Overview: Twyne is a modular risk layer that leverages credit-delegation to unlock new levels of capital efficiency in lending markets.

At its core, Twyne allows:

-

Lenders (Credit LPs) to restake their borrowing power and lend it to others, earning both interest rates and credit-delegation fees, all while retaining full control over their underlying assets.

-

Borrowers, on the other hand, gain access to higher collateral factors, unlocking liquidity that was previously unattainable.

Twyne addresses key challenges: Borrowing Power Utilization: Idle borrowing power represents a missed opportunity for loans to generate additional yield. This results in lower utilization and suppressed interest rates, reducing overall market efficiency. Simultaneously, borrowers often face liquidations due to conservative collateral factors—when just a little extra borrowing power could make all the difference.

Liquidity Fragmentation: Tranches of risk parametrization fragment liquidity, leading to the cold-start conundrum for new markets. In this scenario, no actor in the system is sufficiently incentivized to participate and grow the market.

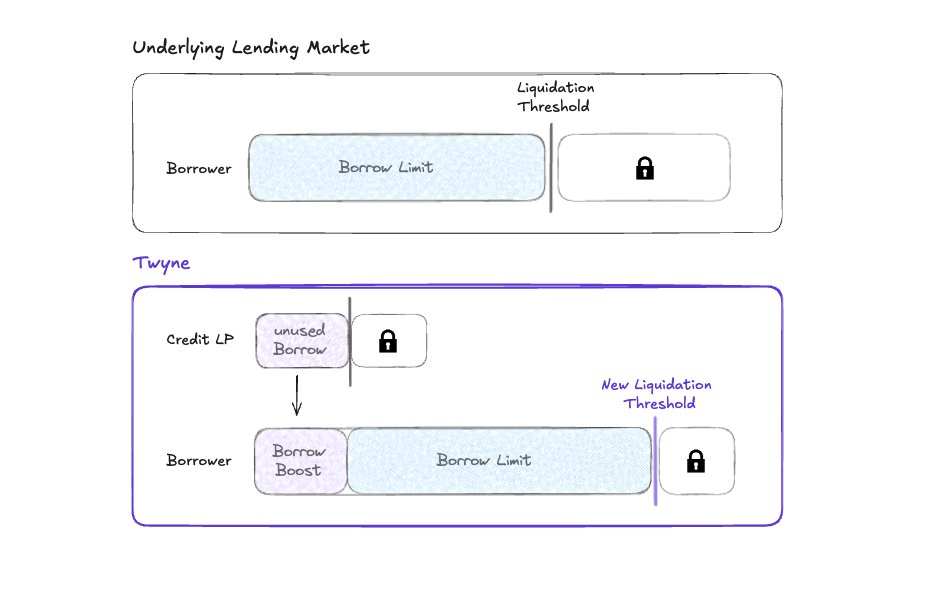

To overcome these challenges, Twyne introduces Collateral-Top-Up Vaults. Lenders provide extra collateral to borrowers, allowing them to borrow more than they could alone. Technically, this is achieved by credit-delegation. This approach boosts borrowing limits while keeping liquidity in the same lending pool and satisfying underlying security constraints. Different risk parameters coexist in one pool, with risks effectively segregated.

The Benefits of Twyne:

-

Increased Flexibility: Lenders gain enhanced optionality with a broader range of yield sources to choose from. Borrowers, pay to increase their leverage or safeguard their positions from incoming liquidations—especially valuable when a user's position is stuck, and they lack the funds to repay.

-

Liquidity Aggregation: Rather than creating fragmented pools with varying parameters, interest rates and liquidity guarantees, Twyne channels borrowing volumes through existing ones, effectively consolidating liquidity.

-

Higher Capital Utilization: Redistributing idle borrowing power to where it is needed most increases borrowing volumes, boosting overall utilization rates. This benefits not only Twyne participants but also lenders exclusively using the underlying lending market.

Twyne introduces a new dimension of lending innovation by structuring and distributing credit products on top of decentralized lending markets. This approach optimizes capital flow while effectively segregating risks. Twyne ensures that borrowers cannot withdraw or misuse the collateral provided by Credit-LPs. Liquidations are managed to prioritize selling off the borrower’s collateral first, protecting the Credit-LPs. However, as the underwriters of the riskier positions, Credit-LPs bear the loss in the event of a shortfall.

To mitigate these risks, Twyne provides flexible options for liquidators. Liquidators can either clear the debt or add collateral to inherit the debt position. This design allows anyone with excess borrowing power to step in as a liquidator without requiring a complex technical setup.

You can think of Twyne as a load balancer, redistributing borrowing power to where it is needed to navigate incoming price movements effectively. It can be used aggressively to leverage up or defensively to prevent unnecessary liquidations. This dynamic approach drives higher capital efficiency, providing a trustless and modular solution that benefits lenders, borrowers, and the underlying lending markets Twyne integrates with.

Conclusion: Twyne empowers lending market users with the freedom to focus on their individual goals: lenders can re-lend, borrowers can re-borrow, and together they drive the emergence of new markets, ensuring capital flows to where it is needed most.

To learn more about Twyne and our upcoming private beta launch, visit our Twitter or try joining our exclusive telegram community!