Pawnfi is an innovative crypto project with an ambitious mission to integrate NFT technology into the decentralized finance (DeFi) space and create an advanced financial infrastructure for NFTs. The unlimited opportunities that the company offers its users exceed all expectations and provide full control over assets and access levels.

Innovative Pawnfi protocol

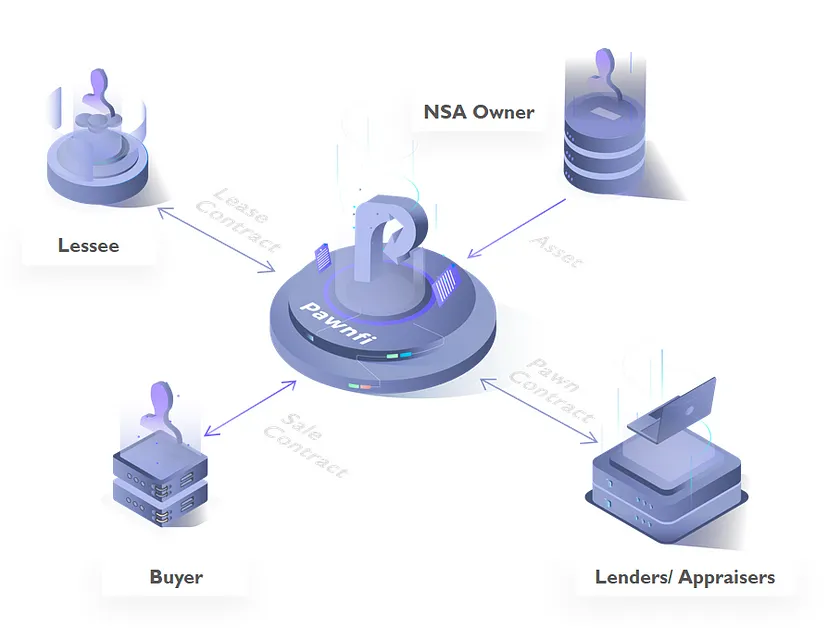

The Pawnfi protocol is the company’s protocol that combines the concept of a pawnshop with the creation of a new lending and leasing market for NSAs. It offers support for a wide range of assets, including NFTs, liquidity provider tokens (LP tokens), tokenized rights, and minor cryptocurrency assets. Users can use these assets as a pledge for loans and leasing agreements, expanding the use of their assets and receiving financial support.

All in one solution

Pawnfi has developed a unique all-in-one system. The company aims to become the leading comprehensive solution for NFT financing, providing income opportunities for all market participants, regardless of their experience and level of knowledge. Thanks to this approach, the financial world becomes more accessible and inclusive, attracting a wide audience of users.

Security and efficiency

Pawnfi attaches great importance to security, making no concessions in ensuring that users are protected from cyberattacks. With their innovative solutions, security becomes the most important aspect and risk management is a priority. Pawnfi considers user responsibility an integral part of their work and never compromises on this issue.

Extensive asset support

Pawnfi supports several popular blockchains, including ETH, BSC, Polygon, Arbitrum, and Moonbeam. The crypto project has integrated multi-chain versions into a single user interface to ensure asset continuity and improve the user experience across different blockchain platforms.

Game aspect and the integration of NFTs

Pawnfi pays special attention to the integration of NFTs into the gameplay. The project team creates a gaming ecosystem where users can use and trade their NFTs, participate in unique game mechanics, and earn digital assets. NFT-based games are becoming a new way to interact with the financial opportunities provided by Pawnfi.

Assessment and risk management

Asset valuation is an important component of the Pawnfi product. The company offers an independent valuation module that is applied to rare types of NFT or long tail assets. The price determined by Pawnfi’s valuation module reflects the estimated value of the asset as a pledge and is usually the ‘bottom price’ of the asset. This makes it possible to determine the ‘true value range’ of non-standard assets through built-in use cases and narrowing this range as the number of market participants increases.

Pawnfi also pays attention to risk management and default control. Similar to pawn shops, Pawnfi has automatic risk control barriers and a clearing process. The difference in price between the valuation of the pledge for a loan, the target sale price, and the requested pledge for a rental creates a natural buffer zone that helps reduce the risk of default.

The risk of default on the part of the borrower (asset owner) is limited, as appraisers/creditors value the asset as a pledge and usually undervalue it to create excess pledge. In case of default, the pledged asset will be liquidated at an auction among the appraisers/creditors who have the first right to purchase the asset at a decent price to make a surplus profit. If none of the appraisers/creditors purchases the pledge, it will be sold on Pawnfi and other partner platforms, and the proceeds will be distributed proportionally between the appraisers/creditors and the borrower.

The risk of default on the part of the lessee is also reduced, as in the event of default, the lessee’s deposit will be settled between the lessor and creditors if the lessor has initiated a pledge agreement for the unreturned asset at the same time. This is similar to if the owner of the asset had sold it to the lessee at a price higher than the target sale price, which reduces the risks of other parties.

Fighting fraud and optimizing the valuation process

Pawnfi attaches great importance to fighting fraud and optimizing the valuation process. In Pawnfi’s product, appraisers have certain requirements to participate in the appraisal, including fixing the amount of ‘willingness to credit’ in the smart contract to increase authenticity. The Pawnfi team also optimizes the entire appraisal process and develops effective anti-fraud mechanisms, especially if the number of appraisal samples is small.

Conclusion

Pawnfi provides a revolutionary solution that combines asset valuation, DeFi, and NFT. The company’s approach to asset valuation as a pledge and the integration of NFT into the gameplay open up new opportunities for users. Pawnfi creates an advanced financial infrastructure and provides a high level of security, support for various blockchains, and effective risk management. With Pawnfi, users can control their assets and generate income by trading, lending, and renting using NFTs and other digital assets.