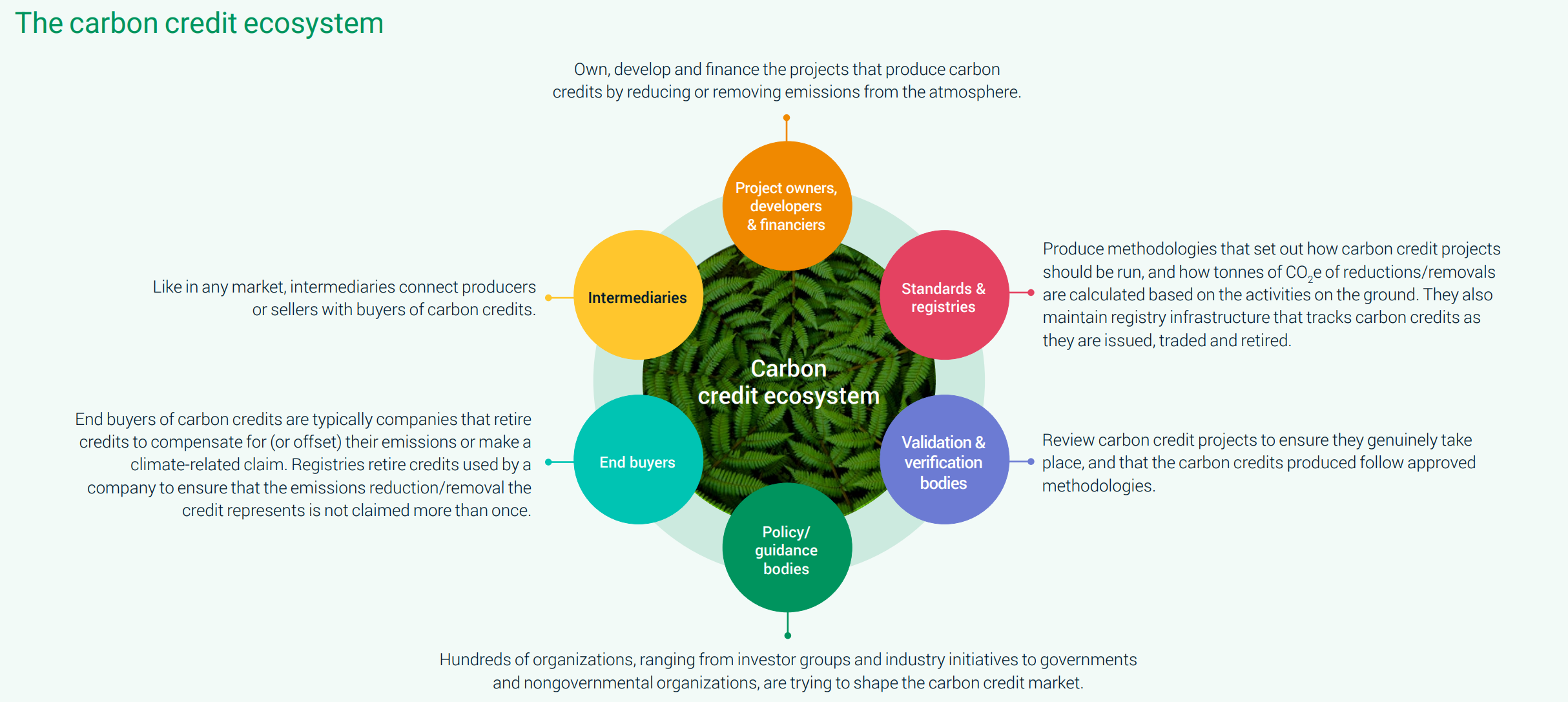

Changes needed in VCM Supply Chain

Project Owners, Developers should move towards dMRV for better pricing of their carbon credits and increased reputation.

Financiers should focus on the Least Developed countries.

Standards & Registries should be merged in an Interoperable International Registry

for a unified standard for carbon credits.

Validation and Verification bodies should be entirely replaced through dMRV

Policy/guidance bodies can be streamlined through DAO’s

Intermediaries are easily replaceable through blockchain ledger once most projects shift towards dMRV

End Buyers should be verified as rigidly as the producers and some incentives & penalties should be placed depending on the time period between buying and retiring CC. and automatically retiring C.C for demand control and less speculation is also a way.

A calculation for an imaginary dMRV device for the most abundant CC producer i.e. Afforestation

By using IoT-Enabled Forest & Soil Monitoring, Satellite & AI-Based Carbon Credit Auditing and On-Chain Carbon Credit Tracking & Retirement using Onchain Oracles, a device can be built which would be used verification of the most abundant and simple type of Carbon Credits produced from Afforestation.

By packing multiple Sensors into a single compact device which can effectively monitor ~100m² – 10,000m² (0.01 - 1 hectare), depending on forest density & sensor sensitivity

A single compact device can include:

-

Temperature & Humidity Sensor (BME280) – Tracks weather conditions.

-

Gas Sensor (MQ-2, MQ-135) – Detects CO₂, smoke, and pollutants.

-

Soil Moisture Sensor – Monitors drought conditions.

-

Acoustic Sensor (Microphone array) – Detects illegal logging (chainsaws, trucks).

-

Infrared Camera – Captures tree density and fire risks.

-

LoRa Communication Module – Enables long-range data transmission.

-

Solar Panel & Battery – Provides sustainable power for remote areas.

Communication between devices can be done through :-

-

The LoRaWAN Gateway which is the same as the devices used in Helium or Chirp Network where each LoRa node transmits data up to 10–15 km to a central gateway.

-

Mesh Network (BLE/WiFi Hybrid): Devices relay data between each other to extend coverage.

-

Satellite Uplink (e.g., Swarm, Starlink): For ultra-remote areas with no infrastructure.

For 1,000 hectares (~10 km²) of forest, ~2,000 devices would be needed (if each covers 0.5 hectare).

Bulk Cost (Per Device)

-

Multi-sensor package ~ $10–$20

-

LoRaWAN module ~ $5–$8

-

Solar panel & battery ~ $10–$15

-

Enclosure (weatherproof) ~ $5–$10

-

Assembly & logistics ~ $5–$10

-

Total Cost (Per Device) ~ $35–$60

🔹 Deploying 2,000 devices (~1,000 hectares coverage) could cost ~$70,000–$120,000.

If selling at $50 per ton, profit could be $500,000 per year from 1,000 hectares, even at $10 per ton, it’s $100,000/year, making it a sustainable and profitable venture and the carbon credit price will slowly grow up because of increasing trust and confidence in the markets due to increasing transparency and verifiability.

These devices can also be used for smaller areas by individuals for their garden at home.

Future Outlook

While the current scenario seems cautiously optimistic for Virtual Carbon Markets with Renewable Energy becoming cost effective, Carbon Removal techniques taking over Carbon Reduction techniques in price premiums, Corporates pushing towards Carbon Credits over changing their supply chain due to saturation of renewable tech.

And for the Compliance Carbon Market the future is pretty bright as more and more governments would want an eco-friendly reputation among the public and an extra stream of income.

There should be inclusion of more and more industries in NDC which will maximize CCM and VCM if gov. does not give VCM the legal red flag

There should be high amount of international funding for the least developed(LD) countries by the developed countries, as low funding provided would result in surveillance less markets and high funding would result in advanced carbon removal practices with dMRV

And on the opposite side, LD Countries should retain low-cost mitigation options for domestic NDCs while authorizing high-cost projects for international financing (e.g., Ghana prioritizing renewable energy ITMOs).

If dMRV works out, VCM would be the one of the greatest return giving market in history

Credits to MSCI for their multi year research on Carbon Credits, I would never be able such write or just learn about this stuff at all without their reports