As a credit delegation protocol, Twyne allows a fast way to restructure and defend your loans on existing lending markets such as Aave, Euler, or Morpho.

How? By giving borrowers access to an instant liquidation buffer.

Twyne lets lenders (Credit LPs) with unused borrowing power delegate it to people that want to improve their debt positions. In other words, borrowers on Twyne can rent other lenders’ credit power to claim higher Liquidation Loan-to-Value Ratios (LLTVs) and protect their loans from downswings.

This effectively means that anyone can use Twyne to avoid liquidation events. If a user ever gets dangerously close to liquidation, they can simply teleport their position to Twyne, reserve more credit and instantly get an extra liquidation buffer. Instead of hard-hitting the limit at (for example) 83% Loan-to-Value (LTV), the borrower would now get liquidated only if their position crosses (for example) 93% LTV.But how useful is this ‘extra buffer’ in practice, really? After all, if the user still gets liquidated on Twyne instead of the underlying lending market - just some time later - what's the point?

To answer this, we analyzed a trove of historical liquidation data for WETH collateral, USDC/USDT debt positions on Aave V3 (mainnet).

Turns out - a disturbing amount of past liquidations could’ve been easily prevented with a Twyne buffer.

Methodology

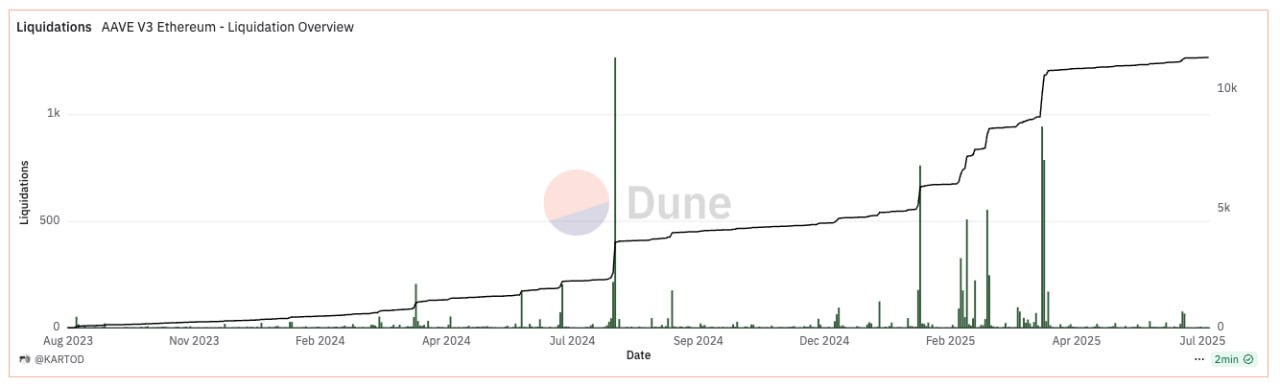

To test our assumption that a fast-acting buffer would (probably) save you from liquidation, we first collected data for all liquidations that have taken place on the AAVE V3 instance on Ethereum mainnet. We used the official AAVE V3 subgraph to extract this data and filter by debt markets.

(For this analysis, we focused only on liquidated debt positions that used WETH as collateral and borrowed either USDC or USDT. We plan to extend the same methodology to other debt markets in future articles.)

At the moment of our backtest, there were a total of 13,386 liquidation transactions recorded on AAVE V3 (mainnet instance). This seems in line with other risk dashboards like the one developed by Block Analitica.

For each historical loan, we queried an archive Ethereum node to construct the user position at the moment of liquidation (liquidation_block-1). We then filtered by specific markets (WETH collateral, USDC/USDT debt), and queried the AAVE subgraph for WETH LTV changes over time. This is needed to compute the fluctuations in each loan’s health factor (HF).

Finally, we needed to extract historical asset prices to track the value of collateral (WETH) over time. For this analysis, we used minute-level data from Binance.

Analysis

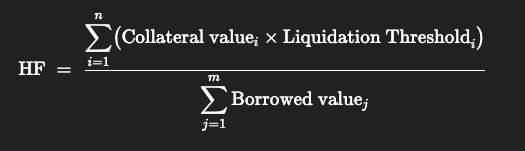

Once we had all the data, the first step of the backtest was to measure the Health Factor of each position at the time they got liquidated. Here’s the formula:

This value is typically just below 1 at the time of liquidation, though it might be lower if liquidators didn’t close the position promptly or there was a big price difference between oracle updates.

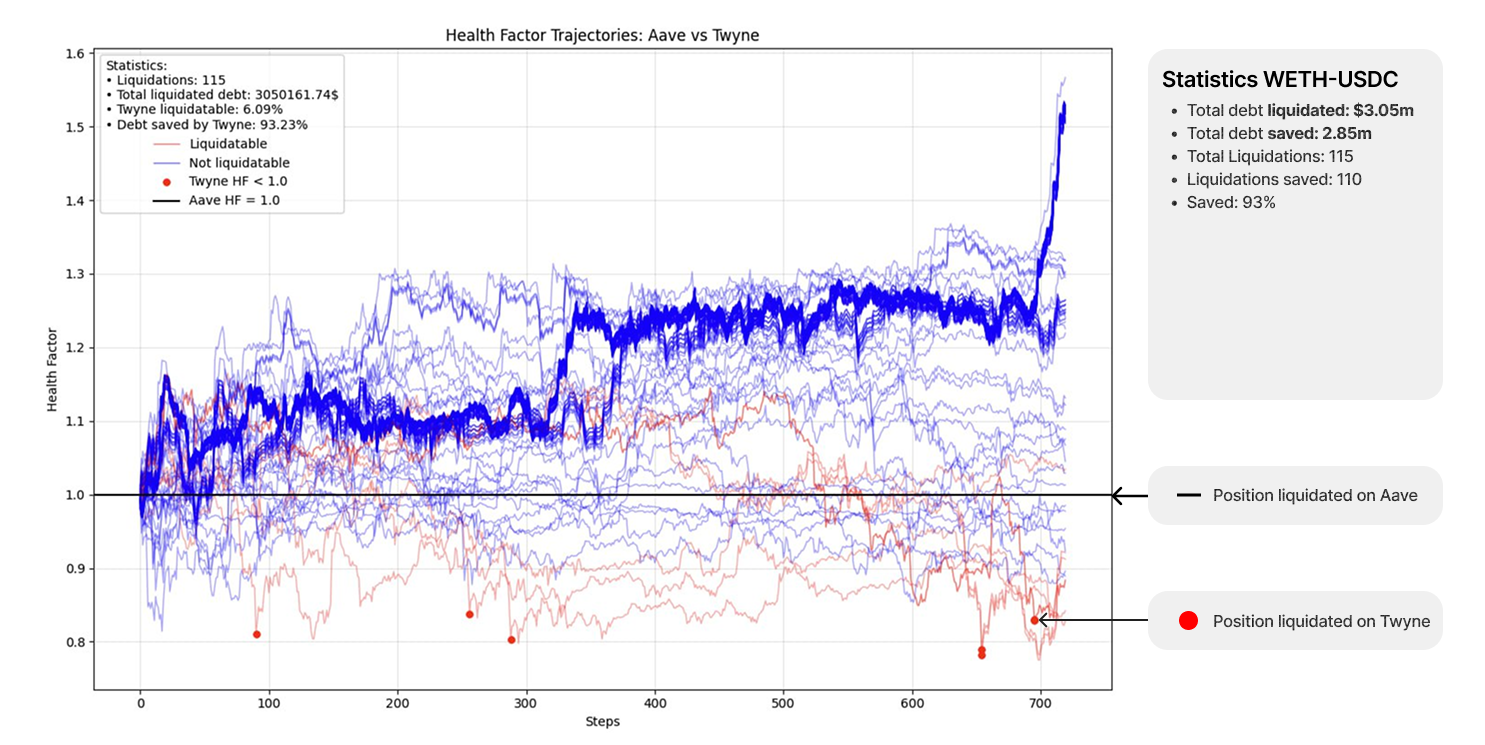

At the moment that each observed position was liquidated, we pretend that the borrower teleported their entire position on Twyne and picked the maximum LLTV available. For the purpose of this analysis, we assume that maximum to be 93% LTV (relative to their original collateral).

Finally, we simulate what happens to each ‘teleported’ position over the next 30 days. We measure the Twyne Health Factor of the positions at each step - if at any point the loan dips below 1, we mark it as liquidatable on Twyne.

The eventual status of all positions ‘teleported’ to Twyne can be seen on the below chart:

Results

Our analysis looked at 115 historical liquidations that have met our criteria (WETH collateral, USDC or USDT borrow) on AAVE V3 mainnet. In total, the combined value of debt accumulated by these positions was slightly above $3M.

How many of these loans could have been saved by Twyne’s liquidation buffer? Assuming Twyne bumped each of them to 93% LLTV, only 5 out of these 115 positions would still have gotten liquidated to this day. The remaining 110 positions would have avoided losing funds altogether by renting other lenders’ borrowing power and boosting their LLTV. That comes out to a total of $2.84M saved with Twyne - and on a very limited sample size!

Risks

At this point, it is worth considering the risks associated with using Twyne as a liquidation protection protocol. These include both risks to the borrowers and the credit liquidity providers (CLPs) that delegate their unused borrowing power to the borrowers:

-

As a borrower, using Twyne gives you a chance to avoid the liquidation altogether. However, in the case you do get liquidated on Twyne, the closing factor is 1 (meaning that the entirety of your position can be repossessed) and the liquidation penalty is implied by the maximum LLTV allowed by the protocol. In our analysis, this value is 93%, implying 7% liquidation penalty (compared to 5-10% liquidation penalty on Aave)

-

For the lenders (CLPs), there is no loss as long as the unhealthy position gets liquidated on Twyne. If this is the case, the liquidator repossesses the entire position and the credit is returned back to the credit vault, where CLPs can safely withdraw at any point. The loss for CLPs only occurs in case the liquidation doesn't take place on Twyne, and the combined user position (including the CLP's credit) gets liquidated on the underlying protocol (AAVE in this case). The loss realized by the CLPs in this scenario is highly dependent on LTV exceedance (the ratio between the position's LTV and LLTV), as well as the closing factor and liquidation incentive executed by the underlying lending market liquidation. We talk extensively about this relationship in our whitepaper.

Next Steps

This analysis could be extended further by expanding beyond WETH-USDC/USDT pairs, and analysing all liquidations that took place on AAVE V3. Let us know if you’d like us to cover this in a future article!

Also, the backtest assumes no interest rate cost associated with reserving the credit on Twyne. While this is unrealistic, the actual interest paid by the borrowers would depend on the utilization rate of the protocol, which we can not really predict beforehand. In any case, the interest costs at short time horizons like the one in our analysis (30 days) are marginal and would not change the results of the analysis qualitatively. As a borrower, how much would you be willing to pay for this kind of liquidation protection?

Finally - Twyne is launching soon. These debt positions already bit the dust - but yours doesn’t have to.

If you want to protect your loan and avoid preventable liquidations, join us in our Telegram!