We are pleased to be integrating lending pools from marginfi into Mantis as the yield backend for our bridge contract. This will support restaking and native yield on Mantis, augmenting yield from these lending pools.

About the Collaboration

All staked funds going through the Mantis rollup will be deposited into lending pools on marginfi. This results in yield for users, enhancing the yield that they already get from native staking and restaking. This is simultaneously earned while users are utilizing their assets on the rollup.

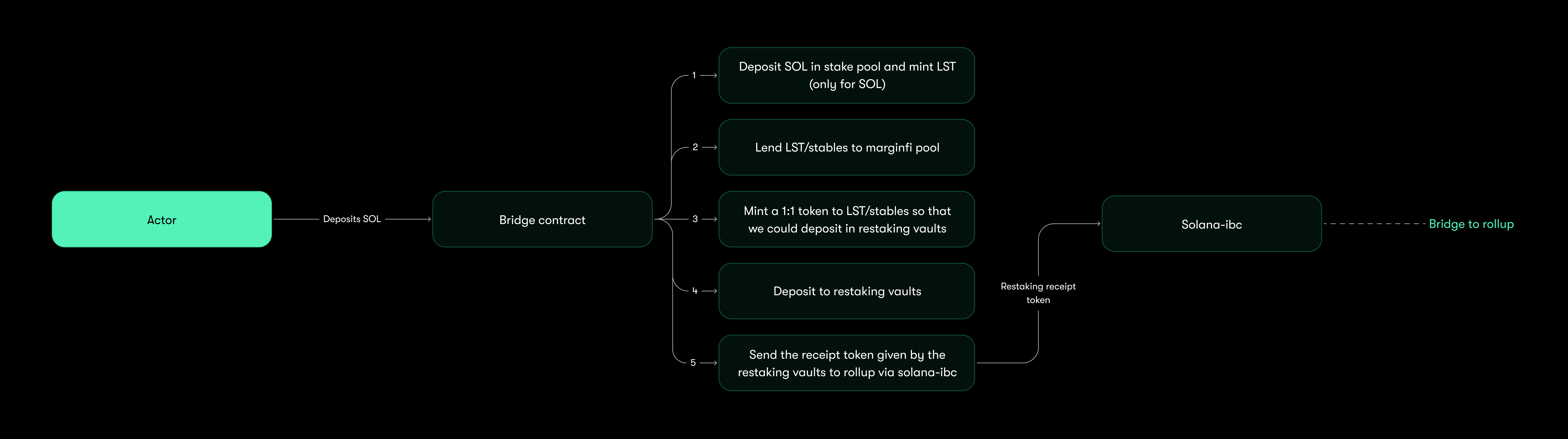

The depositing process for different asset types (SOL, LSTs, and stablecoins) deposited to the Mantis rollup is shown below:

As shown, the user deposits SOL to the bridge contract. This SOL is deposited in the stake pool and an LST is minted to represent this stake. The LST is then sent to a marginfi pool. This mints a 1:1 token for the LST so that it can be deposited into the restaking vaults associated with Picasso. The receipt token from the staking vaults is then sent back to the rollup via IBC which, due to the fact the rollup is natively IBC-enabled, minting SOL onto rollup. This process can also be done for Solana-based LSTs and stablecoins, not just the SOL token itself. This means that:

-SOL assets earn native staking yield and lending yield from marginfi

-SOL LSTs earn native staking yield and lending yield from marginfi

-SOL native stables earn lending yield from marginfi

This process allows users to derive native yield while using assets on the rollup. Furthermore, all assets are restaked into Picasso’s restaking vaults.

More About marginfi

marginfi describes itself as “a new liquidity layer for performant DeFi.” This Solana-based protocol offers a number of different opportunities for users. This includes:

-

mrgnlnd: A lending and borrowing platform offering lenders varying yields (such as 1.38% APY for SOL, 0.15% for bSOL, 9.61% APY for USDC, and 11.76% for USDT at the time of writing). mrgnlend pools will be used for the current collaboration.

-

LST/YBX: Solana's highest yield accruing SOL token and stable-asset, which can be minted from marginfi.

-

mrgntrade: marginfi’s new trading application that allows you to take leveraged long and short positions on your favorite longtail assets (e.g., memecoins). .

At the time of writing, it has $519 million in total liquidity with $80 million staked and $106 million borrowed.