Introduction

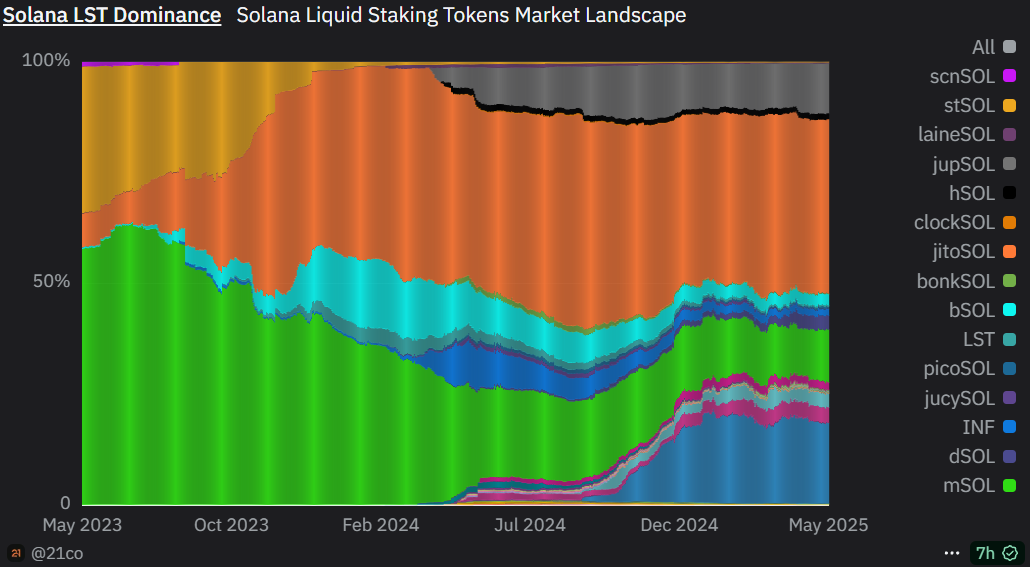

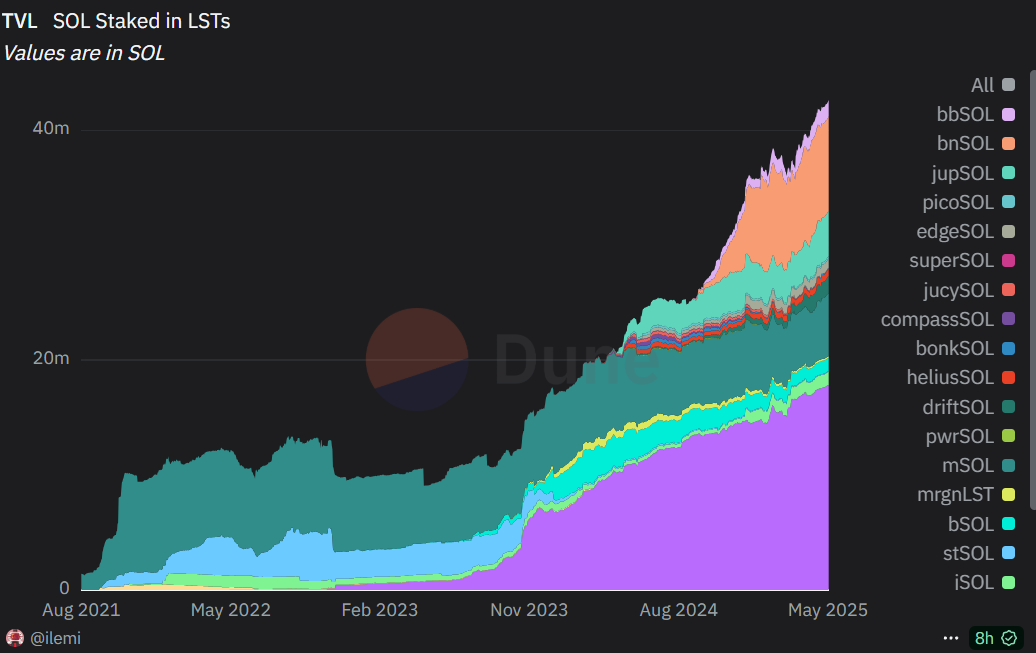

Solana’s staking infrastructure is rapidly evolving, driven by the explosive growth of liquid staking tokens (LSTs). As the ecosystem pushes toward decentralizing validator infrastructure, key challenges like the lack of mempool, slashing, spam, and MEV dominate the landscape—setting Solana apart from Ethereum due to its unique consensus and parallel execution.

At the forefront of solving these challenges is Jito, a protocol offering high-performance infrastructure, analytics, and MEV tooling—poised to capture Solana’s $250M+ annual MEV opportunity and enable future slashing mechanisms.

What is Jito

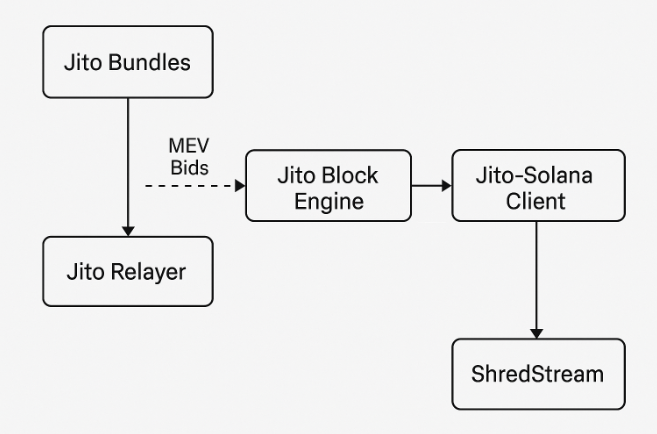

Jito enables MEV extraction on Solana via a custom validator client and a pseudo-mempool enabler, allowing searchers to bid tips for inclusion. This boosts validator and delegator rewards while reducing spam and improving efficiency.

Since Nov 2023, Jito has:

-

Grown JitoSOL from 6.8M to 17M SOL

-

Captured ~90% of validator stake

-

Distributed $674M+ in MEV tips

The lack of a public mempool allows validators to privatize transaction flow. Jito counters this with TipRouter, which routes MEV tips (0–3%) to JTO stakers.

Its StakeNet system ranks validators on-chain—key for enabling future slashing and restaking via NCNs. This gives Jito a credible shot at becoming Solana’s equivalent of Flashbots + Lido + EigenLayer.

Jito’s bullish case is becoming the go to place for the upcoming Validator slashing because of its stake net and all the Dark Validator Forest gets a light due to this Stakenet only and also the Restaking through the NCN is possible only due to this validator ranking data

Jito’s products catalogue

Jito delivers a vertically integrated suite of products designed to unlock MEV, enhance validator performance, and enable restaking on Solana. Its product portfolio spans across four core components:

JitoSOL (Liquid Staking)

JitoSOL is the leading LST on Solana, offering exposure to Base staking rewards and MEV tipsWith market-leading yields (typically 8–10% APY).

Jito Client and Offchain infra

At the core of Jito’s stack is a custom validator client, a fork of Solana’s native client designed to enable MEV bundling—akin to Flashbots on Ethereum.

The Jito Client currently powers ~90% of stake on Solana (vs. ~10% for Agave).

This infrastructure gives Jito outsized control over Solana’s MEV flow, validator efficiency, and future fee markets.

Stakenet

An on-chain, fee-free keeper network that ranks validators and auto-delegates stake for optimal returns—backbone of JitoSOL’s performance, Restaking NCN networks and frontrunner in upcoming slashing products in Solana Validator ecosystem.It is unique in it’s design and no other protocol has automated delegating system such as Stakenet.

Re-staking NCN networks

Jito’s restaking layer enables validators to secure new networks by reallocating staked SOL. TipRouter, Jito’s native coordination network, automates and decentralizes MEV tip distribution—already securing $350M+ in restaked tokens.

Restaking infra is pretty hard to build on Solana due to lack of slashing in it’s core validation program, even Eigenlayer which has the advantage of in-built slashing conditions in EVM consensus is struggling with coming up with it’s own slashing conditions to build on top of that.

New improvements coming to Jito

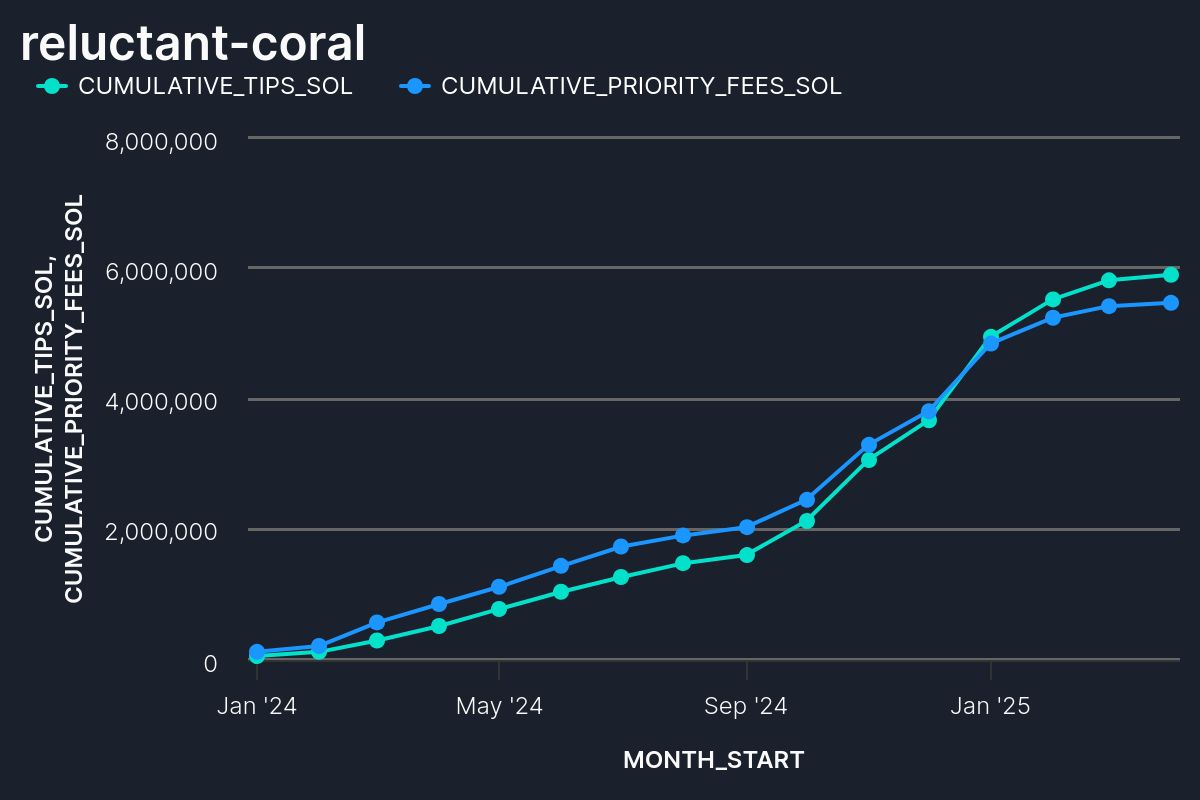

MEV tips and Priority Fee dynamics - Now 100% of priority fee goes to the validator(50% before) which would open up new commission rates for user’s staking as earlier 50% was not shared with user.

This can be seen in the graph below where priority fee has taken over jito tips by a small margin(nearly 55%-45%)

Normally Jito Tips and priority fee are used for different reasons on a broader sense of txn type, where Jito Tips are primarily used for sandwich MEV inclusion and Priority Fee is used for mostly normal transactions(NFT mint, Dex trades etc.) and atomic arbitrage(which takes up >50% of blockspace in solana today)

Sandwich MEV landscape will change to a great extent after native slashing is introduced on Solana chain but it will only increase Jito Tips because of the following reasons

-

Tips would be used more and more for private transaction bundling(similar to CowSwap)

-

Slashing will remove private MEV-flow enabler validators

-

New type of more sophisticated MEV will arise, read this

And Priority Fee will be at par with Tips and both will keep on increasing because of increase in TPS due to Firedancer clients and also increasing block size(read about SIMD-0207 and 0256)

Slashing Updates

SIMD 204 and 212 are new passed proposals which are the stepping stone in how the validator economics work by implementing various measure for shadow- banning malicious validators and slashing them appropriately.

Jito would me main benefactor of these changes to the Solana’s core consensus(after Solana of-course) mainly because of the extensive Validator Data in StakeNet, let’s see Jito would be affected by these

-

JitoSOL is distributed fully automatic without any manual interaction due to Stakenet, and with the data for most efficient validators(non-malicious), other LST protocols would have to undercut more validators manually than Jito would, this would increase the percentage of JitoSOl similar to Lido(70%) and decrease the overall staking APY(but that would be compensated with 100% priority fee) and remember the liquid staking market is only a small share of the staking market compared to ETH

-

Restaking - Solana would be a competitor to ETH for it’s economic security as the most critiques of Solana while comparing to ETH is due to it’s decentralization which is mainly due to no mempool(privatisation of validators) and no slashing.

And Jito already has set up NCN networks and multiple networks are coming up this and the next year.

Jito also has the upper-hand in then establishing it’s own slashing rules on top of Solana’s slashing rules for Restaking protocols which would undercut the time Eigenlayer took to make their protocol work properly.

In the end, economic security is economic security regardless of denominations.

MEV Tips would significantly change their course by moving from sandwiches to private transaction order flow like Cowswap.

Regulatory changes

December 2024 and early 2025 saw partnerships and coverage that raise Jito’s profile. Notably, FalconX’s decision to accept JitoSOL as collateral, citing its “higher overall returns” (from MEV), signals institutional trust. In general, as crypto capital flows back to on-chain yield, professionally operated LSTs with audited products like Jito are likely beneficiaries.

With Solana’s ETF on the brink, Institutes are quite interested as well.

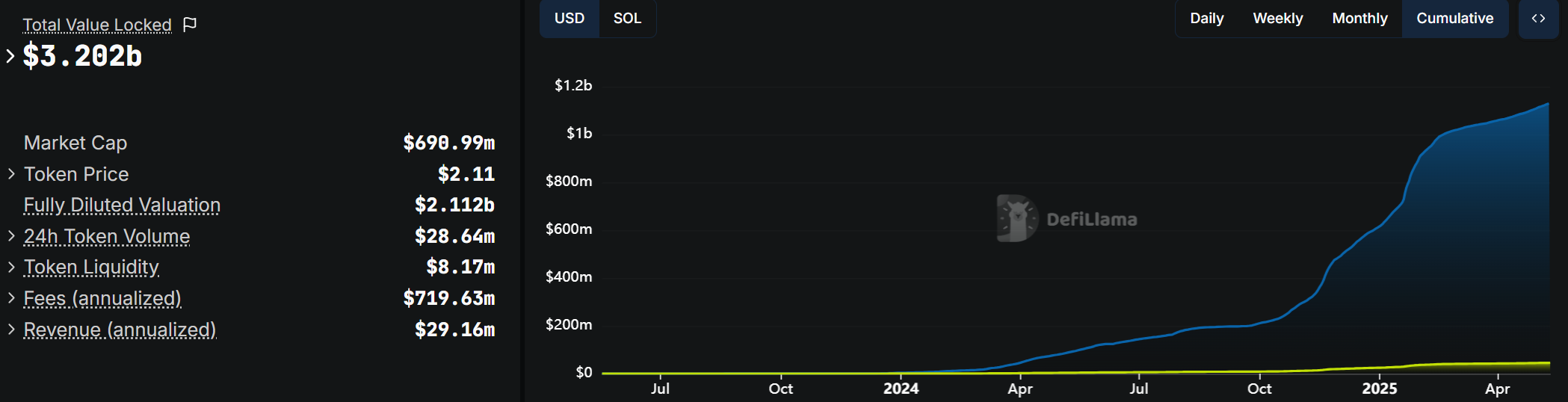

Jito’s Cashflow

Jito’s Revenue goes directly to the Jito DAO Treasury which decides on what percent of it will the JTO token will accure.

As reported by DefiLLama the annual fee(which directly goes to Jito DAO Treasury governed by JTO token) is around 30m which can be divided among the following sources:-

Interceptor Fees (a portion of MEV rewards directed to the DAO).

Current TVL: ~18M SOL

Assumed APY: 8%, Jito Fee: 4% of yield = 0.32% of SOL principal(taking current price Sol at $150) which gets us an annual fee of $9m a year.

This fully goes to Jito DAO Treasury

Tip Router Fees (MEV tips explicitly routed to the DAO).

Annual Tip Volume (2024 est.): $500M

Jito Cut: 2.7% = $13.5M

Withdrawal Fee

The rest of 6-7m comes from 0.1% fee applied on withdrawal of stakes

Priority Fee

The Jito DAO will take a 1.5% fee on all priority fees distributed to users, rather than the 3% fee from the standard TipRouter(750m yin 2024)

Priority Fee are pooled together as Validator Rewards along with base fee and inflationary rewards and normally the average rate of commission is at 5%.

So 750m * 0.95 * 1.5 comes out to 10m in extra revenue

Jito has a unique proposition to Priority fee market as it can take some percentage commission without someone batting an eye because of additional income it provided through tips(until some-one comes up with better product)

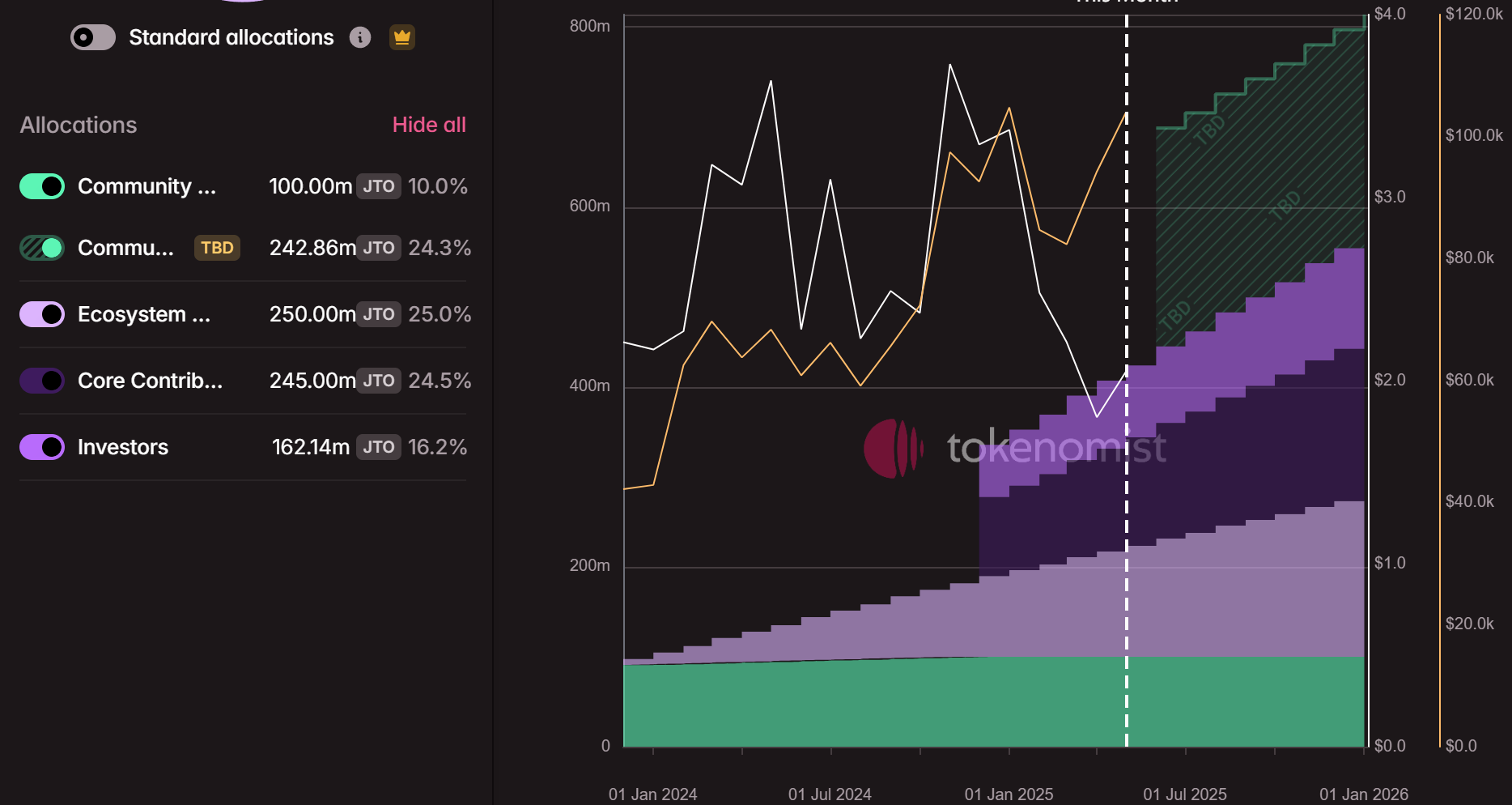

JTO Token

At the moment JTO token is used for governance over

-

Set stake fee of JitoSol, Maintain the treasury of the

-

Configure the StakeNet program and it’s variables

-

Revenue management from JitoSOL’s use in DeFi

-

NCN networks fee changes

And no other measures are being taken to provide value to the token(buybacks, burn etc.) because of need to invest in their infrastructure

Jito must continue to cement jitoSOL as the dominant asset in the Solana ecosystem, especially as ETF staking conversations continue to move forward on the regulatory front.

Future Token and Cashflow Projections

For Tips and Priority Fee we can use Solana Fee Records because they are same for the whole Solana ecosystem and would not make any difference specifically for jitoSOL or jito Client as these are decentralized and can be joined by any honest validator.

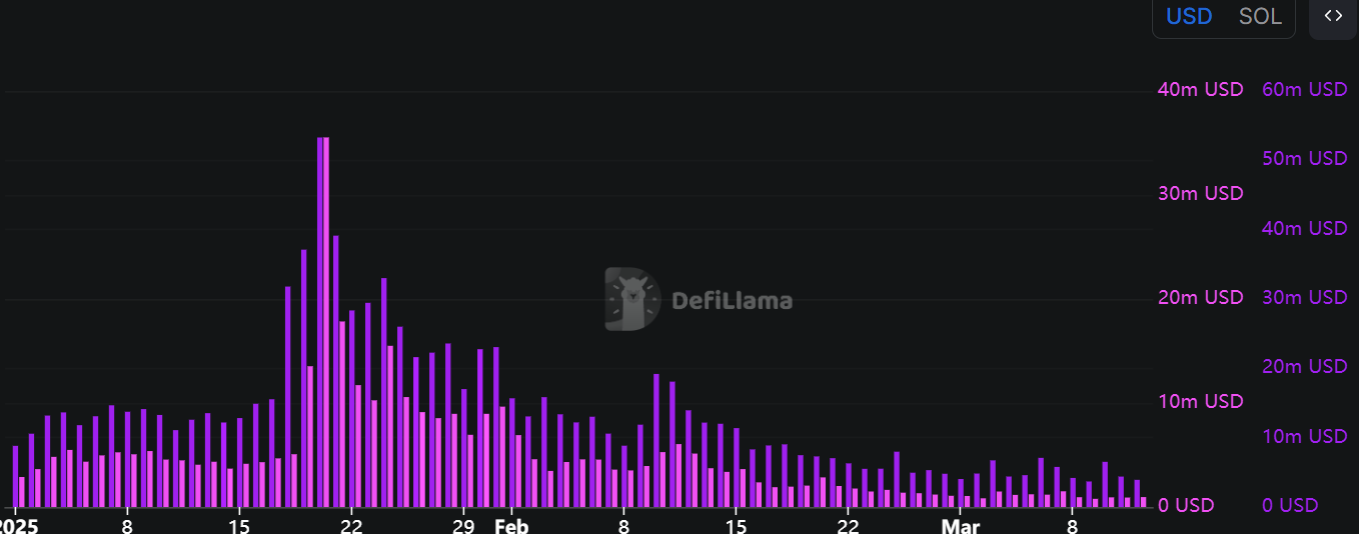

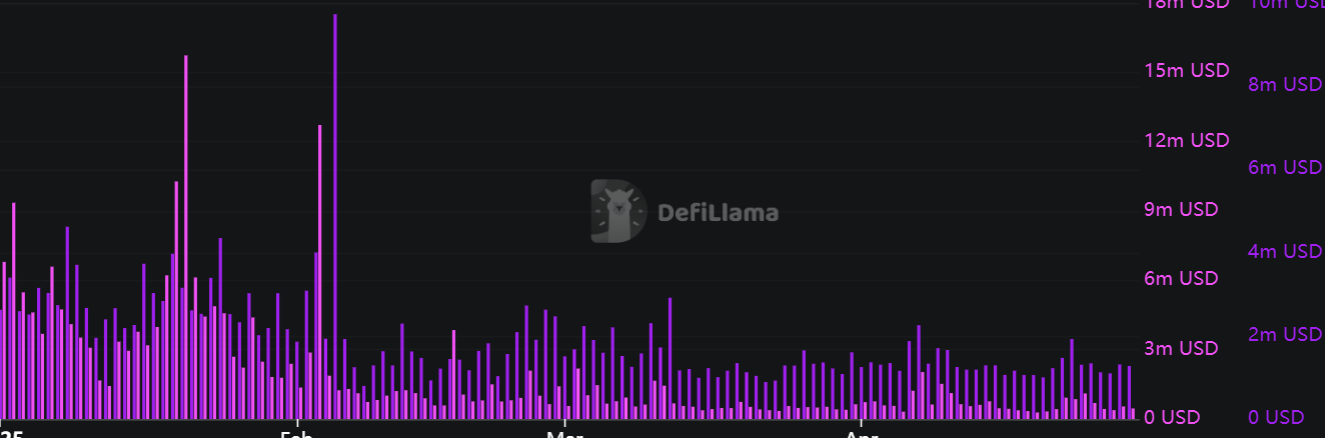

Solana Fees peaked in January at the height of AI Memecoin and TrumpCoin Craze(~200m) and is doing consistent numbers after that, I am considering that to be local top for Solana Fee.

And In 2025 the avg fee for each month is around 40m(which is the lowest volatility since Sep2024), which gets us around 400m in yearly fee and taking 50% YoY increase in that(from 2023-24, it increased by 2800%)

Priority fee takes up more than 85% of total fee which gets us around 35m at the base case of lowest volatility, so taking 40%YoY increase in that and also MEV Tips are at equal to Priority Fee2025 $350 million || 2026 $525 million || 2027 $787.5 million ||2028 $1.181 billion|| 2029 $1.772 billion || 2030 $2.658 billion

These number need to be duplicated for both Tips and Priority Fee

Year Value Tips Revenue Priority Fee Revenue

2025 $350 million $9.45 million $5.25 million

2026 $525 million $14.18 million $7.88 million

2027 $787.5 million $21.26 million $11.81 million

2028 $1.181 billion $31.89 million $17.71 million

2029 $1.772 billion $47.84 million $26.58 million

2030 $2.658 billion $71.77 million $39.87 million

JitoSOL’s number need to be calculated after evaluating the numbers for slashing conditions, how much economic effect that would have on JitoSOL’s growth and what other factors will affect the growth

Stakenet would factor in this, Solana staking is stagnant at 400m SOL(nearly 67%) and liquid staking is at only 40m(only 10% of Total staked) and Liquid staking is increasing at 100%YoY with Jito as the leader with over 40% share and I see this to outgrow the pace of 100% for liquid staking ecosystem because of all the upcoming reasons

So if we take a give the max cap for liquid staking at 50% of total solana(75%, also true for Ethereum) and this number would be achieved in 5 years, that gives us a CAGR of 37% for Solana Liquid Staking Ecosystem and if take 50% for Jito, that gets us 110m in 2030 and Taking Solana’s Price

Bear case - $180 || Base case - $500 || Bull case - $1000+ and Solana becomes top 3 chain by economic security

This gives an increase of 45% YoY in bull case which we if calculate the Jito’s cut of 0.32% of SOL principal

Year Bear Base Bull

2025 $11.52M $32.00M $9.98M

2026 $15.78M $43.84M $19.83M

2027 $21.62M $60.06M $39.40M

2028 $29.62M $82.28M $78.27M

2029 $40.58M $112.73M $155.49M

2030 $55.60M $154.44M $308.88M

Restaking would be akin to Eigenlayer, need to compare the 350m already restaked and how much that would change after slashing conditions

EigenLayer has nearly 20% of all ETH staked and for Solana if we only use 20% of all staked by 2030 that get us at 80M SOL.

Jito monetizes its restaking services by charging a 5% fee on rewards and a 0.1% fee on withdrawals, the average APY on rewards for Eigenlayer is around 1-2% which is separate from the base staking APY but for Solana it is different you can see that in below 2 graphs where Ethereum’s chain fees(not even Revenue, that is too low) ratio with App Revenue has the best case of 2 but Solana consistently has the ratio above 5, so we will take a Rewards APY around 5% for Solana REstaking

Year Bear Case Base Case Bull Case

2025 $0 $0 $0

2026 $6.00M $16.67M $33.33M

2027 $12.00M $33.33M $66.67M

2028 $18.00M $50.00M $100.00M

2029 $24.00M $66.67M $133.33M

2030 $36.00M $100.00M $200.00M

the combined total revenue forecast for Jito from 2025 to 2030, incorporating:

-

Tips Revenue (2.7% of total ecosystem value)

-

Priority Fee Revenue (1.5% of total ecosystem value)

-

Liquid Staking Revenue (Bull Case only)

-

Restaking Revenue (Bull Case only)

Year Total Revenue

2025 $24.68M

2026 $75.22M

2027 $139.14M

2028 $227.87M

2029 $363.24M

2030 $620.52M

To estimate Jito’s token (JTO) price in 2030, I have used the MV = PQ equation.Based on the projections, Jito could generate around $620 million in annual revenue by 2030 from tips, liquid staking, and restaking.

Assuming the total token supply is 1 billion JTO by then and fully unlocked, the token price depends heavily on how frequently the token is used i.e. velocity(currently the token is not used for anything apart from Governance, and if we calculate the velocity according to current prices the velocity comes out at 0.05). If most tokens are staked or locked (low velocity), the price goes up. If tokens are traded or moved around a lot (high velocity), the price is lower.

Here are the projected prices for 2030:

-

Low velocity (0.05): ~$12.41 per token

-

Moderate velocity (0.10 to 0.25): ~$2.48 to $6.21

-

High velocity (1.00): ~$0.62

These prices are considering the current prices and without any inflation(normally crypto tokens are inflated 10x), these figures give over 600% returns over the next 5 years.

Risks

Validator Centralization: JitoSOL’s growth could lead to concentrated staking power in Jito-affiliated validators, increasing the risk of malicious behavior or coordinated attacks. The reliance on off-chain governance blacklists to address misbehavior adds additional risk, and the upgraded fee model could attract disproportionate staking if not monitored.

Key risk: If most of the APY comes from MEV and priority fees, these could significantly reduce after slashing is fully implemented.

Regulatory Uncertainty: Ongoing scrutiny of crypto staking models by regulators, such as the SEC and European MiCAR rules, could lead to new requirements, restrictions, or costs for staking services. This uncertainty could either dampen demand or open institutional channels, depending on the outcome.

Protocol Changes & Exploits: Solana’s evolving protocol presents risks, as changes in inflation or transaction costs could reduce validator rewards. Past network failures and bugs also highlight the potential for downtime or forks. Additionally, Jito's smart contracts and external protocols that hold JitoSOL could be vulnerable to exploits.

Key risk: Competition from other infrastructure builders could decentralize the network, weakening Jito’s position in the market.

Jito is gonna be everything Validator Infra on Solana (NETHERMIND + fLASHBOT + EIGENLAYER)