Bitcoin, despite its unrivaled decentralization and security, faces inherent limitations that hinder network versatility and growth.

As transaction fees skyrocket during network congestion, are there viable solutions to address these limitations?

Fractal Bitcoin, gaining substantial traction in recent months, leverages a “Bitcoin-style” scaling strategy that aims to unlock higher transaction throughput on the Bitcoin network.

This article delves into the mechanics and ecosystem of Fractal Bitcoin, its technical foundations, and its latest developments.

Let’s explore how Fractal Bitcoin seeks to overcome Bitcoin’s challenges and redefine scalability.

1. Bitcoin’s Network Limitations

Bitcoin’s structure, while providing optimal decentralization and security, imposes inherent limitations on network expansion:

-

Slow Transaction Speed: With an average block time of 10 minutes, Bitcoin’s transaction throughput is limited, unable to meet the needs of complex applications, significantly affecting user experience.

-

Rising Transaction Fees: During network congestion, transaction costs surge, making it difficult for regular users to afford.

-

Limited Script Capabilities: Bitcoin’s basic script language restricts smart contract functionality. Even innovative protocols like Ordinals require off-chain indexing, let alone achieving Ethereum-level composability for DeFi applications.

To address these challenges, various scaling solutions have emerged, mainly using sidechains with independent EVM or BitVM execution, relegating Bitcoin to a data availability layer.

Against this backdrop, UniSat’s Fractal Bitcoin introduces a novel “Bitcoin-style” scaling approach, capturing widespread attention with its unique strategy.

2. Bitcoin-Style Scaling Approach

Traditional Bitcoin scaling solutions, such as the Lightning Network, Segregated Witness, larger block sizes, and sidechains, are akin to adding lanes or optimizing traffic rules on an existing highway.

Fractal Bitcoin takes a multi-layered, recursive architecture, elevating the network from a single-layered highway to a multidimensional traffic network.

Most importantly, Fractal Bitcoin maintains compatibility with Bitcoin’s core protocol, analogous to equipping the same vehicle with a more advanced rocket engine without altering its fundamental design.

Origin of the Name

The term “Fractal Bitcoin” derives from the mathematical concept of “fractals,” emphasizing self-similarity and recursive expansion.

Operating as a sidechain running parallel to Bitcoin’s mainnet, Fractal Bitcoin connects closely to the main network through a “Fractal” node.

Key Innovations

Fractal Bitcoin’s core innovation lies in its tree-like, recursive expansion layer architecture (BCSP).

This structure enhances transaction processing capacity by adding layers, without altering the Bitcoin protocol itself.

Not only does this boost parallel processing capability, but it also enables high-frequency, high-volume transactions for complex applications.

Fractal Bitcoin achieves a block time of 30 seconds, significantly improving transaction speed and network throughput.

Its base layer alone provides 20 times the capacity of the Bitcoin mainnet, with each additional layer exponentially increasing that capacity, enabling new possibilities for high-performance applications.

Security Model

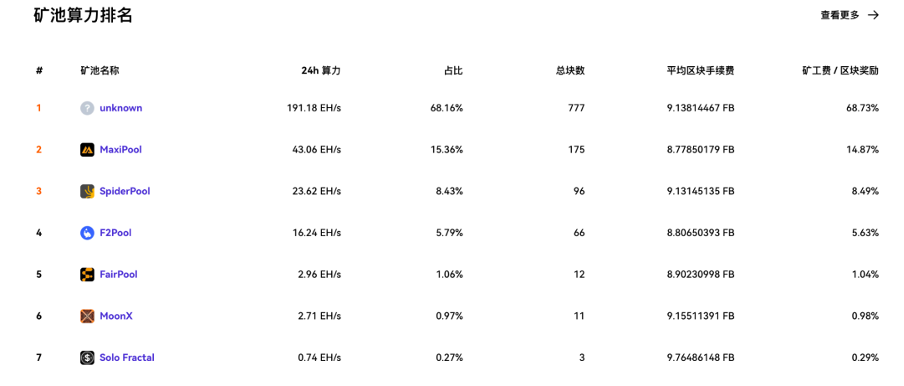

Fractal Bitcoin employs a hybrid mining model, effectively balancing decentralization with security.

In every three blocks, two are mined by permissionless miners, and one is jointly mined with Bitcoin.

This not only reinforces decentralization but also leverages Bitcoin’s hashing power to ensure security.

Within the first three weeks of launch, Fractal’s joint mining has captured over 40% of Bitcoin’s total hash rate, drawing participation from major mining pools like MaxiPool, SpiderPool, and f2pool.

Smart Contract Capabilities

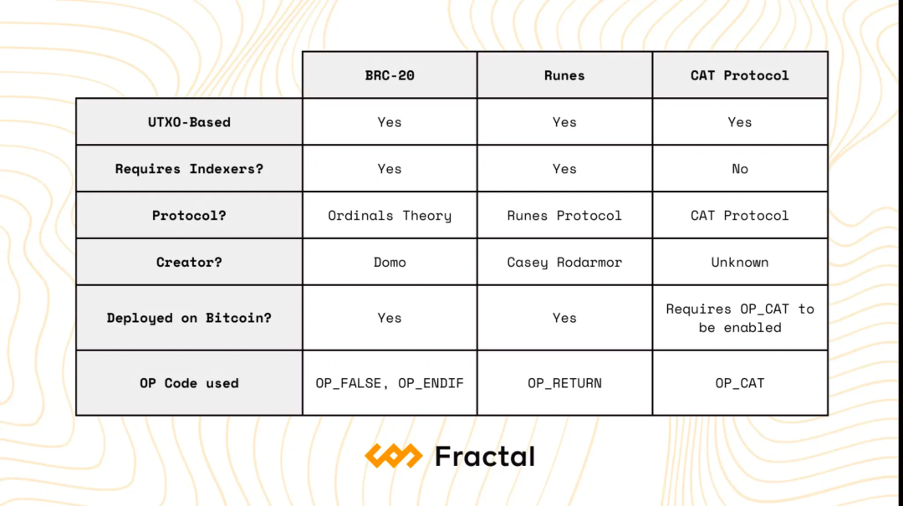

Fractal Bitcoin expands functionality by implementing the OP_CAT opcode, achieving Turing-complete smart contracts on a Bitcoin-based platform. OP_CAT is a simple concatenation operation that, combined with other opcodes, enables complex smart contract logic.

Fractal’s high compatibility with the Bitcoin ecosystem is another notable feature. It is fully compatible with standards like BRC-20 and Ordinals, allowing users to operate with the same addresses on both the Bitcoin mainnet and Fractal Bitcoin, simplifying the user experience and reducing operational risks, akin to switching EVM networks in Metamask.

This design facilitates seamless migration of Bitcoin assets and infrastructure, enabling users to continue leveraging familiar Bitcoin tools.

3. Implications of the Fractal Network

The emergence of Fractal Bitcoin provides a novel scaling solution for the Bitcoin network, opening new avenues for the ecosystem’s future development.

While preserving Bitcoin’s core values, Fractal Bitcoin tackles longstanding issues through technical innovation.

Accelerating Controversial Proposals

Unlike Ethereum, which has the Ethereum Foundation and Vitalik Buterin driving network development, the Bitcoin ecosystem lacks a centralized leadership role.

The OP_CAT opcode proposal remains divisive within the Bitcoin community, with no set timeline for implementation.

Fractal Bitcoin can quickly implement OP_CAT and other “controversial” opcode proposals, enabling native Bitcoin smart contracts based on inscriptions, effectively serving as a trial ground for the Bitcoin mainnet.

Low-Risk, High-Efficiency, and User-Friendly

Fractal’s full compatibility with the Bitcoin mainnet allows seamless migration of existing BTC-based assets and infrastructure, without requiring code modification.

This compatibility provides developers and users with a low-risk, high-efficiency platform for innovation.

Additionally, its 1/3 joint mining mechanism (where mainnet miners can mine a Fractal block every 90 seconds) not only ensures security but also provides miners with additional revenue.

A New Direction for Bitcoin’s Ecosystem

On a broader scale, Fractal Bitcoin has the potential to become an innovation engine for the Bitcoin ecosystem, providing developers with a network rich in incentives, users, and real market testing.

Success on Fractal Bitcoin could foreshadow future developments on the Bitcoin mainnet, allowing assets on Fractal to potentially move back to the mainnet as new features are supported.

This model promises to attract more developers, foster innovation, and generate user adoption, making Fractal a valuable ecosystem that positively influences Bitcoin and creates a positive feedback loop.

Mutual Achievement with UniSat

In this grand vision, UniSat stands out as the most suitable entity to drive the development of Fractal.

Reflecting on the previous wave of Ordinals’ popularity, UniSat distinguished itself through its open-source Bitcoin wallet and tools for minting and trading, gaining a strong foothold amid intense competition.

UniSat’s core strength lies in its extensive experience in large-block Bitcoin development.

As advocates of large Bitcoin blocks, the team members have been involved in Bitcoin forks and have contributed to BSV development for years.

This background enables them to iterate products quickly and respond promptly to market demands.

Fractal can be seen as an extension of UniSat’s broader vision, establishing infrastructure and a highway for even more innovative applications they aim to bring to life.

Additionally, Fractal has direct access to UniSat’s significant user base, which includes one million weekly active users—a promising potential audience.

Market Reception

The market response to Fractal Bitcoin has been notably positive. Within just three weeks since its mainnet launch on September 9, the network has already attracted over 3.8 million on-chain users, with its native token $FB achieving a market cap surpassing $30 million.

More remarkably, the new fungible token standard under OP_CAT on the Fractal network has sparked considerable interest.

The first token issued under this standard, $CAT, has reached a market cap exceeding $40 million. These metrics reflect the market’s acknowledgment of Fractal Bitcoin’s promising potential.

4. Ecosystem Development

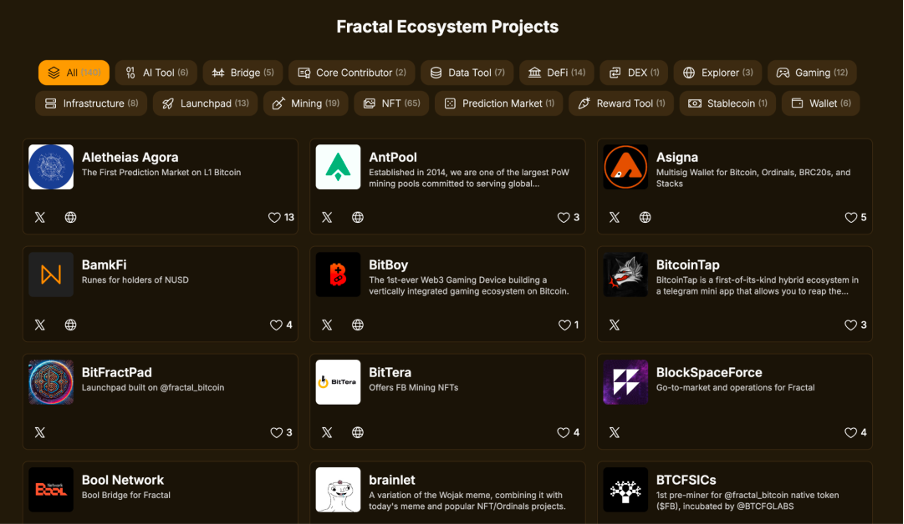

As of now, the Fractal Ecosystem lists 140 projects, with a focus on NFTs and infrastructure.

This distribution reflects the ecosystem’s current stage of development: despite OP_CAT opening the door for smart contracts, building complex applications will take time. In the short term, most projects focus on two main areas: operational NFT projects and essential infrastructure.

Fractal Applications

UniSat founder Lorenzo envisions several promising application types:

-

Cross-Chain Bridges: Facilitating asset transfers between the Bitcoin mainnet and Fractal.

-

Trading-Related Applications: Including native swaps, DEXs, and NFT marketplaces.

-

High-User Engagement Applications: Such as DID, credential issuance, and voting governance.

In terms of assets, Fractal supports Ordinals NFTs, BRC-20 tokens, and Runes, with the CAT20 asset class emerging under the CAT Protocol (Covenant Attested Token)—an innovative UTXO-based Bitcoin token protocol. CAT20 has sparked early interest similar to Ordinals, with related tools and projects seeing significant transaction volume.

UniSat is fully supporting CAT20, with wallet functionality, explorer display, and API support. CAT20 wallet transfers were launched on October 21, followed by the CAT20 marketplace on October 22.

In DeFi, development efforts focus on cross-chain bridges and DEXs. UniSat is working on multiple cross-chain solutions, with PizzaSwap as the first, supporting various bridging assets. DEX projects like MotoSwap are exploring inscription-based smart contracts to implement AMM trading, though there are substantial technical challenges.

5. Challenges Facing Fractal Bitcoin

The Fractal ecosystem is expanding rapidly, spanning infrastructure to innovative applications. However, it faces obvious challenges:

-

Technical Complexity: Implementing smart contracts and gaming on the Bitcoin network is ambitious but highly complex, requiring extensive research. Bitcoin’s script language is more challenging than mainstream languages like Rust or Solidity, potentially limiting developer engagement and slowing ecosystem expansion. Significant effort is needed in ecosystem building and developer relations.

-

Miner Pressure: Miners working with PoW tokens are a potential source of selling pressure. Joint-mining Bitcoin miners receive dual rewards in BTC and FB, but which token will miners favor for sale to cover costs? Fractal quickly attracted major mining pools, capturing over 40% of Bitcoin’s hash rate. While large pools appear to have aligned with Fractal, the behavior of smaller pools and individual miners remains unpredictable, leaving FB’s long-term resilience against selling pressure uncertain.

6. Conclusion

As a unique Bitcoin expansion solution, Fractal Bitcoin injects vitality and potential into the Bitcoin ecosystem. Its tree-structured

scalability, decentralized architecture, and hybrid mining approach have sparked widespread interest, paving the way for increased developer innovation, broader adoption, and potential transformative impacts on Bitcoin’s growth trajectory.

The development of Fractal Bitcoin presents both opportunities and challenges. If successfully navigated, Fractal could become a highly significant scaling and innovation solution, marking a groundbreaking milestone for the Bitcoin ecosystem.