Intro

The latest IEA near-term forecast is for global electricity consumption to grow at close to 4% annually through 2027 and Global energy transition investment has surpassed $2 trillion for the first time and more than doubled since 2020.

Demand for electricity is rising both in emerging markets and developing economies and in many advanced economies, driven by industry and by the growing use of air conditioning, appliances, electric vehicles, heat pumps, artificial intelligence and other technologies.

But still the ways of getting electricity in the hands of the user are decades old and inefficient which is unable to match the growth expected in electricity’s usage and reconstructing the whole grid from bottoms-up is not in the possible-things books without blackouts in the entire USA(or the world apparently).

So the grid should be take care in a addition-dispose method where to dispose a part of grid, it is replaced by a new part and it must be repeated endlessly matching the unlimited growth in electricity demand

This is a multi-faceted problem with multi-faceted solutions and currently one of the most complex practical problems to solve in the world.

The Grid and GTDR

Electricity travels at the speed of light, which gives it an approximately no time delay between its generation and consumption. This fact governs the whole electricity markets cycle and has led to division of the grid in 4 main parts i.e. Generation, Transmission, Distribution and Retail displayed in figure 1 which is a bird-eye view of the whole system.

The general way of grid is to generate electricity in big power plants, then step up the voltage to minimise the energy wastage in form of heat, then transmit it over to distribution centres where a transformer steps down the voltage and then it is further calibrated around 110-120 V or 210-220 V for electrical appliances for the retail usage depending on the country.

Electricity generation anchors one side of the Seesaw of supply and demand with Retail consumers on the side of the grid which needs to be balanced every single second.

So the age-old problem is to match the variable demand with variable supply without any storage facilities(at nascent stage) to easen the dynamics.

Supply Demand Dynamics

As the electricity travels at the speed of light, supply & demand should be instantaneously balance and whenever S>D, the G incurs loss and when D>S, the consumer have to pay huge prices, all of this has led to development of Energy Markets all over the world which are the most complex piece of the grid puzzle.

What makes S-D dynamics so complex apart from natural factors such as weather etc.

-

Analysis of Grid Transmission lines

-

No two-way communication models(no R->D, R->G), imp. for Distributed grid

-

Complex Energy Markets

Let’s look at the first 2 points in the next section

Transmission, Distribution and State Estimation

In a traditional power grid, the supply is centralized and it gets spatially distributed as it goes towards Retail. Supply can be controlled but the demand is variable depending upon user behaviour.

So, in short the grid gets complex as we go from Generation(G) to Retail Consumption(R) through T & D.

The first step towards understanding the grid is analysing the grid itself, which is done through monitoring of the grid in its transmission and distribution phase through variety of sensors both manual and automated which comes under the umbrella of State Estimation(SE) which is basically figuring out the real-time condition of the electrical grid — like voltage, current, power flows — even if you don’t have measurements everywhere.

In reality power transmission lines do exhibit losses and transmission constraints, which lead to nonuniform costs throughout the system. Locational Marginal Prices (LMPs) take these factors into account, and generate price signals that vary across the grid based on location.

The architecture of modern grid monitoring(SE) relies heavily on Energy Management Systems(EMS), which serve as the central nervous system for grid operations. These systems collect and process data from various sensors to create a real-time snapshot of grid conditions.

The data entering the SCADA system(Supervisory Control and Data Acquisition) is taken at points with a time resolution of only 2 to 4 seconds, without precise synchronization between measurements at disparate buses and the SE algorithm is typically run only every 2 minutes or so which means that the transmission system is changed every 2 minutes which is far from speed of electricity which travels through the grid in sub-second time-frames.

Traditionally, the monitoring was done using RTUs (Remote Terminal Units) a type of sensor, but now Phasor Measurement Units (PMUs) are replacing RTUs, these advanced devices utilize GPS clocks for precise synchronization across locations, offering a real-time, wide-area view of the grid by recording data at 100 times per second (100 Hz), far surpassing older systems but these sensors are expensive.

SE in the transmission system was discussed here because it is far better developed than SE in the distribution system, and distribution system SE is largely an extension of it.

Transmission vs. Distribution:

-

Transmission systems are better monitored (mesh networks, multiple paths, higher SE usage).

-

Distribution systems are radial (one path in, many out), less monitored, and have limited SE because of fewer sensors and less redundancy.

-

Distribution grids rely on stable flows from substations, reducing the need for real-time reconfiguration

Distribution side needs some additional measurement sensors and infrastructure such as smart meters, smart switches, reclosers, circuit breakers, fault indicators, and other automated switches that provide one or two-way communications. Using these devices, the feeder can be not only monitored but remotely controlled.

Grid’s architecture is designed for one-way communication from G->T->D->R and due to this the grid is struggling in keeping up with the current dynamics of supply & demand.

The solution to this lies in DER(distributed energy resources) which would make upgrade the grid to a 2-way communication system where the demand side can also communicate with supply generators

A second reason that SE will be desired in a future, decentralized power grid is that calculation of marginal prices at the distribution node level (ie. at individual buildings rather than at the transmission substation level only) and passing them on to customers is an economically efficient way of shifting energy consumption to better align with renewables generation,

Real-time data on grid state in order to actively manage the distribution system will be necessary for integrating DERs at scale.

Some Emerging systems in observation and estimation of the grid are

-

Advanced Distribution Management Systems (ADMS): integrate data and provide real-time visibility at the distribution level.

-

Distributed Energy Resource Management Systems (DERMS): manage DERs and enable them to participate in wholesale markets.

Now onto the Energy Markets, we will look into 2 such major market in USA named ERCOT(in texas) and west/east markets(USA except Texas)

Energy Markets - auctions, credits, certificates

The U.S Energy market is mostly uniform with little differences state-wise but there is an exception with Texas which has its own fully different and functional energy market.

First, we’ll take a look in west/east markets, which works on the principle of auctions, where 80% of Multi Settlement Auctions happen in bilateral trade agreements between the producers(power plants) and consumers(Utilities) on a multi-year time horizon and the other deal is done in the wholesale markets which are divided into “day-ahead” markets and real time markets where trading is done in 5/15 minute intervals.

Wholesale markets are the choice of interest here, as the day to day pricing for generation of electricity is decided through them only, so the wholesale market exists to distribute the power promised in multi-year bilateral deals between power plants and utilities deals among smaller time periods

The most interesting and important point to notice in the power auction is that after a threshold generation of electricity becomes exponentially expensive because of the usage of the other resources for the extra energy generation beyond the normal schedule which can be seen in the graph below depicting day-ahead auctions.

In addition to wholesale markets and long-term procurement contracts, markets for Ancillary Services (AS) are used to ensure grid reliability over the long and short term which includes :-

Forward Capacity Markets - a market to incentivize investment in generation resources for adequate quantity of electricity in future, the auctions are done on a 3 year scale

Forward Reserve Markets - paying generators to reserve some energy for future usage

Blackstart service - Because blackstart capability is rare but essential, grid operators (ISOs) run a separate market for it — a kind of insurance policy.Providers get paid for being available to blackstart if needed, they might also be tested or activated in drills/emergencies

Capacity – just for being available and ready to help.

Mileage – for how much they actually change their output (like how far they “drive” up and down in power).

The distributing utilities have a dilemma in which the wholesale Generation and Transmission prices are determined quite dynamically through auctions but the retail price for the end users are not dynamic and are set by some regulating bodies at a fixed rate, so there is no market for Retail users to participate in, this is due to grid having one-way communication and electricity being treated as a necessity for every person just like water and air.

The ERCOT(Electric Reliability Council of Texas) model works out the ‘true’ cost of getting electricity from 1 place to another and distributors can see these numbers to choose where they want to buy the power from in a real time manner.

There are only real-time auctions similar to loan liquidation in DeFi Lending Protocols, it is open, permissionless, dynamic, fast-paced, high risk/high reward and Price discovery is instantaneous.

Instead of long-time contracts to the power plants by government or utilities, ERCOT relies on scarcity pricing (super-high prices in emergencies, remember the threshold in day ahead power auction) to incentivize builders to build infrastructure for the peak demands.

Market for Retail consumers exist in ERCOT where customers can choose their electricity provider, who offers fixed-rate or variable-rate plans and ERCOT does not have regulated, fixed retail pricing.

Retailers act like mini-traders between the volatile market and your steady home bill. Because ERCOT has no capacity market and relies on price signals, demand-side flexibility became super valuable.

There are criticism of ERCOT having fake choices for retail customers while choosing price plans partially true but it is fully true for other markets as the prices are subsidized but ERCOT provides a system which is much more decentralised and divides the game among more participant(like MEV) for better(competitive prices due to increased type of games and participants mainly new)

how does this scarcity prices help consumers, they are bad for consumers and good for generators I think

One more drawback of ERCOT is that its computer program cannot show future market clearing costs equal to prices sufficient to entice generation and transmission companies to make capital investments to meet future demand growth which in other states is done through long-time contracts, but this is being solved using PCM(Performance Credit Mechanism) which adds a new layer of incentive for generators to provide during peak hours and slashes them with penalties if they are not able to provide electricity during these peak hours and these penalties go directly to the powerplants which produced electricity during peak hours.

In short, ERCOT’s penalties are much more favourable for more competition among generators cause 1 has to pay another if it’s short of capacity and this makes the market much more dynamic.

Apart from the Government Regulated markets other forms of markets also exist such as Futures, Renewable Energy Certificates (RECs) and Carbon Credits which provide additional complexity and revenue models in the game.

Price of electricity in ERCOT

Below is an interesting data on prices of electricity in ERCOT which shows how much skewed the markets are during peak hours and why it is such a big problem

Market Condition Share of Time Share of Generator Revenue

Normal prices (~$30–50/MWh) ~98% ~30–50%

Moderate stress prices (~$100–500/MWh) ~1–2% ~20–30%

Scarcity pricing (~$1,000–9,000/MWh) <0.1% ~20–40%

These large variations in price rates are a major financial problem for retail utilities who are contractually obligated to purchase power at the wholesale LMP(Locational Marginal Prices) and sell it at time-invariant retail rates.

The second disproportionate effect of peak demand is that it determines reserve, transmission and distribution capacity.

These prices are also true for east/west markets but costs are borne by governments or utilities which are subsidized through contracts and other instruments.

Retail Price Trends

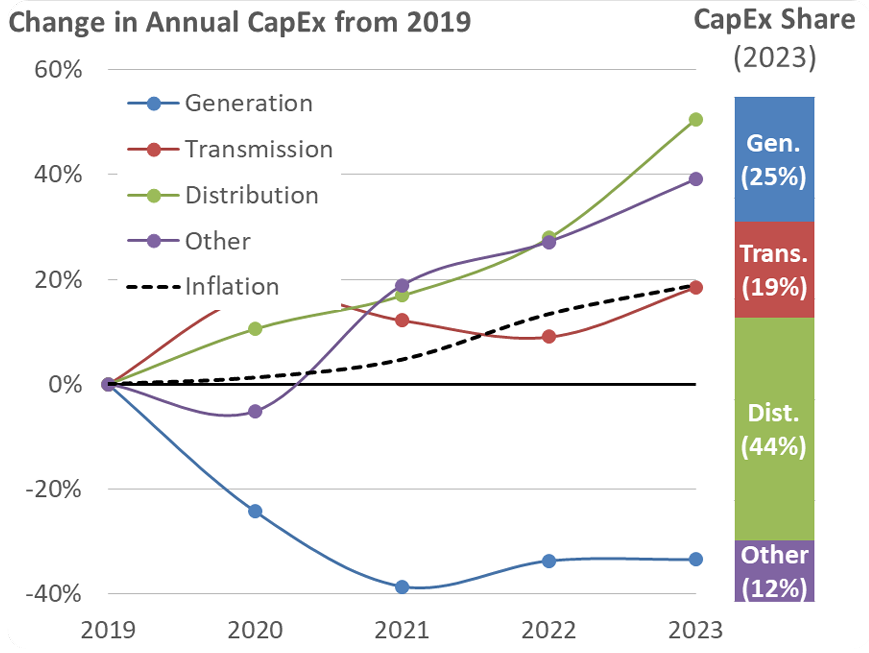

Most change took place from 2019-2023 (the focal time period for this report) where rates rose 2.1 cents/kWh, or 0.5 cents/kWh (4.8%) annually.

Over the focal 5-year period (2019-23), U.S. average retail electricity prices kept pace with inflation and average residential prices rose more than commercial & industrial (C&I) prices

The above graphs shows that while the demand for electricity has pretty much flat but the cost and revenue for utilities has increased.

The main expenditure by plants is on Transmission and Distribution because of mis-match in demand and supply as there is oversupply of power generating sources but less advancements in the distribution sector through which demand can be increased(demand is already there but less technical advancement compared to supply side).

Inefficiencies in Energy Markets and Solutions

Sure! Here's a cleaner and more polished version of your paragraph: --- So far, we've explored what the grid is, how it operates, its architecture, the dynamics of electricity supply and demand, and the functioning of energy markets.

Now feels like the right moment to bring all of this together to identify the inefficiencies within the grid and propose solutions that can either be implemented today or are already in progress to improve its performance.

One-Way Communication Architecture → Distributed Energy Resources(DER)

The grid is one-way communication channel where power flows from generators to the retail consumers and there is no way for the consumers to contribute to the grid other than their monthly bill and this results in inefficient resource allocation and LMP(Locational Marginal Prices) but what if there was a way for consumers or distribution utilities to generate their own electricity and push it back into the grid? Yes there is such a way and it is called DER

Variable Supply-Demand Balance → Renewable Integration

DER is not complete with renewables as not every person can have their own gas/coal power plant at home but what they can have is a small solar panel with almost no cost apart from buying it the first time.

Limited Storage Capabilities → Advanced Battery Systems

The whole problem of supply-demand in the grid comes from lack of a item which can moderate the power by storing it but still it hasn’t done on mass scale and yeah you guessed it right, batteries are that moderating item

Poor Real-Time Monitoring → Edge Computing Solutions

Currently even if the grid had renewable DER with batteries, GRID would still not be sufficient to be said as the perfect utopian grid as if there is nothing to monitor the activity of consumers or even distributors, there can’t be a successful 2-way communication channel established. As discussed earlier, the grid becomes exponentially complex when moving from T -> D -> R, there are fewer and fewer sensors on the electric line.This problem needs to solved for a healthy grid where demand-response can be better, where users can use their data for benefit of the grid and themselves, that’s where Edger Computing comes into play, it is doing computation on the every small node/device possible and getting its data, it’s like SE but with much exponentially large dataset and different new problems to solve

Centralized Market Control → DePIN (Decentralized Physical Infrastructure Networks)

Even if we implemented all 4 solutions mentioned above in the existing grid, it would not be close to grid we want because the data we got from edge computing will be in hands of utilities(just like facebook has your data), you can’t monetise your data, you can’t even form complex system of 2-way communication within different parts of GTDR by yourself. So the grid would still be Oligopoly with nothing for the users but worry not, DReCoN(Prev. DePIN) is here, they are the most efficient way to distribute physical resources and make markets on top of it.

Each solution builds upon the others, creating a framework for the dCFG.

The Utopia - Decentralised Carbon Free Grid

The Grid is evolving fast with the aim of being a Decentralized Carbon Free Grid where the decentralized term comes from consumers decoupling from the traditional GTDR and Carbon-Free comes from replacing fossil fuels by renewable energy resources(sunlight, wind etc.).

dCFG is a grid in which :-

-

Power generation shifts from centralized plants to distributed resources

-

Fossil fuels are replaced by renewable resources

-

Consumers become active participants(Prosumers)

-

Real time pricing reflects true energy cost

-

The grid becomes more and more intelligent with edge computing and AI ass we go towards the end to the retail consumers

The first step is to decentralize the grid

Progress in decentralizing the grid

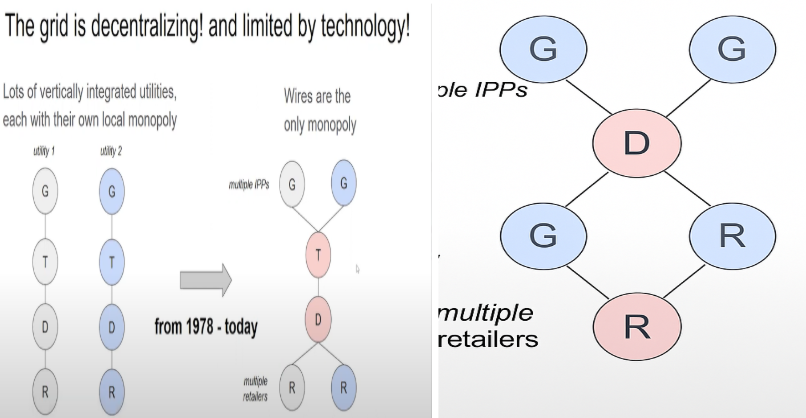

The electric system is a natural monopoly, and is unchallenged when it comes to transmission and distribution infrastructure. (Power lines are expensive and must geographically connect all nodes on the grid.) However, in contemporary design of wholesale power markets and deregulation of retail markets it has been generally accepted that the GTDR system is not monolithic. While the T&D sections are natural monopolies, the end members G and Rcan be supplied by competing providers albeit within the context of a heavily controlled and regulated framework.

And the decentralization of the grid should start from the G and R only, there is a very nice diagram depicting the situation below :-

Electricity Grid is a large optimization problem just like MEV, the method of solving these optimization problem is through decomposing the problem into smaller sub-problems, which are then coordinated by a master problem mainly through 2 methods -

Primal Decomposition - the role of master problem is to properly allocate the existing resources

Dual Decomposition - the role of master problem is to set prices for each subproblem with no limits on resources and obtain the best pricing strategy(ERCOT)

Current GRID is somewhere between the centralised and decentralised network shown above and the goal is the distributed network in the last where each node has the capability to fulfill roles of GTDR itself.

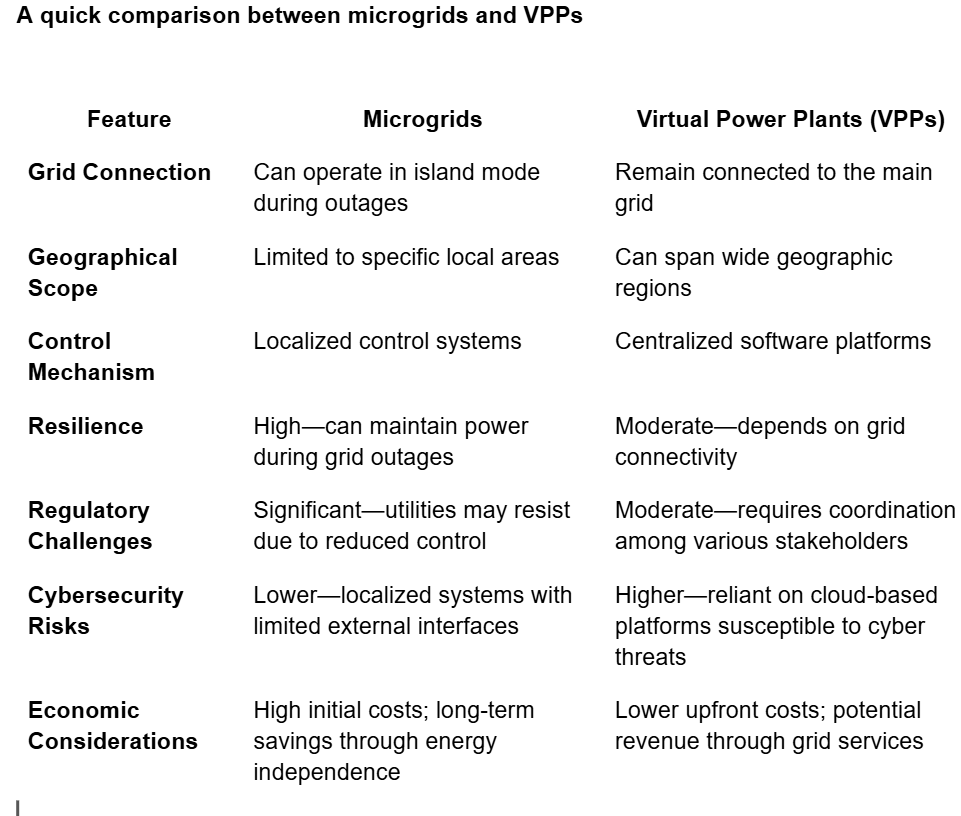

The transition from centralized to distributed networks requires intermediate solutions that can bridge the gap while maintaining grid stability. Two key technologies enabling this transition are Microgrids and Virtual Power Plants (VPPs).

Microgrid is a localized grid system that can operate either connected to or independent from the main grid, providing energy security and local control.

VPP are Cloud-based systems that aggregate and coordinate distributed energy resources to provide grid services and participate in energy markets.

Microgrids and VPPs are not mutually exclusive and can complement each other. A microgrid can participate in a VPP, contributing to broader grid stability, while a VPP can optimize the operation of multiple microgrids.

Market Progress in Microgrids and VPPs

In 2023, the cumulative installed capacity of microgrids in the U.S. reached approximately 5.4 gigawatts (GW), marking more than a fivefold increase since the 1990s.

As of 2023, the U.S. Department of Energy (DOE) estimated VPP capacity between 30 GW to 60 GW, primarily composed of demand response programs.

Future Projections: The DOE suggests that increasing VPP capacity to between 80 GW and 160 GW by 2030 could meet approximately 10% to 20% of peak electricity demand, potentially saving about $10 billion annually in grid costs.

Bonus - Tesla’s South Australia VPP, where thousands of home batteries are aggregated to stabilize the grid launched in 2018, was initially planned to be the world's largest, targeting 50,000 homes with a combined capacity of 250 MW. However, as of late 2024, the project has installed approximately 7,000 Tesla Powerwall batteries, totaling around 35 MW of capacity.

Progress in Carbon Free Grid

Suppose we have microgrids in every home and they work on coal/gas, it would be a disaster because of health/safety hazards and expensive setup. Renewable energy resources help in both of the above along with the fact that they produce little to no emissions, supporting climate goals and reducing environmental impact.

There is a current initiative/campaign running all over the world to decarbonize the world by 2050 by reducing GHG emissions by 95% and limiting global warming to 1.5°C above pre-industrial levels and this can’t be done without reforming one of the most fossil fuel heavy industry i.e. Electric Grid.

There is huge investment being done in clean energy and the government provides many benefits to setup clean energy generators despite the project scale, some quick numbers below

-

24% U.S. electricity from renewables

-

50 GW new solar capacity installed

These numbers are due to 2 major factors

-

Declining technology costs – The cost of solar energy has decreased by 82% since 2010, while wind energy costs have dropped by 40%, making renewables increasingly competitive with fossil fuels (BloombergNEF).

-

Incentives and tax credits – The IRA’s expanded tax benefits have attracted greater investment in clean energy projects across multiple sectors, say you build a solar farm:

You get a 30% ITC on the capital cost.

You sell your electricity under a PPA to a utility.

You earn RECs and sell them to corporations for extra revenue.

You avoid curtailment thanks to grid priority.

You might get local grants depending on your region.

The solar industry was a major beneficiary of subsidies contained in former President Joe Biden's landmark 2022 climate change law, the Inflation Reduction Act (IRA).

The Trump administration has said it was reviewing federal funding plans, and any removal of tax credits, opens new tab issued under the 2022 Inflation Reduction Act would impact clean energy deployment.(**or maybe it is liberal propaganda and TRUMP is more centrist than polymarket thinks but not entirely :) )**With significant changes to U.S. energy policies under the Trump administration, whether these trends will continue is not clear

Among other issues, grid infrastructure has struggled to keep pace with the rate at which new renewable sources are entering the system, this mismatch has led to delays in project deployment and increased financial uncertainty: in 2024, the IEA tracked 1 650 GW of solar and wind projects in advanced stages of development that are awaiting grid connections, a major missed opportunity to bring clean, cost-effective sources of generation into the mix.

Renewables are the cheapest way to inject power in the grid but are not sustainable/sustainable because of external factors such as weather but there is a solution. What if there was a way to store the electricity :)

Batteries - The inefficient Panacea

Batteries are a way to store electric power with its own challenges but they are crucial for a decentralized, renewable-powered grid as renewable energy does not follow a regular pattern and to provide power injection at the correct time, there needs to be a robust storage solution.

Battery storage systems are emerging as the crucial bridge between variable generation and consistent demand

Battery storage serves multiple critical functions in modern grid operations. At the grid level, these systems manage peak demand, provide frequency regulation, and ensure stability during renewable energy integration. They also offer crucial backup during emergencies, effectively acting as a buffer between supply and demand.

They can also be used to arbitrage electricity prices by storing the battery during cheap regular hours and selling that energy in peak hours for an exponential price.

But still Batteries are not wide spread because of some fundamental reasons\

-

Recycling Challenges: Current battery recycling technologies are inefficient.

-

Battery Degradation: Lithium-ion batteries degrade over time, reducing efficiency.

-

Material Shortages: Critical minerals like lithium, cobalt, and nickel are scarce and expensive.

Battery storage growth – U.S. battery storage capacity is projected to more than double by 2027, reaching 30 GW(U.S. Energy Information Administration).

In 2024, large-scale battery storage capacity in the U.S. surged to 24 gigawatt-hours (GWh), a 71% increase from the previous year. This expansion enhances the reliability of renewable energy sources by mitigating their intermittent nature

Till now we have covered the basic trifecta needed in dCFG, i.e. DER, Renewables and Batteries, these 3 would make grid better like 100x but also increase the complexity 1000x, so we would need a system powerful enough to analyze and monitor the grid and even make it autonomous with the latest tech in our Arsenal i.e. A.I.

Edge Computing and AI

Edge computing and AI serve as the "brain" of this evolving system called dCFG, enabling real-time monitoring, control, and optimization

Edge Computing means to compute on devices on the edge of a network such as **different type of nodes in Ethereum or laptops in Grass **and for the electric grid it means computing on the furthest point in grid’s supply chain which contains devices like:

-

Smart meters and sensors

-

Residential solar inverters

-

Battery management systems

-

Smart thermostats and appliances

-

EV charging stations

-

Heat pumps and water heaters

These devices form a vast network of data collection and control points, enabling granular grid management previously impossible with centralized systems.

Artificial intelligence transforms this flood of data into actionable insights. Advanced AI models, from large language models to specialized neural networks, enable everything from automated maintenance scheduling to real-time power flow optimization.

These systems achieve remarkable accuracy in critical tasks like cyber threat detection (92-99.5%), though they face challenges in computational demands(data centers incoming) and system integration.

It is expected that as both the economics and technical implications of increasingly granular price signals are better understood, this will substantially transform the power system. The development of an open source energy trading framework stands to accelerate and enable this process by improving interoperability between legacy systems, affording participants technical control over the system, and allowing them better visibility into its behavior.

The trickle-down effects from the AI usage and investment can be seen in their power consumptions, this report finds that data centers consumed about 4.4% of total U.S. electricity in 2023 and are expected to consume approximately 6.7 to 12% of total U.S. electricity by 2028. The report indicates that total data center electricity usage climbed from 58 TWh in 2014 to 176 TWh in 2023 and estimates an increase between 325 to 580 TWh by 2028.

An exclusive Bloomberg analysis shows that more than three-quarters of highly-distorted power readings across the country are within 50 miles of significant data center activity. While many facilities are popping up near major US cities and adding stress to already fragile grids, this trend holds true in rural areas as well.

How can we(the retail consumers) help

Yes, the masses can also make a difference by saving electricity wherever possible and this could be done through not only using Air Conditioners less but through a lot other methods, let’s go through them one by one.

DR - Demand Response is the technique of switching of appliances during peak hours to save electric costs, it is an established business with experience aggregating distributed energy resources and both selling them to distribution utilities and bidding them as capacity into wholesale markets, so it applies to both consumers and distributors.

The prices in peak demand hours are diabolical and if there were no government regulating bodies keeping the electricity prices at a constant(like ERCOT) then due to the absolute amount of load, expensive generators will be recruited and the marginal generator may be priced well above the usual cost of power, which makes the peak demand prices exponential.

The effect is that a large fraction of distribution utility costs are spent on procuring power during these time periods. For example, just 1% of electricity sold in MA(Massachusetts) during 2013-2015 accounted for 8% of total sales cost and similar ratios are frequently seen in other systems.

Time of use (TOU) pricing reflects a classical economic approach to electricity retail by which customers are passed pricing signals and are able to adjust their behavior based on them, it is much more dynamic than DR as the applications react in real time to price changes.

TOU and DR both fall under the umbrella demand side management and are similar in that they both involve influencing customer behavior via an economic signal.

DR typically uses an on/off signal sent out at varying times in response to grid congestion. TOU pricing, by contrast, captures (usually prescheduled) time-dependent pricing tiers at a range of granularity and DR can be bid into wholesale markets as capacity, whereas TOU can not.

In 2023, more than 10% of all residential customers and more than 11% of all C&I customers were enrolled in time-varying rates nationwide

BTM Generation means that consumers generate their own electricity and replace it with traditional grid connection

Enroll in Energy Efficiency Programs which are generally funded by utilities as it diminishes their costs in peak hours and also normal hours and these utilities are also indirectly funded by State Governments

Using Electric Vehicles(EVs) as they reduce global warming but are also cheaper to run and can provide additional income through charging stations and the demand for these is increasing YoY

DePIN(DReCoN) energy products

Blockchain is the final missing piece for dCFG to work, a distributed ledger(blockchain;) ) can reform the whole business and technical model of how energy is traded, lets’ see why blockchains are so cool

-

DDos attacks can be contained using transaction costs and validators

-

All the data is visible but encrypted thanks to ZK, FHE

-

Removes single point of failure

-

Helps in collaboration of peeps for variety of resources(DePIN) to make a super-giga resource(power rangers robot)

-

Will be super fast(sub-second finality) in the future when every device is a node(edge computing)

-

It is borderless and censorship resistant(to some extent, better than others)

And specially the sub-category DReCon(prev.DePIN) fits the grid perfectly because it handles the allocation of physical resources/infrastructure.

Some projects building in the space are :-

React Network - It is tackling the Retail Consumption side of thing by planting smart sensors to monitor power consumption of a house and stores excess power in a battery to be sold to the grid - VPP with smart meters sensors for demand response

Glow Labs - it basically helps the solar power plants with less income to get more income by selling their carbon credit for clean energy generation if they opt to come in a 4 year agreement to let glow handle the sell of their energy generation, just like Powerledger but instead of p2p trading of energy using microgrids, it sells the energy and carbon credit in year long agreements- not a good use case - tokens are shit also - like VPP with carbon credits

Daylight - it is VPP with providing service of building solar power plants for the users

Powerledger - It is trying to make local microgrid economies without relying on the GRID through making p2p markets in small multiple areas and has a separate markets for certificates like REC, carbon credits, white certificate etc. for corporations and industries

SCRFUL - they are leveraging Helium hotspots to make aggregate data about household energy usage

Plural Energy - They allow people to invest in renewable energy using fractionalizing of assets

Star Power - They make hardware for smart meters. Batteries and give incentive on doing so.

There are many different business model which are being tested or are untouched in the electric grid, let’s look at them with risk factors to higher ones :-

P2P energy trading platform - Where energy is directly traded peer-to-peer quickly, transparently, and inexpensively, some web3 protocols building are Powerledger and LO3 energy.

-

Easy to implement(Low risk) - Small scale markets for microgrids in which direct trading of energy between prosumers and community consumers without any 3rd party. These isolated community microgrids can absolutely demolish the peak hours price because of adequate local supply acc. to local demand and can undercut the prices as decided in the community.

-

Trading Mechanisms - If these microgrid have adequate batteries, then different trading mechanisms can be tried for the stored energy such as Order book and AMM

-

Future Outlook - these p2p microgrids will lessen the burden on supply side of grid and they can evolve in VPP with multiple microgrids polling together and providing electricity to the grid and this whole transaction happens on blockchain where the government/regulatory bodies can then easily give them incentives to do so, these markets can also expand to p2p trading of power for electric vehicle s

P2B energy trading platform - This are modeled upon VPP which can be made through aggregation of small energy sources with the intention of pooling them and selling them back to the grid through utilities or auctions, most of projects are working in this direction only with little bit of differentiation which can be categorized as

-

Certificate trading - Glow labs and Powerledger are building in this where they pool the clean electricity and give additional income on selling their carbon credits to Corporates and industries

-

Building Renewable plants - Daylight provides the full supply chain by building and setting up solar panels and then pooling them.

-

Demand Response - Projects such as React network monitors the house electric usage and pools extra electricity produced through batteries to be sold afterwards.

-

Vehicle-to-Grid (V2G) Integration - Electric vehicles (EVs) are being integrated into the power grid through V2G technology, allowing them to serve as mobile energy storage units.

-

Future Outlook - Blockchain will be essential in forming 2-way communication channels with the grid congestion and outages and also for 2-way payment channels.

Investment Markets - This refers to leading the investment in making the grid cleaner through renewables which is only accessible to Government in giving subsidies and contracts and retail consumer have to normally buy their own solar plants which needs a huge bootup capital, so fractionalizing the big clean energy plants and letting user own those fraction is high time frame - high regulatory risk opportunity for web3

Data collection and processing - blockchains are just a public ledger in the end which are transparent, this sector has the most potential for reformation through use of blockchains

-

Retail side data - data can be collected from each household through various sensors which can help in many ways, such as - demand response, TOU pricing based on the usage patterns, it has less risk factor and more time constraint

-

State Estimation - Apart from the normal use case of data collection and transformation for the government usage, data collected on transmission and distribution lines can be made public and various people can be recruited on the basis of Geo-Location to handle any faults appearing on the grids with instantaneous incentives. Protocols such as **Spexi **can help in in monitoring the electric fires and line defaults from above.

-

Generation - Live feed of data from power plants to straight regulating bodies and consumers would remove the trust based assumptions needed today

Energy Markets to DeFi - Apart from the normal wholesale auction markets or ERCOT’s live markets, there are multiple financial instruments in electricity industry which are plagued/blessed by information asymmetry still, all of which can be bringed on chain, list is below :-

-

Demand Response - this can help users to arbitrage in electricity prices by storing electricity during normal hours and selling during peak hours

-

Forward Capacity and Reserve Markets - these markets if done on chain can help in thinning the bid-ask spread

-

Blackstart service and Mileage - these are plagued heavily with bogus claims and can be streamlined.

-

Battery - Energy storage is akin to Liquidity whether it is in a Liquidity pool or an order book or a DLMM, when the stored energy breaks the barrier of local consumption and produce, will be traded on the grid directly through these price discovery mechanisms.

-

Wholesale Markets and ERCOT - can be brought entirely on blockchain

Legal pipeline - Number of power generating projects in the grid pipeline is huge and most of them are fake/outdated because of multiple filings by the same company depending on dynamic rules/regulations changes. This pipeline process can be streamlined if the whole process is either brought on-chain or either through DAOs.

Future Outlook - Investment, policies and regulations

The exponential growth of AI and data infrastructure is placing unprecedented pressure on global energy networks. We are approaching a paradigm shift.

Consider this: Data centers in the U.S. alone are forecasted to consume 8–12% of total electricity demand by 2030, up from just 3–4% today. In "Data Center Alley" — a dense, 30-square-mile stretch hosting over 200 facilities — power consumption already rivals that of Boston. In a stress event, 60 data centers simultaneously shifted to on-site generators, underscoring how brittle current dependencies have become.

Yet, this is just the tip of the iceberg.

The Texas power grid, a microcosm of this global trend, expects demand to increase 7–8 fold in just five years — accelerated by crypto mining, AI training clusters, and a rapidly electrifying industrial base.

This surging demand is triggering a capital response, but the gap remains glaring.

In 2024, global investment into power grids reached $390 billion, but we need to exceed $200 billion annually by the mid-2030s, and ultimately $250–300 billion per year to align with full decarbonization and resilience goals. Transmission alone saw $140 billion of investment in 2023, a 10% increase YoY, but it still falls short.

Meanwhile, Blackstone has recognized the structural opportunity, deploying $5.6 billion into renewable energy infrastructure, while global energy transition debt surpassed $1 trillion in 2024, with corporate debt rising 5%.

Broader energy transition investment crossed the $2 trillion milestone in 2024, though growth decelerated to 10.7%, down from the breakneck 24–29% CAGR of 2021–2023.

The capital flow has been skewed: ~80% of these investments are concentrated in advanced economies and China, leaving vast underserved markets and grid vulnerabilities globally.

Even within the energy transition, renewables attracted $728 billion, electrified transport $757 billion, and energy storage $54 billion — showing a clear prioritization, but also signaling underinvestment in grid resilience, orchestration, and optimization layers.

And as the energy system scales, so too must its supply chain. Clean energy supply chain investments reached $140 billion, with BNEF projecting an average of $45 billion annually through 2030 just for factory buildout — a threshold we’ve already surpassed.

Yet, the risk of grid instability looms as DERs and corporate virtual power plants introduce new volatility, forcing generators into rapid supply adjustments. Retail customers, largely disengaged from their own energy consumption, represent an untapped opportunity; improving time-of-use pricing and behavioral engagement could create a more dynamic and responsive grid.

The fundamental challenge remains: while generation costs fall, delivery costs rise, and a grid originally built for one-way flow must now accommodate decentralized, bidirectional power exchanges.

The future will belong to systems that not only build abundant capacity but also smartly orchestrate it — balancing supply and demand in real time, empowering consumers as active participants, and ensuring resilience in the face of accelerating electrification and climate pressures.

To meet the ambitions of net zero, our focus must evolve from merely building infrastructure to truly optimizing its use, much lub pp :)