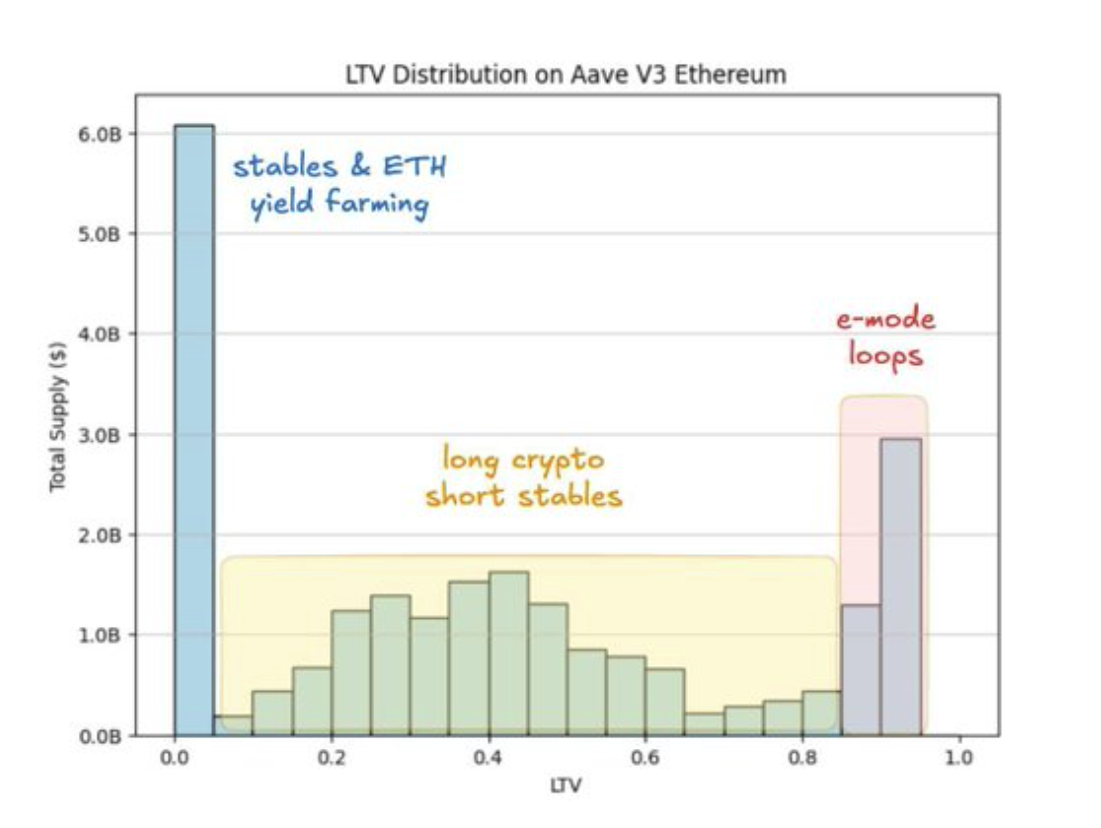

Over 60% of all assets in DeFi are sitting idle.

For every $100 deposited to Euler, AAVE or Morpho, only $30-$40 is ever borrowed. Individual utilization rates ebb and flow based on collateral type, liquidity depth or APY, but the point remains:

A lot of people are depositing into the void.

For many lenders, the choice not to borrow (much or at all) themselves stems from a risk-off mindset. You’re already exposed to smart contract risk - why slap on additional attack vectors and get whipsawed by Liquidation Loan-To-Value (LLTV)? Why pay borrow rates when you can sit comfy in lending APY?

Truth is, lending’s inherently risky. But passive lending is more dangerous than you may want to admit.

The opportunity cost of idle capital is not properly baked into your supply APY. If the lending market gets exploited, you’ll concede your assets for disproportionately small rewards, while wasting the opportunity to accrete value at every step.

And while your borrowing capacity lies untapped, there’s a whole contingent of keen borrowers looking for extra collateral to use for liquidation protection.

This is the dissonance that Twyne was built to address - a way for lenders to delegate their borrowing capacity to eager borrowers and unlock latent yield from their collateral.

This article will try to answer the following questions:

-

What is Twyne?

-

How does Twyne work for lenders?

-

What is Twyne’s delegation APY?

-

What are the net-new risks for lenders on Twyne?

-

When can lenders suffer losses with Twyne?

-

How do I sign up?

Enter Twyne

Whenever you supply to a lending market, you’re issued an IOU token (aETH, eUSDC etc) for your position. These tokens have two independent functions:

-

They passively accrue lending interest

-

They unlock certain borrowing capacity against your collateral

Every lender uses function #1. Few tap into the value-generating opportunities of function #2.

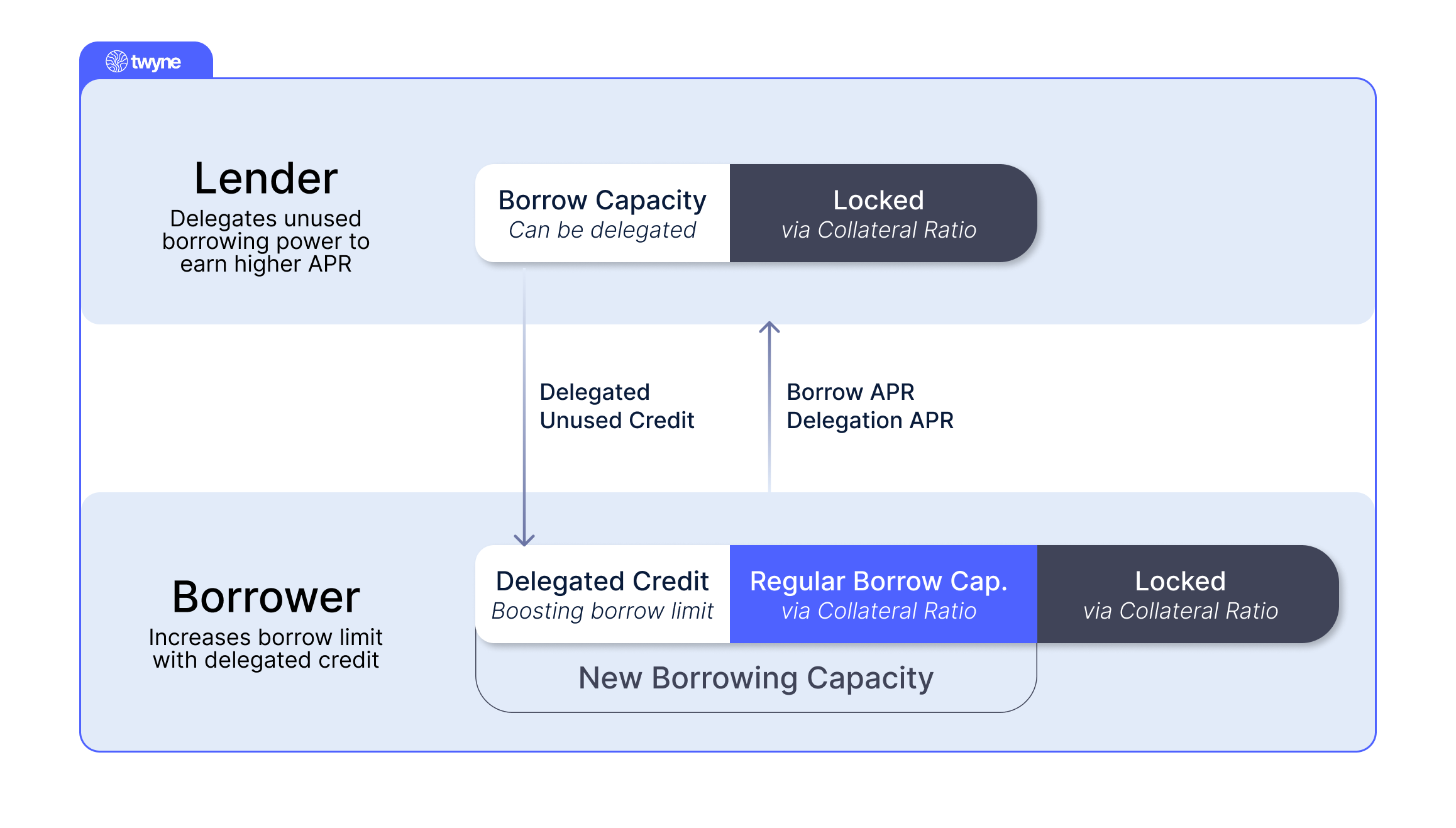

Twyne allows lenders (referred to as Credit LPs) to pass on their unused borrowing power to those that need it and earn additional yield in return, while keeping full control over their underlying assets. Eager borrowers use this additional borrow capacity to raise their effective LLTV and protect themselves from liquidation.

Example: say the underlying lending market’s LLTV is at 80%. With Twyne, lenders can delegate more credit power to borrowers, allowing them to achieve a new LLTV of 95% relative to their original collateral, creating a more robust liquidation buffer.

By delegating their credit power, lenders effectively underwrite the loan of another borrower, which carries additional risk. Twyne addresses this with a custom liquidation mechanism designed to protect Credit LPs and prioritize fullness of their collateral. More on that below.

How Twyne works (for Lenders)

Twyne is built as a credit-delegation layer on top of Euler, using the protocol’s underlying liquidity instead of bootstrapping a lending pool. It has two types of vaults:

-

Credit-vault: one master vault storing all lending IOUs from lenders (Credit LPs)

-

Collateral vault: one per user, allowing borrowers to reserve IOUs from the Credit-vault

The Credit-vault insulates lender deposits and prevents borrowers on Twyne from directly accessing their collateral - only its borrowing power.

For lenders, Twyne user flow looks like this:

-

Deposit USDC to Euler (receive eUSDC)

-

Deposit eUSDC to Twyne

-

Choose your strategy:

-

Pure credit delegation

- eUSDC is deposited into Twyne’s Credit Vault. Lenders fully forgo their borrowing power and delegate credit, underwriting others’ loans

-

Delegation + borrowing

- eUSDC is split between the Credit Vault (to delegate some borrowing power to others) and the Collateral Vault (to borrow for themselves)

-

In either case, lenders are issued a new receipt token: twyne_euler_USDC, which earns them delegation yield denominated in the same asset as their initial deposit. This is an orthogonal source of yield, boosting the lender’s overall returns from lending markets to supply APY (Euler) + delegation APY (Twyne).

What is Twyne’s delegation APY?

While we’ll have to wait for Twyne mainnet (soon!) to see how markets price the excess risk that Credit LPs take on, we have performed some preliminary backtests.

These calculations are based on a string of historical liquidations on AAVE v3 mainnet from deployment to November ‘24. In each case, we assume that a rational borrower would’ve paid lenders (Credit LPs) on Twyne a certain APR to boost their LLTV and not get liquidated.

Our methodology is relatively simple:

-

Take a snapshot of all positions liquidated on AAVE v3 one block before liquidation

-

Track those portfolios through a full year of historical price trajectories (as if the liquidation event never occurred)

-

Measure the portfolio’s LTV at each time step

From this dataset, we extracted the maximum LTV of each position over the observed time frame and asked: what amount of additional credit would this user have needed to NOT get liquidated?

If we assume that any borrower would be willing to pay the liquidation incentive (typically 5-10%) as an APR to avoid liquidation, we can calculate an implied APR of 16.75% from the Credit LP’s perspective (once you account for capital requirements). This back-of-the-envelope estimate shows how Twyne can be leveraged as a loan insurance protocol.

While the numbers look promising, we would also expect the premium to be arbed relatively quickly, dampening the final APY. It’s also worth noting that Twyne’s is a utilization-based APY, and will ultimately depend on network effects.

Regardless of rough estimates, Credit LPs on Twyne will be able to earn orthogonal yield while enjoying several layers of liquidation protection from the protocol. Speaking of which:

What are the net-new risks for lenders on Twyne?

By delegating their borrowing power, Credit LPs are effectively underwriting another borrower’s loan, which expands their risk surface (relative to idle lending). The main concern for Credit LPs is that the borrower’s collateral becomes insufficient to cover both the loan AND the liquidation incentive. If that happens, the liquidation incentive will begin eating into the Credit LP’s own collateral.

To protect Credit LPs and mitigate risk, Twyne has designed a liquidation mechanism that should prevent loss of lender collateral in the majority of cases, while also making Credit LPs a proactive participant in the liquidation process.

In practice, the borrower’s position becomes liquidatable on Twyne and the underlying market (Euler) at the same time. However, while Euler's liquidation incentive starts low and increases as the position becomes riskier, Twyne’s initial liquidation incentive is set higher to ensure it takes over as primary liquidator.

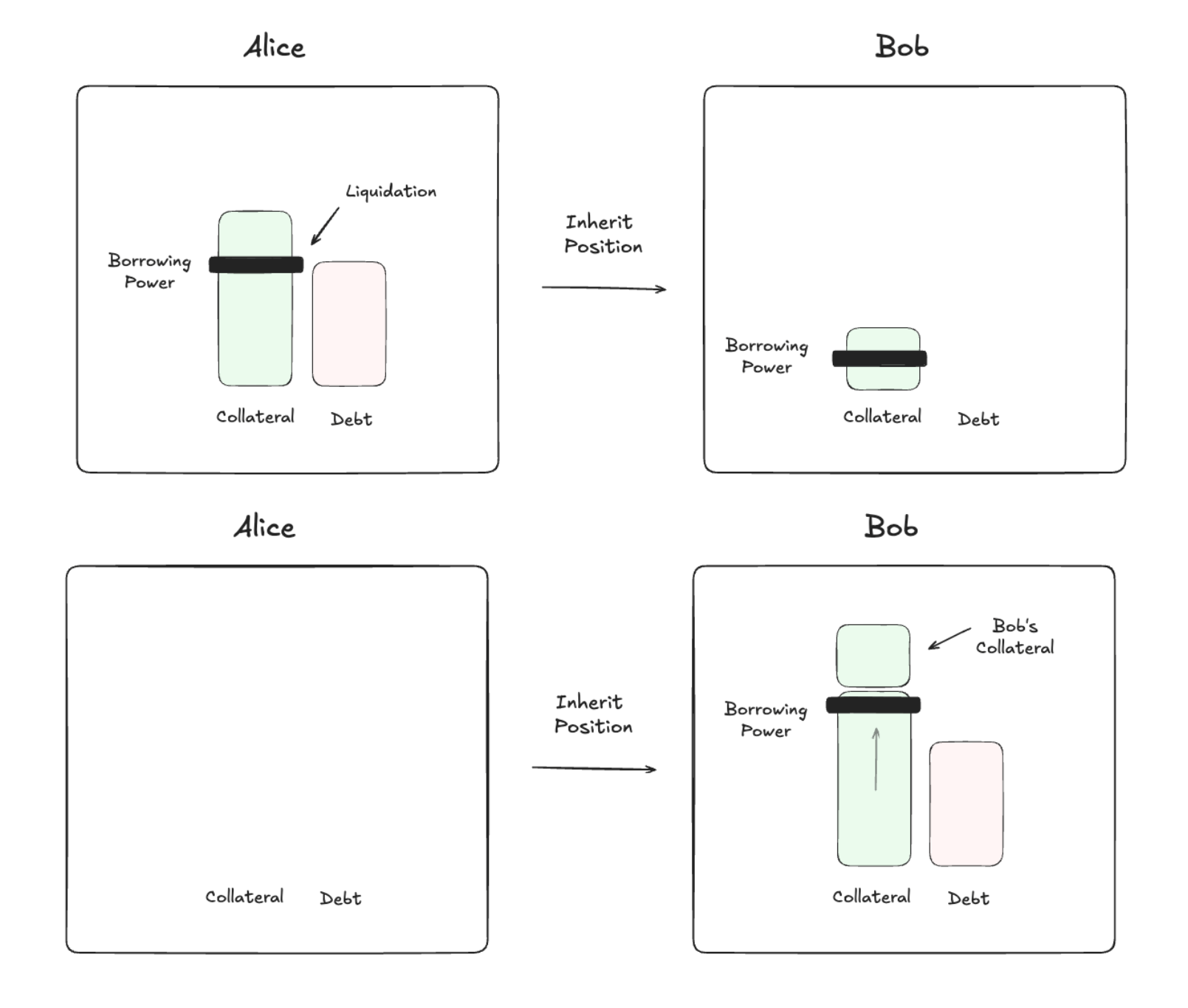

Within Twyne, liquidators can either clear risky debt or add collateral to stabilize and inherit the debt position. What we’re dubbing “liquidation by inheritance” allows lenders and anyone with excess borrowing power to join the system as de-facto liquidators.

‘Inheriting’ means the liquidator can practically step into the borrower’s shoes, take over their unhealthy position and themselves add collateral to lower the LTV. This doesn’t necessitate a swap, or even a technical setup to liquidate - only excess credit to participate.

Let’s look at an example:

-

Alice deposits $100 as collateral and borrows $80. Her maximum allowed LLTV is 95%.

-

Bob (Credit LP) deposits $20 collateral and opts to absorb liquidations.

-

Prices move against Alice, causing her debt to rise to $95.01, now exceeding her allowed 95% LTV limit. Alice becomes eligible for liquidation.

-

Liquidation occurs: Alice’s entire position ($100 collateral and $95.01 debt) is automatically transferred to Bob.

-

After the liquidation transfer, Bob’s new position is:

-

Collateral: $120 ($20 original + $100 from Alice)

-

Debt: $95.01

-

Resulting LTV: ~80% (now safer and healthier).

-

-

Bob effectively gained ~$5 in net worth, because he acquired Alice’s collateral at a discounted rate (below market value). He can now:

-

Repay the debt immediately to secure his profit, or

-

Keep the position open, betting on a mean reversion.

-

This process not only minimizes TVL bleeding but also creates opportunities for CreditLPs and smart borrowers on Twyne to come in and acquire assets at discounted rates - all while preserving the protocol's stability.

When can the lender suffer losses with Twyne?

To protect Credit LPs, Twyne is usually taking the role of priority liquidator, ensuring that the borrower’s position - boosted by lender’s collateral - is resolved or made healthy before being liquidated on the underlying protocol.

In cases of extreme volatility and swift downward market pressure, there might be cases where nobody has inherited a risky debt or triggered a liquidation on Twyne; in such a scenario the underlying protocol kicks in as the fallback liquidator, which would likely incur losses for the Credit LP.

Let’s look at an example:

-

Alice has initially borrowed a certain amount on Euler at an 80% LLTV. Alice’s collateral is now liquidatable on Euler at an 80% Loan-to-Value.

-

Alice then taps into Bob’s credit capacity on Twyne to boost her borrowing limit by 8%. Alice’s collateral + Bob’s credit has raised her effective LLTV to 88%. Alice’s collateral is now liquidatable on Twyne at an effective 88% Loan-to-Value while, from Euler’s perspective, the combined Alice+Bob position is still liquidatable at 80% LLTV.

-

To protect credit LPs and make sure the protocol processes most liquidations, Twyne implements a 5% safety buffer. This means that, in the moment Alice’s position first becomes liquidatable on Twyne (i.e. when Alice’s LTV reaches 88%), the combined Alice+Bob position will still be at 76% LTV on Euler (5% buffer to 80% LLTV).

-

The added 5% effectively works as Twyne’s time window to liquidate the position - before Euler takes over.

Once the underlying protocol seizes the liquidation process, it is quite likely the Credit LP will incur some losses. That said, there are still possible cases where the position is liquidated safely on the underlying protocol while the Credit LP is made whole (depending on the actual LLTV of the borrower being liquidated on Twyne).

For instance, in the above example, Euler would liquidate the combined position once the debt gets close to a Loan-to-Value of 90% relative to Alice’s original collateral. As long as Euler’s liquidation incentive isn’t higher than (roughly) 10%, Alice’s initial collateral will be enough to cover the entire debt plus the liquidator fee.

Join Twyne’s Whitelist

We’re launching a curated whitelist for all farmers, degens, and traders.

-

1:1 product walkthrough with the founder

-

Access to a private group of sharp DeFi users

-

Direct influence on the product roadmap