Disclaimer none of what I say here should be taken as investment advice, this is simply an examination of how the platform works. The goal of these articles is to simplify complex topics for both myself and the reader! I am learning about these myself and attempting to break things down in public. If anything has been misunderstood please feel free to reach out and I will amend where necessary

No, not a TokAmak, but a TokEmak. I am not here to do a dive into nuclear fusion today. I wish I could jump to a discipline like that, but I am not a galaxy brain!

This will not be an exhaustive look into Tokemak but rather an introduction to how it works for those curious to learn more.

Tokemak is a relatively ‘new’ protocol, it launched in July/Aug 2021 (aka 100 years ago in DeFi).

Tokemak’s goal is to create: “sustainable DeFi liquidity and capital efficient markets through a convenient decentralized market making protocol”.

That sounds wonderful, but what on earth does it mean?…

Liquidity is simply the amount of capital around to let you swap from one asset into another. The more liquidity there is, the less effect you have on the price of the assets when swapping them. If you think of suppy vs demand. If I have £10 and I want to swap it for $’s, there is (probably) trillions worth of liquidity between those two assets, so me swapping £10 doesn’t effect the swap price. Now imagine if there was only $100 of liquidity, when I went to swap £10, I move the supply/demand curve significantly and I can affect the price (this is also known as slippage).

All markets ideally want more liquidity because it creates more efficiency an price stability. You are able to enter or exit assets without making the price. I.E if I had $1million versus 1 billion worth of Apple stock, it is easier to sell $1 million and not move the price as I mak up a smaller % of the market.

Liquidity in DeFi

DeFi has a liquidity issue, it is hooked on inflationary liquidity mining rewards, and while it tells us it can ‘quit anytime it wants’, that remains to be seen…

So now we know what liqudity is, what’s the issue?

DeFi protocols want liquidity to help grow their platform. This has typically involved something called liquidity mining/liquidity bootstrapping. What this means is that protocols will set aside a % of their tokens as rewards for the early providers of liquidity.

So a trader comes in to X Protocol who are just getting started. X Protocol has set up a liquidity pool on Uniswap to of ETH/XProtocol. X Protocol have also declared that they are doing an incentivised liquidity mining scheme. 25% of their tokens will be rewarded to liquidity providers for the first 3 months of the pools life.

What happens? Traders will come and provide liquidity, but they are mercenaries, they will try and capture as many of the rewards as they can before dumping the token on the market and guess what that does to the price…

This means DeFi protocols are in a tricky spot, they need liquidity to scale and grow but they don’t want to attract the wrong kind of liquidity and damage the project. It is also expensive for these protocols, they have to acquire enough ETH to be able to create a pool to start (A pool will start 50% one asset/ 50% the other). This is time-intensive as well as capital intensive.

Call in the Tokemak

This is where Tokemak enters the stage. They are aiming to solve this problem, and create sustainable liquidity which in their words is:

- Sustainably produced — not powered by inflationary means

- Democratically sourced

- Capital efficient

- Super fluid — flowed to markets where it’s most beneficial

- Encourages a deep accumulation of assets to reduce slippage towards zero

Oh and also reduces impermanent loss, so not an ambitious project at all… :)

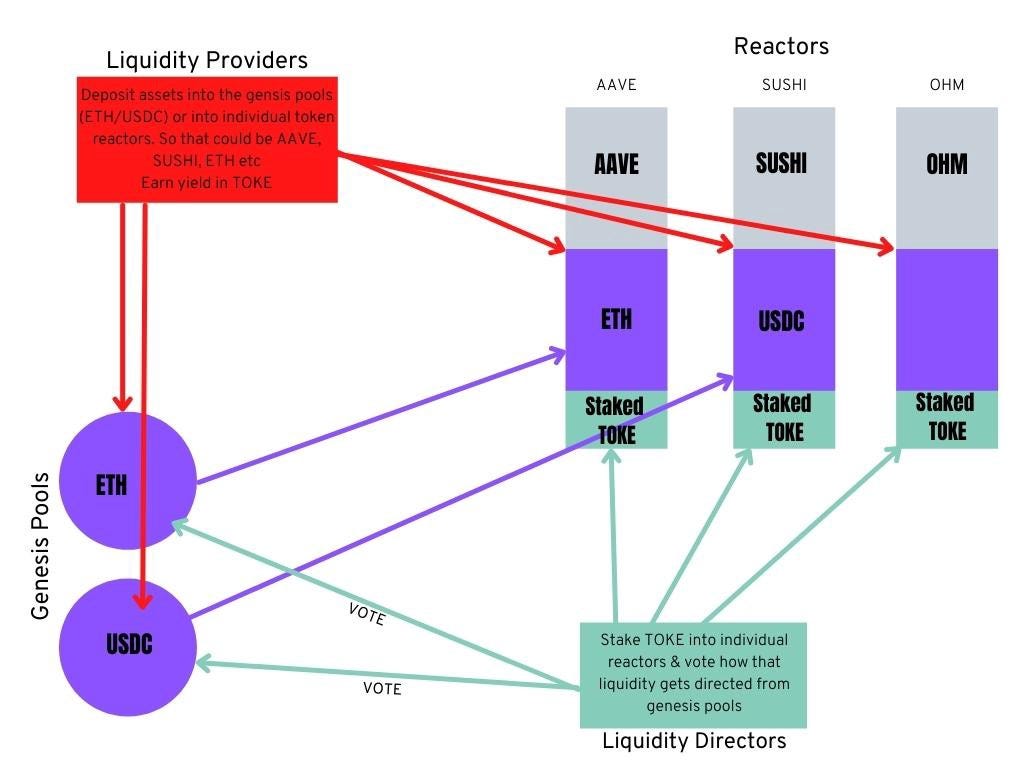

There are quite a few moving parts of Tokemak. While trying to come to grips with everything I have also made a few diagrams to go alongside the description. Stick with me!

The intial keys parts of Tokemak are:

- Liquidity Providers

- Liquidity Directors

- Genesis Pools

- Individual Reactors

- TOKE token

Liquidity Providers- these participants provide the assets needed. A liquidity provider could be a protocol providing their own token, or an individual providing idle assets such as ETH/USDC etc.

Liquidity providers have 2 options: they can deposit ETH or USDC into the ‘Genesis Pools’ or they can also deposit into the individual reactors.

Liquidity Directors- these participants stake TOKE in the individual reactors to then get a vote on directing liquidity to the reactors AND which exchange the liquidity is then deployed on- i.e Uniswap, Sushiswap etc. Liquidity directors earn yield in TOKE for doing a good job. However their staked TOKE is collateral to cover losses in the case of poor performance, so they have skin in the game.

Genesis Pools (aka Pair Reactors)- these are the pools where LPs can deposit either ETH or USDC. The benefit here is it is a general pool from which the liquidity directors can direct the ETH or USDC to specific reactors. So an LP doesn’t have to actively manage where they are deploying their assets, the LDs do it for them.

Individual Reactors- these provide the liquidity for specific projects. An individual reactor could for example be AAVE/ETH or SUSHI/USDC or many other pairings. LDs stake their TOKE in these individual reactors to get a vote on how much ETH/USDC to deploy into the reactor and then which exchange the combined assets (e.g AAVE/ETH)are deployed on.

TOKE token- I can’t say it better than Tokemak themselves: “*TOKE *can be thought of as generalized or tokenized liquidity. TOKE holders are able to generate liquidity on demand for whatever tokens they want, on whatever exchange they want, by controlling and directing Tokemak’s TVL”

Here is how I am understanding/visualising the flow:

Example of an individual reactor:

Oversimplification but highlights the main points for now :)

Now a new DeFi protocol can spin up their own reactor.

The reason yield is earned in TOKE? This is the part where Tokemak are trying to eliminate impermanent loss for the depositors (great video here if you aren’t familair with the concept). The rewards that Tokemak earns in the native assets by deploying them on exchanges becomes part of what known as ‘Protocol Controlled Assets’. So it gets put in a pot that Tokemak now ‘owns’.

When you, as an individual liquidity provider go to withdraw your funds you are always able to withdraw the same amount and if there is any shortfall it will be made whole either by; the PCA pot being used, or in the worst case by TOKE which is taken from the liquidity directors staked TOKE.

This reminds me of AAVEs collateral staking model where staked AAVE is used as repayment of last resort in a catastrophic event.

There are a number of potential benefits to Tokemak. If you are a new DeFi protocol you can start a new reactor- although how you then incentivise LDs to bring liquidity to you I am not clear on?

If you are a large protocol or an exchange you can acquire TOKE, stake and then vote to bring liquidity to your protocol or exchange. You benefit from more volume and then you also share in the rewards on the TOKE side.

If you are a TOKE holder, long term the aim of Tokemak is to build their PCA vault up to such a size they can provide their own liquidity anywhere. The yield generated may be paid out to token holders and exposure to a wide variety of assets in the PCA.

Tokemak is still in its early days, with $947m TVL at the time of writing this, it is nothing to be scoffed at.

There are more individual reactors coming online,they are currently at 9, and just as I write this the team have released a short-term roadmap you can find here :)

I feel like I could write a short book ok Tokemak, we didn’t touch on how DAOs can use it for their treasuries for example. However, I think the above is enough to digest for now!

Cheers

Kieran

P.S. for more in-depth information on the protocol check out the team docs here: https://docs.tokemak.xyz/