Mantis serves as a vertically integrated intent pipeline, complete with expression, execution, and settlement. Continue reading to learn about the technical innovations powering Mantis, including the Picasso Network and the Inter-Blockchain Communication (IBC) Protocol.

Mantis Architecture

The main components of the Mantis ecosystem are the Mantis rollup, protocol, and token. These components synergize with the Picasso Network and IBC for cross-chain capability.

Overview: Mantis V1

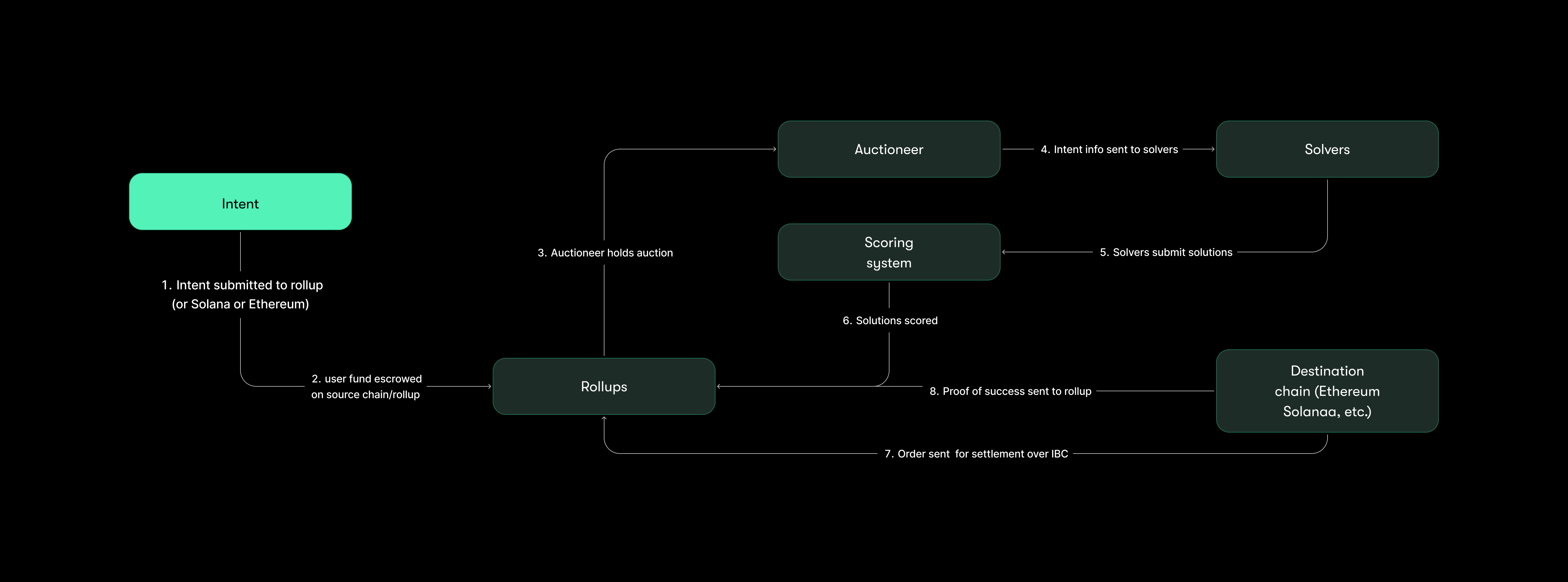

A summary of the first iteration of Mantis is as follows:

-

Intents are submitted to the Mantis interface (via the Mantis rollup directly or via another IBC-connected chain like Solana or Ethereum), enabling users to express preferences for a cross-chain transaction.

-

User funds are escrowed on the source chain (or the rollup, if that is where the intent is submitted).

-

All intents flow to the Mantis rollup and then to an auctioneer (an off-chain actor).

-

Information on intents is sent to solvers.

-

Solvers then submit solutions (e.g. transaction routes) for user intents to the rollup.

-

Solutions are scored off-chain by the auctioneer.

-

Once the winning solution is determined, the solver that proposed it must execute the intent, sending out the transaction over the IBC protocol (via the Picasso Network) to any relevant chains.

-

Once the transaction is completed, proof of success is sent to the rollup.

This architectural flow is summarized below:

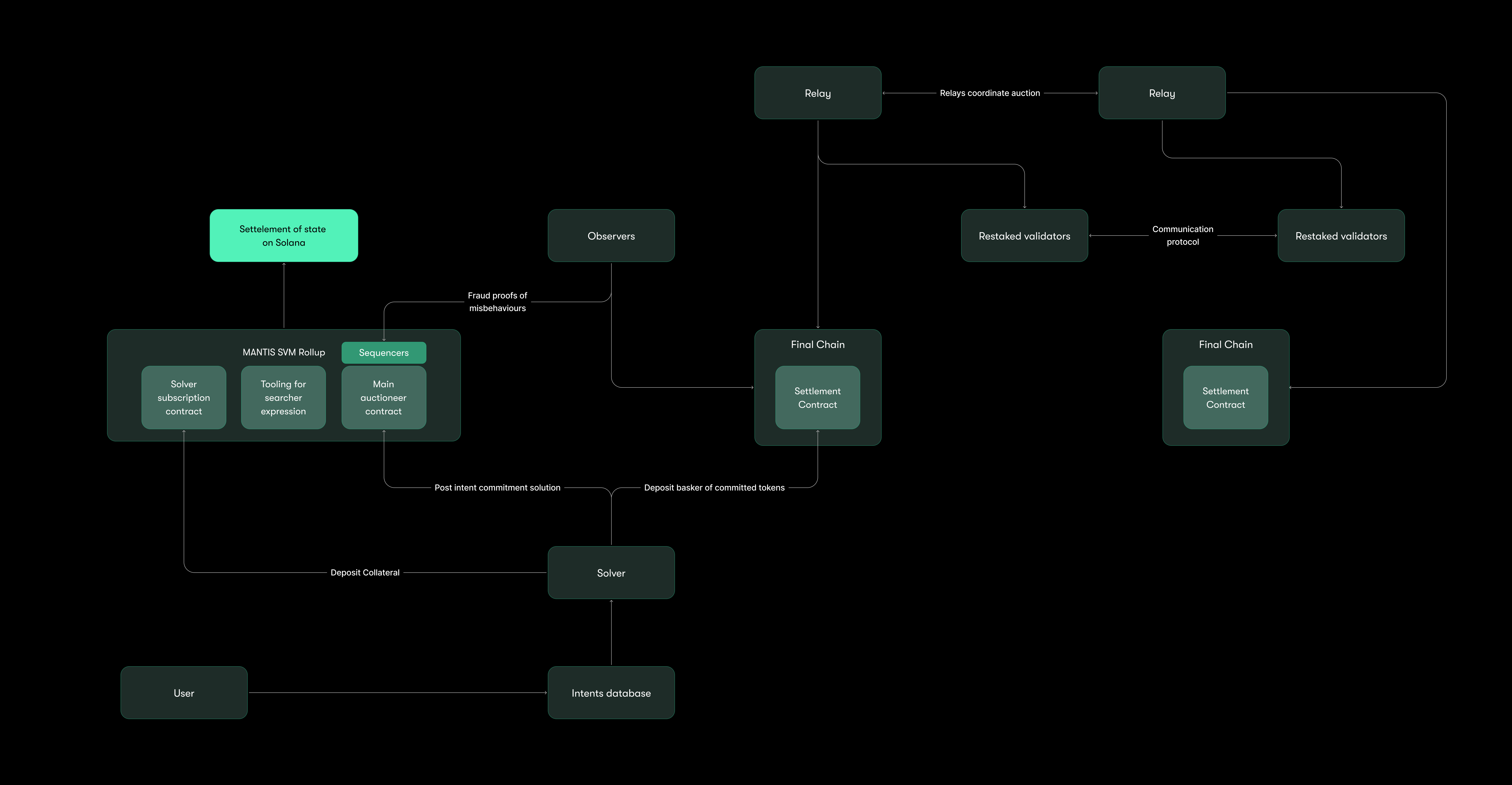

The Mantis Rollup

Before Mantis, rollups were limited to the optimistic or ZK rollups in Ethereum. Thus, Composable created the first Solana Virtual Machine (SVM) rollup. The Mantis rollup serves to coordinate and settle the cross-chain intents on Mantis. It also provides a framework for cross-chain block proposals and credible commitments.

Mantis rollup components are depicted in the following diagram and described below:

Deposits:

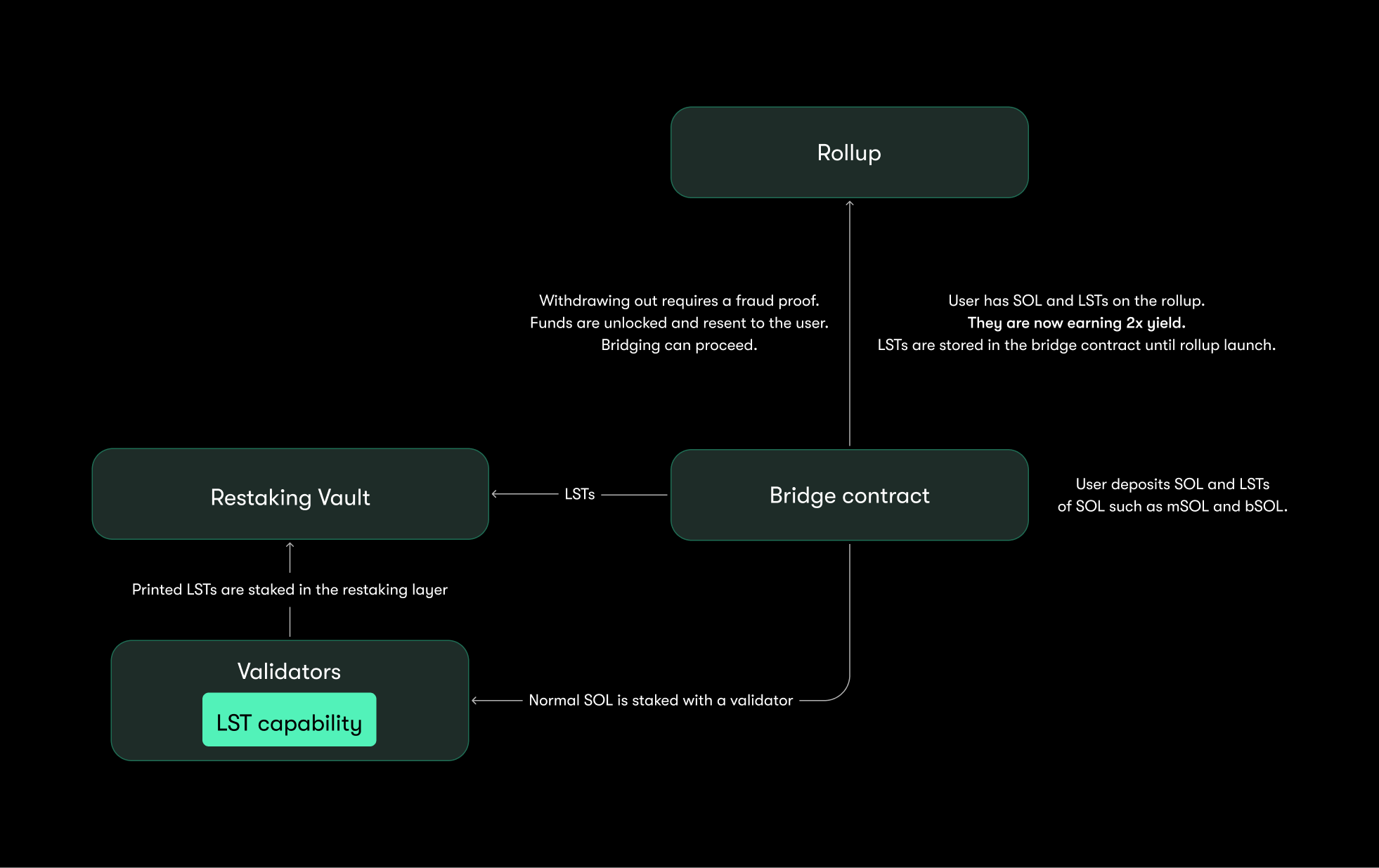

As shown in the above diagram, the bridge contract interacts with the rollup. Users deposit SOL as well as a number of liquid staked tokens (LSTs) from SOL into this bridge contract.

Then, deposited SOL is staked with Solana validators for proof-of-stake validation, providing native yield. This staked SOL will be represented by an LST. Users can then choose to also restake their LSTs into our Solana restaking layer. This provides users with doubled staking yield while abstracting away the additional steps for users to perform restaking on their own.

Any LSTs that have been directly deposited into the bridge contract flow to the restaking vault. The resulting crypto-economic security can be leveraged by the Mantis rollup as well as Actively Validated Services (AVSes) paying for this security.

Additionally, when deposited into the bridge contract, stablecoins that are Solana native will be deposited into lending protocols on Solana such as Kamino and marginfi. The user can then choose to restake their stablecoins into the Solana restaking layer. This also results in double yield for the user.

Withdrawals

If a user wants to withdraw their (re)staked tokens, a fraud proof is generated to ensure that the sequencer has not misbehaved. This is a specific zero knowledge (ZK) proof that unlocks funds on the bridge contract and contains a Mantis Virtual Machine instruction. Once this proof goes through, funds are unlocked and sent back to the user in the form in which they were deposited (i.e. if a user deposited SOL, SOL will be returned to them). The user can then bridge these tokens to other locations or perform other functionalities with them again over IBC.

Native Yield

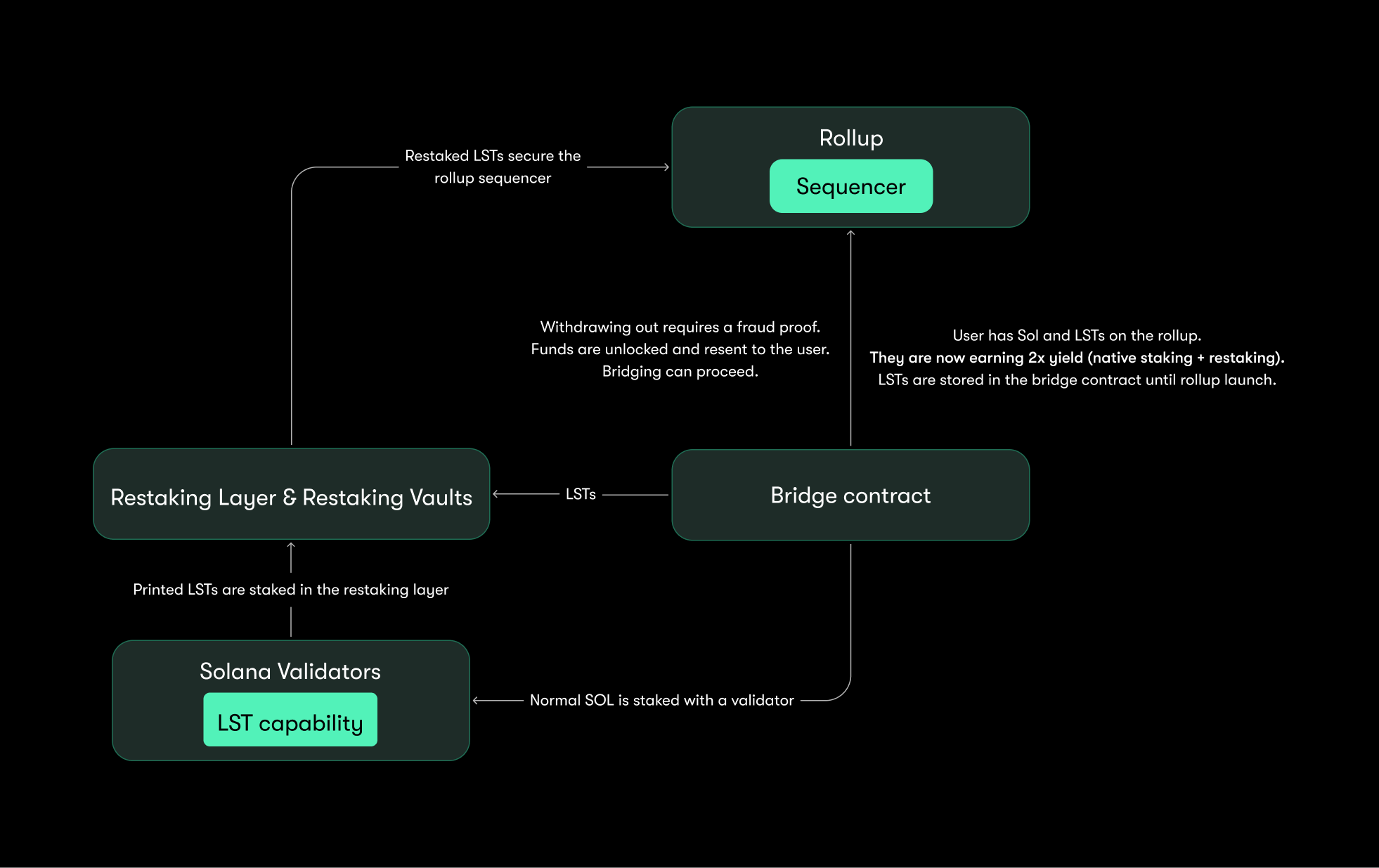

Users can stake SOL tokens directly into mantis.app. These SOL are then delegated on the backend to Solana validators.

This will allow users to accrue native yield, just as they normally would from using their SOL for proof-of-stake validation on Solana. Users will also receive a liquid staking token (LST) to represent their SOL stake.

Users with LSTs from SOL native staking on MANTIS can opt into staking these tokens in Picasso’s Restaking Layer. Tokens that have been restaked in this layer will be used to secure the sequencers of the MANTIS Solana-based rollup. The rollup is decentralized with a rotating set of independent sequencers that ensures censorship-resistance. This is critical for guaranteeing intents and solutions are accepted before the end of the scoring period, maintaining the credibility of scoring and facilitating blockspace auctions. This is done similarly to AltLayer’s restaked rollup design, which incorporates decentralized sequencing into a rollup’s architecture. This ensures that transaction inclusion on layer 1 is not done in a malicious way, allowing our solvers to crowdsource their collateral.

Users will earn additional rewards from opting into restaking, enhancing their overall yield from the same amount of underlying assets.

The flow of native staking and restaking in MANTIS is depicted in the figure below. As shown, these processes are combined in the MANTIS framework (though each can still be individually performed), streamlining the (re)staking process for users:

SVM and Sequencer

The rollup’s execution engine is a lightweight SVM with a sequencer (similar to the Jito validator client with mempool). The sequencer interacts directly with the bridge contract on Solana mainnet for funds unlocking and routing to other chains. The rollup also directly connects with IBC through Picasso’s Solana IBC implementation. Initially, Mantis token staking will determine sequencer leader selection.

The initial Mantis implementation will have solvers directly tap into the sequencer to query the intents mempool. In the future, we will introduce other privacy mechanisms.

The Mantis Protocol

On the Mantis rollup resides the Mantis protocol for optimal execution of cross-domain intent via a competition of solvers. In this protocol, users sign intents which are contained on a private rollup mempool. Solvers are staked agents that can a) observe the transactions on the mempool and b) post solutions in the auctioneer contract. The auctioneer contract scores the solutions in terms of users utility maximization. The winner of the auction is responsible for settling the outcome of the intent to the solution settlement contracts in the final chain expressed by the intent.

This protocol works as follows:

-

Users express their intents into the Mantis.app interface

- Intents can be submitted from any IBC-connected chains or protocols

-

Users sign these intents, which are then sent to a private rollup mempool

-

Solvers observe the mempool and work to develop optimized solutions (e.g. settlement routes) for intents

-

Solutions can use order matching via Coincidence of Wants (CoWs) and/or requests for quotes (RFQs) to market makers to provide liquidity

-

Solutions can also implement Mantis fast withdrawals, an architecture we are creating to enable the user to get the funds from the market maker quickly

-

-

Solvers must put up a stake (which is slashed if they misbehave) to post solutions in the Mantis rollup auctioneer contract

-

The auctioneer contract scores the solutions, determining the solution that best maximizes user welfare and desires

-

The solver that wins the auction must settle the intent to the solution settlement contracts in the final chain expressed by the intent

- The resulting transaction routes are processed over IBC, where they are able to be settled on any IBC-enabled destination chain or protocol

The Mantis Token

The Mantis token is the native utility token for the Mantis framework, supporting various network functionalities. More information on the Mantis token will become available post-token generation event.

The IBC Protocol

The IBC Protocol facilitates communication between different blockchain ecosystems in a manner that is trustless, secure, censorship-resistant, permissionless, fast, cost-effective, and natively interoperable. Therefore, the IBC was chosen as the cross-chain communication mechanism of Mantis, via the Picasso Network.

The Picasso Network & Its Restaking Pool

The Picasso Network’s goal is to deliver ecosystem-agnosticism to DeFi. Currently, with the work done by Picasso, IBC connects not only the Cosmos Hub and Cosmos SDK chains it originally linked but also Polkadot and Kusama parachains, Ethereum, and Solana. Picasso is planning even more IBC connections for the future. The Picasso Layer 1, a Cosmos software development kit (SDK) blockchain, thus acts as an IBC hub between Cosmos and these other non-Cosmos IBC-enabled chains.

Picasso makes Mantis cross-chain capable, with Mantis transactions being grouped into IBC bundles and sent out over Picasso/IBC to relevant blockchains for final settlement. Picasso’s Generalized Restaking Layer also plays a role in Mantis; this cross-chain staking mechanism secures the Mantis rollup.

Summary

Architecting Mantis required the integration of powerful existing technologies like Picasso and IBC as well as the creation of novel innovations like a first-of-its-kind rollup on Solana. All of these pieces of Mantis synergize to deliver chain-agnostic, optimized intent execution. Ultimately, we believe this framework will abstract away the complexities in cross-chain DeFi, making the process more efficient and valuable for all participants and helping the industry achieve mass adoption.