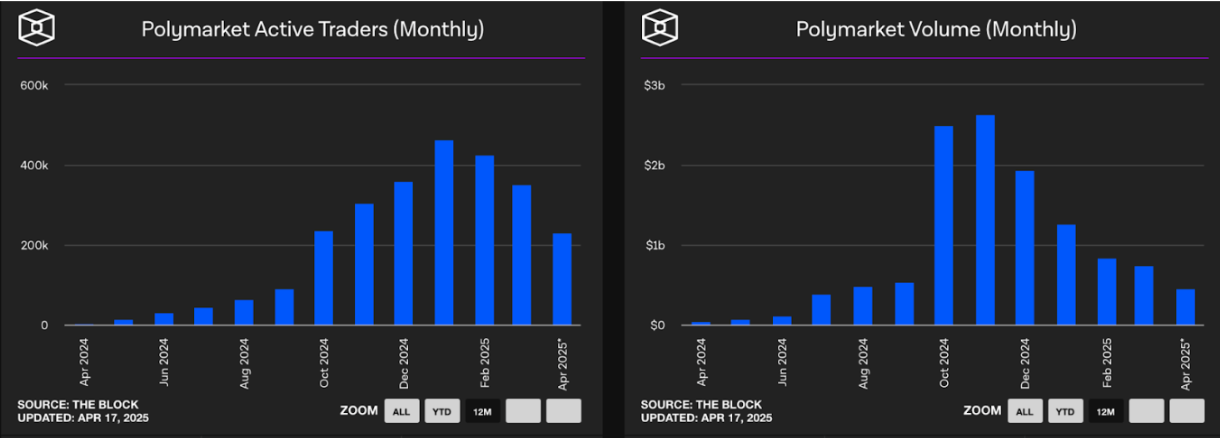

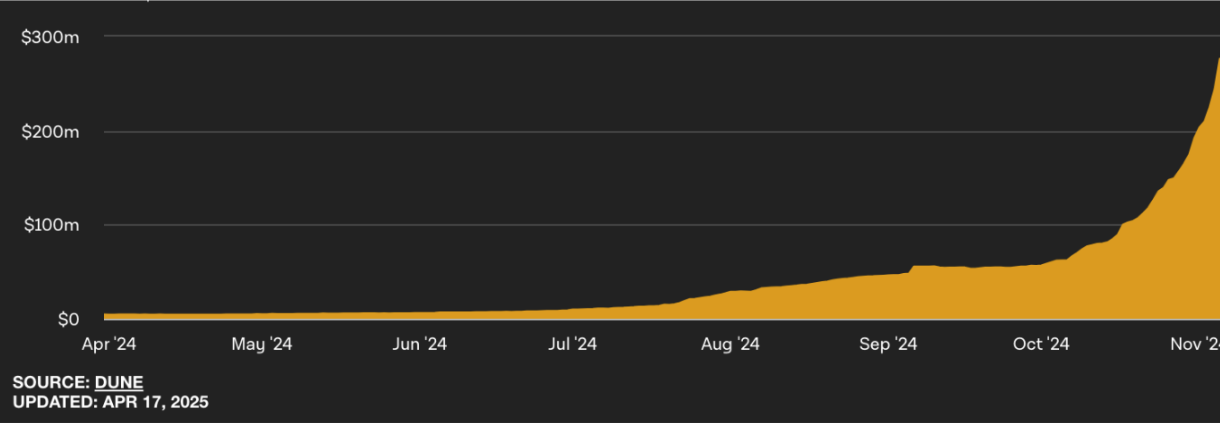

As someone who’s now been building an Info Finance protocol for the last 5 months, a constant hurdle I see across most protocols and dapps in Info Finance is the access to sustainable liquidity. The most successful platform Polymarket has seen massive adoption but also a drastic decline in volumes since the 2024 US presidential election.

So what seems to be the problem, officer? Whitaker & Mazlish go down an interesting path on reasoning in their article on why prediction markets aren’t popular, namely the incentives for different market actors to deploy capital into prediction markets. They state that financial markets largely have three main participant groups:

-

Savers - people looking to grow their savings by investing rather passively

-

Gamblers - people looking for quick wins, dopamine and entertainment value

-

Smart money - institutions and well-versed investors looking for an edge against others

Applying this lens to prediction markets helps us understand why prediction markets struggle with liquidity.

- Prediction markets often take a long time to settle

One of the deeply consequential features of many prediction markets is their long time to resolution. While this might seem like a minor design detail, it has massive implications for who is willing to participate.

Take gamblers, for instance. Gamblers look for volatility, adrenaline, and instant feedback loops. The appeal of trading memecoins or betting on tonight’s NBA game is that you’ll know the result in hours, sometimes even minutes. It scratches the dopamine itch. A prediction market on whether Biden will drop out of the race by August? That’s a multimonth wait, during which the capital is effectively locked up and the entertainment value drops off a cliff.

Now consider savers. Their mindset is entirely different, they’re less thrill-seeking, more yield-seeking. But even for them, tying up funds in a prediction market for months on end just doesn’t make sense. Why would they wager on the outcome of a political debate when they could passively park the same capital in a bond ETF or yield-bearing stablecoin and earn 4-6% with virtually no effort? Even if the prediction market offers higher upside, the friction of uncertainty and illiquidity makes it a tough sell.

This slow resolution cycle fundamentally shortens the window for trading activity and narrows the participant pool. Once a market has been live for a few weeks, most traders move on, and liquidity dries up long before the outcome is known. This creates a ghost-town effect: a market that technically exists but is functionally untradeable. And once that happens, smart money has no reason to stay either.

- Prediction markets are strictly zero sum

Another structural challenge prediction markets face is that they are, by design, zero-sum games. This means that for every dollar made, someone else must lose a dollar. In a way, this isn’t so different from most financial markets. But the difference lies in who is playing and why.

Savers have little appetite for zero-sum exposure. Their goal is not to outwit an opponent and capture their losses but to steadily grow wealth over time. That’s why “positive sum” products like index funds, dividend stocks, and interest-bearing accounts dominate retail portfolios.

Prediction markets offer no such comfort. They don't compound over time. They don’t pay yield. You either win or you lose. This creates a psychological and practical barrier for saver participation, effectively excluding a massive pool of potential liquidity.

The absence of savers is not really the main issue, but contributes to second order effects. Without passive capital to anchor the ecosystem, market makers and gamblers lose a significant chunk of their counter parties. Fewer market participants mean less incentive to market make, leading to thinner order books, wider spreads, and more price volatility.

Ironically, even the “smart money” suffers here. While they might welcome a sharp playing field, they also depend on inefficiencies they can profit from and on enough dumb or passive capital to absorb their edge. When the only people left are sharks circling each other, participating in even the most well-designed market becomes tough to justify.

- Prediction markets settle abruptly

While the reasoning above is a large part of the problem, a discussion I had with Millie, the Founder of True Markets, shed quite a bit of light on the issue. At its core, a prediction market functions like a binary option tied to a specific event. Structurally, it closely resembles traditional derivatives as a financial instrument.

However, traditional derivatives like futures and options tend to be highly liquid. Despite being zero-sum instruments (they don’t pay dividends and attract fewer “savers” than spot assets), they often enjoy more liquidity than the underlying spot markets. This is largely thanks to sophisticated actors who can market make effectively.

The key difference lies in price discovery. Traditional derivatives have a clear reference price, aka the underlying asset, so market makers can derive fair pricing using well-established models. This reference point anchors liquidity.

Prediction markets lack this anchor. There is no live, observable “underlying” price—only an implicit probability of an event occurring. Participants must estimate this probability, which is subjective by nature. That alone makes it harder to price and thus harder to market make.

Add to that the spontaneous resolution of many prediction markets which unlike traditional options expire on fixed dates and the liquidity challenge becomes even clearer.

The fact is that a large part of prediction markets revolve around individuals or organizations doing or not doing X. For example: US-China trade deal before June?

This market could resolve any time Trump or Xi wakes up and gets on the phone with the other to come to an agreement. Even sports betting is more structured. A football match, for instance, has a scheduled kickoff time, and the odds of rescheduling are low. Barring last-minute disruptions, prices can stabilise well in advance, and liquidity providers can pull out before the event begins. Prediction markets don’t always offer that predictability, which adds to their illiquidity.

So Where Do We Go From Here?

Taken together, the structural issues facing prediction markets are clear:

-

They resolve too slowly for gamblers,

-

They’re zero-sum and yield-less, deterring savers,

-

And they lack pricing anchors, making them hard to market make.

These aren’t UX/UI problems but foundational mismatches between the product design and the behavior of capital. And while Polymarket and others have shown what's possible for prediction markets, sustaining that liquidity across a broader selection of markets remains a whole different challenge.

But maybe we’ve just been asking the wrong question.

What if prediction markets were never meant to stand alone? What if, instead of trying to mimic traditional derivatives, we embedded them inside a system where patience and uncertainty are assets not liabilities?

What if the markets didn’t need to resolve at all to be useful?

What if they could pay you to care about the future?

There’s a version of prediction markets that looks less like gambling, and more like information infrastructure. A new kind of financial primitive: modular, expressive, and deeply composable with the rest of DeFi.

We’ve been building something in that direction. And we’re almost ready to show it.

Prediction markets haven’t failed.

They’ve just been stuck in the wrong design space.

Let’s move them into the right one.

Join the conversation here.