There’s a native inefficiency in how DeFi throttles borrowers.

No matter your collateral, use case, or lending market, your credit capacity always gets kneecapped by the Liquidation Loan-to-Value (LLTV).

Imagine you deposit $1000 worth of WETH into Euler and borrow 500 USDC. You’re deliberately leaving a healthy liquidation buffer to shield yourself from market swings.

At origination, you’re sitting at 50% Loan-to-Value (LTV) - pretty conservative. But then prices move against you. Suddenly, you’re at 75% LTV, with only ~10% margin before Euler’s hardwired 85% Liquidation LTV.

Now, you’re just one bad Trump tweet away from liquidation.

Not good. So what can a rational borrower do to beef up their buffer and get some peace of mind?

Your current market options:

-

Option A: Inject more collateral

-

Option B: Unwind - sell some collateral to repay part of the loan

But unwinding comes with pain - you’re selling at a loss because and you may trigger tax events.

While this seems like a built-in limit of over-collateralized systems, that’s only half the story.

The reality is, there’s a simple but (so far) inaccessible Option C:

What if you could use other people’s borrowing power to improve your Liquidation LTV, without adding more collateral or unwinding?

Enter Twyne - a credit delegation layer that lets borrowers tap into lenders’ unused credit capacity, boosting their borrow limits while staying overcollateralized.

This article will answer the following questions:

-

What is Twyne?

-

How Twyne works for borrowers

-

How (much) does Twyne boost your borrow limits?

-

How is the extra interest rate calculated?

-

What are the added risks for borrowers?

-

How do liquidations work on Twyne?

-

Wen mainnet?

What is Twyne?

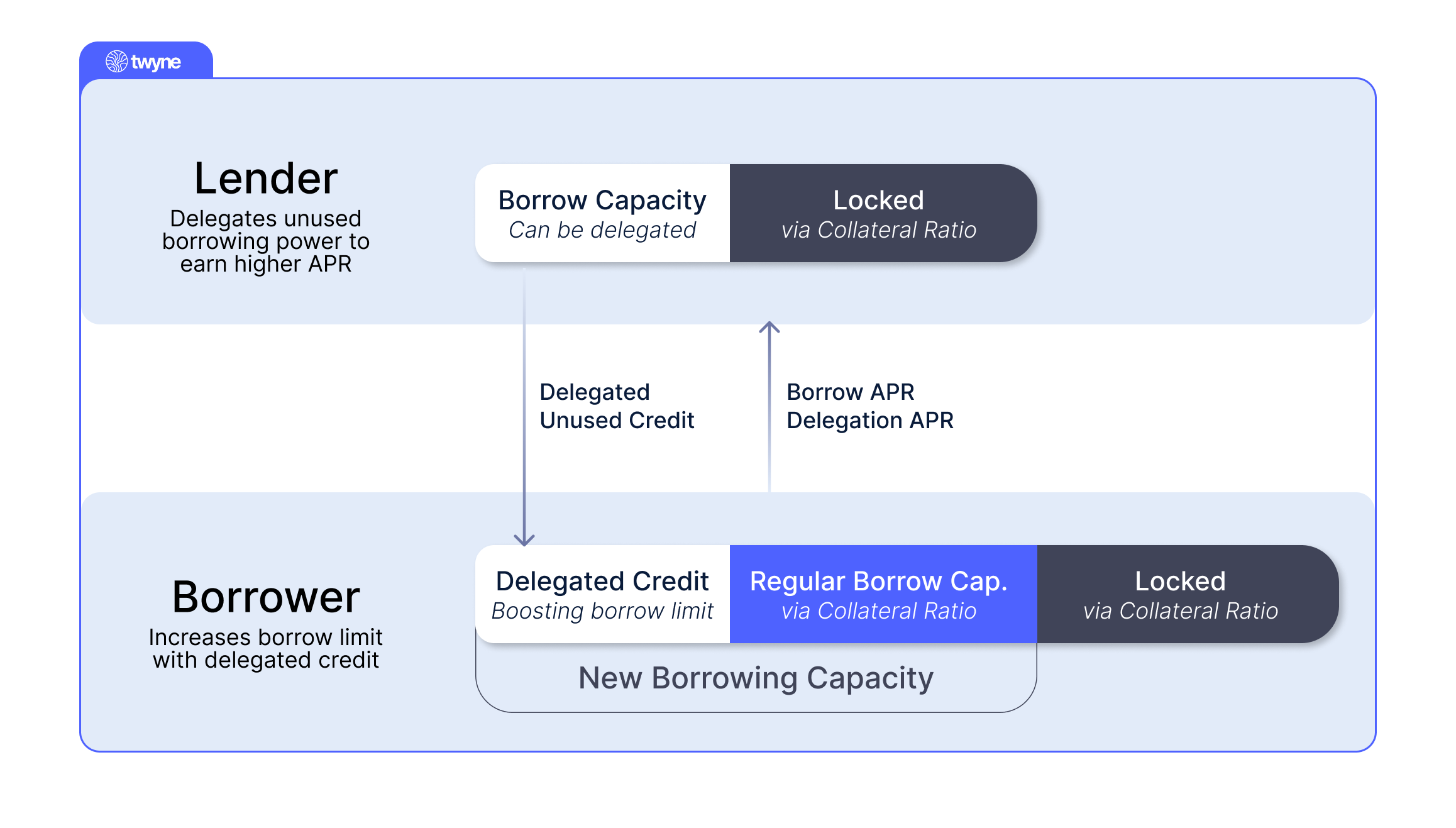

Twyne allows idle lenders (referred to as Credit LPs) to pass on their unused borrowing power to users that need it, and earn orthogonal yield in return. Eager borrowers can take this added credit capacity to boost their liquidation LTV and borrow more, while staying fully over-collateralized.

For borrowers, Twyne v1 is a capital-efficient buffer against preventable liquidations. Why would you have to partially unwind or add more of your own collateral to defend your at-risk position?

By letting you rent others’ borrowing power, Twyne reinforces your outstanding loan and makes it healthier in the eyes of the (underlying) lending market, without forcing you to lock in a loss or shovel in extra capital.

Example: You’ve deposited $1000 worth of ETH and borrowed $700 USDC against it, putting you at a 70% Loan-to-Value ratio. The market’s LLTV is hardwired at 80%, so you’re left with a thin safety margin in case ETH tumbles. Twyne lets you reserve more credit from other lenders and in doing so boost your effective LLTV to (example) 95% relative to your original collateral. This gives your position a significantly larger cushion and higher tolerance to major price drops.

If you already maintain a hefty liquidation buffer to protect your loan but wish you could borrow more, you can use Twyne to increase your debt position while lowering your liquidation risk.

Depending on your LTV, a 15% price drop might put you at risk of liquidation on the underlying protocol. But with Twyne, you can borrow more and still stay protected even if prices move by 15%, thanks to the added buffer from delegated credit.

Finally, there are borrowers that have already used up some but not all of their borrowing power. Twyne allows them to borrow for themselves AND delegate their remaining credit capacity to others, earning them an orthogonal source of yield.

How Twyne works (for Borrowers)

Twyne is built as a credit-delegation layer on top of Euler. The protocol allows Credit LPs to delegate their Euler IOUs in a controlled environment, letting borrowers leverage their unused credit capacity.

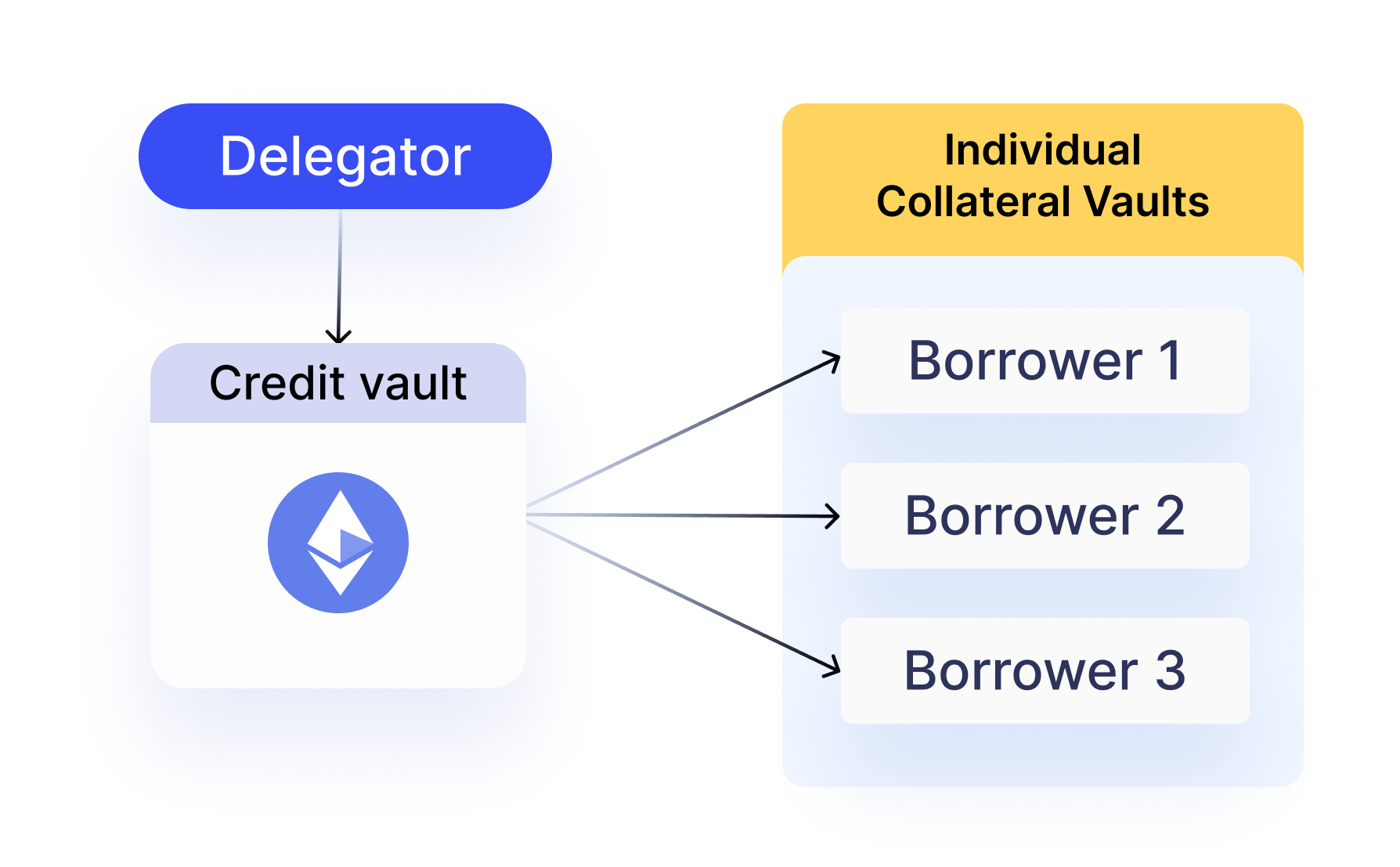

Twyne has two types of vaults:

-

Credit vault: one master vault storing all lending IOUs from Credit LPs Individual

-

Collateral vault: one per user, allowing borrowers to reserve IOUs from the Credit-vault

The vault infrastructure insulates lender IOUs similar to Credit Accounts on Gearbox. Borrowers never get access to lender collateral directly - only their borrowing power, and only within the confines of their Collateral Vault.

For borrowers, Twyne user flow looks like this (we’ll use eUSDC as example):

-

Deposit USDC to Euler (receive eUSDC)

-

Deposit eUSDC to Twyne

-

Reserve credit capacity from the Credit Vault

-

Additional eUSDC from Credit LPs gets transferred to your Collateral Vault

To Euler, this merger of borrower and Credit LP’s capital simply looks like a singular debt position that’s just gotten more healthy. To the borrower, it instantly boosts their Liquidation LTV relative to their original collateral, allowing them to borrow more than they otherwise could.

There are three ways borrowers can use Twyne:

-

Borrow only with your own collateral — works just like borrowing directly on Euler

-

Borrow with your own collateral and boost borrowing power — tap into others’ unused credit to increase your limits

-

Split between borrowing and delegating your own borrowing power — borrow while also lending out your unused credit capacity to others for additional yield

How (much) does Twyne boost your borrow limit?

Twyne lets the borrower unlock a higher liquidation LTV than the one supported by the underlying lending market. Sticking with eUSDC as an example, it does this by pairing the borrower’s eUSDC within the Collateral Vault with some amount of additional eUSDC from the Credit Vault.

For the underlying protocol (Euler), this still appears like a single position - it just added more collateral.

Example:

-

Euler’s Liquidation LTV: 80%

-

Twyne’s boosted Liquidation LTV: 90%

-

Extra credit needed: (0.9 / 0.8) - 1 = 12.5%

In this case, the borrower can reserve 12.5% additional collateral on Twyne to reach a new 90% Liquidation LTV relative to their collateral.

The maximum LTV that you can achieve with Twyne is set by the protocol’s risk team for each asset and based on internal simulations that stress-test edge cases.

This is entirely handled in the background - all you have to do as a borrower is select the desired (boosted) Liquidation LTV, and Twyne will automatically reserve additional credit from Credit LPs and use it to top up your Collateral Vault.

How is the extra interest rate calculated?

In return for improving your LLTV and boosting your borrow limit, borrowers are charged interest on the reserved credit.

We call this the Borrower Siphoning rate, paid out of the borrower’s collateral directly to Credit LPs. Think of this as a negative supply APY that the borrower pays to access more credit capacity.

Example:

-

Boosting from 80% → 90% LLTV requires 12.5% extra credit (see above)

-

Exemplary Siphoning rate = 10% APY

In the above case, borrowers are charged the Siphoning rate only on the 12.5% credit that they reserved from the Credit-vault. Spread over the whole collateral, that comes out to just 1.25% APY.

Compare this to average liquidation costs which often incur 2–10% penalties upfront, plus at least part of your collateral. For overextended users, Twyne is a way to beef up the liquidation buffer without needing to unwind or inject more collateral, and do so at an affordable price point.

Siphoning rates are utilization-based, just like in typical lending markets. As more credit gets reserved, rates adjust dynamically to manage liquidity.

What are the added risks for borrowers using Twyne?

Using Twyne raises your liquidation LTV so you can borrow more, but that higher threshold carries risks. If the market falls, liquidators need a larger reward to clear your debt, so they take a bigger penalty from your collateral. Twyne applies a 100% close factor, meaning the whole position is liquidated in one shot. In practice, at these high liqLTVs, if you borrow $95 against $100 of collateral, only $5 is left for the liquidator—roughly the same net loss you would face on other platforms.

If you choose a lower liqLTV and delegate part of your collateral for yield, that delegated share is locked in the credit vault, leaving less collateral to back your own loan. Any new debt can therefore be liquidated at the chosen liqLTV, even while the delegated collateral stays intact. For now, you must release or reserve credit manually; auto-rebalancing to dynamically adjust your liqLTV is on the roadmap but not yet live, so you need to monitor prices and collateral levels yourself to avoid abrupt, full-position liquidation.

How do liquidations work on Twyne?

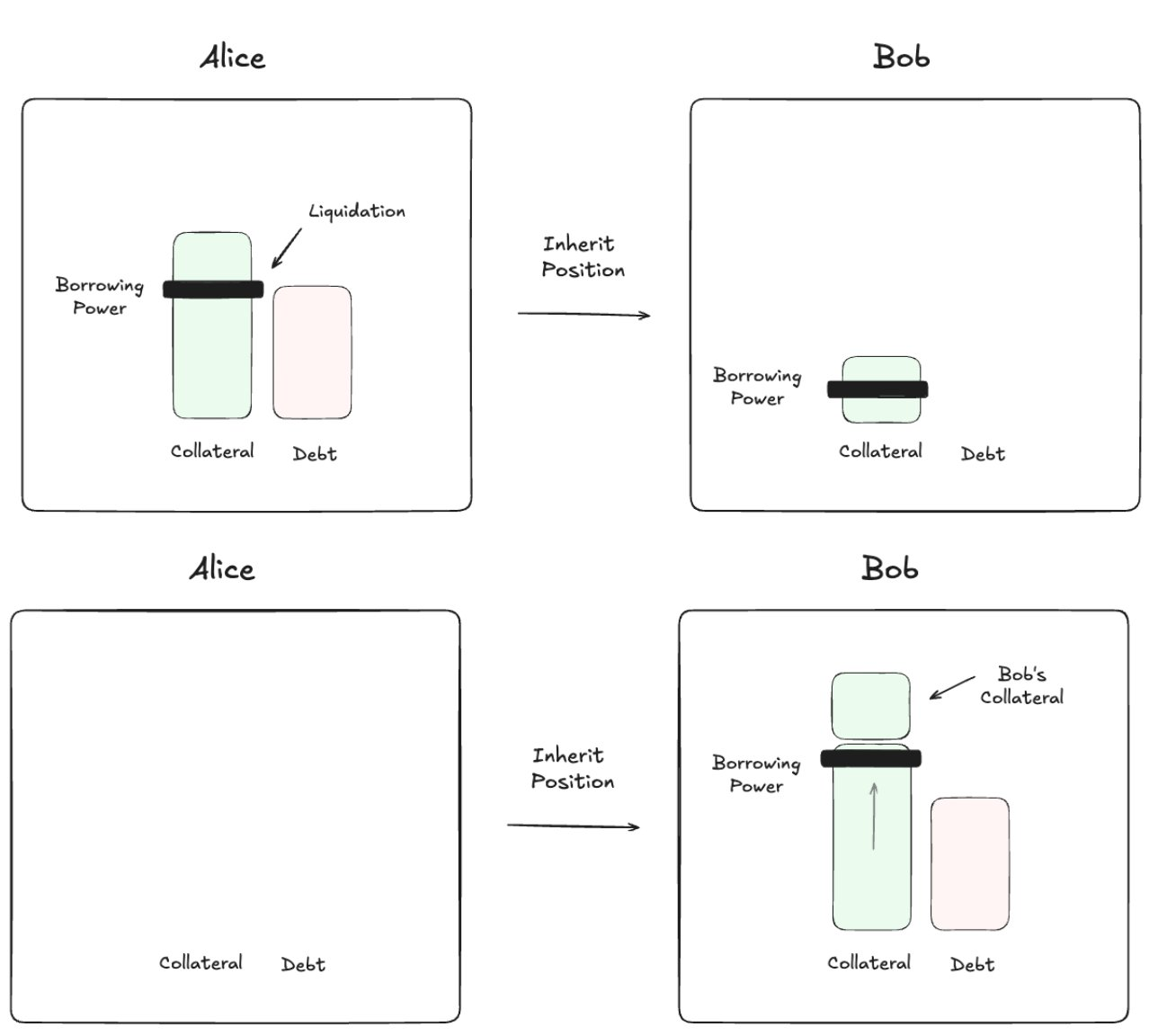

Within Twyne, liquidators can either clear risky debt or add collateral to stabilize and inherit the debt position. What we’re dubbing “liquidation by inheritance” allows lenders and anyone with excess borrowing power to join the system as de-facto liquidators.

‘Inheriting’ means the liquidator can practically step into the borrower’s shoes, take over their unhealthy position and themselves add collateral to lower the LTV. This doesn’t necessitate a swap, or even a technical setup to liquidate - only excess credit to participate.

-

Alice deposits $100 as collateral and borrows $80. Her maximum allowed LLTV is 95%

-

Bob deposits $20 collateral and opts to absorb liquidations

-

Prices move against Alice, causing her debt to rise to $95.01, now exceeding her allowed 95% LTV limit. Alice becomes eligible for liquidation

-

Liquidation occurs: Alice’s entire position ($100 collateral and $95.01 debt) is automatically transferred to Bob

-

After the liquidation transfer, Bob’s new position is:- Collateral: $120 ($20 original + $100 from Alice)- Debt: $95.01- Resulting LTV: ~80% (now safer and healthier)

-

Bob effectively gained ~$5 in net worth, because he acquired Alice’s collateral at a discounted rate (below market value). He can now: a) Repay the debt immediately to secure his profit b) Keep the position open, betting on a mean reversion

This process not only minimizes TVL bleeding losses but also creates opportunities for Credit LPs and smart borrowers to acquire assets at discounted rates - all while preserving the protocol's stability.

Want to try it out?

We're launching with a private whitelist, get on by filling this form: https://forms.gle/WR4npakZqmfabueM8

By joining, you also get:🤝 1:1 walkthrough with the founder 🧠 Private group of sharp DeFi minds Direct influence on the roadmap