Summary

Innovators create real value, and groundbreaking innovations that create real value, such as the telephone, steam engine, computer, and internet, have improved the lives of billions. Charm supports innovators by helping them create liquid markets for their ideas, products, and service, so that their innovations can be enjoyed or traded by more people.

Introduction

The financial economy allocates funds to the real economy, so that innovation can get the funding it needs to grow. If this process isn’t efficient, the real economy will stagnate, and the financial economy will collapse with devastating consequences.

The crypto economy is similar to other parts of the financial economy, except that value can be easily transferred within the crypto economy. A mechanism that connects crypto value to real value will bring significant benefits to society, because it can transfer more value to the real economy. Decentralised Liquidity Management (DLM) is one such mechanism.

What is DLM

DLM was invented by Charm, and is one of the most popular ways to manage liquidity. It uses decentralised market making strategies to create liquid markets for tokens in the crypto economy.

DLM was founded on the principles of decentralisation and open source. This means anyone can use DLM to create liquid markets for their ideas, products, and services. Alpha Vaults is a protocol that simplifies DLM for users.

DLM transfers crypto value to the real economy when liquid markets are created for tokenized products and services.

What is Real Value

Real value is the inflation adjusted market value of all the products and services in the real economy (ie the real GDP).

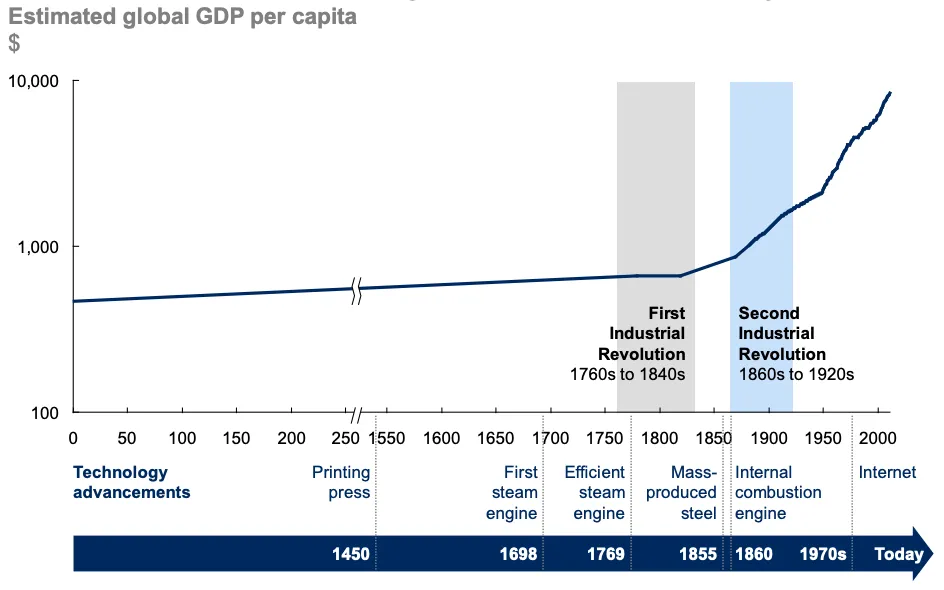

Innovation are new ways to create real value. They are the most powerful drivers of human progress, as they directly influence the goods or services available for purchase. The importance of innovation is shown in the chart below:

All innovations need money to grow and develop.

What is money

Money is commonly defined as a storehold of wealth, but it is actually credits created by centralized or decentralized entities. Holders of money (eg USD, Bitcoin, Ethereum) are entitled to future payments from the creators of money.

The money can be used to generate more money (eg by purchasing investments, lending); but eventually, all money must be exchanged for products and service in the real economy, because money in itself has no value.

After their creation, money can be lent to debtors to create debts, and debtors can use the money to create new financial assets (eg stocks, tokens, bonds, options, tokens), buy financial assets, or to create even more debt. The creation and trading of financial assets creates the financial economy, of which a small subset is the crypto economy.

What is Crypto Value

Crypto value is the market value of digital assets within the crypto economy.

The crypto economy is an extension of the financial economy, where money and financial assets are created using real value as collateral. When financial assets are traded, money should be allocated to activities that increase the real value.

By removing the intermediaries in financial economies, the crypto economy offers a cheaper, more efficient and fairer way to allocate capital, and a better way to grow the real economy.

When things go wrong…

Things go wrong because the financial economy have a tendency to create debts, and if the debts cannot be repaid using real value, the financial economy shrinks to match the size of the real economy.

When this happens, there will be heavy losses for debt holders (ie purchasers of financial assets), leading to recessions, bankruptcies, unemployment, and loss of livelihoods.

To avoid these catastrophes, the real economy must keep growing, in order to support the financial economy built on top of it. It is the only way to create a positive outcome for all.

How to grow the real economy

Connecting crypto value to real value is a good way to grow the real economy, because the crypto economy is fundamentally a grass-root movement where money, credit, debts, and assets are created by individuals within the real economy, rather than by centralized intermediaries.

Charm has been working on ways to connect crypto value to real value since its founding 2+ years ago, and its efforts led to the creation of a new industry for Decentralized Liquidity Management (DLM).

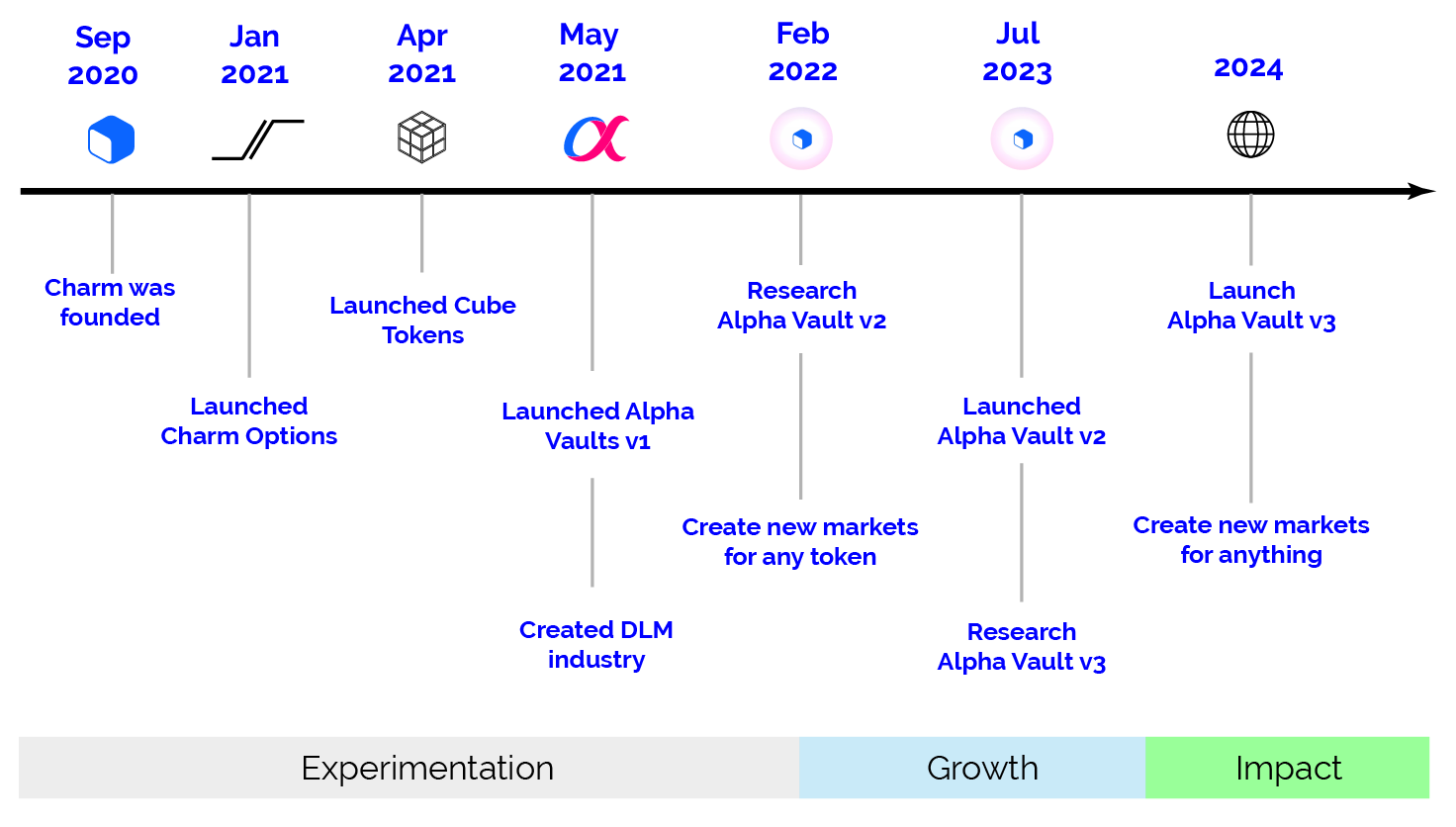

The following is a roadmap to describe Charm’s plans to grow the DLM industry.

Charm’s roadmap

Phase 1 of Charm’s roadmap was to experiment different ways to connect Crypto Value to Real Value. This was a year long effort leading to the launch of Alpha Vaults v1, and the creation of a new industry for Decentralized Liquidity Management (DLM).

Phase 2 is to grow the DLM industry, starting with the launch of Alpha Vault v2.

Phase 3 is to help anyone create new ideas, products, and services; and then use DLM to market their innovations. A key milestone for this phase will be the launch of Alpha Vaults v3.

Conclusion

The financial economy supports the real economy by funding innovation and growth. If innovations do not receive the funds, the real economy stops growing, and the financial economy collapses, resulting in recessions, bankruptcies, and unemployment.

This is why financial value should be connected to real value, so that innovations will always be funded. This can be achieved using Decentralised Liquidity Management (DLM). Charm was the first to use DLM, and is working on solutions to increase the number of markets it can create, in order to bring out more innovations that will otherwise go un-noticed.

If you’re interested in innovation, decentralization, and creating real value, don’t hesitate to get in touch with Charm — we would love to work with you to build a sustainable future for all!

Join the community

To be the first to receive updates, follow @charmfinance on Twitter.

Feel free to ask questions, suggest ideas or chat about anything on Discord or Telegram.