Introduction

dYdX was founded by Antonio Juliano in July 2017 after he worked at Coinbase and built a search engine for decentralized apps called Weipoint. dYdX’s vision is to empower traders worldwide with open, secure, and robust financial products that run on Ethereum.

-

dYdX’s first product was Expo, a brokerage app allowing users to buy leveraged tokens representing short or long-margin positions on ETH.

-

dYdX’s second product was Solo, a margin trading protocol that enabled users to borrow, lend, and trade any supported asset with up to 4x leverage.

-

dYdX’s third and current product is a decentralized exchange that offers perpetual contracts, margin trading, and spot trading for various crypto assets.

dYdX leverages L2 scaling solutions provided by StarkWare, a company specializing in zero-knowledge proofs and scalability engines. It uses StarkWare’s StarkEx technology to move most of its trade execution and settlement off-chain while maintaining data availability and security on-chain.

Recently, dYdX announced that it had completed its v4 milestone 3 by successfully integrating StarkWare’s Cairo programming language and StarkNet network into its platform.

More about dYdX’s v4 Milestone in the end

By using Cairo and StarkNet, dYdX will be able to offer fast and cheap trading on Ethereum with the following:

-

zero gas costs,

-

low minimum trade sizes,

-

low trading fees,

-

high throughput, and

-

non-custodial security.

Let’s Dive Straight Into dYdX Tokenomics.

dYdX has its own governance token called DYDX, which can be used to participate in staking pools, governance proposals, trading rewards, and fee discounts on the platform.

DYDX tokens have a maximum supply of 1 billion, which will be fully unlocked by July 2026. Starting five years after launch, a maximum perpetual inflation rate of 2% per year may be utilized by governance to increase the supply of dYdX.

DYDX tokens are distributed to various groups according to the following initial allocation.

-

Investors: 27.7% (~277 million tokens)

-

Trading Rewards: 25% (~250 million tokens)

-

Employees and Consultants: 15.3% (~153 million tokens)

-

Airdrop: 7.5% (~75 million tokens)

-

Liquidity Provider Rewards: 7.5% (~75 million tokens)

-

Future Employees and Consultants: 7% (~70 million tokens)

-

Treasury: 5% (~50 million tokens)

-

Liquidity Staking Pool: 2.5% (~25 million tokens)

-

Safety Staking Pool: 2.5% (~25 million tokens)

However, since the launch of DYDX, several governance proposals have resulted in changes to the initial allocation. The updated allocation is reflected in the following chart.

The updated allocation of DYDX tokens is as follows:

-

Investors: 27.7% (277 million tokens)

-

Trading Rewards: 20.2% (202 million tokens)

-

Employees and Consultants: 15.3% (153 million tokens)

-

Airdrop: 5% (50 million tokens)

-

Liquidity Provider Rewards: 7.5% (75 million tokens)

-

Future Employees and Consultants: 7% (70 million tokens)

-

Treasury: 16.2% (162 million tokens)

-

Liquidity Staking Pool: 0.6% (6 million tokens)

-

Safety Staking Pool: 0.5% (5 million tokens)

Staking pools for DYDX tokens are divided into two types: Safety pool and Liquidity pool.

The safety pool acts as a backstop for the platform in case of insolvency or liquidation events, while the liquidity pool rewards users who provide liquidity to the platform’s markets.

The safety staking pool is a smart contract-based component that allows dydx token holders to stake their tokens and earn rewards for securing the protocol. The staked dydx tokens can be used as a mitigation tool in case of a shortfall event on the protocol, such as exchange insolvency, smart contract attacks, or other issues that result in a deficit.

The occurrence and interpretation of a shortfall event are subject to dydx governance votes. The staked dydx tokens can be slashed and transferred to another address or contract to cover the losses in a shortfall event. The safety staking pool functions as an additional layer to protect users in the case of insolvency or other issues with the protocol.

-

0.5% of the dydx token supply (5M DYDX) will be distributed to users who stake DYDX to the safety staking pool.

-

DYDX rewards will be distributed continuously according to each staker’s portion of the total DYDX in the pool.

A staker must request to withdraw DYDX at least 14 days (Blackout Window) before the end of an epoch to be able to withdraw their DYDX after the end of that epoch.

-

If stakers do not request to withdraw, their staked DYDX is rolled over into the next epoch.

-

Withdrawals cannot be requested during the Blackout Window.

Risks: All funds in the contract, active or inactive, are slashable. Stakers may lose dydx in the event of a shortfall event. Stakers could lose a portion of their staked DYDX if a market maker were to lose DYDX via poor trading and cannot replenish the safety staking pool.

The liquidity pool is a smart contract-based component that allows USDC holders to stake their tokens and earn rewards for providing liquidity to the platform’s markets.

The liquidity staking pool is a smart contract-based component that allows USDC token holders to stake their tokens and earn dYdX rewards for providing liquidity to the dYdX Layer 2 protocol. The staked USDC tokens are used by community-approved liquidity providers who can make markets on the dYdX L2 perpetual protocol, offering competitive prices and tight spreads across various markets.

The liquidity providers are restricted from using borrowed funds outside the dYdX L2 protocol. The liquidity staking pool is a similar incentive that market makers use from centralized exchanges: interest-free, uncollateralized credit lines to be used solely on the dYdX L2 perpetual protocol.

The liquidity staking pool also benefits traders who can enjoy tighter spreads and more depth across all markets.

-

0.6% of the dYdX token supply (6M dYdX) will be distributed to users who stake USDC in the liquidity staking pool.

-

dYdX rewards will be distributed continuously according to each staker’s portion of the total USDC in the pool.

A staker must request to withdraw USDC at least 14 days (Blackout Window) before the end of an epoch to be able to withdraw their USDC after the end of that epoch.

-

If stakers do not request to withdraw, their staked USDC is rolled over into the next epoch, and

-

Withdrawals cannot be requested during the Blackout Window.

Risks: Stakers may lose USDC if a borrower never repays a debt or loses USDC via poor trading and cannot replenish the liquidity staking pool.

Governance mechanism for DYDX tokens.

Snapshot, a gasless off-chain voting tool, facilitates the governance process.

DYDX tokens grant their holders the right to participate in the governance of the dYdX Layer 2 protocol. DYDX token holders can create and vote on proposals that can change various aspects of the protocol, such as risk parameters, staking pool payouts, trading fee discounts, community treasury allocations, and more.

DYDX token holders can also delegate voting power to other addresses or entities they trust or support.

The governance process consists of four stages:

-

Proposal creation is an off-chain process that allows anyone with at least 1 DYDX token to create a draft proposal on Snapshot and gather feedback and support from the community.

-

Proposal submission is an on-chain process that requires at least 1% of the total DYDX supply (10 million tokens) to submit a proposal to the dYdX Governance contract.

-

The voting period is an off-chain process that lasts three days and allows DYDX token holders or delegates to cast their votes on Snapshot using their token balance at the time of proposal submission.

-

The execution period is an on-chain process that lasts two days and allows anyone to execute a successful proposal that has received more than 50% of the votes cast and at least 4% of the total DYDX supply (40 million tokens).

Snapshot is a gasless off-chain voting tool that enables DYDX token holders or delegates to vote on proposals without spending any gas fees or locking their tokens. Snapshot uses signatures to verify votes and stores them on IPFS, a decentralized storage network.

Trading rewards for DYDX tokens

Trading rewards incentivize users to trade on the dYdX L2 protocol and earn DYDX tokens for their activity.

Trading rewards are distributed to users who trade on the perpetual markets, which are leveraged contracts that track the price of an underlying asset without expiry.

Trading rewards are based on a combination of fees paid and open interest on the protocol.

-

Fees are determined by the 30-day volume-weighted maker-taker schedule, which ranges from 0.05% to 0.15% for takers and from 0% to -0.025% for makers.

-

Open interest is measured every minute across all markets and averaged across a given epoch.

Trading rewards are calculated using a formula considering the user’s trading tier, market share, and reward rate. The formula is as follows:

-

Trading Score = (Fees Paid + Open Interest) * Tier Multiplier

-

Market Share = Trading Score / Total Trading Score

-

Reward Rate = DYDX Distributed / Total Trading Score

-

Trading Rewards = Market Share * Reward Rate

The trading tier is a factor that increases the user’s trading score based on their trading volume. There are four tiers: Bronze (1x), Silver (1.25x), Gold (1.5x), and Platinum (2x). The tier thresholds are as follows:

-

Bronze: Less than $100k in trading volume

-

Silver: Between $100k and $1M in trading volume

-

Gold: Between $1M and $10M in trading volume

-

Platinum: More than $10M in trading volume

The market share is the user’s proportion of the total trading score across all users in a given epoch. The reward rate is the amount of DYDX tokens distributed per unit of trading score in a given epoch.

The rewards are the amount of DYDX tokens the user earns in a given epoch based on their market share and reward rate. Trading rewards are distributed at the end of each epoch, lasting 28 days.

Trading rewards initially had 25% of the total DYDX token supply (250 million tokens) allocated for distribution over five years. However, this was reduced to 20.2% (202 million tokens) after a governance vote. Trading rewards are subject to change based on future governance proposals or market conditions.

The discounts, however, are based on a sliding scale that depends on the user’s token balance and staking duration.

Fee discounts reduce the trading fees for users who hold or stake DYDX tokens on the dYdX Layer 2 protocol. They are based on the user’s current balance of DYDX and stkDYDX (staked DYDX) tokens in their wallet. The higher the balance, the higher the discount.

Fee discounts are also based on the user’s staking duration of DYDX tokens in the liquidity pool.

The longer the staking duration, the higher the discount.

Discounts are applied to both maker and taker fees according to the following table:

Some Insights and Challenges for dYdX

dYdX has several competitive advantages that make it one of the leading crypto derivatives platforms in the market.

Some of these are:

-

Scalability: dYdX leverages L2 scaling solutions provided by StarkWare to offer fast and cheap trading on Ethereum, with zero gas costs, low minimum trade sizes, low trading fees, high throughput, and non-custodial security.

-

Liquidity: dYdX has abundant liquidity through collaboration with various market makers such as Amber Group and Sixtant, as well as liquidity provider rewards and staking pools that incentivize users to provide liquidity to the platform’s markets.

-

Innovation: dYdX is constantly innovating and adding new features and products to its platform, such as perpetual contracts, cross-margin trading, limit orders, stop-loss orders, isolated margin trading, and more.

-

Governance: dYdX has a decentralized governance mechanism that allows DYDX token holders to vote on proposals that affect the platform’s parameters, features, and policies.

dYdX faces several regulatory risks that could hamper its growth or operations.

Some of these are:

-

Security token classification: dYdX may face regulatory scrutiny from the US Securities and Exchange Commission (SEC) or other regulators if its DYDX token is deemed a security token rather than a utility token. This could result in legal actions, fines, or restrictions for the platform and its users.

-

KYC/AML compliance: dYdX may be required to implement know-your-customer (KYC) and anti-money laundering (AML) procedures to comply with local or international laws and regulations. This could compromise the privacy and anonymity of its users, as well as increase the operational costs and complexity of the platform.

-

Jurisdictional limitations: dYdX may be prohibited or restricted from operating in certain jurisdictions that have unfavorable or unclear laws or regulations regarding crypto derivatives trading. This could limit the market size and user base for the platform.

dYdX has achieved impressive user adoption since its launch in 2017.

Some of its user adoption metrics are:

Trading volume: As of April 18, dYdX has processed over $19.2 billion in cumulative trading volume across its perpetual, margin, and spot markets in 2023 alone.

Number of users: dYdX has over 40,000 active users who trade on its platform regularly.

Token distribution: dYdX has distributed over 156 million DYDX tokens to its users through various programs such as airdrops, trading rewards, liquidity provider rewards, staking pools, and governance proposals.

dYdX has an ambitious future roadmap to make it the largest global cryptocurrency exchange.

Some of its future plans are:

-

Launching its own blockchain: dYdX plans to launch its standalone blockchain called the dYdX Chain in Q2 2023. The dYdX Chain will be based on Cosmos SDK and Tendermint consensus protocol and use DYDX as its native token. The dYdX Chain will enable complete decentralization of the platform’s off-chain orderbook perpetual futures exchange.

-

Expanding its product offerings: dYdX plans to expand its product offerings to include more markets, assets, order types, leverage options, risk management tools, and analytics features. Some of the products in development or planned are options contracts, futures contracts, portfolio margining, trailing stop orders, conditional orders, subaccounts, and more.

dYdX plans to grow its community and ecosystem by engaging more with its users, partners, developers, validators, and regulators.

Some of the initiatives that are underway or planned are:

-

Launching a developer portal and SDK: dYdX intends to launch a developer portal and SDK that will allow developers to quickly build applications and integrations on top of the dYdX Chain and protocol.

-

Supporting bridges and interoperability: dYdX plans to support bridges and interoperability with other blockchains and platforms, such as Ethereum, Polygon, Binance Smart Chain, Solana, and more. This will allow users to access dYdX from various wallets, networks, and devices.

-

Educating and informing users: dYdX plans to educate and inform users about its platform, products, features, and benefits through various channels and resources, such as blogs, podcasts, videos, webinars, tutorials, guides, newsletters, social media, and more.

-

Collaborating and partnering with stakeholders: dYdX plans to collaborate and partner with various stakeholders in the crypto space, such as market makers, liquidity providers, exchanges, aggregators, data providers, research firms, media outlets, influencers, regulators, and more. This will help dYdX increase its exposure, reputation, trust, and compliance.

Latest Updates on dYdX

#1

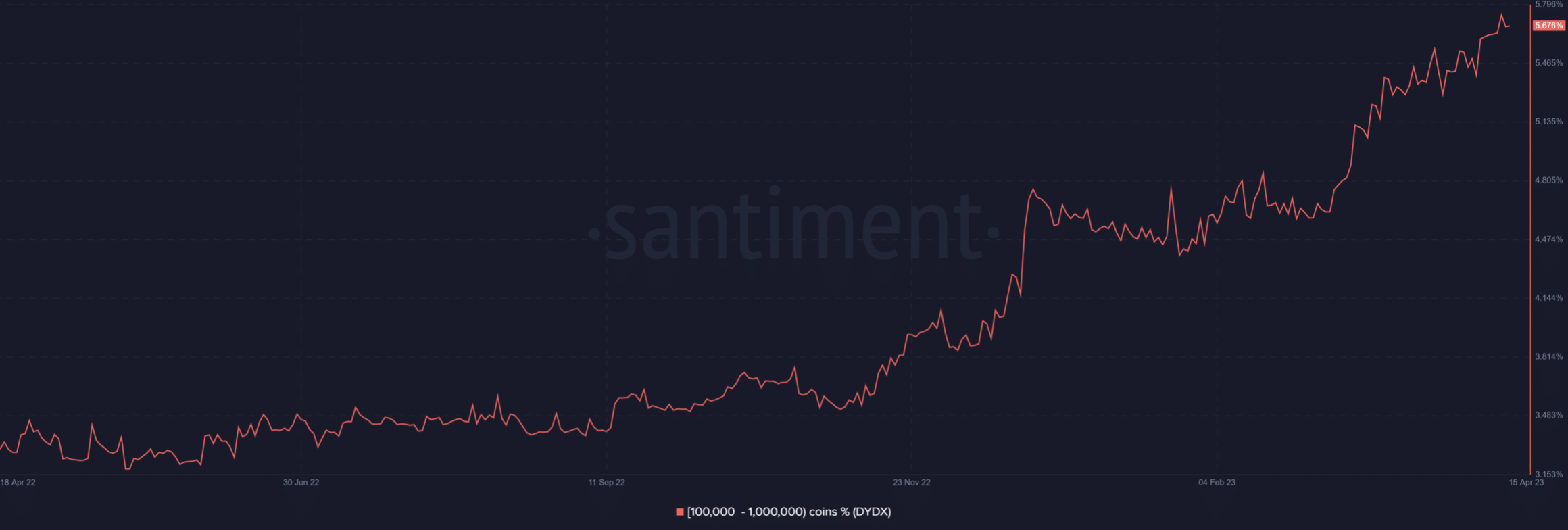

dYdX token’s large wallet investors have steadily accumulated the asset since March 2023. They have been buying more tokens and increasing their holdings over time. This can be seen from the data provided by Santiment, a crypto analytics platform, which shows that this segment of whales now holds over 5.6% of the total dYdX supply.

Whale accumulation coupled with a declining supply on exchanges is considered a bullish sign for the token. This creates a scarcity effect that can drive up the token's price.

The supply of dYdX tokens on exchanges has declined by over 10 million between February and April 2023, indicating lower selling pressure.

Experts predict a sustained uptrend in dYdX. Some of the factors that support this prediction are:

-

The breakout of dYdX from its downtrend and consolidation phase signals a change in market sentiment and momentum.

-

The reduction of trading rewards by 45% after a governance vote aims to improve the tokenomics and sustainability of the platform.

-

The announcement of launching its standalone blockchain, called the dYdX Chain, in Q2 2023 will enable complete decentralization and innovation for the platform.

#2

dYdX has announced its exit from the Ethereum network and its plan to launch its standalone blockchain called the dYdX Chain in Q2 2023 using the Cosmos SDK. This framework allows developers to build custom blockchains that can interoperate with each other.

The dYdX Chain will be based on Cosmos SDK and Tendermint consensus protocol and will use DYDX as its native token for governance and for paying fees, staking, and voting.

The dYdX Chain aims to decentralize the platform’s off-chain orderbook perpetual futures exchange fully. The orders will be matched in real-time by the network of validators and then committed on-chain. This will enable faster and cheaper trading without compromising security or transparency.

But why did dYdX decide to leave Ethereum and choose Cosmos for their blockchain:

-

Scalability: dYdX faced scalability issues on Ethereum due to its high gas fees, low throughput, and network congestion. These issues limited the platform’s growth and user experience. By moving to Cosmos, dYdX expects to increase its processing capacity by at least ten times and eliminate gas fees for trading.

-

Customization: dYdX wanted more control and flexibility over its blockchain and protocol parameters. Using Cosmos SDK, dYdX can customize its blockchain to suit its specific needs and optimize its performance. For example, dYdX can choose its consensus algorithm, block time, transaction format, fee structure, etc.

-

Interoperability: dYdX wanted to be able to connect and communicate with other blockchains and platforms in the crypto space. By joining Cosmos, dYdX can leverage the Inter-Blockchain Communication (IBC) protocol, enabling the cross-chain transfer of tokens and data. This will allow dYdX to access more liquidity, markets, assets, and users.

#3

dYdX has extended the lock-up period for DYDX tokens issued to investors, employees, and consultants until Dec 1, 2023. These tokens were initially scheduled to be unlocked on Feb 1, 2023, but they will remain locked for another 10 months.

The move signals the long-term support and commitment of the stakeholders to the dYdX protocol and its vision showing their confidence and loyalty to the dYdX project and its future goals. The move also indicates that the stakeholders are not interested in selling their tokens in the short-term and are willing to wait for the long-term growth and development of the platform.

The extension of the lock-up period affects 156 million DYDX tokens, representing about 15.6% of the total supply of 1 billion DYDX tokens. These tokens are held by various parties, such as:

-

Past investors of dYdX Trading Inc., the company behind the dYdX protocol, received 27.7% of the total DYDX supply in exchange for their funding.

-

Founders, employees, advisors, and consultants of dYdX Trading Inc. and dYdX Foundation, the non-profit organization that supports and governs the dYdX protocol, received 15.3% of the total DYDX supply as compensation for their work.

A mutual agreement decided the extension of the lock-up period between dYdX Trading Inc., dYdX Foundation, and certain parties who hold the Warrants to Purchase Tokens (Warrants). These contracts grant the right to buy DYDX tokens at a fixed price.

The agreement was signed on Jan 24, 2023, and announced on Jan 31, 2023.

The market and the community have well received the extension of the lock-up period, as it shows a strong alignment of interests and incentives between the stakeholders and the platform. The news also reduced the selling pressure and increased the scarcity of DYDX tokens in circulation.

dYdX v4 Milestones

dYdX’s v4 milestone is the final stage of its roadmap to launch its own decentralized blockchain for trading perpetual contracts on Layer 2. The v4 milestone consists of five sub-milestones, each with a set of features to be built and a network release to be launched1. The sub-milestones are:

After Thoughts

dYdX has achieved impressive user adoption, trading volume, innovative product offerings, and governance features. The platform faces several challenges, such as regulatory risks, jurisdictional limitations, and competition from other platforms.

However, the platform has several competitive advantages, such as liquidity, interoperability, and community engagement. For example, the platform has recently announced its plan to launch its standalone blockchain called the dYdX Chain in Q2 2023, enabling complete decentralization and performance optimization.

The platform has also extended the lock-up period for DYDX tokens issued to investors, employees, and consultants until Dec 1, 2023, which signals the long-term support and commitment of the stakeholders to the dYdX protocol and its vision.

Thank you for reading through, and subscribe below for regular post updates.

I’d also appreciate it if you shared this with your friends, who would enjoy reading this.

You can contact me here: Twitter and LinkedIn.

My previous research: