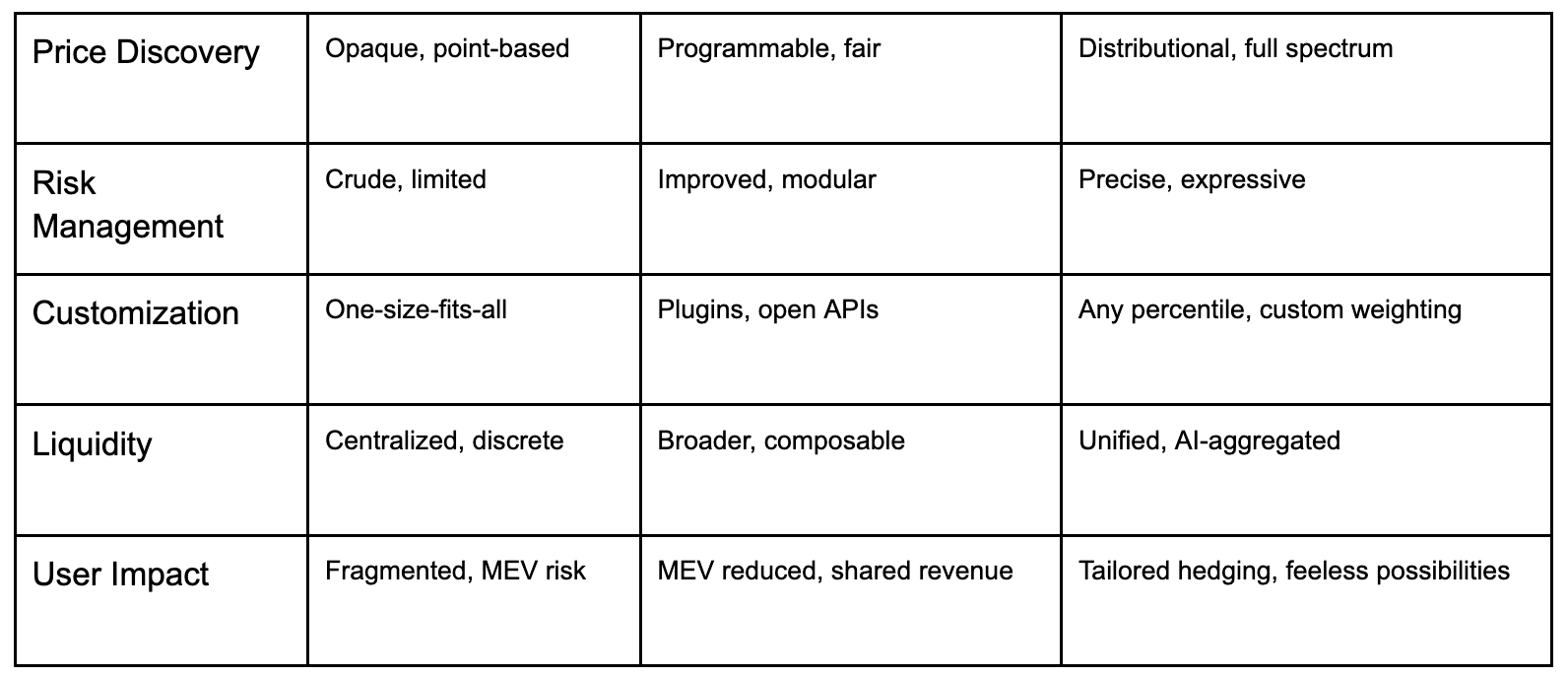

The silent revolution in DeFi isn’t just about throughput or yields; it’s about who controls market risk and how fairly that risk is shared. Two breakthrough innovations are colliding to redefine these rules: Solana’s Block Assembly Marketplace (BAM) and EQLZR’s GasFi platform. Together, they’re pushing the industry past the bottlenecks of legacy order books, toward a world of expressive, programmable, and unified risk markets.

The Block Auction Era: Why Solana Needed BAM

For years, Solana excelled with its blinding speed, but its fee markets lagged behind. Blockspace was allocated using relatively opaque, off-chain auctions where specialized actors jostled for trading priority, leaving regular users exposed to invisible costs and toxic strategies like MEV (Maximal Extractable Value). This opacity stifled innovation and fragmented value, constricting the creative arteries of DeFi.

What BAM Changes

-

Programmable Blockspace: BAM introduces a decentralized, programmable marketplace for transaction ordering, using Trusted Execution Environments (TEEs). These secure enclaves privately and fairly sequence transactions, greatly reducing MEV risk and information leakage without sacrificing speed.

-

Custom Plugins & Revenue Sharing: Developers, dApps, and protocols can now deploy plugins—custom logic for transaction bundling, order-matching, and more—monetizing their blockspace logic and unlocking brand-new revenue flows.

-

Transparent, Auditable Fairness: With TEEs and open APIs, anyone can audit how blocks are assembled, leveling the transparency for users, validators, and institutions alike.

Why It Matters

Now, blockspace is no longer a shadowy backroom. BAM makes it an open, programmable resource - much more agile than the rigid, closed-off order books of the past.

Fee Markets 2.0: From Discrete to Distributed Risk

Traditionally, blockchains (and even DeFi) have only let you “bid” on basic blockspace positions: get my trade in fast, or at a certain price. But markets are richer than single points; the future is a distribution, not a number.

Imagine wanting to hedge not just if your trade clears, but how volatile network fees might be in the next hour. Most order books ignore this. The risk of gas spikes remains unhedged. Enter GasFi.

GasFi and EQLZR: Hedging the Shape of Risk

EQLZR’s GasFi platform delivers the first true distributional market for network fees. It lets users move beyond the old usual limits: basic perps and CLOBs, into sophisticated hedges and bets on the entire fee distribution.

How GasFi Works on EQLZR

-

Trade Any Segment, Not Just Price: Traders can take positions on any percentile segment of a future gas fee distribution; be that the median, the right tail, or even a custom range. No longer are you restricted to “above or below X gwei” - now, you can target spikes, median stability, or tail events.

-

Unified, Standardized Liquidity: Unlike legacy “bucketed” prediction markets that fragment liquidity, EQLZR standardizes main percentile ranges and uses protocol-owned liquidity and AI-driven aggregation to keep order books deep and unified, even for niche exposures.

-

Continuous, Expressive Reward: Payouts aren’t winner-take-all - they scale with how accurately your position matches the realized gas outcome and with the risk you take, making market-neutral and volatility strategies viable for the first time.

The Solana BAM–EQLZR Connection

So, what happens when you combine Solana’s BAM with a GasFi market like EQLZR?

BAM’s programmable, MEV-resistant blockspace enables dApps like EQLZR to offer advanced, modular GasFi hedges directly on-chain, with deep liquidity and dynamic risk allocation. BAM’s plugin layer means dApps can build natively into the block assembly process: imagine a scenario where not just regular swaps or CLOBs but even outcome-linked gas fee derivatives are sequenced fairly alongside every other transaction.

-

Developers can expose gas fee odds directly in wallet UX, thanks to programmable plugins.

-

Validators earn new revenue by supporting specialized gas markets, alongside normal validation.

-

End-users can finally hedge against gas surges, tail risk, or even monetize their superior timing, with payouts that mirror the true distribution of outcomes.

This closes the loop between fair block allocation and expressive risk trading, bridging blockspace and riskspace.

Why It Matters for DeFi’s Future

-

Laid-Open Blockspace: Solana’s move with BAM is pushing DeFi fee markets into the open, making blockspace programmable, fair, and a direct revenue source for more of the community.

-

Distributional Risk as a Primitive: EQLZR’s model is making “distributional trading” as simple as spot swaps or perps; finally realistic for gas risk, volatility, and beyond.

-

Composability and Innovation: Together, they point to a DeFi where markets for risk on anything from swap fees to validator income volatility can be composed, traded, and hedged, at a depth and expressiveness impossible until now.

The result?

Programmable, auditable, and composable fee/risk markets empowering everyone from dApp users to infrastructure builders to own their destiny in the unpredictable, high-speed world of blockchain.

The Final Take

With Solana’s BAM opening the blockspace layer and EQLZR’s GasFi expressing the full spectrum of fee risk, DeFi is evolving from simplistic, fragmented markets into a unified, expressive risk machine. The next chapter is here: time to trade the entire future, not just a point.

Links: Website | Telegram Group | Telegram Announcement Channel | X