Mantis is an SVM L2 powering best execution. This is made possible by the Inter-Blockchain Communication (IBC) Protocol, which carries out trust-minimized cross-chain messaging. As a result, Mantis is able to facilitate bridging for cross-chain intents in a decentralized and secure manner

In this article, explore how this process of managing intents works on Mantis.

Background: Trustlessness and the IBC Protocol

Trustlessness is a term that often confuses people. Isn’t trust a good thing? If trust is good, then is trustlessness bad? The answers are not what someone new to these terms might think.

When we talk about trust or something being “trusted” in DeFi, we are referring to the fact that we need to trust a third party to behave as expected in order for a protocol or process to work properly. Ethereum Co-Founder Vitalik Buterin defines trust as “the use of any assumptions about the behavior of other people”. Trust in the DeFi space essentially means that you have to trust a stranger to do something in order for you to get your desired result. This term ties in with the concept of “centralization” as well. If a specific entity has control over a particular part of a system, centralization increases.

Of course, the trusted third party can be incentivized to behave as expected with rewards, or disincentivized to misbehave with slashing or other punishments. But sometimes, there can be external incentives that may make a trusted entity misbehave - such as the opportunity to earn more than the rewards presented by behaving as expected.

Thus, we have turned to truslessness as a pillar of decentralized finance. Vitalik Buterin defines trustlessness as “the ability of the application to continue operating in an expected way without needing to rely on a specific actor to behave in a specific way even when their interests might change and push them to act in some different unexpected way in the future”. In other words, something is trustless when we do not need a third party to behave a certain way in order for a protocol or process to work properly.

The Inter-Blockchain Communication Protocol was created as a trustless mechanism for cross-chain bridging. As the Picasso Network has previously described, in terms of trust assumptions, IBC-based bridging is superior to centralized, permissioned, and optimistic bridges. It is comparable to ZK bridges, which are a trustless mechanism for bridging but are not suitable for connecting all chains. This is the main reason why Mantis selected IBC as our bridging mechanism of choice.

IBC connections on Mantis are facilitated by the Picasso Network. Picasso has expanded the reach of IBC without introducing new trust assumptions. Now, IBC connects Cosmos/the Interchain, Ethereum, Solana, Polkadot, and Kusama. Picasso has plans to further expand the IBC to other networks as well, such as by creating an IBC Bitcoin connection.

Trustlessly Settling Cross-Chain Intents with Mantis

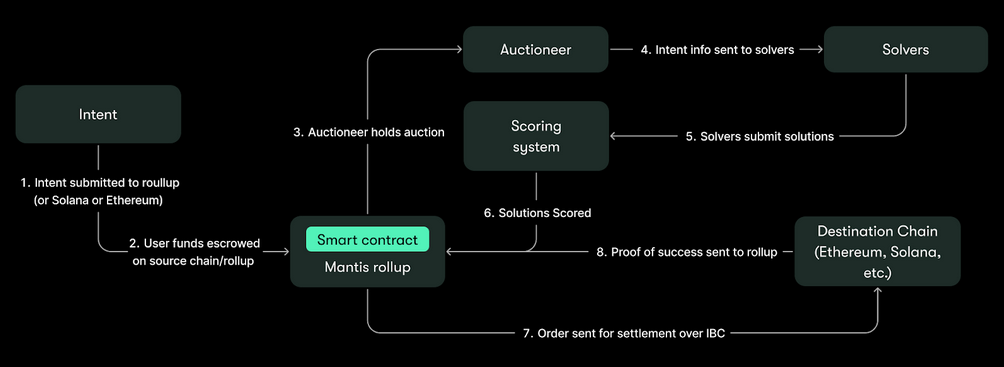

Some people have made the argument that intents rely on off-chain, trusted bridging - and thus are incongruous with the ethos of decentralized finance. However, intents on Mantis do not use trusted bridging and instead implement trust-minimized bridging via the IBC. Here’s more details on how cross-chain intents are settled on Mantis v1:

-

Intents (preferences for a cross-chain transaction) are submitted to the Mantis interface via the Mantis rollup directly or via another IBC-connected chain like Solana or Ethereum.

-

User funds are escrowed on the source chain or the rollup (where the intent is submitted).

-

All intents then flow to the Mantis rollup. From here, a smart contract on the Mantis rollup sends intents to an off-chain auctioneer.

-

Information on intents is sent to solvers.

-

Solvers submit solutions (i.e. transaction routes) for user intents to the rollup.

-

Solutions are scored off-chain by the auctioneer.

-

Once the winning solution is determined, the solver that proposed it must execute the intent. This is done by sending out the transaction over the IBC protocol (via the Picasso Network) to any relevant chains.

-

Once the transaction is completed, proof of success is sent to the rollup.

This lifecycle is depicted in the diagram below:

As you can see, the IBC is used in all cross-chain operations on Mantis. In this model, there is minimal trust involved. The only trusted parties (and an explanation of how the trust in them is minimized) on Mantis are as follows:

The IBC Protocol:

This is used in the final step of sending funds from Mantis to the destination chain. IBC was selected as Mantis’s mechanism for cross-chain operations because it is trust-minimized. However, Mantis still places trust in the IBC protocol itself.

IBC trusts only the consensus of transferring and receiving chains, imposing no new trust requirements itself. It relies upon light clients to facilitate communication between connected chains. Light clients are lightweight representations of one blockchain that live in the state machine of another blockchain. Specifically, light clients keep track of a blockchain’s consensus algorithm by verifying block headers and Merkle proofs.

The Auctioneer:

On Mantis, trust is placed in the auctioneer (initially, an off-chain actor) to deposit escrowed user funds. However, the auctioneer's power is limited in scope. They can, at most, censor intents and solutions. In addition, Mantis has incentives and checks and balances in place to discourage any incorrect information sent to the solvers by auctioneers. They do not hold users' funds at any point in the process. Once a solver submits a solution, proof of this submission is made via IBC. This eliminates the need for trust in the auctioneer at this stage.

The interests of the auctioneer are generally aligned with those of solvers and users. Better solutions typically result in higher fees paid to the auctioneer. The result is an incentive for fair and efficient operation. While off-chain agreements between solvers and the auctioneer are theoretically possible, such collusion would likely be statistically observable by other solvers. This provides a form of checks and balances within the system.

This structure aims to create a trustless or trust-minimized environment where the auctioneer's role is important but constrained. Moreover, multiple parties have incentives to maintain the integrity of the system.

Key Takeaways

At Mantis, we think that it is incredibly important to prioritize trust-minimization. This is especially important in cross-chain bridges, as trusted or centralized bridges are more often the subjects of exploits. In contrast, trust-minimized bridges better secure user assets.

Thus, we have implemented IBC for cross-chain operations on the Mantis protocol. As IBC is trustless, Mantis is able to uphold the ideals of decentralization and deliver an optimally secure and fair user experience.