In his recent blog post, Vitalik Buterin explores the critical need for scaling Layer 1 (L1) solutions like Ethereum, particularly in light of increasing transaction demands. He argues for a significant increase in the L1 gas limit—potentially by a factor of 10—to enhance transaction efficiency and reduce fees. Vitalik points out that while recent adjustments have increased the gas limit from 30 million to 36 million (a 20% increase), more substantial scaling is necessary to accommodate the growing user base and application demand.

Key Insights from Vitalik's Post

-

Censorship Resistance: A primary concern for any blockchain is ensuring that valid transactions can be processed quickly, especially in high-stakes environments like decentralized finance (DeFi). Vitalik emphasizes that a robust L1 is essential for maintaining this censorship resistance, even as many applications migrate to Layer 2 (L2) solutions.

-

Long-Term Value: The post argues that scaling L1 is not just about immediate transaction cost reductions but also about fostering a secure environment for application development. However, he warns that increasing gas limits could lead to centralization risks if not managed carefully.

-

Economic Implications: Vitalik provides mathematical insights into the costs associated with bypassing censorship and executing transactions on L1 versus L2. He highlights that achieving affordable transaction costs may necessitate significant scaling, which poses challenges in terms of consensus among stakeholders.

The Impact of High Gas Fees on Users and dApps

Our study reveals that high gas fees are a substantial barrier to entry for users and developers alike within the Ethereum ecosystem. As of early 2024, average Ethereum gas fees have fluctuated significantly, often surpassing $20, which deters smaller transactions and inhibits user engagement.

-

User Experience: Over 60% of users cite high gas fees as a major obstacle to adopting Ethereum applications. This sentiment is echoed by Chainalysis data indicating that high fees can lead to a 30% drop in active users on Ethereum-based dApps during peak times.

-

Impact on dApps: For developers, high transaction costs can stifle innovation and deter new projects from launching on Ethereum. For instance, the average cost of minting an NFT reached around $70, creating barriers for artists and creators looking to enter the market.

-

Market Comparisons: Traditional payment systems offer lower and more predictable fees, making them increasingly attractive compared to blockchain solutions. This disparity poses a risk of alienating potential users who may opt for conventional financial systems over decentralized alternatives.

Introducing GasFi: A Viable Alternative NOW

In light of these challenges, we propose GasFi, a groundbreaking market-neutral trading framework designed to address gas fee volatility across all blockchain networks. Unlike the ambitious scaling proposals discussed by Vitalik, GasFi offers an immediate solution that empowers users and developers without waiting for uncertain long-term scaling outcomes.

Why GasFi Stands Out

-

Feeless User Experience: GasFi enables users to interact with dApps without worrying about gas fees, effectively creating a feeless user experience. This is crucial for onboarding new users who may be deterred by transaction costs.

-

Diverse Derivative Instruments: GasFi provides various derivatives—such as prediction markets, futures, options, and swaps—that allow users to hedge against gas fee fluctuations while generating returns. This flexibility empowers both retail and institutional investors.

-

Cross-Chain Compatibility: Unlike many existing solutions that are limited to specific blockchains, GasFi operates across various Layer 1 and Layer 2 networks, ensuring broader applicability and adoption.

EQLZR: The market-neutral GasFi platform

EQLZR is a pioneering market-neutral GasFi platform that addresses the pressing issue of high gas fees in the blockchain ecosystem. By leveraging innovative trading strategies and derivative instruments, EQLZR enables users to interact with decentralized applications (dApps) without the burden of transaction costs. This unique approach not only enhances user experience but also provides institutional investors with novel yield-generating opportunities. As the demand for seamless and cost-effective solutions grows, EQLZR stands out as a vital player in the Web3 landscape, poised to drive mass adoption and operational stability across various Layer 1 and Layer 2 networks.

Competitive Analysis: EQLZR vs. other GasFi initiatives

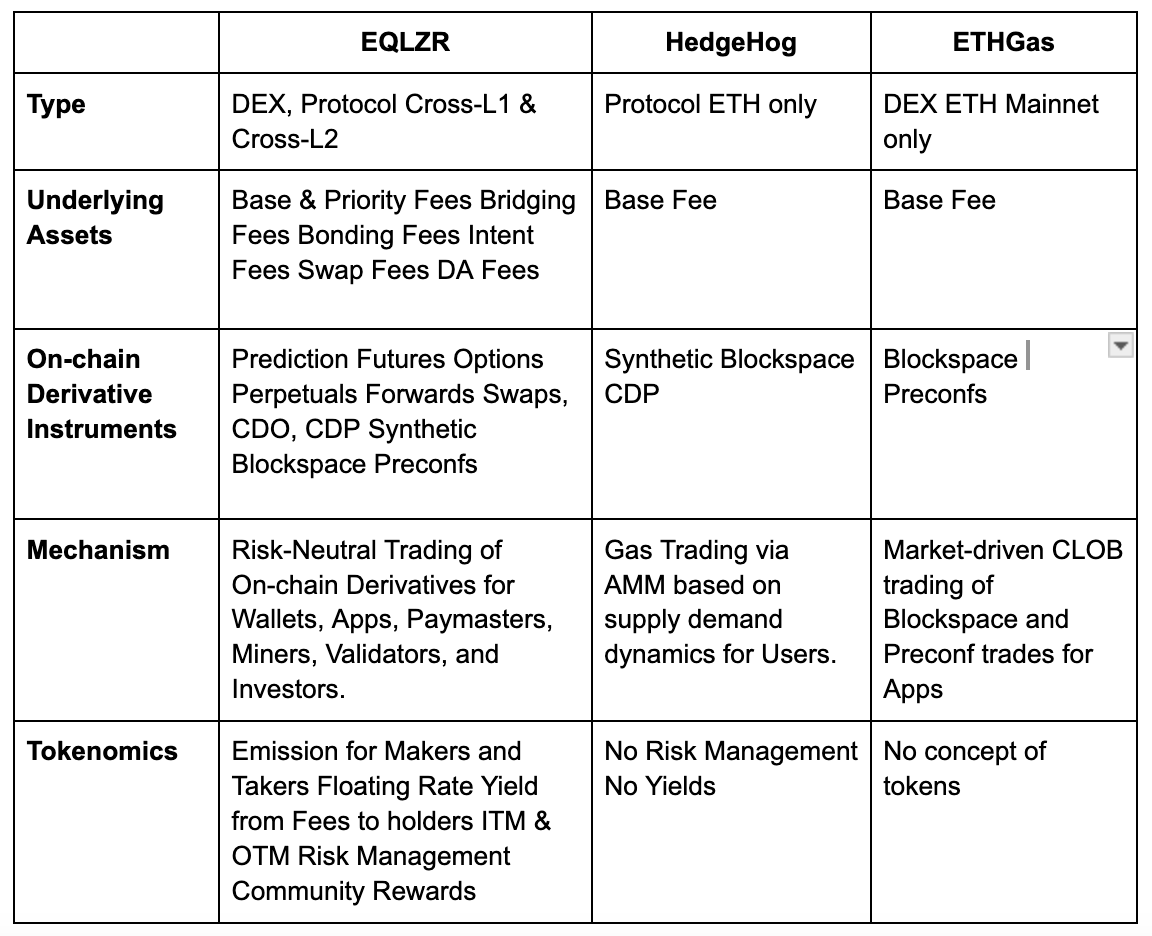

EQLZR distinguishes itself by offering comprehensive risk management tools alongside an immediate solution to high gas fees, making it an attractive alternative compared to other startups in the space.

Conclusion

As we look towards the future of Web3, it is clear that high transaction fees pose a significant barrier to mass adoption. While Vitalik Buterin's vision for scaling L1 solutions is insightful and necessary in the long term, it remains a complex challenge requiring consensus among stakeholders.

In contrast, GasFi presents an actionable solution that addresses immediate concerns surrounding gas fees while fostering innovation across the ecosystem. By leveraging GasFi's unique offerings today, users can mitigate costs while contributing to a more robust decentralized landscape. As we continue to witness the surge of GasFi across various chains and infrastructures, it becomes increasingly evident that this new DeFi primitive has the potential to transform how we engage with blockchain technology—making it accessible and efficient for all participants in the ecosystem.