Intro

The Stablecoin market cap has crossed over Total TVL on Solana which means that retail interest is being shown and TRUMP memecoin pretty much cemented it It means more and more pools would be denoted in USD instead of SOL and the SOL leftover from there would either be sold or would be staked

The protocols gain TVL either from the loose Solana, the newly unstaked Solana or the stablecoins

Out of these we’ll denote the three-horseman of Solana in the near future. These are Sanctum, Meteora and Jupiter, all of these are quite tightly connected in values as well tech behind them as all are quite dependent on each other

Any blockchain needs 3 basic actions to run i.e. LP Pools to store tokens and maintain price, Transaction Executor between different LP pools and smart-contracts to stake, all apart from these are made on top of these primitives you may ask where is lend, they are busy building leverage on the LP and stake positions

Sanctum is the one with staking which changes how people look at liquid staking protocols, ask yourself when you choose the protocol for staking your ETH, what parameters do you see outside the APY given, Sanctum gives you a full-fledged marketplace where multiple type of rewards from multiple type of validators are available in an infinite loop of innovation.

Ethereum has around 28% of it’s supply staked and around 60% of that is liquid staked, comparing that with Solana which has around 70% supply staked has only 12% of that as liquid staked, that is due to multiple reasons but one of the main reason is the friction in Solana ecosystem in staking which much complex than Ethereum along with no innovation till now

Problems in the Solana liquid staking ecosystem

The top problems with liquid staking in Solana are:-

-

When staking natively, the APY for most validators is more or less the same, which means that validators don’t have a way to differentiate themselves.

-

Even if it's with the same validator, stake accounts with the same validator don't automatically combine, so now your wallet is littered with many stake accounts and you have to "merge" them one by one.

-

All stake pools split their stake amongst multiple different validators, and also charge a management fee. But many people want to stake to a specific validator, and they don't want to pay extra fees in order to access liquid stacking. So many people choose to stick with native staking instead.

-

Normal Staking Dapps/Protocols has too much abstracted away the working behind staking procedure by not showing the validators and not giving options while choosing validators, which is good for a retail investor but not enough a crypto power user and most of the liquidity today in crypto markets is provided by the power user apart from memes, so there should be someone to bridge this gap who not only provides multiple options while staking but also obfuscate the details as such it feels like a stock/meme buy experience

The staking infrastructure is too simple to implement for any person/entity as all the code is already written and the staking procedure is native to the chain(so no code and operator risk there) but then why are there only a handful of LST protocols?

The reason is pretty simple which is lack of initial liquidity of LST to maintain various LPs across the chain cause if there is no liquidity for the LST why would a user buy it(the primary moat of LST is to have free liquidity while staking at the same time), it also brings depeg risk cause of low liquidity

mSOL depeg in dec 2023 was a great example of what happens when you have a low liquidity LST in the event mSOL went down 20%(even below the price of SOL) due to single sell of 8m mSOL, to avoid this there are multiple solutions ➖

-

Having a big reserve for the LST(bootstrapping liquidity problem again)

-

Somehow the the validators inform before of the incoming transaction

-

Very good routing of the big orders through multiple LPs

-

Sell order can be divided among multiple small orders to avoid depletion in value and give good price to the seller(much like OTC)

And even if the liquidity problem is bootstrapped, then a single LST vendor comes with the age old problem of centralization(Lido) and why it is still the leader is due to lack of innovative LST protocols

So, the limited infrastructure and no innovation make it quite pvp between different LST protocols and some which try to do better(Puffer Finance or Eigenlayer which is entire new paradigm) are far ahead in term of execution

It became clear to us that for all LSTs to co-exist, be sustainable and have unique value propositions above the usual "earn staking yields", they each need to access the full depth of unified liquidity across all LSTs – a unified liquidity layer.

It also addresses the problem of LST’s value being below the 1.1 peg to the collateral despite being given the constant dividend which kicks out the staking reward out of window(this is due to multiple factors, most of which are risk associated with the LST provider and swapping of LST with other tokens cause the stakers only wants airdrop XP)

This is prevented by an infallible on-chain oracle that tells us the floor price of every LST. The price of every LST can simply be read off the account itself

One problem can be that, if you want to use them small LST outside the scope of Sanctum then there are no liquidity pools but if there were liquidity pools then it would have that same problem again but it can have lending and borrowing mechanism to utilize those NFT’s without having a LP to affect their prices, This is quite natural to LST as they are yield bearing and don’t have LP, so they always reflect the staking rewards(dividends) in their price which means that the collateral would always increase in price

So how does Sanctum make a difference, onto the next one.

Sanctum, infinite staking yield moats

In a nutshell Sanctum does this by focusing on 3 functions of stake pools: delegation, tokenisation, and liquidity.

Delegation and Tokenisation - There are 3 stake pool programs on Solana, all identical for now but with different upgrade paths**.** Sanctum uses 3 SPL Stake Pool Programs, out of which 2 are made by Sanctum only, this helps Sanctum to differentiate each LST in different groups and upgrade the contracts according to different SPL program, which also helps in creating new programs if needed and much less code mumble-jumble

Sanctum SPL 1: This is an improved version of Solana SVSP program which eases the creation of LST for a single/<10 validator who don’t actively manage the stake between different validators, it is best suited for teams which want to run the validator but don’t want to actively manage and rebalance User stake while giving other rewards to User’s

hSOL, dSOL, compassSOL

Sanctum SPL 2: Sanctum LST 2 is meant to be upgraded to a version of the Infinity program, which will allow the LST to hold other LSTs, to best suited for People who don’t own a validator such as creators etc., it mostly has the best APY

jupSOL, pineSOL, fpSOL, uwuSOL, flojoSOL…

Original SPL: It is best designed for teams who have plethora of validators under them and actively manage and rebalance stake between hundred of validators to get best security guaranteesjitoSOL, bSOL, aeroSOL, vSOL

These contracts are secured by the Sanctum Multi-sig(used to upgrade contracts) is a 6-of-11 multi-sig composed of members of the Solana community, of which they include parties from: Jupiter, Jito Labs, Laine, Mango Markets, MRGN, Sanctum, SolanaFM, BlazeStake.

This is a strict upgrade over native staking and a compelling alternative to stake pools

Liquidity - This is done by 2 important piece of infra that are Router and Reserve. Sanctum Router is integrated in Jupiter, it allows people to convert one LST to another even when there is normally no route between two LSTs. This unifies LST liquidity by allowing small LSTs to access the liquidity of much larger LSTs.

Sanctum has a reserve of over 300k(75m) SOL through which Sanctum can accept ALL staked SOL and give SOL in return. It can then unstake the staked SOL to replenish its SOL reserves. Reserve’s Solana is divided in 2 parts

-

20%: new LSTs to incentivize the creation of new LSTs and kickstart the infinite-LST future

-

80%: basket of LSTs + trading returns

JUP integration addresses a key challenge in LST adoption, where liquidators can now effectively manage larger liquidations with enhanced liquidity via Jupiter's routing, including Sanctum's SOL reserve pool.

Sanctum has built a base layer for LST where each operator then can infinitely improve the tech behind their validators etc. cause Sanctum doesn’t have a say in how someone uses their base layer.We’ll delve more into how it all started

History of Sanctum

Sanctum started with Jupiter working on unstake.fi(now the reserve) which helped in bringing together different LPs on different protocols through a single transaction through Sanctum Router

Sanctum was previously unstake.fi(It is a pool of liquid SOL that is able to service instant unstake for all LSTs) which enabled peeps to move their staked Solana from a validator stake pool to another validator stake pool or unstake from any validator - but for all of this to happen their should be deep liquidity pool of Solana in the custody of the unstake.fi for such fast conversion and unstakes

Sanctum did exactly this by providing a backstop of SOL liquidity and make lending-borrowing protocols remain solvent in their LST pools by making Flash Loans when the position becomes uncollateralized through it's SOL reserve

Sanctum invented Slumlord which is the world’s first public and in-production Ideally program. Ideally is an alternative approach to Native Solana programming invented by our co-founder HY.

The Slumlord program is a zero-fee flash loan program that anyone can use to temporarily pay for an ephemeral account's rent.

How does Sanctum does it?

All the innovation done in the last 3 years, came boiling down to a single piece of infra that is Infinity Pool which is brainchild of router and reserve

Infinity is a multi-LST LP that supports swaps between all LSTs in the pool. Most pools support only two assets (e.g. jitoSOL-bSOL); Infinity support thousands. This allows Infinity to be much more capital-efficient than normal pools. In fact, it's the most capital-efficient LST AMM design possible; the optimal liquidity solution for an infinite-LST future.

The inbuilt price from on-chain oracle brings a problem of rebalancing the LST inside the infinity pool which doesn’t affect the price of LST as that is pre- built but affects the exchange rate of them between each other in a single way(like taxing the conversion of low number LST to the high number LST) and also if that is not possible than manual rebalancing of the pool using conversion of stake accounts from the reserve and this also can be done be unstaking which takes time

Infinity is the only liquidity pool able to support millions of different LSTs natively. Because all LSTs can be converted into a stake account, it is possible to calculate a fair price for every LST by looking at the SOL contained in the stake account. This lets Infinity support swaps between any two LSTs of any size without having to rely on any constant-product or stableswap invariant.

In this way the infinity pool acts as a large infinite stable-pool with arbitrages coming within the pool not externally

Sanctum also provides instant conversion of any stake account to the any LST or Solana itself through it’s reserve obviously, all of this with instant unstakes

Current State of Sanctum and the Future

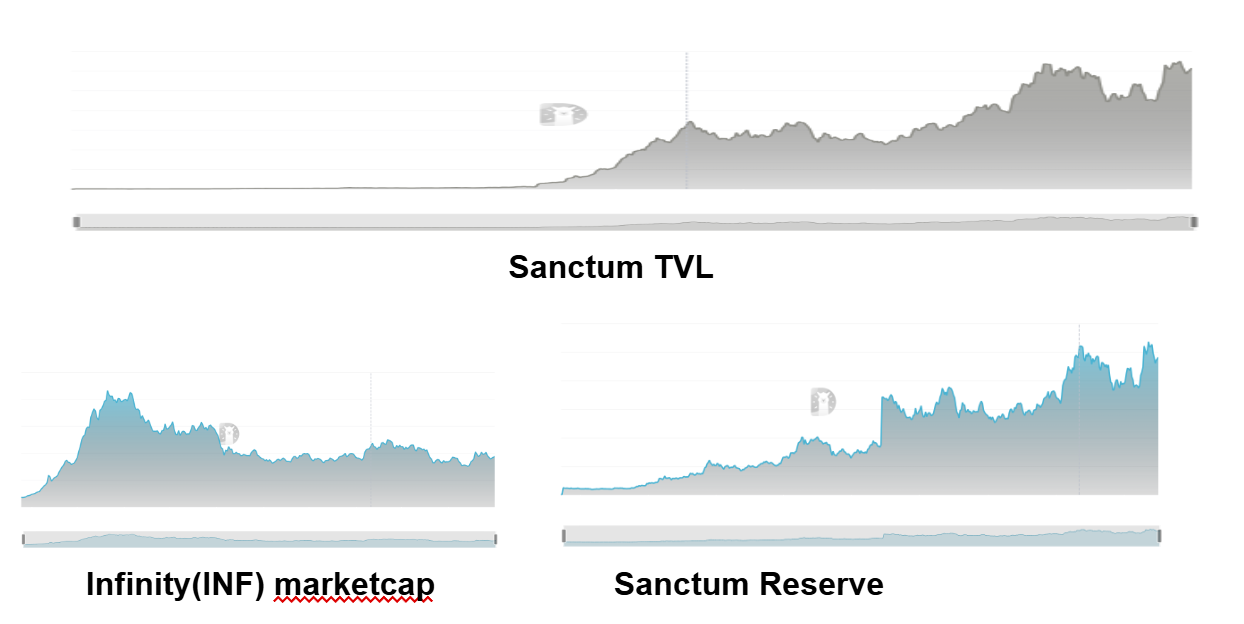

It is quite easy to see the growth of Sanctum, from the graphs below. Sanctum is the 3rs biggest LST provider after Jito and Marinade, and both of the above protocol’s LST can also be swapped through Sanctum

The market effects of Sanctum can be seen through the adoption of it’s base layer by Bybit(bbSOL - 300m), Drift(dSOL - 120m) and many more.

But this is just tip of the iceberg, Sanctum is much more than a simple launchpad for LST for the top Solana protocols, it’s value is embedded in the ways to use Staking Yields in whole new different ways that ultimately strengthens Solana’s security by increasing the stake, strengthens decentralization by increasing the number of single validators and giving value to those who need the most.

Some great examples of Sanctum’s impact are below:-

-

Laine, one of the top validators on Solana, rewards laineSOL holders with extra block rewards (beyond what constitutes the APY), resulting in holders getting more than twice the native staking yields. Similarly, validator Juicy Stake recently airdropped SOL to all wallets that held at least 1 jucySOL.

-

Jupiter is running a validator and has released JupSOL cause the more stake Jupiter’s validator has, the easier it is for them to send successful transactions to the Solana network, leading to user orders getting fulfilled more quickly.

-

One of the top meme coins on Solana, recently released their own validator and LST called bonkSOL. The perks of holding one? In addition to getting staking yield, holders also earn the $BONK token in rewards.

-

fpSOL, released by Sanctum founder FP Lee. Those who hold at least 1 fpSOL get access to a private chat with FP Lee (similar to a Friend.tech key), while the staking rewards go to charity

The next big thing to be excited about is Creator coins which is in beta, the main difference between them and LST is creator coins is that when you hold a creator coin the fully yield of that staked Solana goes to the creator instead of you, so it is a way of showing support without going through mumble-jumble and risks of creator coins platform such as friend.tech etc.

It's a great way to support the creator cause of low volatility in Solana price and getting good rewards atm and ultimately bootstrapping Solana's security(Creator Tokens)

Creator Coins make it easy for anyone to support or be supported in a simple, fun, and safe way. Each Creator Coin is uniquely tied to a creator and is a Solana liquid staking token (LST) under the hood, backed by Sanctum's unified liquidity layer. This way, creators and their communities get a token that’s safe, liquid, and cannot be “rugged.”

For creators, Creator Coins offer ongoing support and a direct line to build deeper relationships with their fans. Supporters can enjoy engaging more meaningfully with the creators they admire, earning Seeds—a currency for perks—along the way.

Just imagine your neighborhood organic vegetable vendor running a Solana Validator node and sharing his veggie earnings with you

Another great feature they have in works is Sanctum Pay - which will ultimately be a debit card with the backings off all your LST and you can spend all your LST converted to $USDC to your local veggie vendor

Tokenomics

Total Supply - 1b

Token Emission Schedule

All team and investor tokens unlock over 3 years with a 1-year cliff. That means that 33% of the tokens will unlock 1 year after TGE, while the other 66% will vest linearly over 24 months after the cliff. All team and investor tokens will be fully vested 36 months after TGE.

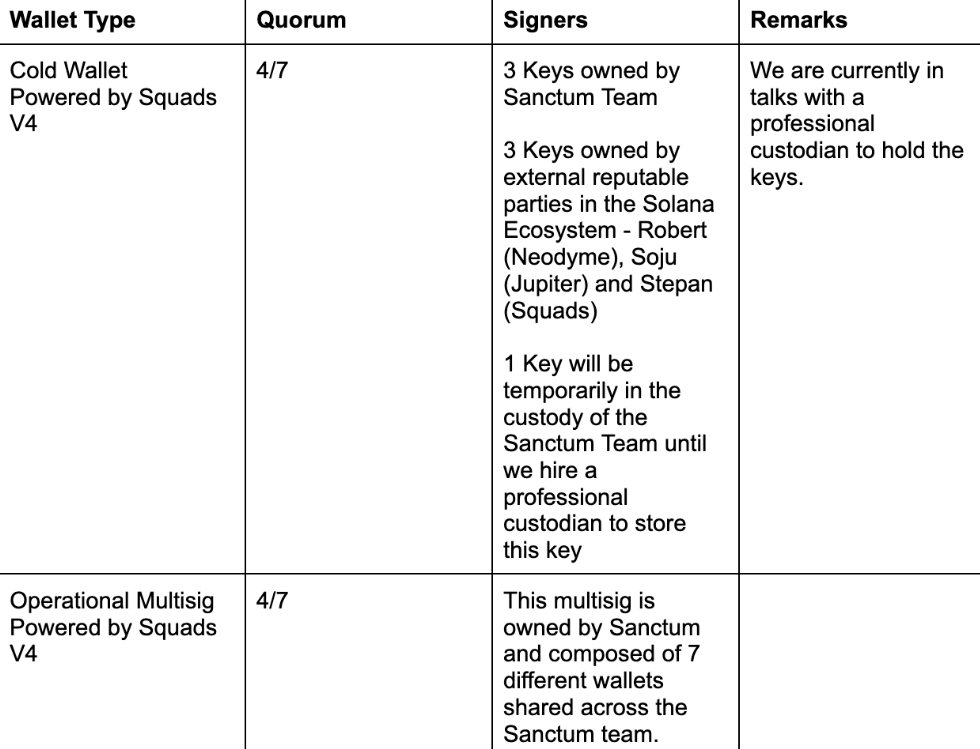

Sanctum’s $CLOUD multisig structure has multiple actors involved listed below

-

Sanctum Team

-

Independent Ecosystem Signers - Stepan (Squads), Robert (Neodyme) and Soju (Jupiter).

-

Professional Custodians - 1-2 professional custodians to hold a key where they will take on the role of a backup signer.

When there is sufficient evidence that access to 3 keys are missing or in a deadlock. Reported loss of keys and assistance is needed to update keys of current multisig members quickly. Emergency unexpected situations that might require rapid reactions to secure fun

**AIRDROP**Total 100m $CLOUD tokens were airdrop to users and 100m were unlocked for LP pools

The IDO curve started at $1m, lower than the valuation of seed round(50m), which means that buyers got an opportunity to get in at the same price as seed investors.

We can see in the chart above that the trading started on july 18th after the IDO was done and the spot price started from 0.286 dollars cause of oversubscription of alpha vault and dumped on the POINT 1 after the first 100% airdrop bonus unlocked, it rode the wave of hype till mid-november when people realized that it didn’t had any utility at the moment and along with other alts it went to Valhalla and on point 3 the last 100% bonus of airdrop unlocked which dumped the price furtherSome of most important unlocks are coming on July 2025 where 33% of investors and team allocation will be unlocked which amounts to around 130 million( $13m) $CLOUD tokens and rest of the tokens for team and investors will keep unlocking daily for the next 2 years

The point to notice here is that investors got the token at 50m FDV which values the token price at 0.05, so it is a level to watch on July 18th of 2025

Future Valuation of $CLOUD

There are few models for Crypto Asset Valuation and most of them are either outdated with the pace of crypto market or focus only on 1-2 metrics for the growth of the asset, but few stand the test of time and are still valid, I’ll use multiple valuation framework in accordance to each other and these models are DCF(discounted cash Flow), Chris Burniske and Brett Winton inspired QTM

So to start off we’ll first list the use cases of the $CLOUD token and currently there are none but being a part of Sanctum DAO, there are multiple utilities on the way as the focus for the first year is on product-market fit and most probably before the unlocks in July 2025, these utilities will be unlocked, listing them below

-

Staking by users and wannabe LST owners

-

Governance using MetaDAO’s Futarchy approach

-

No buybacks or burn mechanism

Decrease in CLOUD token in holding each year will occur or not? -> Yes it will be due to staking and participation of new LST and users by betting on the governance decisions

The most important thing I have noticed in both Brett Winton and Chris Burniske models were their different ways of calculating size of the monetary base required to support a crypto-economy(M) of size PQ with velocity V and then I merged the calculation of all three with the Fee collected by the products in Sanctum and set that equal to M.

Sanctum charges a dynamic range of fees from 0.01% to 3% based on the percentage of SOL taken from the reserve pool. This allows for low fees for smaller retail users, and ensures efficient usage of SOL in times of crisis. Sanctum also takes a 0.01% fee on swapping from one LST to another.

Sanctum’s fee model is quite different from all other LST protocols as it doesn’t take a cut out of staking rewards but rather through swapping of 1 LST to another LST and through it’s reserve pool when a user stakes/unstakes Solana.

Total revenue can be seen through change in it’s Reserve Pool which started at 200k SOL and now stand at 400k SOL, the USD has drastically changed due to reprice in SOL. The total difference comes out around $80m which is the total fee generated by Sanctum.

This proves the worthiness of the model, where other projects(Lido -> fees-1b, revenue-111m, Jito -> fees-600m, revenue-35m, Marinade -> fees-100m, revenue -5m) nab into User’s staking rewards to be profitable, Sanctum’s innovative model is outperforming those

To compare Sanctum with other LST protocols above look at the fee generated rather than the revenue cause they put most of it into either buybacks/burn or provide dividend to the user’s through value accrual in Staking and Sanctum doesn’t have any of them at the moment.

But it is safe to say that most of it will go to $CLOUD token value accrual if we take close example of their peer Jupiter which recently announced burn of 50% fee, so we will take that figure only.

The value of token is justified at the moment which amounts to 140m FDV and 30m circulating mcap as there is no current usage of the coin, but inflated premium on a coin are not a new thing in crypto(Ethereum ahemm..)

To get clarity on future fee we will take the growth CAGR of Solana’s liquid staking market which is currently at 12% of the 70% total staked.

The total TVL of liquid staking on Solana at the start of 2024 was around $2b which at the start of 2025 is at the peak of $11b and will continuously increase as this cycle, Solana is the chosen one.

Sanctum has grown it’s TVL from 0 to 1.5b in 2024, the closest competitor is Jito which has grown from 600m to 4b.

So taking the max cap of conversion of around 69% of total Solana staked to liquid staking and considering there will not be change in total Solana staked for conservative targets by 2030. The CAGR for liquid staking market comes at 40% and this becomes more conservative target cause we are not taking the change in SOL’s value in this equation.

To get estimate of Sanctum’s share of this pie which will in form of the base layer for all the activity happening anywhere in the LST market, we can use the same CAGR for Sanctum’s TVL too(it is conservative take cause sanctum has increased way more percentage wise than the LST market and has multiple new products on the way), it comes to around 450m in fee in 2030.

So by putting these value in the M.V = P.Q, we get M = 50% of total fee which will used to value accrual to $CLOUD token, we get the table below

It may seem quite low according to the bar set by other cryptocurrency cause while doing valuation of any asset, the valuation is mainly observed from 3 perspectives

-

Store of Value

-

CashFlow

-

Collectible

Bitcoin falls in Store of value, NFT’s fall in Collectible but Infra projects depend on the cashflow but are inflated in their token value enormously giving huge premium’s on the price, just take example of biggest network there is i.e. Ethereum, which gives a premium of over 1000x on ETH token if we take account of fee collected, MEV and stake rewards.So, truth to be told, even the lowest of crypto currency is inflated atleast 10x in price, some examples of protocols in which we divide their TVL by Mcap to get more estimated price

-

Jupiter - 0.4

-

JTO - 0.9

-

Drift - 1

So that’s it, have fun, give reviews and ask me anything :)